Introduction

Commercial real estate distress 2025 is taking center stage—but it’s not the crisis many assume. Just ask John Chang, Senior VP at Marcus & Millichap, whose on-the-road market update brings clarity and candor. His perspective captures the volatility of the market—and its resilience.

The Delinquency Decipher: Is CRE in Crisis?

Is this a wave or just ripples? CMBS delinquency rates rose 50 basis points in 2025—now 200 basis points higher than 2024. But the story is nuanced:

Office: 10.3%, still elevated, but below late 2024.

Industrial: 0.5%, near-zero distress.

Retail: 7.1%, improving from COVID-era highs.

Lodging: 7.9%, elevated but not alarming.

This isn’t a full-scale meltdown. It's targeted market friction.

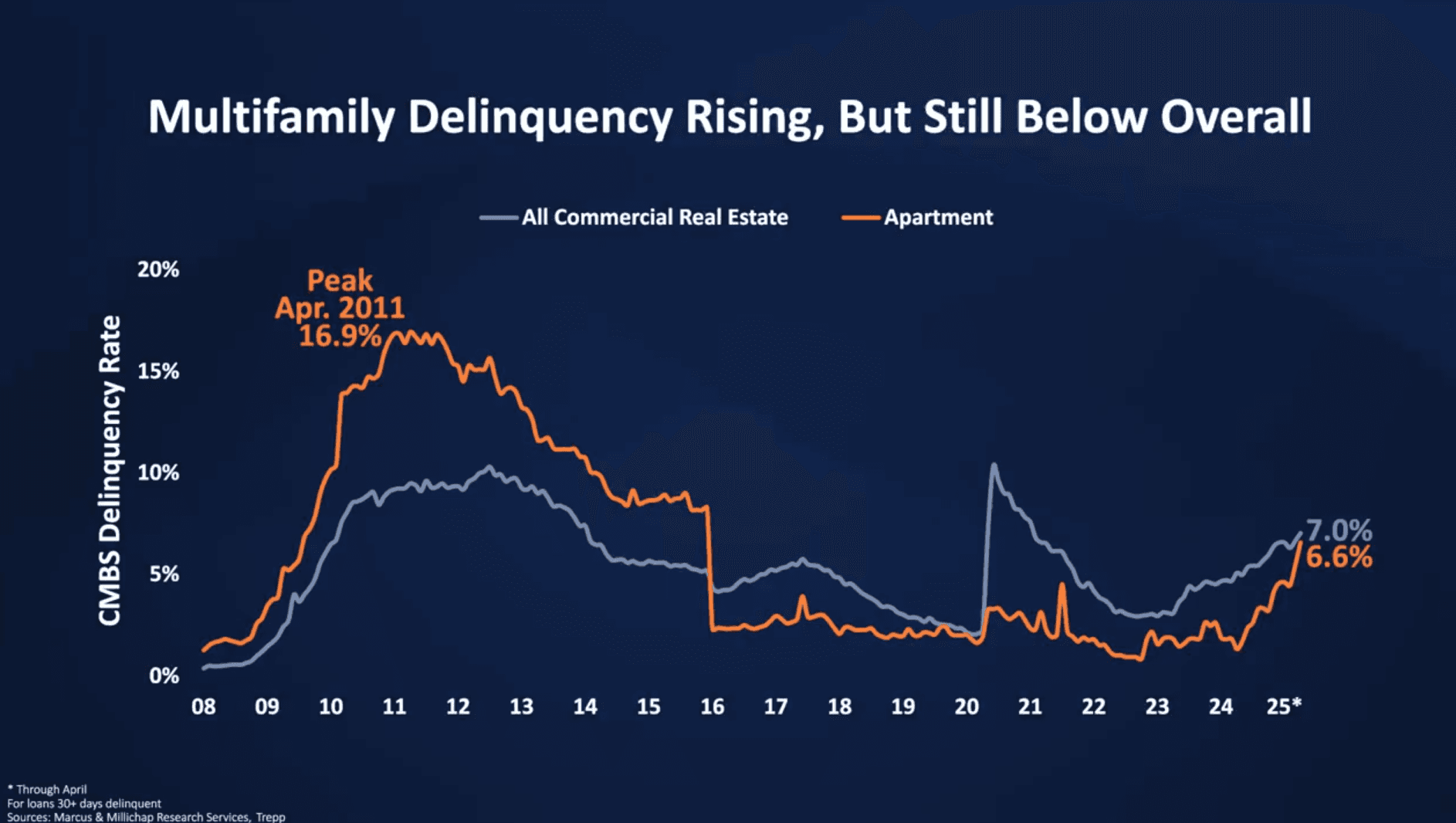

Multifamily Sector: Where Pressure Is Building

The multifamily delinquency rate has reached 6.6% in 2025—up significantly, but still far from the 16.9% seen in 2010–2011. The pressure is localized:

Sunbelt metros like Dallas, Phoenix, and Florida

Properties acquired at peak pricing with low-interest debt

Inexperienced operators now facing loan maturity

Chang notes, “This isn’t widespread failure. It’s a matter of misaligned projections and tighter lending.”

Lenders Shift Gears: Less Forgiveness, More Action

For years, lenders extended terms or deferred payments. In 2025, that flexibility is gone:

Loans must be refinanced or sold

Notes are changing hands

Foreclosure starts are ticking up

Distress is entering the market slowly—but firmly.

Sector Snapshots: Comparing 2025 CRE Delinquency

Office: Still Volatile

10.3% delinquency. Tenant downsizing and hybrid work persist.

Industrial: Strong and Steady

0.5% delinquency. Demand remains robust across logistics and warehouse properties.

Retail: Mixed Outlook

7.1% delinquency. Results vary by submarket and tenant strength.

Lodging: Gradual Rebound

7.9% delinquency. Some assets remain distressed due to slower recovery and rising costs.

Multifamily: Watch the Sunbelt

6.6% delinquency. Still manageable, but the Sunbelt faces investor retrenchment.

Investor Psychology: Headlines vs. Reality

Distress doesn’t mean discounts. Many troubled properties require capital, repositioning, or involve legal headaches. “Extend and pretend” is fading, but buyers must remain cautious.

The hype? Overstated. The opportunity? Real—but complicated.

Conclusion: Context is Everything in 2025

Commercial real estate distress 2025 is a market reality—but not a repeat of 2008. Each sector is reacting differently, and smart investors are responding accordingly. The fundamentals remain strong where underwriting was sound.

“Distress isn’t a wave sweeping across the industry—it’s a trickle, highly localized and sector-specific.” — John Chang

Source: https://www.linkedin.com/feed/update/urn:li:activity:7330275843224625152/

https://creconsult.net/commercial-real-estate-distress-2025/?fsp_sid=902