eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Friday, May 31, 2024

Fairway Lakes Estates

Fairway Lakes Estates -Frankfort, IL

Price: 6,950,000

60 single-family lots

R-2: Residential Single Family

Golf Course Views-Green Garden Country Club

Public sewer, water, and paved roads

Listing Agent: Randolph Taylor

rtaylor@creconsult.net | 630.474.6441

Property Website/OM:

https://www.creconsult.net/fairway-lakes-estates-development-opportunity/

Thursday, May 30, 2024

Multifamily Property Sales in Naperville and Aurora | eXp Commercial

Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://tidycal.com/creconsult/discovery-call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/Wednesday, May 29, 2024

924 Greenbrier

Price: $1,200,000

GOI: $132,600

Cap Rate: 7.68%

Fully Occupied

Below-market rents

Solid Flexicore Construction

New Boiler/Newer Roof

Resurfaced Parking Lot

Listing Agent: Randolph Taylor

rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/dekalb-il-multifamily-property-sale-924-greenbrier/

Friday, May 24, 2024

Indian Creek Sold

1015-1025 N Farnsworth Ave | Aurora, IL

24-Unit Multifamily Property

Fully Occupied

Multiple Offers

Sold $2,800,000

Brokered by: Randolph Taylor, CCIM

Multifamily Investment Sales Broker

National Multifamily Division

exp Commercial - Chicago

rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/company-news/sale-indian-creek-apartments-aurora-il/

Sale of Indian Creek Apartments in Aurora, IL by eXp Commercial

[row]

[col span__sm="12"]

[row]

[col span__sm="12"]

Aurora, IL, May 23, 2024: eXp Commercial (NASDAQ: EXPI), the fastest-growing national commercial real estate brokerage firm, announced the sale of Indian Creek Apartments in Aurora, Illinois.

Indian Creek Apartments is located at 1015–1025 N Farnsworth Ave. in West Suburban Aurora, Illinois, within the Chicago Metro market. The property consists of 24 multifamily rental units, including 22 two-bedroom units and two one-bedroom units. At the time of the sale, the property was fully occupied and presented as a value-add opportunity. The property sold for $2,800,000

The transaction was brokered by Randolph Taylor. Randolph is a Multifamily Investment Sales Broker in the National Multifamily Division with eXp Commercial – Chicago. Randolph focuses on the listing and sale of multifamily properties in the greater Chicago area and suburbs. Randolph has over 26 years of commercial real estate experience, including corporate real estate, asset management, and brokerage. Randolph’s broad knowledge of the commercial real estate industry, financial analysis, marketing, and negotiating skills uniquely position him to provide a superior level of service to his clients.

Randolph can be contacted at rtaylor@creconsult.net or (630) 474-6441.

[/col] [/row] https://www.creconsult.net/company-news/sale-indian-creek-apartments-aurora-il/Thursday, May 23, 2024

Multifamily Property Sales in Naperville and Aurora | eXp Commercial

Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://tidycal.com/creconsult/discovery-call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/Friday, May 17, 2024

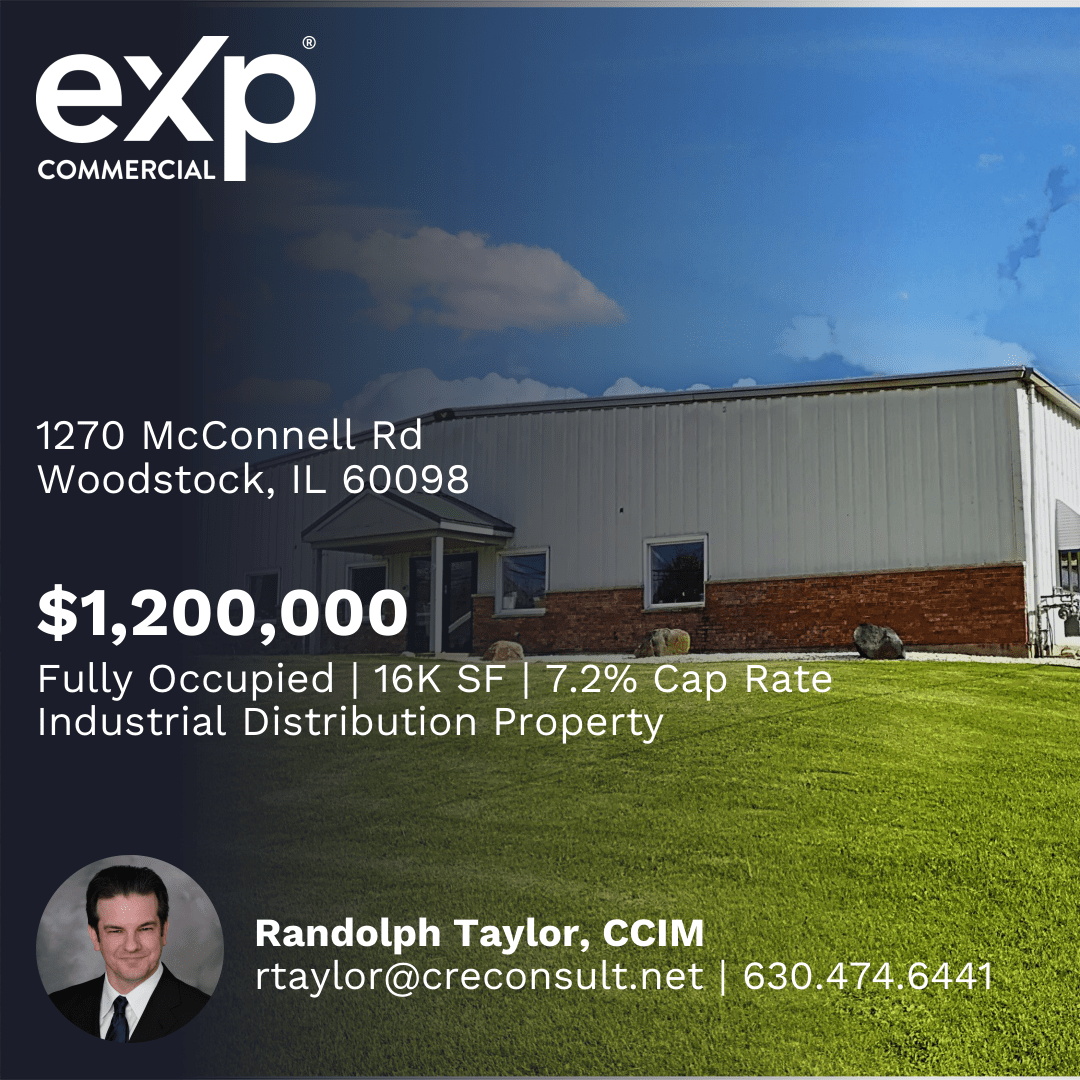

1270 MCConnell Rd

PRICE: $1,200,00

HIGHLIGHTS:

16,000 SF, 1 Acre, M1 Zoning

Fully Occupied, Stable Tenants

Steel Construction/Steel Roof

16' Ceiling Heights

2-Dock High Doors

1 Grade Level Door

Fully Sprinklered/Monitored

Connecting Ramp/Dock Doors Adjacent Property

1150 McConnell, 73K SF Also For Sale

LISTING BROKER: Randolph Taylor

rtaylor@creconsult.net, 630.474.6441

PROPERTY WEBSITE/OM:

https://www.creconsult.net/occupied-industrial-property-woodstock-sale/

Thursday, May 16, 2024

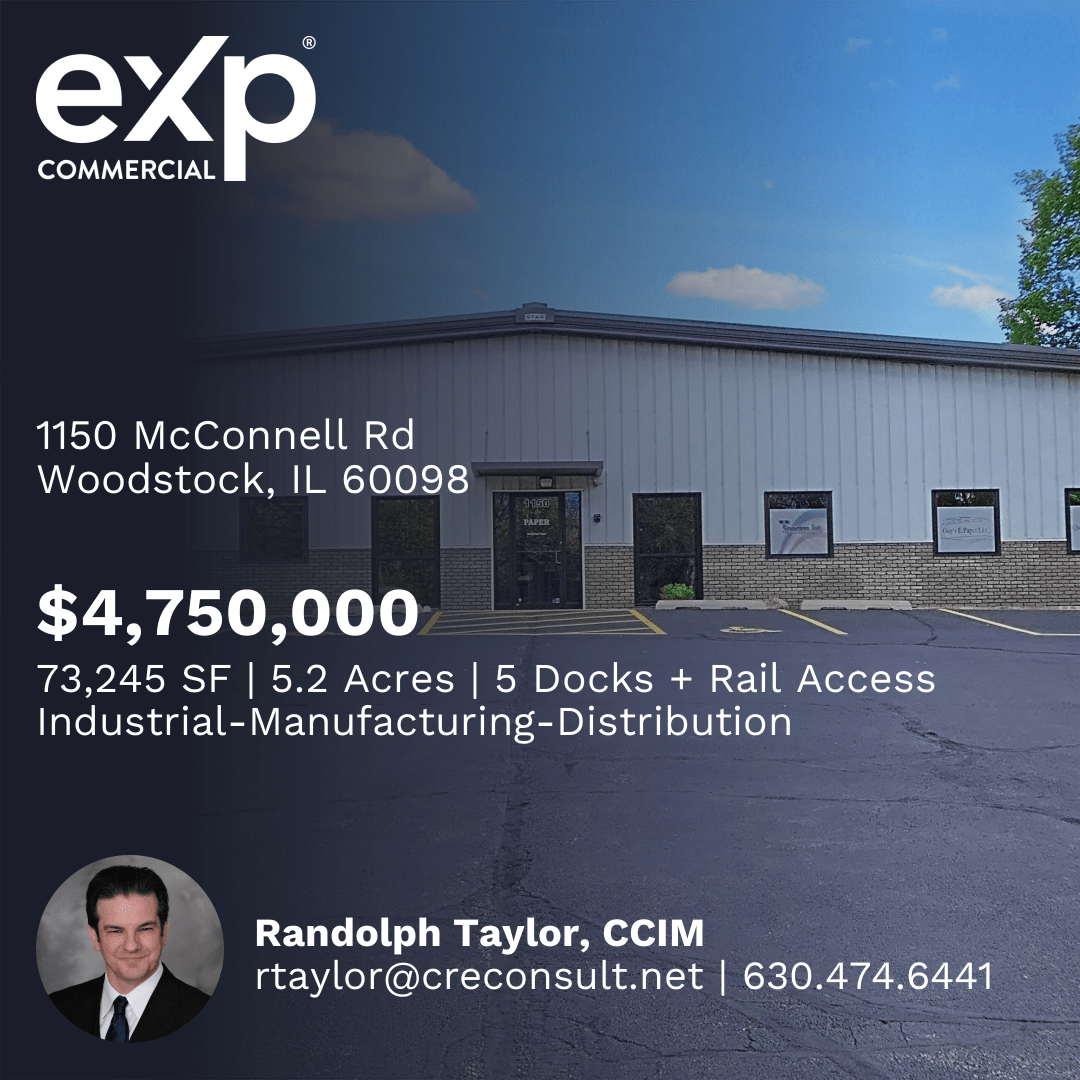

1150 McConnell

1150 McConnel Rd. Woodstock, IL 60098

Price: $4.,750,000

Highlights:

5.2 Acres, M1 Zoning

Owner-User/Investor Offering

5 Dock High Doors/1 Grade Level

Dedicated Active Rail Spur/Dock

Recently Renovated Well Finished Offices

Heavy Floor Load 9" Concrete

Heavy Power: 480V/3-Phase

Connecting Ramp/Dock Doors Adjacent Property

1270 McConnell, 16K SF Also For Sale

Listing Agent: Randolph Taylor

P: rtaylor@creconsult.net | 630.474.6441

Property Website/OM:

https://www.creconsult.net/industrial-property-for-sale-73245-sf-in-woodstock-il/

Multifamily Property Sales in Naperville and Aurora | eXp Commercial

Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://tidycal.com/creconsult/discovery-call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/Tuesday, May 14, 2024

Sequence 8

View our Blog To Keep Up To Date On

The Multifamily Market

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

https://www.creconsult.net/blog/

Thursday, May 9, 2024

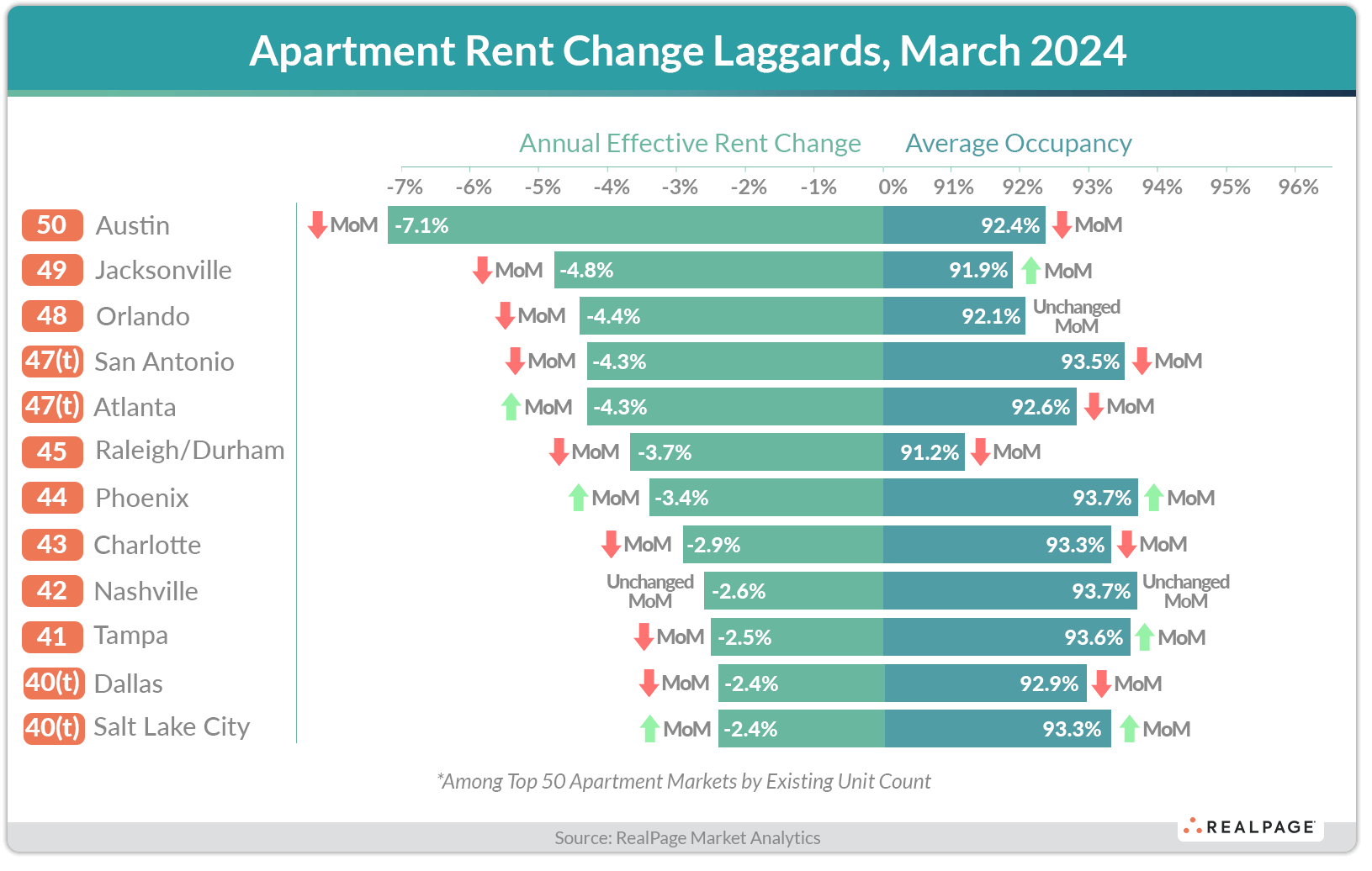

US Apartment Market Q1 2024: Supply Outpaces High Demand

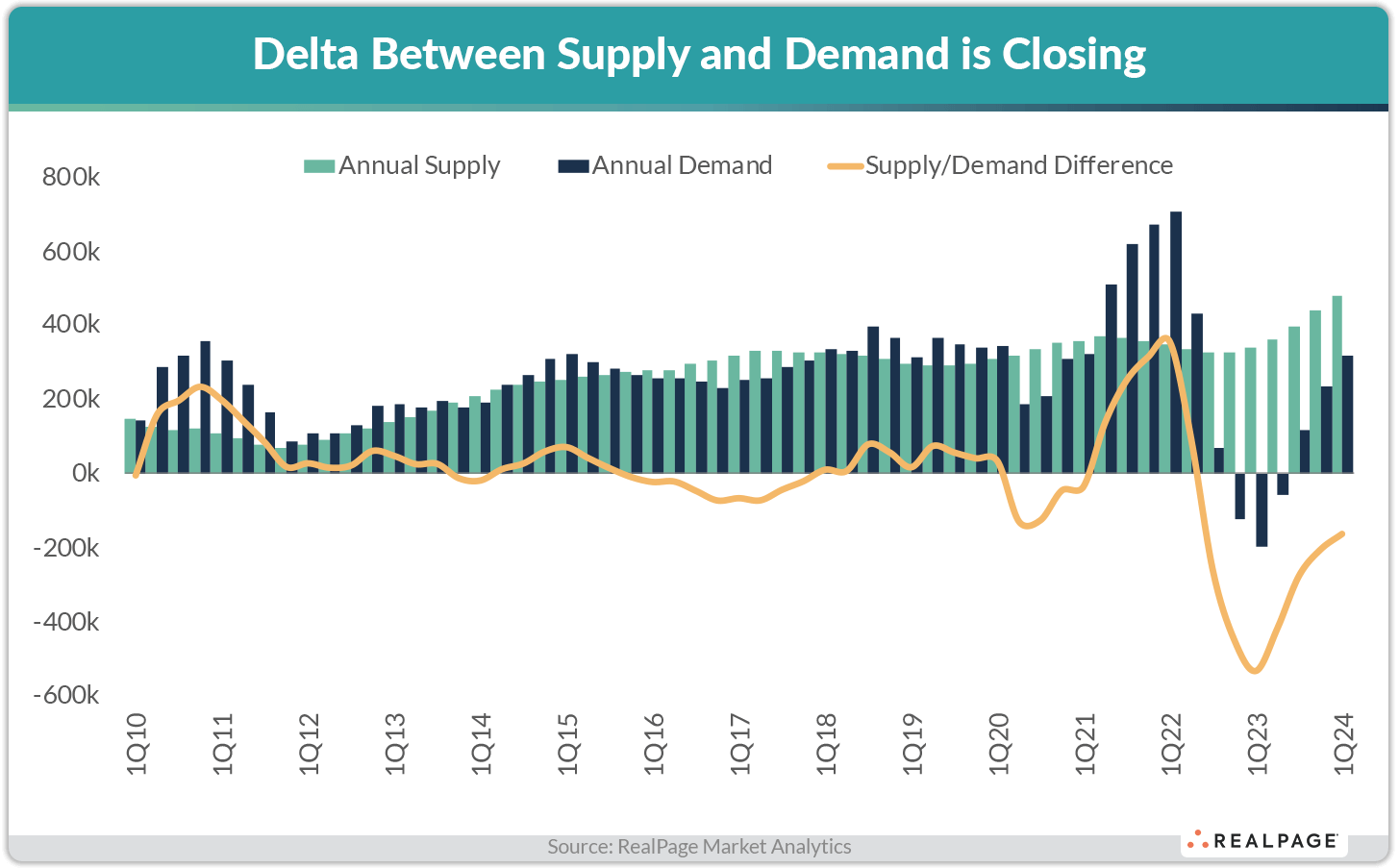

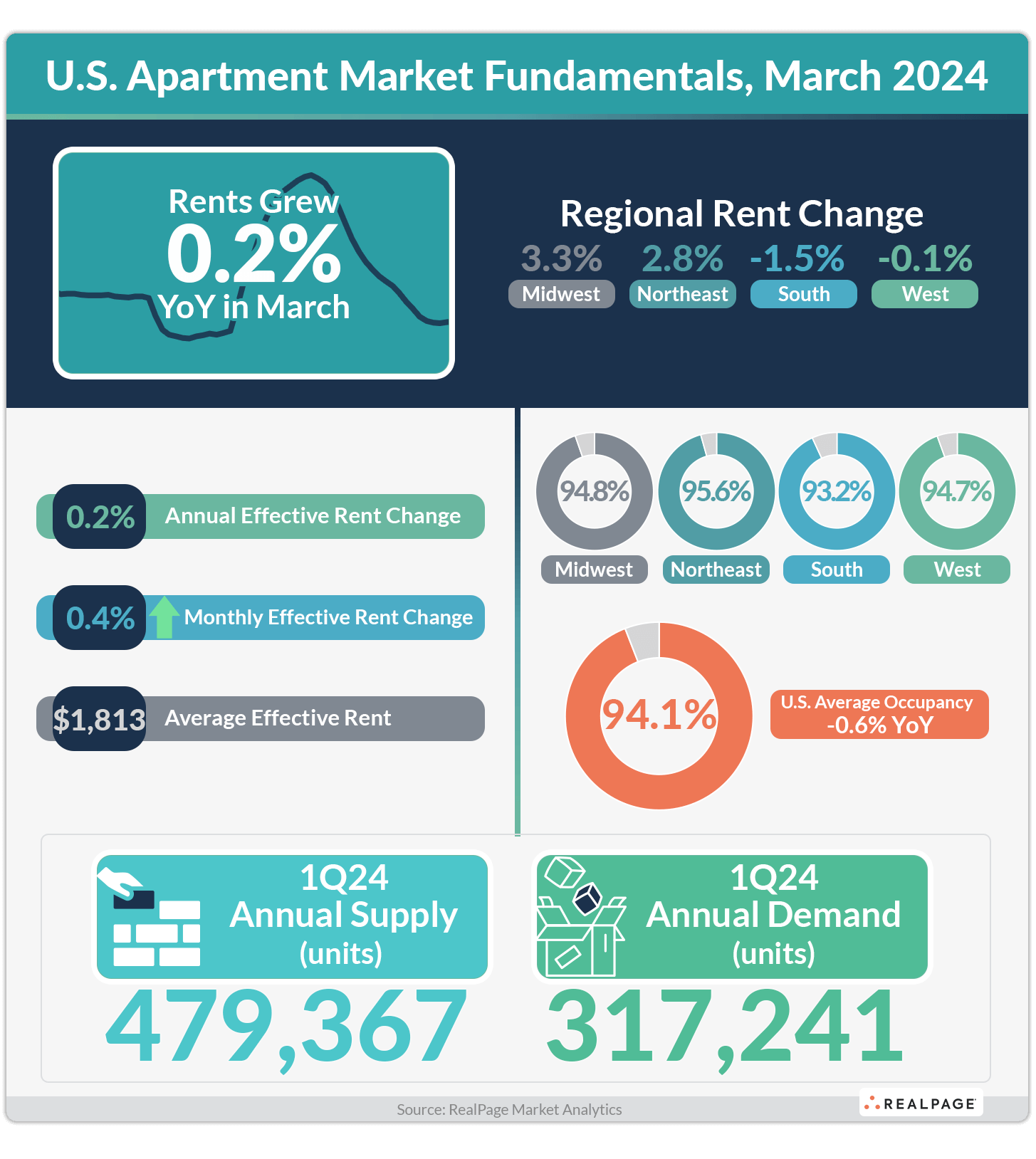

Despite apartment demand recovering to stand above normal levels in 1st quarter 2024, even heavier supply continued to weigh down rent and occupancy figures.

In the first three months of 2024, the U.S. absorbed 103,826 apartment units on net, according to data from RealPage Market Analytics. That strong quarterly tally brought annual demand to stand at 317,241 units absorbed in the year-ending 1st quarter 2024. That rate registered about 20% higher than a typical annual absorption rate from the 2010s decade.

Fueling this demand strength is a confluence of factors, including persistent wage growth (which has now outpaced rent growth for 16 straight months), solid job growth, demographic tailwinds and arguably the lowest level of move-outs from apartment units and into single-family homes since the Great Financial Crisis.

Still, even higher-than-average demand failed to keep pace with nearly unprecedented supply that delivered concurrently. In the first three months of 2024, there were 135,652 apartment units completed nationwide. In total, the U.S. delivered 479,367 new multifamily units in the year-ending 1st quarter 2024, representing a 10% increase from the prior quarter.

New apartment supply continues to be the primary influence on national performance. We’re sitting at the highest annual supply figure dating back to 1986 when approximately 550,000 new units were delivered. Though it’s important to note that today’s relative expansion rate of 2.5% remains comfortably below the 1986 expansion rate of 3%.

Also of note, the difference between supply and demand narrowed in 1st quarter to its lowest delta since mid-2022. The mismatch between supply and demand shrank to approximately 160,000 units – still a historically high figure, but much lower than the over 530,000-unit delta seen one year ago.

Slight Rent Growth Still Typical Nationwide

As has been the case for several months, rent growth for professionally managed apartments remained near stagnant nationwide as of March. Asking rents for professionally managed apartments inched up just 0.2% in the year-ending March 2024, with change measured on a same-store basis.

That rate mirrored February’s annual rate, indicating that as the imbalanced relationship between supply and demand narrows, rents rent growth will likely remain muted throughout the remainder of 2024.

This interplay between supply (much higher than usual) and demand (strong, but trailing supply) is the crux of today’s modest rent growth.

Occupancy, meanwhile, remained lower than typical, but not to a severe degree. Apartment occupancy averaged 94.1% nationwide as of March, matching February’s rate and holding approximately in line with the long-term average.

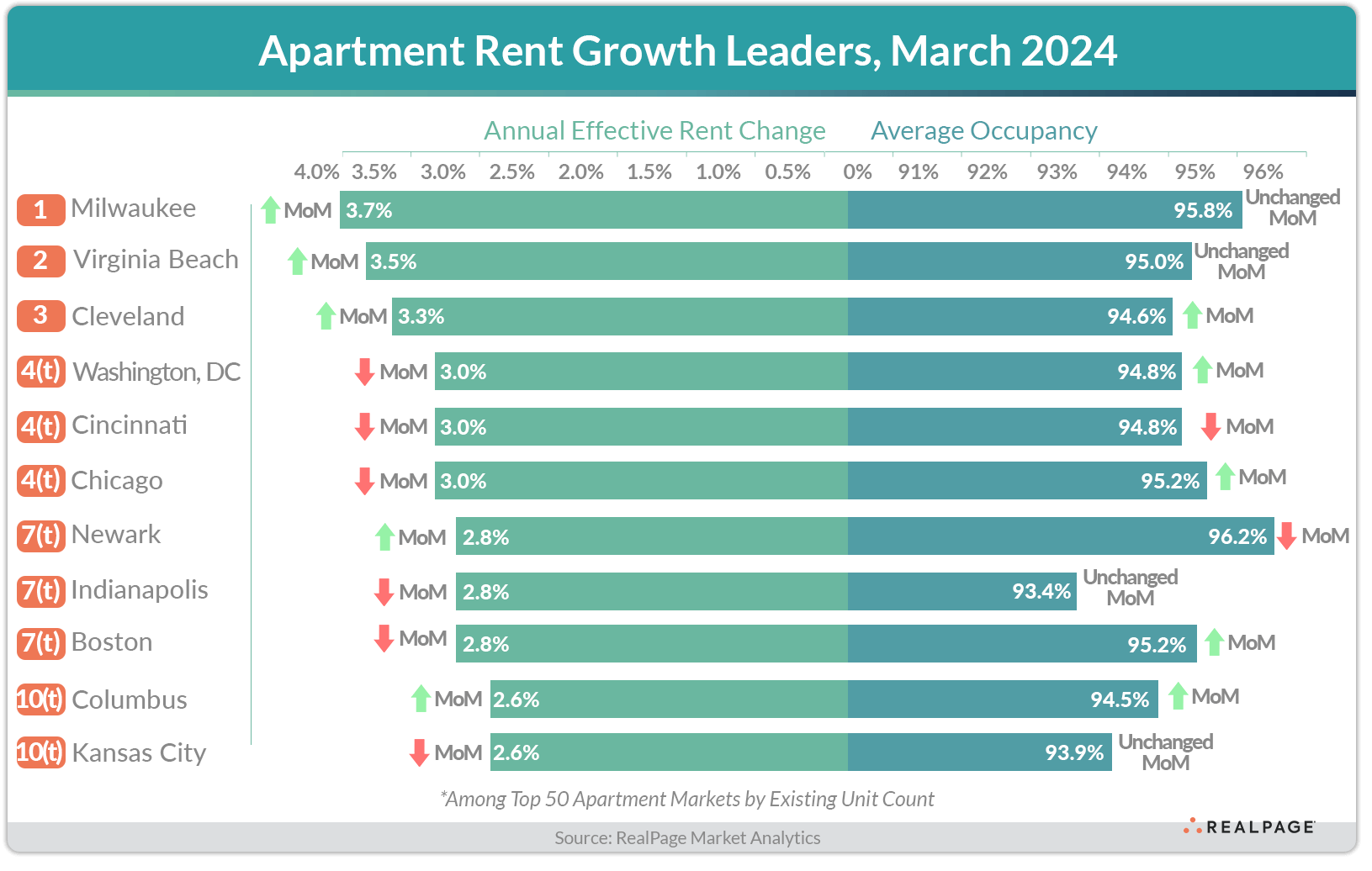

Rent Growth Leaders and Laggards Divided by Supply

Markets with very modest new supply tended to grow rents at the fastest pace in 1st quarter 2024. Of the 12 major markets that posted annual effective rent growth of 2.6% or higher in March, all but two (Columbus and Indianapolis) concurrently posted annual inventory growth below the national norm. The lower the annual inventory, the more likely a market is to be posting nation-leading rent growth.

Conversely, markets that delivered the most new supply tended to experience the most downward pressure on rents. Of the 11 major markets posting annual rent cuts of 2.5% or deeper in March, all concurrently posted annual inventory growth above the national norm. As has been the case for months, markets delivering the most new supply – such as Austin, Atlanta and Dallas – were all among the national laggards for rent cuts in March.

Regionally, the Midwest and Northeast continue to lead with historically normal rent growth. Rent change in the South region, meanwhile, continues to labor under considerable supply pressure. The West region shows mixed results. Soft performance in more inner-West markets, such as Phoenix and Salt Lake City, can be attributed to hefty supply. In more coastal West markets, such as the Bay Area, other factors such as out migration and job losses, appear to be softening apartment demand.

https://www.creconsult.net/market-trends/us-apartment-market-q1-2024-demand-supply/Multifamily Property Sales in Naperville and Aurora | eXp Commercial

Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://tidycal.com/creconsult/discovery-call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/Wednesday, May 8, 2024

Sequence 7

No Matter Where You Are In The Investment Cycle

with Your Multifamily Property

We Can Help You!

Buy | Sell | Hold | Finance

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

https://www.creconsult.net/

Tuesday, May 7, 2024

9301 Golf

Price: $3,900,000

SF: 35,245

Stories: 3

Occupancy: 82.3%

Cap Rate: 9.63%

* Stabilized Medical Office Building with Value-Added Potential

* Established Medical Tenants

* 5 Minutes from Advocate Lutheran General Hospital

* 1/2 mile to I-294 and Milwaukee Avenue

* Recent Building Modernization

* Value Add Through Leasing of Vacant Space

Listing Agent: Randolph Taylor

rtaylor@creconsult.net | 630.474.6441

Property Website: https://www.creconsult.net/stabilized-golf-sumac-medical-offices/

Sequence 6

Expert Property Tax Evaluation to Estimate The

Potential to Appeal Your Property Taxes

REQUEST: https://www.creconsult.net/resources/

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

Monday, May 6, 2024

High Rates Challenge Commercial Property Strategy

|

Commercial property owners are grappling with the reality that the anticipated interest rate cuts might not materialize. But it’s not just borrowers who are on the hook; lenders are in a tight spot, too. |

|

|

A new reality: Persistently high-interest rates are challenging commercial property owners to rethink strategies; as Fed Chair Powell said last week, “Restrictive monetary policy needs more time to do its job.” Hopes for easing refinancing conditions in 2024 are diminishing amid stubborn inflation and strong economic data, shifting expectations in the real estate market. |

|

|

Escalating costs: Investor expectations for the secured overnight financing rate (SOFR) have shifted significantly, now predicting it to stabilize at 4.825% by early 2025, with only two minor rate cuts anticipated this year, down from six expected in January. This change has sharply increased hedging costs for borrowers with floating-rate debt. The cost to extend an interest-rate cap on a $100M mortgage has surged from $1.3M to $2.1M, posing a new financial challenge for owners. |

|

|

|

|

Zoom in: Lenders are also under pressure as persistent high interest rates lead to commercial real estate loans rolling over. MBA notes that $929 billion in property loans are maturing in 2024, up 41% due to extensions from 2023. Previously effective during the low-rate environment post-2008, the "extend-and-pretend" strategy now risks tying up significant capital with no imminent return to low rates. This affects not only banks, where these loans form over a fifth of portfolios but also investors in CMBS loans, who face disappointing returns as low as 3% on top-tier bonds. |

|

|

Case in point: In New York, landlords like SL Green and Vornado have paid about $100M to extend a $1.08B loan for an office building, reflecting the lengths some property owners will go to avoid defaults. However, smaller owners might choose to relinquish their properties rather than invest further. |

|

➥ THE TAKEAWAY |

|

|

Big picture: Sustained high interest rates are freezing property transactions as elevated debt costs challenge buyers to meet lenders’ coverage requirements. Property owners face tough choices: either reduce prices or invest more capital into their properties to secure loan extensions. This new reality forces sellers and borrowers to navigate a constrained market with limited options. |

Thursday, May 2, 2024

Multifamily Property Sales in Naperville and Aurora | eXp Commercial

Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://tidycal.com/creconsult/discovery-call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/Wednesday, May 1, 2024

Sequence 5

Current Market Rents For Your Multifamily Property

Estimate Potential Rental Income

REQUEST: https://www.creconsult.net/resources/

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

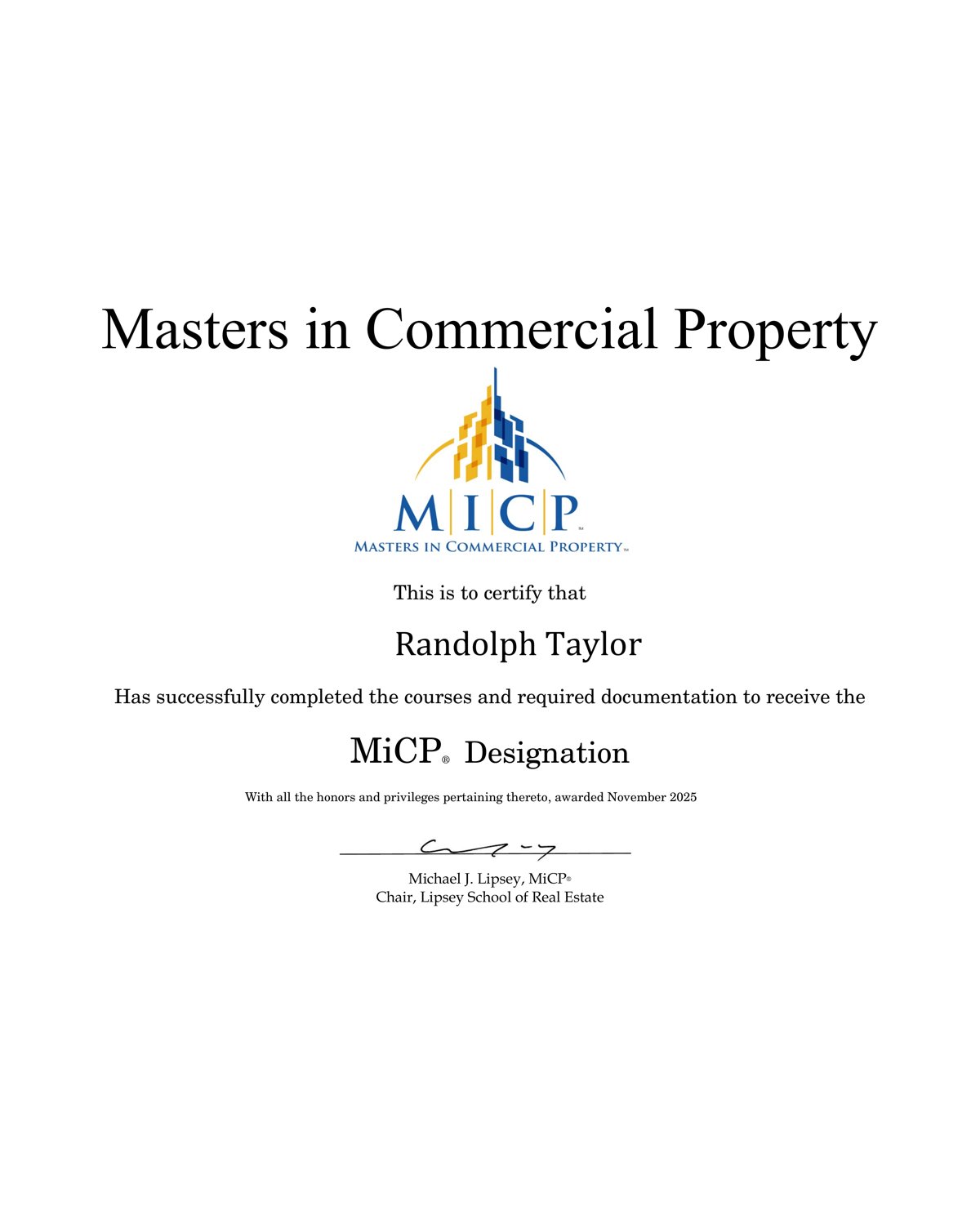

Masters in Commercial Property (MiCP®): Randolph Taylor of eXp Commercial

Randolph Taylor, Senior Associate with eXp Commercial’s National Multifamily Division, has earned the Masters in Commercial Property (MiCP®)...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...