Turning Distressed Downtown Hotels Into Apartments May Just Be Their Highest, Best Use

For most areas in downtown Chicago, the precipitous drop in office occupancy is devastating to more than just the office landlords. Fewer downtown workers equal less demand for retail tenants and for hotels relying on midweek business travel.

By year-end 2021, Chicago hotels’ revenue per available room, or RevPAR, was down 40% compared to 2019, with that performance ranking in the bottom third of the top 25 U.S. markets tracked by STR, CoStar Group's hospitality analytics firm. It doesn’t help that six hotels — making up over 3,400 keys and 2.5 million square feet of inventory — are 90-plus days delinquent on their loans and in special servicing or foreclosure, such as the JW Marriott Chicago and the Palmer House Hilton.

To solve Chicago's hotel inventory problem, owners and investors should consider converting some of these assets to multifamily use.

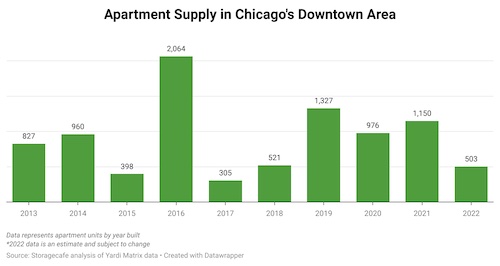

Looking at what's happening in the downtown apartment market, it makes sense. Demand downtown is at peaks never seen before, with 3,800 units absorbed year over year. The Loop business district and adjacent submarkets command some of the area's highest rents at $2,834 per unit and the most compression in vacancy rates with a 3.6% decline, posting a 5.5% overall rate.

Yet development here appears to be tapering off, with only 3,600 units under construction this quarter, most of which will be completed by 2023. For context, this is below the 10-year average of 5,000 apartments built per year. As such, this amount represents the smallest percentage of multifamily space under construction in the area since mid-2011. There is certainly room for growth.

Missing Business Demand

Meanwhile, downtown Chicago’s hospitality demand is heavily reliant on large citywide conventions, conferences and corporate tourism, all of which have yet to bounce back. Chicago’s challenges in regaining its business travel, and therefore pushing up its hotel occupancy rates, are driven by a multitude of factors that stymie the local hospitality sector’s profitability and cash flow.

Year to date through June, market RevPAR is still 14% below 2019 levels. And office occupancy levels are still only 42% of those reached before the pandemic, according to security tech firm Kastle Systems' Back to Work Barometer. Combine this with increased hotel operating expenses, heightened labor union-related costs, diminished leisure and business travel, and increased fears of recession and discretionary spending dips, and the outlook for Chicago’s downtown hospitality sector is less attractive when compared to urban markets whose occupancy demand is more diversified.

Converting distressed hotel buildings in Chicago certainly comes with challenges that go beyond the necessary space reconfigurations and specific guidelines for preserving the facades and decor of architectural treasures. There is competition from new multifamily construction and proposals far along in the pipeline. At last count, there were another 4,000 units developers hope to deliver by the end of 2023.

However, the potential to turn an underperforming hotel into a thriving multifamily complex is still supported by today’s demand and by key stakeholders, from politicians and city planners to developers experienced with this kind of commercial real estate transformation. Hotel amenities such as parking, pools, restaurants, bars, and dry cleaning and laundry rooms are virtually plug-and-play options for residential use. Mechanical, electrical, and plumbing upgrades and changes should be relatively easy compared to an office-to-multifamily conversion. Some local examples of successful transformations were when the 100-room Seneca Hotel & Suites became the 268-unit Seneca apartments and when the single-room occupancy hotel The Carling was renovated to its current incarnation as the 80-unit Carling Hotel apartments, an affordable housing property.

The greatest reason to convert, of course, is the potential upside for investment returns. Year to date, the average three-, four- or five-star apartment building in Chicago sold for $361,000 per unit and $313 per square foot. The average downtown Chicago hotel sold for $155,000 per unit and $147 per square foot. The roughly $200,000 per unit and $170 per square foot differential could result in a solid profit margin from a stable multifamily investment, even after factoring in conversion costs. If one considers the Seneca conversion mentioned above, where the property increased its unit count almost threefold, the creative developer has an opportunity to create more usable, profit-making square footage within a project.

Source: Multifamily Conversions Could Be a Lifeline for Chicago’s Ailing Hotels

https://www.creconsult.net/market-trends/multifamily-conversions-could-be-a-lifeline-for-chicagos-ailing-hotels/

A variety of unprecedented events over the last few years have impacted markets around the world. There have been growing concerns about inflation across the commercial real estate sector, but the overall economic outlook is positive. However, one element that still worries industry participants is the rise and uncertainty of interest rates. It should be no surprise that inflation has increased as a result of supply chain disruption, manufacturing slowdowns, unanticipated spikes in demand, and the U.S. Federal Reserve pumping money into the economy in an attempt to alleviate these market issues that arose from events like the global pandemic. Overall, rising interest rates have been used as a tool to stifle demand, in the hopes that slowing it down will also slow price escalation.

Manufacturing And Real Estate Amid Economic Uncertainty

At the start of the pandemic, manufacturing and production slowed significantly or shut down as organizations prepared for consumers to cut spending. Surprisingly, demand skyrocketed—but with production scaled back and factories shut down due to Covid-19, it proved difficult to meet the growing need for goods. The pandemic also drove major changes in consumer behavior, including online shopping, remote working, and migration, predominantly to warmer cities and sunbelt markets. All these changes have led to unpredictable shifts in business demand for commercial space, occupancy rates, earnings for commercial real estate and property valuations.

Additionally, the demand for new semiconductor chip plants, battery manufacturing plants, data centers, and electric car manufacturing plants has put incredible pressure on supply resulting in meaningful inflation, material delays, and supply chain disruptions. Capacity restrictions could potentially be stopped or alleviated by central banks. There are long- and short-term ways to impact this, such as reducing quantitative easing, selling bonds, and raising interest rates. This directly affects real estate because when buyers have a higher cost of debt, they are less willing to pay for assets to deliver the same yield or investment returns. In the near term, the rising cost of debt and uncertainty around its availability can make it difficult to underwrite new developments or acquisitions. However, high-barrier-to-entry markets with limited supply or investments with long-term horizons are both still very achievable to finance today.

Rising Rates And Real Estate

The American people’s investment patterns during turbulent times directly impact our economy. Although the market and rates are currently rebounding, public concern makes sense when considering the initial data. The U.S. Labor Department reported that the consumer-price index rose 8.3% for the 12 months ending in August—but this is a smaller figure than the 8.5% increase over the 12-month-period ending in July. Consumers need to note that rates are improving and easing from the unprecedented spikes seen earlier this year.

Insight from Axios and analysts (subscription required) highlights that the public’s general perception and fear could actually seal an economy into a recession. Regardless of the statistical odds of a recession occurring, if the public is wary about opening their wallets, especially in capitalistic markets powered by consumer spending, a recession could become a self-fulfilling prophecy. Public behavior could also cause inflation in a similar way: If individuals and businesses believe the cost of buying goods today will be less expensive than in the future, buying extra goods will inherently drive higher inflation by adding extra demand to an already supply-strained economy.

The Fed has used interest rate hikes to give consumers confidence that inflation will remain in check. But under these circumstances, it has become more difficult to finance new real estate projects or acquire existing assets, leaving buyers unable to predict their cost of debt and developers unable to gauge exit valuation rates when underwriting deals.

This has also brought a steep increase in mortgage rates, causing homeowners to pay higher prices, resulting in an influx of renters and buyers reconsidering deals until prices return to being affordable. It makes sense both that buyers are increasingly rejecting record home prices, while sellers are unwilling to accept a lower price than values achieved only months earlier.

As someone who frequently engages with commercial real estate investors, it’s been interesting to see how many investors have shifted their focus toward build-to-rent and single-family homes. Build-to-rent communities, in particular, offer many of the amenities and luxuries that buyers today seek. I expect that these two areas should do increasingly well in this market as we wait for prices to stabilize.

A Bright Future

Data shows that younger generations have the most positive outlook on their financial futures, with

A variety of unprecedented events over the last few years have impacted markets around the world. There have been growing concerns about inflation across the commercial real estate sector, but the overall economic outlook is positive. However, one element that still worries industry participants is the rise and uncertainty of interest rates. It should be no surprise that inflation has increased as a result of supply chain disruption, manufacturing slowdowns, unanticipated spikes in demand, and the U.S. Federal Reserve pumping money into the economy in an attempt to alleviate these market issues that arose from events like the global pandemic. Overall, rising interest rates have been used as a tool to stifle demand, in the hopes that slowing it down will also slow price escalation.

Manufacturing And Real Estate Amid Economic Uncertainty

At the start of the pandemic, manufacturing and production slowed significantly or shut down as organizations prepared for consumers to cut spending. Surprisingly, demand skyrocketed—but with production scaled back and factories shut down due to Covid-19, it proved difficult to meet the growing need for goods. The pandemic also drove major changes in consumer behavior, including online shopping, remote working, and migration, predominantly to warmer cities and sunbelt markets. All these changes have led to unpredictable shifts in business demand for commercial space, occupancy rates, earnings for commercial real estate and property valuations.

Additionally, the demand for new semiconductor chip plants, battery manufacturing plants, data centers, and electric car manufacturing plants has put incredible pressure on supply resulting in meaningful inflation, material delays, and supply chain disruptions. Capacity restrictions could potentially be stopped or alleviated by central banks. There are long- and short-term ways to impact this, such as reducing quantitative easing, selling bonds, and raising interest rates. This directly affects real estate because when buyers have a higher cost of debt, they are less willing to pay for assets to deliver the same yield or investment returns. In the near term, the rising cost of debt and uncertainty around its availability can make it difficult to underwrite new developments or acquisitions. However, high-barrier-to-entry markets with limited supply or investments with long-term horizons are both still very achievable to finance today.

Rising Rates And Real Estate

The American people’s investment patterns during turbulent times directly impact our economy. Although the market and rates are currently rebounding, public concern makes sense when considering the initial data. The U.S. Labor Department reported that the consumer-price index rose 8.3% for the 12 months ending in August—but this is a smaller figure than the 8.5% increase over the 12-month-period ending in July. Consumers need to note that rates are improving and easing from the unprecedented spikes seen earlier this year.

Insight from Axios and analysts (subscription required) highlights that the public’s general perception and fear could actually seal an economy into a recession. Regardless of the statistical odds of a recession occurring, if the public is wary about opening their wallets, especially in capitalistic markets powered by consumer spending, a recession could become a self-fulfilling prophecy. Public behavior could also cause inflation in a similar way: If individuals and businesses believe the cost of buying goods today will be less expensive than in the future, buying extra goods will inherently drive higher inflation by adding extra demand to an already supply-strained economy.

The Fed has used interest rate hikes to give consumers confidence that inflation will remain in check. But under these circumstances, it has become more difficult to finance new real estate projects or acquire existing assets, leaving buyers unable to predict their cost of debt and developers unable to gauge exit valuation rates when underwriting deals.

This has also brought a steep increase in mortgage rates, causing homeowners to pay higher prices, resulting in an influx of renters and buyers reconsidering deals until prices return to being affordable. It makes sense both that buyers are increasingly rejecting record home prices, while sellers are unwilling to accept a lower price than values achieved only months earlier.

As someone who frequently engages with commercial real estate investors, it’s been interesting to see how many investors have shifted their focus toward build-to-rent and single-family homes. Build-to-rent communities, in particular, offer many of the amenities and luxuries that buyers today seek. I expect that these two areas should do increasingly well in this market as we wait for prices to stabilize.

A Bright Future

Data shows that younger generations have the most positive outlook on their financial futures, with