There is no doubt that the real estate market has been a wild ride since the pandemic changed the normal course of our lives over two years ago. Lending did not escape the effects of Covid-19, and many active investors have learned more about the loan process than they ever did before the pandemic.

In the spring of 2020, some lenders left active investors in a bind, closing their doors or halting lending while they evaluated the new risks in the marketplace. Over two years later, the market is changing again, and investors need to know how to pivot to keep their pipeline flowing. While everyone is watching rates increase, they are taking their eyes off the real question right now: Can they close this loan?

Realizing a preapproval and rate and term sheet are not set in stone will go a long way in the current lending environment. Lenders are changing underwriting criteria, not making as many or any exceptions to lending guidelines, and lowering loan-to-value midstream in the escrow process. Most investors never thought about the source of their capital before March 2020. The most concerning part of the lending process was getting through underwriting and receiving the message that you were approved and cleared to close. Whatever happened behind the scenes inside the lending machine wasn’t a concern to an active investor. As long as money made it to the closing table, they were happy. This strategy worked until the capital never made it to the closing table.

When lenders suddenly turned off the spigot to cheap capital, investors scrambled to save deals any way they could. This pushed private lenders with their own capital to lend to the forefront in the hunt for leverage. Active investors scrambled to find funding or negotiate contract extensions to restart the lending process.

Private lenders who lend their own capital have more control. Large nationwide or even regional lenders have significant strings attached to the capital they lend out, and those strings are pulled by forces outside the lender’s control.

For example, large institutional lenders are often funded by lines of credit from banks or even selling their loans on the secondary market. In both of those cases, there is another entity establishing what they can lend out, where they can lend it, and the pricing of those loans. These lenders require the line of credit to stay open or the capital markets to continue purchasing loans, so they have enough liquidity to keep new loans coming into the pipeline.

What does that mean for you as a borrower? It means that the rates and terms you are quoted may suddenly change, or funding, in general, may be halted at a moment’s notice. So how can you protect your real estate investing business in this period of turbulence?

Start asking questions about how the lender acquires their capital and diversify lending sources based on where they get their capital.

The Four Types of Lenders

For the sake of simplicity, you can think of capital in one of four buckets for alternative lending: national lenders, regional lenders, local lenders, and private loans from a lender who lends their own capital, including seller financing. While there are many flavors and options within each bucket, knowing the general purpose of each can help you decide what type of financing to use for which project.

Alternative lending automatically means it is not going to be the conforming conventional loans you may have used to purchase your own home. Since they are non-conforming loans, the variables offered are numerous and vary greatly. Having a conversation with your lender about the types of projects they fund and general guidelines for their loan products can go a long way to choosing the right lender for the right project.

National Lenders

National lenders are pretty easy to locate. Their brand and names are spoken widely across online platforms, forums, and even REI meetings. Their business model has the borrower and decision maker for the loan the furthest removed from each other. To these lenders, every application and, ultimately, file on their desk is a series of numbers and check marks. A business model like this shows up to the active investor (borrower) with high single-digit interest rates and lower fees, but those come at the cost of higher documentation requirements, full third-party appraisals, and a longer closing time. This group of lenders is often very sensitive to changes in the capital markets or economic outlooks. If you need a deal to close super quickly with minimal documentation, this may not be the best tool to use. On the other hand, if you have time for the closing such as a refinance into permanent debt, this may be a great option to pursue.

Regional Lenders

Regional lenders may not have the brand recognition of “the big guys,” but within their markets, they can be relatively well known. Their mid-range interest rates and somewhat higher fees often come with lower requirements for documentation and longer financing timeframes than national lenders. Depending on the lender, they may require a full appraisal or may opt to do an online valuation through a third party. These regional lenders can be a great option for borrowers that have some unique borrowing challenges, such as new employment or acquiring financing as a new business entity.

Local Lenders

Local lenders tend to be smaller asset-backed lenders or smaller bank/credit unions in the market. They tend to lend in just a certain area of a state or the entire state if it’s small enough (such as Delaware or Rhode Island). These local lenders usually have higher rates, especially if they are asset-backed, but also usually have low or no documentation requirements. This translates through to a borrower with higher rates and usually higher fees. These asset-based lenders can often close quicker and use some sort of in-house valuation methods for the real estate securing the loan. Credit unions may also use the same valuation tools but often want a higher level of documentation to understand the lending opportunity. For investors operating in one particular market, this classification of lender tends to be the most helpful since they are local. This class of lenders understands the market they are lending in and has experience with other lending opportunities in the same area.

Individuals

Lastly, we will look at loans that come from individuals, or what we term “private lenders .”These loans come from capital that an individual or their business entity has. These individuals are often seeking to have passive income or put their retirement funds to work in real estate versus the stock market. Depending on the amount of capital they have available to them, they may not always have the liquidity to fund a loan when the capital is needed. Many of these lenders work with established networks of borrowers, sometimes rolling capital from one deal to the next with the same borrower. These lenders may have very low documentation requirements, flexibility on the type of properties they are willing to lend on, and vary in terms of interest rates, fees, and length of the loan. They also can generally close very quickly, sometimes within a few days if needed. While they won’t be the cheapest or longest-term loan out there, the flexibility this type of lender offers more than makes up for it.

The Type of Lender Determines the Variables

As you can see, there is somewhat of a correlation between the documentation and underwriting guidelines and the rate being charged. When you, as a borrower, can show the standards a lender believes are lower risk, you can then be rewarded with a lower rate. In addition, other value-add components can also increase annualized interest rates and fees being charged. If a lender can get a deal closed in three days with minimal documentation, that can be a more expensive loan because the borrower needs to move quickly or is unable or unwilling to go through a more thorough vetting process for the loan.

Conclusion

Understanding what your needs are for financing each property really allows you to find not just a lender but the right lender for the job. The lender’s ability to close the loan is more important than rates and terms right now. Ask questions about the lender’s access to capital and if that access is likely to change in the next several weeks. Depending on the size of the lender you are speaking with, they may not be able to answer that question, but thinking about this as a borrower can never hurt to consider. Keeping another lender in your back pocket that may be able to close quickly, even if it is a higher rate, maybe the difference between closing or not.

Receive a Loan Quote from eXp Commercial's Capital Markets Partner CommLoan Thousands of Loan Programs. Hundreds of Lenders. One Commercial Real Estate Lending Platform. One-stop shopping and unprecedented access to the capital markets.

[sc name="financing"][/sc]

Source: Do You Know Where Your Money Is Coming From? Navigating Today’s Lending Market

https://www.creconsult.net/market-trends/do-you-know-where-your-money-is-coming-from-navigating-todays-lending-market/

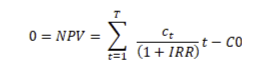

For commercial real estate investors, having access to as many metrics as possible to provide insight and comparison opportunities is critical. Various metrics are available, including cash-on-cash return and internal rate of return, enabling investors to compare properties more closely when deciding which to choose for investment.

Most investors set their own threshold of what is acceptable to meet their needs or to ensure they hit a certain target before investment. Yet, when investors consider dozens of opportunities each day, it is helpful to have a straightforward metric to help compare properties. These two figures are core components, and knowing the difference between IRR and cash on cash is critical.

For commercial real estate investors, having access to as many metrics as possible to provide insight and comparison opportunities is critical. Various metrics are available, including cash-on-cash return and internal rate of return, enabling investors to compare properties more closely when deciding which to choose for investment.

Most investors set their own threshold of what is acceptable to meet their needs or to ensure they hit a certain target before investment. Yet, when investors consider dozens of opportunities each day, it is helpful to have a straightforward metric to help compare properties. These two figures are core components, and knowing the difference between IRR and cash on cash is critical.