How does transaction velocity in 2021 compare to past years?

What's driving such aggressive investment activity?

How does sales volume vary by property type?

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

How does transaction velocity in 2021 compare to past years?

What's driving such aggressive investment activity?

How does sales volume vary by property type?

Commercial real estate prices have increased measurably this year delivering positive results for investors, John Chang, Senior Vice President and National Director Research Services at Marcus & Millichap said in a recent video.

In the third quarter CRE sales are up 12.7% over 2019 and the preliminary data for the fourth quarter look promising, he pointed out.

While pundits and consumers are worried headline inflation has risen to 6.2% compared to 1.3% a year ago this month, Chang said in times like this when inflation pressure is elevated, CRE can outperform.

“Commercial real estate is a long investment,” he stressed.

Speaking to the strength of CRE currently, the Marcus & Millichap research leader said self-storage property transactions have surged by 56% in the third quarter of this year compared to the third quarter in 2019 with hospitality deals up 46% and industrial property transactions up 17.4% while apartment sales are up 15.4%.and retail up 7.9%

The only property transaction lagging is office, down 4.6% from 2019.

Industrial has been an investor darling throughout the pandemic, with prices increasing steadily among booming demand for space. More than $100 billion has been spent on industrial properties this year, according to Real Capital Analytics, and the asset class saw the fastest annual and monthly price upticks of all sectors at 18.9% in October from a year ago and 1.9% from September.

“Investors are purchasing these properties based on rising demand driven by e-commerce and supply chain disruptions,” said Chang. “But even though industrial absorption is at a record level, so is construction, and new development could ultimately bypass demand.”

U.S. apartment leasing activity normally slows as the weather cools late in the year. In turn, occupancy tends to backtrack a bit, and property owners cut move-in lease prices a little. However, 2021 hasn’t been a normal year for the rental housing sector, and an outperformance relative to historical standards continues to register as the year winds down.

RealPage, Inc. information shows apartment occupancy hitting a new all-time high of 97.5% in November. Occupancy is now up a notable 250 basis points or so from the long-term norm of roughly 95% establish over the course of the past three decades.

Effective asking rents for new move-in leases reached a national average of $1,631 in November.

November’s pricing was up 0.4% from the October figure. While that increase is well below the monthly rent growth seen in the spring and summer months, any bump at all is a big deal since prices normally are cut in October, November and December.

The slowest growth rates as of November were increases of about 2% in small Youngstown, OH and Champaign/Urbana, IL. The top 50 metro with the slowest growth was Minneapolis/St. Paul, where pricing climbed 4.1% during the year-ending in November.

In its most recent survey, the National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found significantly more than three in four apartment households paid rent in full or part by early this month. The survey of 11.8 million units of professionally managed apartment properties across the country revealed 77.1 percent made a full or partial payment by December 6. The figure represents a 1.7 percentage point increase from the share who paid rent through December 6 of last year, and compares with the 83.2 percent that paid rent through December 6 as of two years ago.

“This concluding release for the NMHC Rent Payment Tracker continues a relatively stable pattern that we’ve observed since early in the pandemic, namely, apartment residents in professionally managed communities have continued to meet their housing obligations,” Caitlin Walter, NMHC vice president for research, told Multi-Housing News.

“Because of the swift efforts by property owners to support their residents early in the pandemic, significant government funds and, more recently, federal rental assistance, apartment residents continue to pay their rent,” she added.The data in studies in the Rent Payment Tracker encompasses a broad array of market-rate rental properties across the U.S., which can vary by size, type and average rental price. The metric furnishes insight into the changes in resident rent payment behavior over the course of each month, and, as the dataset ages, between months. Intended to serve as an indicator of resident financial challenges, the tracker also is intended to monitor recovery, including government stimulus and subsidies’ effectiveness.

The December 2021 Rent Payment Tracker data is the last to be released under the NMHC Rent Payment Tracker. Full-month December rent payment numbers will be posted on the NMHC Rent Payment webpage in January 2022.

As recently as October, lumber prices seemed to be moving to a new sustainable norm. It seemed as though prices in the $500 to $600 range per thousand board feet might become the new normal for the next year or so.

Or so it seemed … until the middle of November, when prices again began to rise. Yesterday closed at $979.30.

“The factors that caused the rise in lumber prices earlier in the year are still at play today,” Chip Setzer, director of trading and growth at commodities platform Mickey, tells GlobeSt.com. “Weather continues to be a driving factor for both supply and demand. We’ve seen unseasonably warmer temperatures across the US which has allowed construction to continue well into the start of winter. This has allowed the demand for building materials to remain strong. Also worth noting is that interest rates remain low, which is continuing to fuel housing demands.” Canada has also seen ongoing bad weather conditions, including major flooding affecting highway systems, that delayed and even stopped many lumber shipments into the U.S.

Prices “may continue to rise to above $1,000, which was last seen in Spring 2021,” Ross Price, director of finance at Mickey, tells GlobeSt.com. “This has been driven by a combination of strong construction activity, limited supply due to labor shortages, flooding in Canada, and an announcement by the US government that it would double tariffs on Canada’s lumber.”

The tariffs had been about 9%, but just before Thanksgiving, the U.S. decided to double duties to 17.9% on Canadian softwood lumber. Softwood is the material used in such applications as framing and concrete forms.

“As a result, the cost of home prices is expected to increase, which will continue to cause issues to homebuilders,” Price continues. “At some point, demand for new housing should subside which will lower the demand for lumber and prices could potentially fall.”

The housing market’s growth has shown recent signs of slowing, although the S&P CoreLogic Case-Shiller Index has still been above the 2006 through 2019 average.

“Traditionally in Q4 we see a large push for orders to be filled prior to the holidays,” Alex Meyers, Mickey’s director of operations, says. “In export markets to Asia for example, manufacturers and distributors will take larger than normal inventory positions to ensure sufficient levels of stock are arriving prior to and after lunar new year, which typically grinds the market to a halt for 3-4 weeks.” Given existing low availability of materials and ongoing supply chain problems, “demand far outweighs available supply and prices trend up as a result.”

Call it a lump of coal in the stocking of development and construction.

Montgomery, IL, December 15th, 2021 – Marcus & Millichap (NYSE: MMI), a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced today the sale of Victorian Apartments, a 152-unit multifamily property located in Montgomery, IL, according to Steven D. Weinstock, regional manager and first vice president of the firm’s Chicago Oak Brook office. The asset sold for $13,500,000.

The offering was an exclusive listing of Marcus & Millichap and both Buyer and Seller were represented by Randolph Taylor, Senior Associate, and an investment specialist in the National Multi Housing Division in Marcus & Millichap’s Chicago Oak Brook office.

The property is located at 834 Victoria Drive in Montgomery, Illinois approximately 40 miles southwest of downtown Chicago. Victorian Apartments consists of 32 large studios, 72 one-bedrooms, and 48 two-bedroom apartment homes.

# # #

About Marcus & Millichap (NYSE: MMI)

With over 2,000 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed 8.954 transactions in 2021 with a value of approximately $43.4 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors.

Are you looking to Buy, Sell or Finance/Refinance Multifamily Property?

While the U.S. economy has produced its highest growth in decades, much of the economy-related attention is focused on inflation, which not coincidentally is also running at its hottest level since the 1980s. Are the worries justified, especially for real estate?

Qualms about inflation are typically couched in terms of whether it will spiral out of control and prompt the Federal Reserve to act to reduce growth that leads to a recession. That scenario is based on the experience of the last sustained bout of inflation in the 1970s and early 1980s, but there are important differences between the economy of that era and today that are likely to mitigate the likelihood of “stagflation.”

In any event, whether high inflation is a problem for commercial real estate is another question. A recent study by Greg MacKinnon, research director of the Pension Real Estate Association, found that commercial real estate performance has been good during periods of high inflation and that returns are much more closely correlated to growth than inflation. “The lesson for today’s real estate investors trying to interpret what the macroeconomic environment means for real estate is that overall economic strength is much more important than whether inflation may rise or fall going forward,” the paper said. Or as MacKinnon put it in a recent webinar: “If the economy is doing well, real estate will do well, no matter what happens with inflation. Inflation is not critical in itself for commercial real estate.”Growth is good for the economy, and inflation is also considered a positive—up to a certain point. The Federal Reserve sets monetary policy to balance full employment and an optimal level of inflation, which is set at a 2 percent long-term average. Even though the 2 percent number is somewhat arbitrary, given the impact of inflation in the past it is proper to ask whether the current level will persist and inflict longer-term damage on the economy.

The spikes in growth and inflation have been caused by a culmination of events started by the pandemic, the unprecedented halt to parts of the economy, and the extraordinary amount of monetary and fiscal stimulus provided by the federal government. Consumer balance sheets have been boosted by roughly $2.7 trillion of additional savings and government stimulus during the lockdown. As cities eased lockdowns in the spring, the combination of pent-up spending, supply chain disruptions, wage increases, and higher energy and commodity prices prompted inflation to soar. While few expect inflation to recede to the Fed’s target level soon, the prognosis and severity are debated. Optimists say that inflation will gradually ease. In this view, the impact of the stimulus is abating, while energy prices will level off or decline. Meanwhile, the supply chain disruptions are receding, and consumer spending will normalize as the pent-up spending runs its course. Finally, wage growth will moderate as people who left the labor force during the pandemic return and ease the shortage of workers, especially for service jobs. “In our view, hand-wringing about inflation is both justified and reaching the end of its critical period,” Wells Fargo Bank senior economist Tim Quinlan said during the webinar last week. “While we do (forecast) above-trend growth in inflation for each of the next couple of years, we see the headline rate of inflation coming down perhaps as soon as late in the first quarter (of 2022), certainly by the middle of next year.” Others say inflation may not be so quick to recede. One reason is the rapid growth in housing costs—reflected in the 13.7 percent growth in U.S. multifamily asking rents year-over-year through November, according to Yardi Matrix—which comprise nearly one-third of the CPI. Because of the way housing costs are calculated in the CPI, it can take six months or more to show up in government consumer price index data, which means the rise in housing costs might impact CPI in the coming months. To be sure, though, the increase in asking rents only affects vacant units that are released, and rent increases are much smaller for tenants that rollover an existing lease. It’s also far from clear that the “Great Resignation” is about to reverse—and even if it does, whether that would slow wage gains. Some workers have decided to retire permanently, while others have concerns about health and safety, and still, others must care for children or the elderly. Another inflation concern is additional federal stimulus, which includes the newly passed $1 trillion infrastructure package and a second $1.5 trillion package that is being negotiated in Congress. That leads some to contend that even if growth recedes to the 4 percent range in 2022, inflation may remain at unhealthy levels. “It’s hard to see the growth of that kind without (high) inflation,” former Treasury Secretary Larry Summers said during a recent interview. Federal Reserve chairman Jerome Powell and other Biden administration officials downplayed the potential of long-term inflation for most of the year, dubbing it “transitory.” However, more recently they stopped using that word, and they are now talking about unwinding the Fed’s $9 trillion balance sheet. While Federal Reserve executives are not commenting on raising the fed funds rate, most observers expect rates to increase starting in 2022 (earlier than previously expected).What’s more, the U.S. economy is more diverse and resilient than it was in the period leading up to stagflation. The technology industry, which today is the most vibrant sector of the economy and has companies with the largest employment growth and market capitalizations, was barely a glimmer in the 1970s. For all those reasons, the comparisons with inflation in the past seem overblown.

The strength of commercial real estate returns during periods of high inflation might best be explained by the fact that investors will pay higher prices (or lower acquisition yields/capitalization rates relative to Treasury rates) when they feel confident about future rents increasing. As the PREA study put it: “The effect of inflation on property is complicated, depending on how (net operating income) reacts and on how that NOI is valued by the market (i.e., cap rates).”

The evidence seems to indicate that high inflation over time is a lesser problem for commercial real estate than low growth. Even so, it is appropriate that policymakers adjust policy sooner rather than later to prevent negative impact on consumer and business confidence. And the real estate industry should not be sanguine about the potential for havoc that inflation could create and plan accordingly.

High prices on properties shouldn’t scare off real estate investors, says John Chang, Senior Vice President and National Director Research Services at Marcus & Millichap in a video.

“Just because the price of a piece of property has risen dramatically does not mean its value cannot and will not continue to rise,” said Chang.

What matters, said the Marcus & Millichap expert, is the purchase price today, cash needed to buy, rates and terms for a loan, cash flow today, cash flow in the future, and the price at the time of sale.

“(Investors) should focus on two things: the value of cash flow from that property today and the value of cash flow from a future disposition date, Chang asserted.

The history of the rise and fall in a particular piece of real estate over the last several years is irrelevant, he contended.

Chang noted appreciation has been strong in the last year in a number of property types in commercial real estate. He pointed out year over year the US average increase for multifamily has been 16.1% with 12.7% for retail, 10.9% for office, and 21.7 for industrial. In certain cases, there have been huge gains for some markets including a 35.4% hike for multifamily in Phoenix and 32.1% for offices in Atlanta.

Chang provided more nuance for investors in an earlier video last month when he noted that investors would be well-served to consider the three- to five-year supply and demand outlook before snapping up assets.

Consider industrial, an asset class that’s up 22.3% over pre-pandemic levels, with revenues up by 11% and vacancies at a low near 4%. Despite that gap, “investors are purchasing these properties based on rising demand driven by e-commerce and supply chain disruptions,” Chang says. “But even though industrial absorption is at a record level, so is construction, and new development could ultimately bypass demand.”

It’s a similar story for multifamily.

“There’s a lot of speculation that apartment pricing is overheated,” Chang says. “We’re seeing cap rates hit record lows and record-high prices in many markets, mostly high population growth areas.”

The average price per unit for apartments nationally is up 11.9% over the end of 2019 levels, according to M&M data, but revenues are up by 12.6% and vacancies are at a record low of 2.8%.

The study found common ground for implementing and improving best practices for resident stability. Practitioners were generally supportive of efforts that would identify and disseminate best practices for improving resident stability, while tenant advocates showed wide support for a ‘renter bill of rights that would present a set of principles and policy recommendations for local and state officials looking to level the playing field and/or improve tenant protections.

Photo by Konstantin Evdokimov on Unsplash

High inflation is now the beast that the Federal Reserve is out to slay.

At least that's the big takeaway from Federal Reserve Chair Jerome Powell after the Federal Open Market Committee meeting on Wednesday — though he didn't use such metaphorical language.

Rather, Powell said that “elevated inflation pressures” spurred the central bank to plan to cut asset purchases twice as fast as it previously announced, which sets the stage for interest rate increases starting in 2022. “They are revising up inflation, revising down unemployment, and as a result, they’re pushing up the path for interest rates,” Renaissance Macro head of U.S. economics Neil Dutta told The New York Times. “It’s a bit of a 180 on Powell’s part.” Consumer inflation is as high as it has been since the early 1980s, and the government reported on Tuesday that wholesale prices jumped at a rate of 9.6% year-over-year in November, the fasted pace on record. “I think it’s the impact on the broader population that’s really the Fed’s challenge,” Logan Capital Management Principal Stephen Lee told NBC.Bankrate Chief Financial Analyst Greg McBride told the network that until there is greater clarity about the transmissibility of the omicron variant and its possible economic fallout, with the latest move the central bank left itself room to reverse course on its monetary policy, if necessary.

At the latest meeting, the FOMC didn't raise interest rates, but it did forecast that there will be three hikes next year — up from the two it anticipated in September. The committee also foresees three more increases in 2023 and two the following year. The median projection among FOMC members for the federal funds rate in 2022 is to end the year at 0.9%, while the median for 2023 is 1.6%, and the committee expects the long-term rate to be 2.5%. The tapering of asset purchases gives the Fed flexibility when it comes to starting rate hikes, Janus Henderson Investors Global Bonds Portfolio Manager Jason England told Bisnow by email. “This should put pressure on the front-end of the U.S. Treasury curve, leading to more flattening, with the trajectory of front-end rates higher,” England said.Powell stressed that the Fed isn't going to move precipitously in its monetary policy, with two more meetings to go until asset purchases are completely wound down. On the other hand, he also said that he didn't anticipate much of a waiting period afterward before interest rates rise, as occurred in the mid-2010s.

Moreover, the central bank also said that it is waiting for the labor market, which has been improving lately, to improve more before it ramps up interest rates.“With inflation having exceeded 2% for some time, the committee expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment,” the Fed said in a statement.

When asked what would constitute maximum employment, Powell wasn't specific, saying that it would be a judgment call on the part of the committee, based on the unemployment rate, but also the labor participation rate, as well as wages and other factors.Investors reacted positively on Wednesday, with the Dow Jones Industrial Average and the S&P 500 both up. The Dow gained 1.08% for the day, while the S&P 500 was up 1.63%. The FTSE NAREIT Composite index likewise had a good day on Wednesday, ending up at 1.32%.

The headline rate of U.S. property price growth climbed to the fastest annual rate in the history of the RCA CPPI in October amid intense investor demand for commercial real estate. The RCA CPPI National All-Property Index rose 15.9% from a year ago and 1.7% from September, the latest RCA CPPI: US report shows.

For the year through October, investors acquired $523.8 billion of commercial property assets, a 70% increase on the same period in 2021, as shown in the US Capital Trends report, also released this week. Investors spent more than $200 billion on apartment properties in the first 10 months of 2021, almost double the activity seen at this point in 2020, and more than $100 billion on industrial properties.

The office index increased 13.7% year-over-year in October, a fourth consecutive month of double-digit growth. Suburban office prices continued to drive gains, increasing 15.6% from a year prior. The CBD office index rose 0.9% year-over-year, an improvement from the declines seen for most of 2021.

Remote work continues to dominate renter migration patterns, according to data released this week by Apartment List—particularly in tech-hub markets such as San Jose, Raleigh, and Austin.

Dramatic rent increases have hit virtually all corners of the nation in 2021. Nationally, the median rent price is up over 16% since January, and in some cities rent growth is more than double that, Apartment List reported.

“Today, renters who are looking to move are not only dealing with this affordability crunch, but also navigating a tight market with historically low vacancy rates,” according to the report. “At the same time, migration patterns are also being impacted by one of the most significant societal shifts brought about by the COVID pandemic—remote work.”

Top Three ‘Revolving Door’ Markets

San Jose, Raleigh, and Austin are experiencing high turnover with many renters considering moving both in and out.

These three “revolving-door” metros are the only places that appear in the top 10 for both metrics. In San Jose and Raleigh specifically, the cross-metro rate exceeds 50% for both outbound and inbound searches.

These regions stand out as technology hubs heavily disrupted by the remote work revolution. In fact, they rank first (San Jose), fourth (Austin), and eighth (Raleigh) in terms of the share of their workforce that have remote-friendly occupations.

This quarter’s report incorporates the search preferences of users who registered with Apartment List between July 1 and Sept. 30, 2021.

“Newfound flexibility has likely given many residents of these three metros the opportunity to move somewhere new, which in turn creates vacancies that attract new renters from afar,” Apartment List reported. “We have seen this dynamic play out in local rent prices, where over the last 18 months these cities experienced dramatic rent declines followed by similarly-dramatic rent rebounds as residents cycle in and out of the rental market.”

Beyond these three, other technology-friendly markets that are experiencing high outbound migration this quarter (e.g., San Francisco, Boston, Denver, Baltimore) also rank high in terms of remote-friendly workforces and dramatic price swings.

Long-Distance Moves on the Increase

This collision of market trends and changing preferences may result in a greater number of longer-distance moves—in Q3 2021, 40% of Apartment List users were searching to move to a new metropolitan area, and 26% were searching in a different state altogether.

Despite being separated by more than 1,000 miles, Miami is the number one destination for New York City renters, narrowly edging out nearby Philadelphia. 6.1% of searches leaving the New York City metro are destined for Miami, and another 7.8% are destined for other parts of Florida, namely Tampa, Orlando, and Jacksonville metros.

California: A Major Exporter of Renters

As a large, expensive, and politically liberal state, California has long held a reputation for exporting residents across the country and altering economic and political landscapes along the way. This notion hit a major milestone in 2020, when for the first time in its 170-year history California experienced net population loss, losing over 182,000 residents in the wake of the COVID-19 pandemic.

Apartment List search data indicate that this trend may be continuing, as California supplies more search interest across the country than any other state. In the most recent quarter, eight states—Alaska, Hawaii, Washington, Oregon, Nevada, Arizona, Utah, and Texas—received more searches from California than any other state. In Nevada specifically, over half of all apartment searches came from California residents.

While you won't get a tax break for your contributions to a Roth IRA, the after-tax money you put in will then grow tax-free and can be withdrawn tax-free once you reach retirement age. In 2022 you can contribute up to $6,000 a year ($7,000 if you're 50 or older).

High earners, however, are prohibited from contributing directly to a Roth IRA if their modified adjusted gross income in 2022 is at least $144,000 ($214,000 if married).

But they can still create a Roth IRA through a so-called "backdoor" strategy that involves converting their other IRA savings.In transferring a non-deductible IRA to a Roth, you would owe tax on the gains that had accrued on your contributions. That's avoidable, however, if you make the conversion immediately after making your non-deductible IRA contribution, since there would be no time for the money to grow.

But this strategy may get the ax. Starting next year, the House-passed bill would prohibit all taxpayers from converting their after-tax contributions using this "backdoor" conversion method to a Roth IRA.

The bill would also prohibit a similar strategy that is currently permitted when it comes to Roth 401(k)s.

Roth 401(k)s are another great way to build tax-free retirement savings and they are now offered by a majority of employers that offer tax-deferred 401(k) plans. Unlike Roth IRAs, Roth 401(k)s do not have any income eligibility rules and they allow for much higher contributions -- up to the 401(k) limit of $20,500 starting next year ($27,000 if you're at least 50).

On top of that, your employer also may let you make after-tax contributions to your regular 401(k), the gains on which would be taxable when you withdraw them. Under current law, you may convert those pre-tax and after-tax savings from your 401(k) account into a Roth and thereby skip having to pay taxes on future withdrawals.In total, savers effectively can sock away up to $61,000 next year ($67,500 if you're at least 50) -- once your contributions, your employer match and your after-tax contributions are counted.

So for high-income earners, it is possible to convert large sums of money into a Roth 401(k) through what's known as a 'mega backdoor' strategy. Under the bill, however, starting next year, taxpayers would be prohibited from converting the after-tax portion of their 401(k) savings into a Roth.Then, a decade from now -- in 2032 -- anyone with modified AGI over $400,000 (or $450,000 if married and filing jointly) would also be prohibited from converting their pretax savings into a Roth. That would apply whether their pre-tax savings come from their 401(k) or a traditional, deductible IRA.

And nothing likely will change for anyone when it comes to their 2021 savings strategies. "We're executing 2021 contributions [and] conversions by December 31 as our best thinking is the bill will have no effect on 2021. For 2022 and beyond, we're taking a wait-and-see approach," said New Jersey-based CPA and certified financial planner Joseph Doerrer.

But for his high-income clients, Doerrer said he is strategizing when and what portion of their savings it makes sense to convert to a Roth before the window potentially closes for them in 2032."We're modeling out smaller piecemeal conversions, if we have any favorable play in their tax brackets, to chip away at their pre-tax balances in the event there is the 10-year or so proposed window after which Roth conversions would be unavailable to higher income individuals."

For Florida-based certified financial planner Mari Adam, her advice to clients remains the same regardless of the fate of the Roth provisions in the bill."Save consistently, spend moderately and invest for the long-term," she said. "The only advice I would add? Stay nimble. Tax rules change, so stay flexible and avoid committing to any financial strategy that can't easily be undone when the tax regime changes."

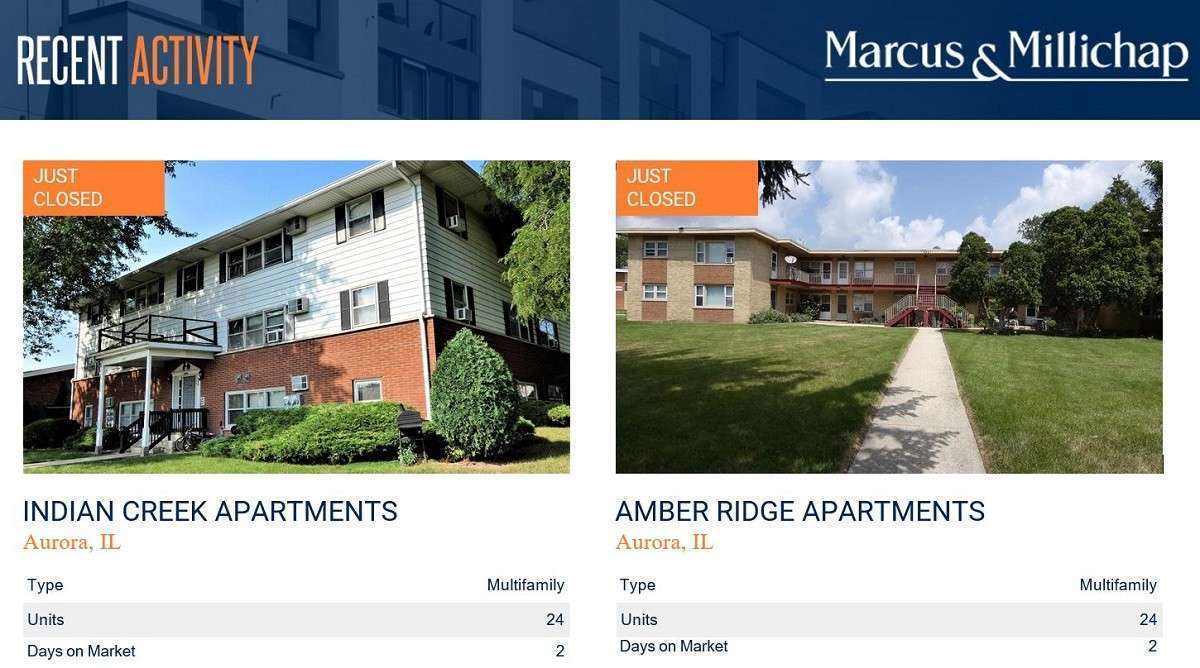

Aurora, IL, December 6th, 2021 – Marcus & Millichap (NYSE: MMI), a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced today the sale of two adjacent 24-unit apartment properties located in Aurora, IL, according to Steven D. Weinstock, regional manager and first vice president of the firm’s Chicago Oak Brook office. The assets, Amber Ridge Apartments and Indian Creek Apartments, sold for $1,850,000 and $1,885,000 respectively.

The sellers and buyer of both properties were secured and represented by Randolph Taylor, Senior Associate, and an investment specialist in the National Multi Housing Division in Marcus & Millichap’s Chicago Oak Brook office.

The properties are located at 1015 N Farnsworth Ave and 991 Tollview Ave in Northeast Aurora, IL. The properties were sold to a repeat buyer for the agent and the firm and were financed by the Marcus & Millichap Capital Group.

# # #

About Marcus & Millichap (NYSE: MMI)

With over 2,000 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed 8.954 transactions in 2021 with a value of approximately $43.4 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors. To learn more, please visit: www.MarcusMillichap.com.

Are you looking to Buy, Sell or Finance/Refinance Multifamily Property?

How does transaction velocity in 2021 compare to past years?

What's driving such aggressive investment activity?

How does sales volume vary by property type?

Commercial real estate prices have increased measurably this year delivering positive results for investors, John Chang, Senior Vice President and National Director Research Services at Marcus & Millichap said in a recent video.

In the third quarter CRE sales are up 12.7% over 2019 and the preliminary data for the fourth quarter look promising, he pointed out.

While pundits and consumers are worried headline inflation has risen to 6.2% compared to 1.3% a year ago this month, Chang said in times like this when inflation pressure is elevated, CRE can outperform.

“Commercial real estate is a long investment,” he stressed.

Speaking to the strength of CRE currently, the Marcus & Millichap research leader said self-storage property transactions have surged by 56% in the third quarter of this year compared to the third quarter in 2019 with hospitality deals up 46% and industrial property transactions up 17.4% while apartment sales are up 15.4%.and retail up 7.9%

The only property transaction lagging is office, down 4.6% from 2019.

Industrial has been an investor darling throughout the pandemic, with prices increasing steadily among booming demand for space. More than $100 billion has been spent on industrial properties this year, according to Real Capital Analytics, and the asset class saw the fastest annual and monthly price upticks of all sectors at 18.9% in October from a year ago and 1.9% from September.

“Investors are purchasing these properties based on rising demand driven by e-commerce and supply chain disruptions,” said Chang. “But even though industrial absorption is at a record level, so is construction, and new development could ultimately bypass demand.”

Montgomery, IL, December 15th, 2021 – Marcus & Millichap (NYSE: MMI), a leading commercial real estate brokerage firm specializing in investment sales, financing, research and advisory services, announced today the sale of Victorian Apartments, a 152-unit multifamily property located in Montgomery, IL, according to Steven D. Weinstock, regional manager and first vice president of the firm’s Chicago Oak Brook office. The asset sold for $13,500,000.

The offering was an exclusive listing of Marcus & Millichap and both Buyer and Seller were represented by Randolph Taylor, Senior Associate, and an investment specialist in the National Multi Housing Division in Marcus & Millichap’s Chicago Oak Brook office.

The property is located at 834 Victoria Drive in Montgomery, Illinois approximately 40 miles southwest of downtown Chicago. Victorian Apartments consists of 32 large studios, 72 one-bedrooms, and 48 two-bedroom apartment homes.

# # #

About Marcus & Millichap (NYSE: MMI)

With over 2,000 investment sales and financing professionals located throughout the United States and Canada, Marcus & Millichap is a leading specialist in commercial real estate investment sales, financing, research and advisory services. Founded in 1971, the firm closed 8.954 transactions in 2021 with a value of approximately $43.4 billion. Marcus & Millichap has perfected a powerful system for marketing properties that combines investment specialization, local market expertise, the industry’s most comprehensive research, state-of-the-art technology, and relationships with the largest pool of qualified investors.

Are you looking to Buy, Sell or Finance/Refinance Multifamily Property?

U.S. apartment leasing activity normally slows as the weather cools late in the year. In turn, occupancy tends to backtrack a bit, and property owners cut move-in lease prices a little. However, 2021 hasn’t been a normal year for the rental housing sector, and an outperformance relative to historical standards continues to register as the year winds down.

RealPage, Inc. information shows apartment occupancy hitting a new all-time high of 97.5% in November. Occupancy is now up a notable 250 basis points or so from the long-term norm of roughly 95% establish over the course of the past three decades.

Effective asking rents for new move-in leases reached a national average of $1,631 in November.

November’s pricing was up 0.4% from the October figure. While that increase is well below the monthly rent growth seen in the spring and summer months, any bump at all is a big deal since prices normally are cut in October, November and December.

The slowest growth rates as of November were increases of about 2% in small Youngstown, OH and Champaign/Urbana, IL. The top 50 metro with the slowest growth was Minneapolis/St. Paul, where pricing climbed 4.1% during the year-ending in November.

In its most recent survey, the National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found significantly more than three in four apartment households paid rent in full or part by early this month. The survey of 11.8 million units of professionally managed apartment properties across the country revealed 77.1 percent made a full or partial payment by December 6. The figure represents a 1.7 percentage point increase from the share who paid rent through December 6 of last year, and compares with the 83.2 percent that paid rent through December 6 as of two years ago.

“This concluding release for the NMHC Rent Payment Tracker continues a relatively stable pattern that we’ve observed since early in the pandemic, namely, apartment residents in professionally managed communities have continued to meet their housing obligations,” Caitlin Walter, NMHC vice president for research, told Multi-Housing News.

“Because of the swift efforts by property owners to support their residents early in the pandemic, significant government funds and, more recently, federal rental assistance, apartment residents continue to pay their rent,” she added.The data in studies in the Rent Payment Tracker encompasses a broad array of market-rate rental properties across the U.S., which can vary by size, type and average rental price. The metric furnishes insight into the changes in resident rent payment behavior over the course of each month, and, as the dataset ages, between months. Intended to serve as an indicator of resident financial challenges, the tracker also is intended to monitor recovery, including government stimulus and subsidies’ effectiveness.

The December 2021 Rent Payment Tracker data is the last to be released under the NMHC Rent Payment Tracker. Full-month December rent payment numbers will be posted on the NMHC Rent Payment webpage in January 2022.

As recently as October, lumber prices seemed to be moving to a new sustainable norm. It seemed as though prices in the $500 to $600 range per thousand board feet might become the new normal for the next year or so.

Or so it seemed … until the middle of November, when prices again began to rise. Yesterday closed at $979.30.

“The factors that caused the rise in lumber prices earlier in the year are still at play today,” Chip Setzer, director of trading and growth at commodities platform Mickey, tells GlobeSt.com. “Weather continues to be a driving factor for both supply and demand. We’ve seen unseasonably warmer temperatures across the US which has allowed construction to continue well into the start of winter. This has allowed the demand for building materials to remain strong. Also worth noting is that interest rates remain low, which is continuing to fuel housing demands.” Canada has also seen ongoing bad weather conditions, including major flooding affecting highway systems, that delayed and even stopped many lumber shipments into the U.S.

Prices “may continue to rise to above $1,000, which was last seen in Spring 2021,” Ross Price, director of finance at Mickey, tells GlobeSt.com. “This has been driven by a combination of strong construction activity, limited supply due to labor shortages, flooding in Canada, and an announcement by the US government that it would double tariffs on Canada’s lumber.”

The tariffs had been about 9%, but just before Thanksgiving, the U.S. decided to double duties to 17.9% on Canadian softwood lumber. Softwood is the material used in such applications as framing and concrete forms.

“As a result, the cost of home prices is expected to increase, which will continue to cause issues to homebuilders,” Price continues. “At some point, demand for new housing should subside which will lower the demand for lumber and prices could potentially fall.”

The housing market’s growth has shown recent signs of slowing, although the S&P CoreLogic Case-Shiller Index has still been above the 2006 through 2019 average.

“Traditionally in Q4 we see a large push for orders to be filled prior to the holidays,” Alex Meyers, Mickey’s director of operations, says. “In export markets to Asia for example, manufacturers and distributors will take larger than normal inventory positions to ensure sufficient levels of stock are arriving prior to and after lunar new year, which typically grinds the market to a halt for 3-4 weeks.” Given existing low availability of materials and ongoing supply chain problems, “demand far outweighs available supply and prices trend up as a result.”

Call it a lump of coal in the stocking of development and construction.

Apartment developers will create more new apartments in 2021 in old office, retail, and hotel buildings than at any time in the last decade.

The pandemic didn’t slow down apartment developers who adaptively reuse old buildings. Rising apartment rents allow investors to spend more to buy and redevelopment old buildings—income from the finished apartments should eventually pay for the high cost of development.

“We will likely see a fair amount of this—redevelopment and converting properties to apartments—over the next few years,” says John Sebree, senior vice president and national director of multifamily for Marcus & Millichap, working in the firm’s Chicago offices. “That is the result of being in a housing crisis, and without new product being built at the same pace as demand.” Developers are likely to finish a record 20,100 new apartments in 2021 in buildings converted from other uses, according to Yardi Matrix. That will make 2021 the busiest year for conversions in the last 10 years. It’s also up sharply from an average of about 12,000 a year over the last five years. “The pandemic has accelerated the need for a rapid supply of housing stock,” says Doug Ressler, manager of business intelligence for Yardi Matrix, working in the firm’s Scottsdale, Ariz., offices. The number of new apartments created in converted buildings grew steadily from about 5,000 in 2010 to 15,000 in 2017. It dipped to less than 9,000 in 2018… but quickly recovered to close to 12,000 a year in both 2019 and the pandemic year of 2020. The cost of redevelopment varies a lot depending on the building being repurposed—but it is generally significantly cheaper than building similar new apartments from the ground up.“One estimate could be that renovations could cost about 30 to 40 percent less than new construction for the same number of units,” says Emil E. Malizia, a research professor in the Department of City and Regional Planning at the University of North Carolina at Chapel Hill. “Total development cost per unit should be less as long as the cost of the site and building is not significantly more expensive than the cost of site acquisition for new construction.”

The pandemic has hurt demand for hotels, offices, and retail space—but the occupancy rate for apartments is still well above 90 percent and rents continue to grow on average, even in the once-bustling downtown areas hurt the most by the pandemic. The relatively strong demand for apartments compared to the demand for office space and hotels is helping to make more deals work to adaptively reuse these buildings.Nearly half (41 percent) of the conversions being completed in 2020 and 2021 are in former office buildings.

“The trend toward office conversions is a significant departure from the last decade when hotel conversions were popular,” says Ressler. Old hotels were relatively easy to turn into apartment buildings because the existing floorplans and utilities were already a good fit with residential use. “However, consistent urban demand and increased preference for open-plan layouts and out-of-the-box designs revealed the housing potential in non-residential buildings.” In cities like Philadelphia and Washington, D.C., the return of capital and demand in submarkets in and around the central business district has made it possible for developers to create thousands of new apartments in converted buildings. The top cities where developers created the most new apartments in converted office building in 2020 and 2021 include Washington D.C. (1,091 apartments) and Chicago (1,020 apartments).Stabilizing Debt Costs Create Tactical Opportunities for Apartment Owners Updated: February 2026 Chicago multifamily mortgage rates are stab...