Despite the market’s uncertainty, commercial real estate performed well in 2022. With healthy balance sheets, consumer demand was significantly boosted in retail and industrial asset classes. In both sectors of the real estate market, vacancy rates fell even further than the previous year, illustrating strong demand for retail and industrial spaces in the post-pandemic period. Specifically, the retail sector experienced the most significant drop in vacancy rates to 4.2% at the end of 2022. Due to a lack of new supply, net absorption and rent price gains were substantial in the retail sector.

2023 Commercial Real Estate Outlook

However, this year will be challenging for most commercial real estate market sectors, with higher vacancy rates in the office and multifamily sectors.

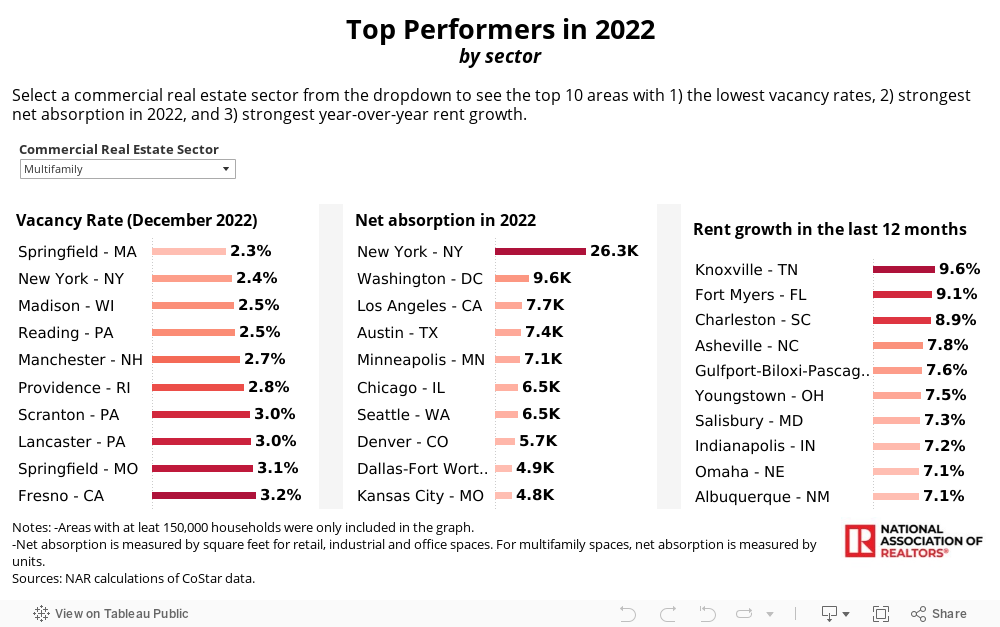

After its recent record-breaking year in 2021, the multifamily sector has started to slow down in the second quarter of 2022. Demand remains solid, but net absorption dropped by 75 percentage points in 2022 compared to 2021. As a result, rent growth decelerated, and the vacancy rate increased in 2022. Due to rising borrowing costs, people may need to rent for a longer period keeping strong demand for apartment buildings. While the U.S. may skirt the recession, the multifamily sector will likely regain momentum later this year and perform better than pre-pandemic.

The future of office space is ambiguous. COVID-19 has already disrupted the “traditional office” work environment. Hybrid work is now a reality for many people, and this trend only goes one way, just like e-commerce changed the “traditional retail” sector. Thus, 2023 will be another challenging year for the office sector as this sector will continue to change to improve the occupant experience and attract more employees to return to the office. But, this may be even more difficult with older office spaces lacking modern amenities. Vacancy rates may drop even further for these office spaces.

Thanks to the rise of e-commerce during the pandemic, industrial real estate outperformed in the last couple of years. Big online retailers needed warehouses to store their products, boosting the demand for industrial spaces. Even though demand for industrial space cooled off in 2022, the industrial sector will continue to be one of the bright spots of commercial real estate in 2023. Despite the slowdown, vacancy rates will remain low, and rent growth will double due to low supply in the industrial sector.

The retail sector is expected to remain strong and perform better than pre-pandemic levels. With inflation moving down and interest rates to stabilize later this year, consumer spending power will be back this year. Specifically, growth in the brick-and-mortar stores will be driven mainly by smaller shops such as neighborhood centers. The trend is clear. Due to remote-work policies, neighborhood stores are on the rise, and this trend will continue this year. Consumers like to shop locally as these neighborhood stores offer convenience and personal interaction.

Hotel revenue dipped in 2020 due to the COVID-19 travel restrictions and self-quarantine orders, but it fully recovered in 2022. The revenue per available room (RevPAR) is 10 percent higher than the pre-pandemic level. After two years of social distancing and working from home, Americans travel again. With business and leisure time increasing, the demand for hospitality spaces will continue to grow in 2023. The year is still young.

Inflation, interest rates, supply chain, and geopolitical events are the main factors determining how commercial real estate will perform in the following months. The National Association of REALTORS® will keep you informed monthly about the developments in commercial real estate.

Source: 2022 Commercial Real Estate Top Performers and 2023 Outlook

https://www.creconsult.net/market-trends/2022-commercial-real-estate-top-performers-and-2023-outlook/