October 2024 Multifamily Mortgage Rate Update for Chicago Property Owners

For multifamily property owners in the Chicago area, staying informed on mortgage rate changes is essential when evaluating the timing of a potential sale or acquisition. While our primary focus at eXp Commercial is the listing and sale of multifamily properties, understanding current financing trends can support informed decision-making. Here’s the latest update on multifamily mortgage rates from our Capital Markets partner, CommLoan, and insights on how these rates could influence your investment strategy.

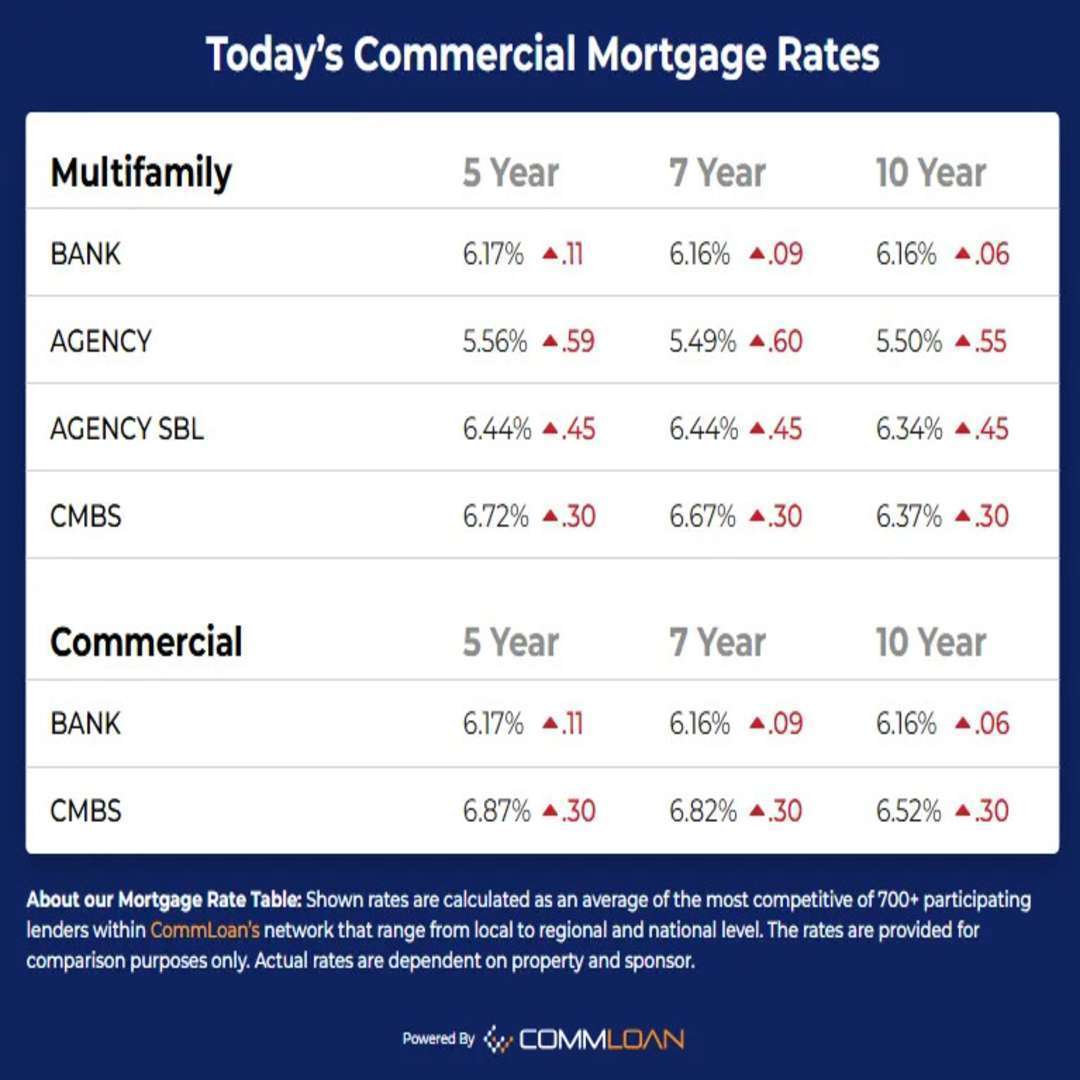

October 2024 Multifamily Mortgage Rates Overview

The latest multifamily mortgage rates have seen notable shifts, presenting both challenges and opportunities:

Bank Loans (5-Year Fixed): Now at 6.17%, up by 11 basis points. Although slightly higher, bank loans remain a solid choice for stable financing options.

Agency Loans: Increased to 5.56% for 5-year terms, up by 59 basis points. Agency loans are ideal for larger, long-term investments, offering stability for property buyers and sellers considering repositioning assets.

Agency SBL Loans: Now at 6.44% for both 5- and 7-year terms, reflecting a 45-basis-point rise. Agency SBL loans are designed for smaller properties, supporting streamlined financing even with the recent rate increase.

CMBS Loans: At 6.72% for 5-year terms, up by 30 basis points. CMBS loans provide flexible repayment options, benefiting more complex or large-scale transactions.

How These Rates Impact Chicago Multifamily Property Dispositions

As Chicago-area multifamily brokers, our primary focus is advising clients on property listings and sales. Current rate trends can impact market demand and timing considerations for dispositions:

Refinancing Prior to Sale: Some owners may consider refinancing to improve cash flow or extend holding periods until market conditions are optimal for listing. Locking in current rates can help stabilize finances while awaiting favorable selling opportunities.

Attracting Buyers: For buyers, the rise in agency and CMBS rates may affect purchasing power, influencing the types of financing they pursue. Understanding rate trends can help sellers better anticipate buyer needs and tailor their listing strategies.

Maximizing Sale Value: Even with rate increases, Chicago’s multifamily market remains competitive. By aligning with a brokerage that provides targeted marketing, expert valuation, and strategic negotiation, sellers can position their property to attract strong offers despite changing financing conditions.

Expert Multifamily Brokerage Services for Chicago Investors

With over 26 years of experience in Chicago’s multifamily market, I specialize in providing tailored solutions that support property dispositions. As a Senior Associate with eXp Commercial’s National Multifamily Division, my services are designed to maximize the value of your property through:

Accurate Valuations: In-depth, market-based assessments that help you understand your property’s current worth and its potential appeal to prospective buyers.

Targeted Marketing: Custom marketing strategies that attract competitive offers and increase the visibility of your listing among qualified investors.

Strategic Negotiation: Skilled negotiation to secure favorable terms and ensure a smooth transaction, maximizing your return on investment.

Backed by eXp Commercial’s national resources and our partnership with CommLoan, I provide my clients with insights into financing options that align with current market trends. This collaboration allows me to offer added value, helping you make informed decisions as you consider selling, refinancing, or holding your multifamily assets.

Ready to Explore Listing Options? Schedule a Call

If you’re considering selling your multifamily property or want to understand how today’s mortgage rates may affect your investment strategy, I’m here to help. Let’s discuss how we can position your property to achieve the best possible outcome in Chicago’s multifamily market.

Schedule a discovery call with Randolph Taylor, MBA, CCIM to explore listing opportunities and get expert guidance on maximizing the value of your investment.

Contact Information

Randolph Taylor, MBA, CCIM

Senior Associate | Multifamily Sales Broker

eXp Commercial | National Multifamily Division

📞 (630) 474-6441

📧 rtaylor@creconsult.net

https://www.creconsult.net/market-trends/2024-multifamily-mortgage-rates-chicago-listing/?fsp_sid=153