Amid rising interest rates, some troubles at regional banks and investment sales volume that has shrunk to a fraction of its size from cyclical peaks, a lot of the debate around commercial real estate for the past half a year has revolved around how much people should worry about potential defaults. The Mortgage Bankers Association, an industry trade group, reported that in the first quarter of 2023, banks and thrifts experienced a 13-basis-point quarter-over-quarter increase in the 90-plus days delinquency rate on their commercial/multifamily loans, while life insurers and CMBS lenders experienced 10-basis-point increases each.

Real estate data firm MSCI Real Assets reported that at midyear, the volume of distress in the U.S. commercial real estate market rose to $71.8 billion, outpacing workouts by more than $8 billion. MSCI defines distress as encompassing bankruptcies, defaults, court administration, tenant distress or liquidation and loan transfers to special servicers. Much of that distress is concentrated on two property sectors with more than $24.0 billion of that outstanding distress tied to office buildings, and $22.6 billion in the retail sector. As of the second quarter, multifamily properties accounted for $6.8 billion in distressed situations. So, while the amount of distress in the commercial real estate market is growing, the question is how broad-based the challenges will be for borrowers and lenders.

To get a perspective on what’s happening in the lending market, WMRE talked with Willy Walker, chairman and CEO of Walker & Dunlop, a commercial real estate finance and advisory firm with a loan servicing portfolio that last year totaled $123 billion.

This Q&A has been edited for length, style and clarity.

WMRE: We keep seeing headlines about how the commercial real estate industry is “headed for a crisis.” How do you assess the commercial real estate industry’s health right now, what’s your outlook on it?

Willy Walker: I think it’s very important to define commercial real estate. Inside of commercial real estate there are various asset classes that all have very distinct performances at this time in the economy, at this time in the cycle. With that said, many people say “commercial real estate debt crisis” and they throw everything into [their definition of] commercial real estate and that’s not the case. If you look at the amount of debt outstanding in the commercial real estate today, it’s $4.5 trillion, but it’s very important to note that half of the debt outstanding in the commercial real estate world, $2.0 trillion, is to multifamily properties. There’s no crisis in multifamily whatsoever today. Period. So, when headlines say there’s a crisis in commercial real estate debt, half of that debt is in multifamily. What most people are talking about when they are talking about the crisis is they are talking about office. The office market is not doing so great. [But] when people say “commercial real estate crisis,” they are not looking at the performance of multifamily, retail, industrial, hospitality and they are going straight to office. So, specifically to your question, there is no crisis in commercial real estate.

WMRE: How much of a problem are office loans right now?

Willy Walker: Office is 17% of the total debt outstanding in commercial real estate today. And the Mortgage Bankers Association estimates that there are $98 billion of bank office loans that need to be refinanced in 2023. That’s a very significant amount of loans. But what you are finding right now is that lenders are working with borrowers to rework those loans and make it so the borrower is not defaulting and the lender is not taking control of the property. So the Office of the Comptroller of the Currency, the Federal Reserve and FDIC in June guided the banks that they could set up reserves against those loans and be able to engage with borrowers to rework the terms and conditions of those loans. So, what you saw in Q2 earning of CitiGroup, and JP Morgan and Wells Fargo were significant reserves [about $1 billion each for CitiGroup and JP Morgan] that allow them to go and work with the borrowers on those loans and make it so they don’t have to foreclose on those loans. The banks have plenty of liquidity today to be able to work with borrowers to rework these loans. Will there be defaults? Yes. Will there be loans foreclosed on? Yes. But there has not been this huge crisis [people] are talking of. Are there problems in the office sector? Yes. There is no investor, no lender today that says “I need to make a loan on an office.” [But they will work with borrowers on existing loans]. So, the big difference between 2023 and 2009 is that in the Great Financial Crisis, banks didn’t have liquidity, banks had to foreclose on properties and they had to move fast to get any money they could. Today, they don’t need to nor want to do that.

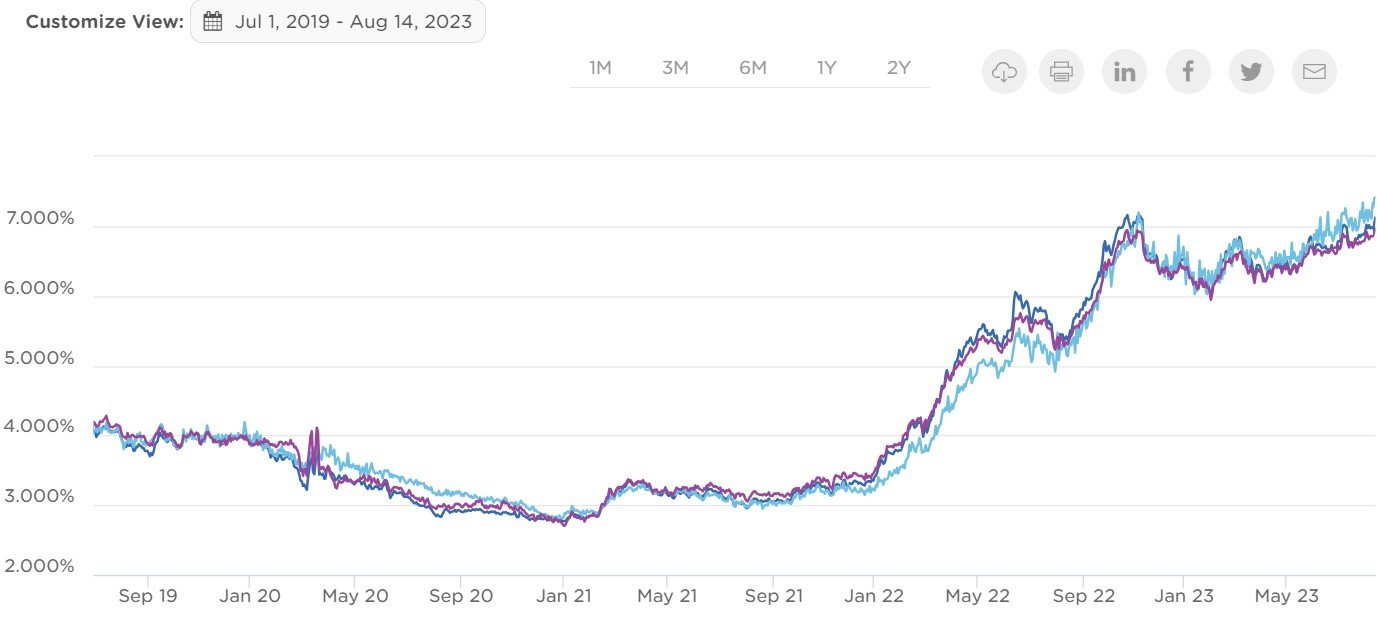

WMRE: If the Federal Reserve continues to raise interest rates, how do you expect it to impact the availability of debt in the commercial real estate sector?

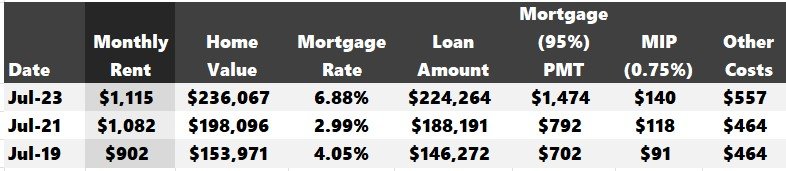

Willy Walker: So, my understanding of what the Fed said is that they are not planning on continuing to raise rates, but they will look in September at whether they need to raise rates. What I did hear is that they are having difficulty getting to their 2% inflation target and that they have work to get through it. There are two very important things to keep in mind—the Fed Funds rate, which is a short-term interest rate and directly ties into SOFR, has gone up now by 525 basis points in the last 16 months. The 10-year Treasury over the last year has gone up about 100 basis points. The real estate capital markets are based off, in today’s market, the 10-year Treasury and not SOFR. There’s clearly a significant amount of debt that is outstanding in commercial real estate that is SOFR-based. So, if you were going to have borrowed on a floating-rate loan two years ago, your interest rate on that loan will have gone up by 400 to 500 basis points. If you are a fixed-rate borrower, you loan is based on the 10-year Treasury, and when you go to refinance, most people today are borrowing at a fixed rate. So, what’s important to understand is that there is plenty of real estate debt outstanding where the cost has gone up to the borrower, but if you are a fixed-rate borrower and you are refinancing, it’s not that dramatic a change. Also, if the short-term rates keep going up, the chance of a recession gets greater and greater, and so that is why the long yield of the curve has continued to be shorter and shorter and actually going down. One of the big issues here is how much more will [the Fed] raise on the short end of the curve and how it relates to the long end of the curve. The bottom line is if they keep raising rates, the chance of recession continues to go up, which will have the inverse effect on the long end of the curve [and bring financing costs down] because most people today are borrowing at fixed-rate and not floating- rate.

WMRE: Has Walker & Dunlop changed its lending strategy in any significant way in response to rising rates and concerns about the health of commercial real estate?

Willy Walker: No. But you also have to be clear. We only take risk on multifamily loans. So, we don’t have any risk in our loan portfolio on office, retail, industrial, hospitality. Ninety-one percent of those multifamily loans are fixed-rate loans. So, we don’t have credit issue. Specifically to multifamily loans, we’ve always been a predominantly fixed-rate lender. But also, the loans we take risks on we originate and securitize with Fannie Mae, and Fannie Mae and Freddie Mac since the Great Financial Crisis [GFC], have been debt service coverage lenders and not leverage lenders. So, they have a floor of 1.25 debt service coverage. So, we will not do a loan that does not have that coverage. What that means is that values can move around quite a bit as it relates to cap rates, and at the same time, all of these loans that were underwritten at 1.25 debt service coverage and because the majority of them are fixed-rate loans, you have no credit issue whatsoever. So, have we changed our underwriting standards over the last year? No. The issue with that is that we’ve been doing very low loan-to-value deals because of that 1.25 debt service coverage requirement. So, most of the lending we’ve been doing in 2023 is that low 50s to 50% loan to value. What that means is that many of our borrowers are getting 55% leverage.

WMRE: From conversations you might have had with executives from banks that do hold office loans and other types of commercial loans that are more prone to experience distress than multifamily, how are they dealing with it? How much “pretend and extend” situations are happening in the marketplace?

Willy Walker: There is a lot of pretend and extend going on. That term is a very bad term. Pretend and extend, it should be more like—"reality check and let’s work together.” In other words, “pretend and extend” is a term that basically said you are going to pretend the loan is okay, you are going to extend it for a period of time and cross your fingers that everything works. It’s a really bad way of looking at loan modifications. You are not pretending anything. You are realizing that the property isn’t performing, and you are making adjustments to make sure that the owner can hold on to the property and that the lender can get their money back at some point in the future. If there is anything I would underscore in that conversation is that “pretend and extend” is a very bad term. Banks don’t need the capital back right now, they don’t need their principle balance back right now, so as long as the banking system remains healthy, and we don’t drop ourselves into some big recession, you are going to be able to work with real estate borrowers and developers to work these loans out. But there are concerns. There is a lot of work going on at a lot of banks and they don’t want to take on additional exposure right now. If you go in and say “I need a new loan,” they are not going to be excited. And so that’s a problem right now.

WMRE: Some people did make money during the Great Financial Crisis because they were willing to take some risks where they saw opportunity for the future. Do you see any new opportunities in today’s marketplace? What are they?

Willy Walker: There is always opportunity. An example is seniors housing right now is still quite challenged because you still have a hangover from the pandemic. Fundamentals haven’t gotten back to where they used to be before the pandemic. But the demographics behind seniors housing are fantastic because of the aging population and their needs. So, if you can buy into the market today, with challenged fundamentals [at an appropriate cap rate] and finance it with a fixed-rate loan and wait, you know there are going to be improving fundamentals over the next five years. And I do think we will start to see a shift in back-to-office in the U.S. I don’t think that office recovers quickly. But first, it will happen to trophy assets, trophy office is an asset class that’s performing very well right now and [it gets mixed in with regular office]. Retail—lots of people are sitting there saying “consumer sales are weak, we are going into a recession.” We are not going into a recession right now. We just got the numbers. Retail is an asset class that’s held up exceedingly well. So, there are plenty of opportunities to invest in retail properties, and with retail cap rates where they are and financing costs on retail where they are, you can actually find positive leverage on retail that is very hard to find in multifamily.