eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Tuesday, November 19, 2024

We invite you to join us for showings of two high-potential multifamily properties on Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Friday, November 15, 2024

Unlocking the Potential of Industrial Real Estate: 1150 McConnell Road

Picture yourself strolling through a lively industrial area, where the sounds of machinery and teamwork fill the air. This is the reality at 1150 McConnell Road in Woodstock, Illinois. This expansive manufacturing and distribution center is not just a building; it opens doors to endless possibilities for those in the industrial field. Let’s explore what makes this facility a standout find in the real estate market.

TL;DR: 1150 McConnell Road is a prime 73,245 sq ft industrial facility in Woodstock, IL, featuring modern office space, extensive loading capabilities, and excellent access to major highways, making it perfect for various industrial operations.

The Impressive Features of 1150 McConnell Road

Located in Woodstock, Illinois, the property at 1150 McConnell Road is a major opportunity for businesses looking to expand or invest. Covering a generous area of 73,245 sq ft of heavy-duty construction, the facility is designed to meet the demands of various industries.

Heavy-Duty Construction

The robust construction of this property is particularly noteworthy. With a combination of partial block and steel frame, it's made to withstand the rigors of industrial use. Can you imagine the peace of mind that comes with knowing your facility can handle high-demand operations?

Renovated Office Spaces

One of the standout features is the renovated office spaces. Spanning approximately 10,000 square feet, these spaces are thoughtfully designed for productivity. Equipped with modern offices, collaborative cubicles, and comfortable conference rooms, they aim to attract today’s workforce. Imagine working in a setting that not only looks good but also maximizes productivity.

Well-appointed offices

Employee kitchen

ADA-compliant restrooms

Fitness center

These amenities cater to the diverse needs of employees, making the workspace a more inviting place.

Rail Access for Efficient Distribution

For companies involved in manufacturing and logistics, rail access is crucial. The property provides this key feature, ensuring efficient distribution of goods. This aspect may mean lower transportation costs and faster delivery times. Doesn’t that sound appealing for logistics efficiency?

Robust Power Capabilities

In addition to its structural advantages, 1150 McConnell Road boasts robust power capabilities. This is essential for industrial operations, particularly for enterprises that require significant electrical resources.

This combination of features positions 1150 McConnell Road as not just a building but a fully equipped solution tailored to modern business needs. If you are interested in exploring this exceptional opportunity, visit the property listing for more information.

Understanding the Strategic Location

Location, location, location. This saying plays a crucial role in real estate and business success. Why? Because the right location can significantly influence a company’s operations and bottom line. Situated in Woodstock, IL, just 50 miles from downtown Chicago, this area presents an incredible opportunity for businesses looking to thrive.

Accessibility Matters

One of the most prominent features of Woodstock is its easy access to major transportation routes. Businesses can quickly connect with clients and suppliers via:

US Route 14

US Route 47

Think about it—shift access to highways and routes saves time and boosts efficiency. It also enhances logistics operations. For those engaged in distribution or manufacturing, this feature can't be overstated.

Cost-Effectiveness

The operational costs in Woodstock are notably competitive compared to larger metropolitan areas. Why is that important?

In cities like Chicago, expenses can skyrocket. For many businesses, cutting costs while maintaining quality is essential. Woodstock provides an appealing alternative, allowing companies to invest their savings back into growth and innovation.

Skilled Labor Availability

Another significant advantage is the presence of a skilled labor force. The region isn’t just about affordable costs; it’s also home to established manufacturers like Other World Computing and Medsior. These companies contribute to a pipeline of skilled workers ready to meet the demands of various industries.

Moreover, the supportive business environment further strengthens this location's appeal. Woodstock promotes pro-business policies that encourage growth. This creates a momentum that attracts even more businesses and talent to the area.

In summary, the strategic location of Woodstock, its accessibility, and its skilled workforce make it a prime spot for businesses. The opportunity to engage in a thriving community that is beneficial from both a logistical and financial standpoint is a game changer.

For those intrigued by this unique property offering, the industrial property at 1150 McConnell Road in Woodstock is an opportunity not to be missed. Explore the details further at this link.

.png)

Why Invest in Industrial Real Estate Now?

The landscape of industrial real estate is rapidly evolving. The post-pandemic world has ignited a growing demand for manufacturing spaces. As businesses adapt and expand, investing in industrial properties is no longer just an option; it’s a strategic necessity.

1. Growing Demand for Manufacturing Spaces

Following the pandemic, companies in various sectors are reshaping their operational needs. Factors contributing to this demand include:

Increased E-Commerce: The surge in online shopping has driven businesses to optimize logistics. They now need more warehouse and distribution space.

Reshoring Production: Many firms are relocating manufacturing back to domestic grounds, seeking spaces that meet modern safety and efficiency standards.

The result? A race for viable industrial spaces that can accommodate these evolving needs.

2. Advantages of Versatile Spaces

Investors can find unique value in properties designed for multifunctional use. Properties like the one located at eleven fifty McConnell Road in Woodstock, Illinois, exemplify this flexibility. Such sites are ideal for:

Multi-Industry Usage: From electric car repair to semiconductor production, versatility means attracting diverse tenants.

Customization Potential: Spaces can be tailored to meet specific industry requirements without extensive renovations.

With these advantages in mind, investors can appeal to a broader audience and reduce vacancy rates.

3. Significant ROI Potential

Another compelling reason to invest now is the potential for significant returns on investment (ROI). Consider the options:

Owner-Occupied: Purchasing a property for personal business use can eliminate rental costs and build equity over time.

Tenant Scenarios: Leasing the space to multiple tenants offers a steady revenue stream and reduces overall risk.

This flexibility ensures that investors can maximize their investment's potential, adapting to market demands as needed.

As Randolph Taylor from eXp Commercial states, "Investing in well-located and versatile properties allows for long-term growth and stability.

Today's market presents a wealth of opportunities for savvy investors. With a property like eleven fifty McConnell Road, the combination of strategic location, robust features, and versatile use beckons to be explored. Don’t miss out on this unique opportunity!

Highlighting the Unique Office Space Offering

In today’s competitive market, the right office space can make all the difference. Recently renovated, this attractive office space boasts a generous 10,000 sq ft layout, providing ample room for creativity and productivity. But what truly sets this space apart? Let’s dive into the remarkable features that appeal to a modern workforce.

Modern Amenities

Today’s employees seek more than just a place to sit and work. They desire an environment that fosters collaboration and well-being. This office space includes:

A state-of-the-art fitness center—ideal for quick workouts and stress relief.

Collaborative areas: designed to encourage teamwork and creativity.

Imagine stepping into your office and having the option to take a refreshing break at the gym or meeting a colleague in a vibrant collaborative area. Isn't that an intriguing thought?

An Office Designed for the Modern Workforce

Today’s workforce craves more than just a desk. They want spaces that inspire them. This office has been thoughtfully designed with this in mind.

Well-appointed offices that promote focus and productivity.

Accessible restrooms are ADA compliant, ensuring inclusivity.

Conference rooms are perfect for meetings and brainstorming sessions.

It’s not just about aesthetics; it’s about creating an environment where employees can thrive. Wouldn't you want to work in such an inspiring space? By prioritizing comfort and functionality, this office space meets the needs of today’s dynamic workforce.

Why Choose This Office Space?

Incorporating modern amenities with a focus on employee satisfaction makes this office one to consider. It’s a unique opportunity for businesses looking to attract top talent. Additionally, the layout encourages collaboration and well-being.

To explore this exceptional offering further, head to the property listing for more details: Property Listing. Interested parties can also reach out for an opportunity to see the space firsthand. Don’t miss out on what could be the next perfect office location!

Taking the Next Step: Viewing and Inquiries

When considering your next investment, it’s important to gather all relevant information. The industrial property known as eleven fifty McConnell Road is not just a location; it’s an opportunity.

Explore the Property's Detailed Listing

Start by checking out the detailed listing link. This website offers insights into the expansive seventy-three thousand square feet facility located in Woodstock, Illinois. Imagine a place that’s only fifty miles from downtown Chicago, equipped with essential rail access and modern office spaces. It’s like finding a gem in a city full of them.

Contact the Listing Broker

For any inquiries, don’t hesitate to reach out to the listing broker, Randolph Taylor. He brings expertise in the commercial real estate market and can provide tailored answers to your questions. You can contact him directly at six three zero four seven four six four four one. Could there be a better resource for understanding this property’s potential?

Investment Opportunity or Operating Site

This property is more than just a building; it’s a dual-purpose investment. Not only does it present a significant chance for those looking to generate income or host a tenant, but it’s also suitable for those wanting to establish their manufacturing or distribution operation. Think of it as a blank canvas ready for your vision.

The architectural design, featuring durable block and steel frame construction, caters to a variety of high-demand industries. Whether it’s rail car repair, semiconductor production, or electric car maintenance, this facility has the infrastructure to support those needs. With the added bonus of a recently renovated office space, you can create the ultimate environment for productivity and success.

In summary, eleven fifty McConnell Road in Woodstock offers an attractive mix of strategic location, functionality, and modern amenities. This is not just another property; this is a chance to step into a thriving industrial sector. So, why wait? Explore the possibility of this unique offering today. Your next big move starts here.

https://www.creconsult.net/market-trends/unlocking-the-potential-of-industrial-real-estate-1150-mcconnell-road/?fsp_sid=218

Wednesday, November 13, 2024

Join us for a showing of two fully occupied, cash-flowing multifamily properties ideal for investors. Showings are set for Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Property 2: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

These properties have undergone recent upgrades and are located close to major amenities. Don’t miss this opportunity to secure stable, income-producing assets!

Contact to Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

We invite you to join us for showings of two high-potential multifamily properties on Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Thursday, October 31, 2024

Multifamily Mortgage Rates Chicago | October 2024 Update

October 2024 Multifamily Mortgage Rate Update for Chicago Property Owners

For multifamily property owners in the Chicago area, staying informed on mortgage rate changes is essential when evaluating the timing of a potential sale or acquisition. While our primary focus at eXp Commercial is the listing and sale of multifamily properties, understanding current financing trends can support informed decision-making. Here’s the latest update on multifamily mortgage rates from our Capital Markets partner, CommLoan, and insights on how these rates could influence your investment strategy.

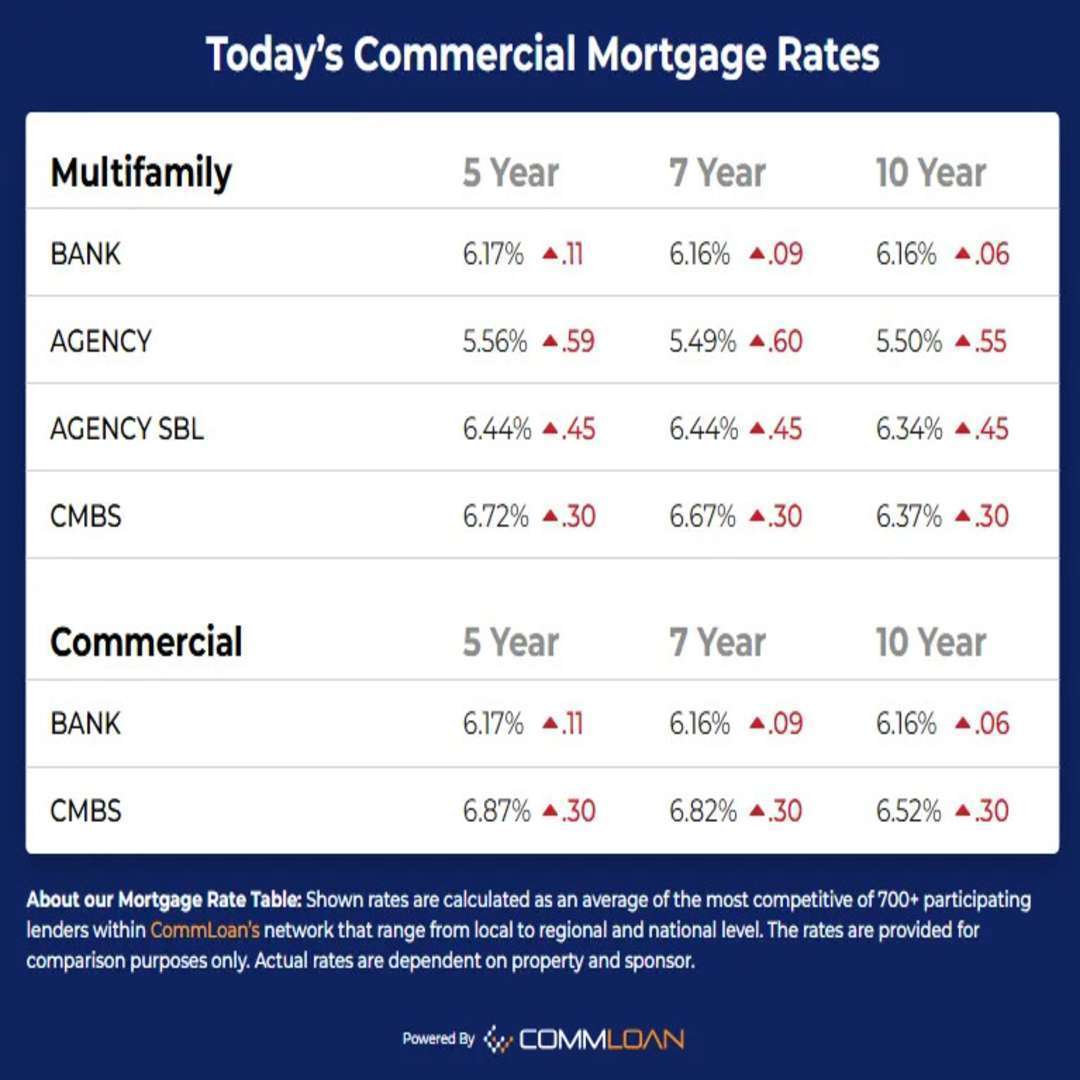

October 2024 Multifamily Mortgage Rates Overview

The latest multifamily mortgage rates have seen notable shifts, presenting both challenges and opportunities:

Bank Loans (5-Year Fixed): Now at 6.17%, up by 11 basis points. Although slightly higher, bank loans remain a solid choice for stable financing options.

Agency Loans: Increased to 5.56% for 5-year terms, up by 59 basis points. Agency loans are ideal for larger, long-term investments, offering stability for property buyers and sellers considering repositioning assets.

Agency SBL Loans: Now at 6.44% for both 5- and 7-year terms, reflecting a 45-basis-point rise. Agency SBL loans are designed for smaller properties, supporting streamlined financing even with the recent rate increase.

CMBS Loans: At 6.72% for 5-year terms, up by 30 basis points. CMBS loans provide flexible repayment options, benefiting more complex or large-scale transactions.

How These Rates Impact Chicago Multifamily Property Dispositions

As Chicago-area multifamily brokers, our primary focus is advising clients on property listings and sales. Current rate trends can impact market demand and timing considerations for dispositions:

Refinancing Prior to Sale: Some owners may consider refinancing to improve cash flow or extend holding periods until market conditions are optimal for listing. Locking in current rates can help stabilize finances while awaiting favorable selling opportunities.

Attracting Buyers: For buyers, the rise in agency and CMBS rates may affect purchasing power, influencing the types of financing they pursue. Understanding rate trends can help sellers better anticipate buyer needs and tailor their listing strategies.

Maximizing Sale Value: Even with rate increases, Chicago’s multifamily market remains competitive. By aligning with a brokerage that provides targeted marketing, expert valuation, and strategic negotiation, sellers can position their property to attract strong offers despite changing financing conditions.

Expert Multifamily Brokerage Services for Chicago Investors

With over 26 years of experience in Chicago’s multifamily market, I specialize in providing tailored solutions that support property dispositions. As a Senior Associate with eXp Commercial’s National Multifamily Division, my services are designed to maximize the value of your property through:

Accurate Valuations: In-depth, market-based assessments that help you understand your property’s current worth and its potential appeal to prospective buyers.

Targeted Marketing: Custom marketing strategies that attract competitive offers and increase the visibility of your listing among qualified investors.

Strategic Negotiation: Skilled negotiation to secure favorable terms and ensure a smooth transaction, maximizing your return on investment.

Backed by eXp Commercial’s national resources and our partnership with CommLoan, I provide my clients with insights into financing options that align with current market trends. This collaboration allows me to offer added value, helping you make informed decisions as you consider selling, refinancing, or holding your multifamily assets.

Ready to Explore Listing Options? Schedule a Call

If you’re considering selling your multifamily property or want to understand how today’s mortgage rates may affect your investment strategy, I’m here to help. Let’s discuss how we can position your property to achieve the best possible outcome in Chicago’s multifamily market.

Schedule a discovery call with Randolph Taylor, MBA, CCIM to explore listing opportunities and get expert guidance on maximizing the value of your investment.

Contact Information

Randolph Taylor, MBA, CCIM

Senior Associate | Multifamily Sales Broker

eXp Commercial | National Multifamily Division

📞 (630) 474-6441

📧 rtaylor@creconsult.net

https://www.creconsult.net/market-trends/2024-multifamily-mortgage-rates-chicago-listing/?fsp_sid=153

Multifamily Mortgage Rates Chicago | October 2024 Update

Explore October 2024 multifamily mortgage rates in Chicago and how they impact property sales and listing strategies for investors.

Wednesday, October 30, 2024

Aurora Naperville Multifamily Market Q3 2024 Trends

Aurora Naperville multifamily market Q3 2024 report: rent trends, vacancy rates, and investments. Download the full report now!

🏡 SOUTHEAST DUPAGE MULTIFAMILY: Q4 2025 MARKET SNAPSHOT Quiet stability, high occupancy, and buyers circling for suburban product. In towns...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...