As multifamily property owners navigate the complexities of today's real estate market, insights from expert economists can significantly shape their strategies. This blog summarizes key findings from the recent NMHC Q2 2025 webinar and examines essential data for those considering selling, valuing, or repositioning their investments in the Chicago area. The increasing demand for insights into market conditions reflects ongoing shifts in the multifamily landscape.

Understanding Market Conditions

Overview of the Quarterly Survey Results

In a recent webinar hosted by the National Multifamily Housing Council (NMHC), key insights were shared regarding the current state of the apartment market. The session featured Chris Bruin, the senior director of research and economist, who presented findings from their April quarterly survey. This survey gathered sentiments from CEOs and executives in the apartment sector, providing a comprehensive overview of market conditions.

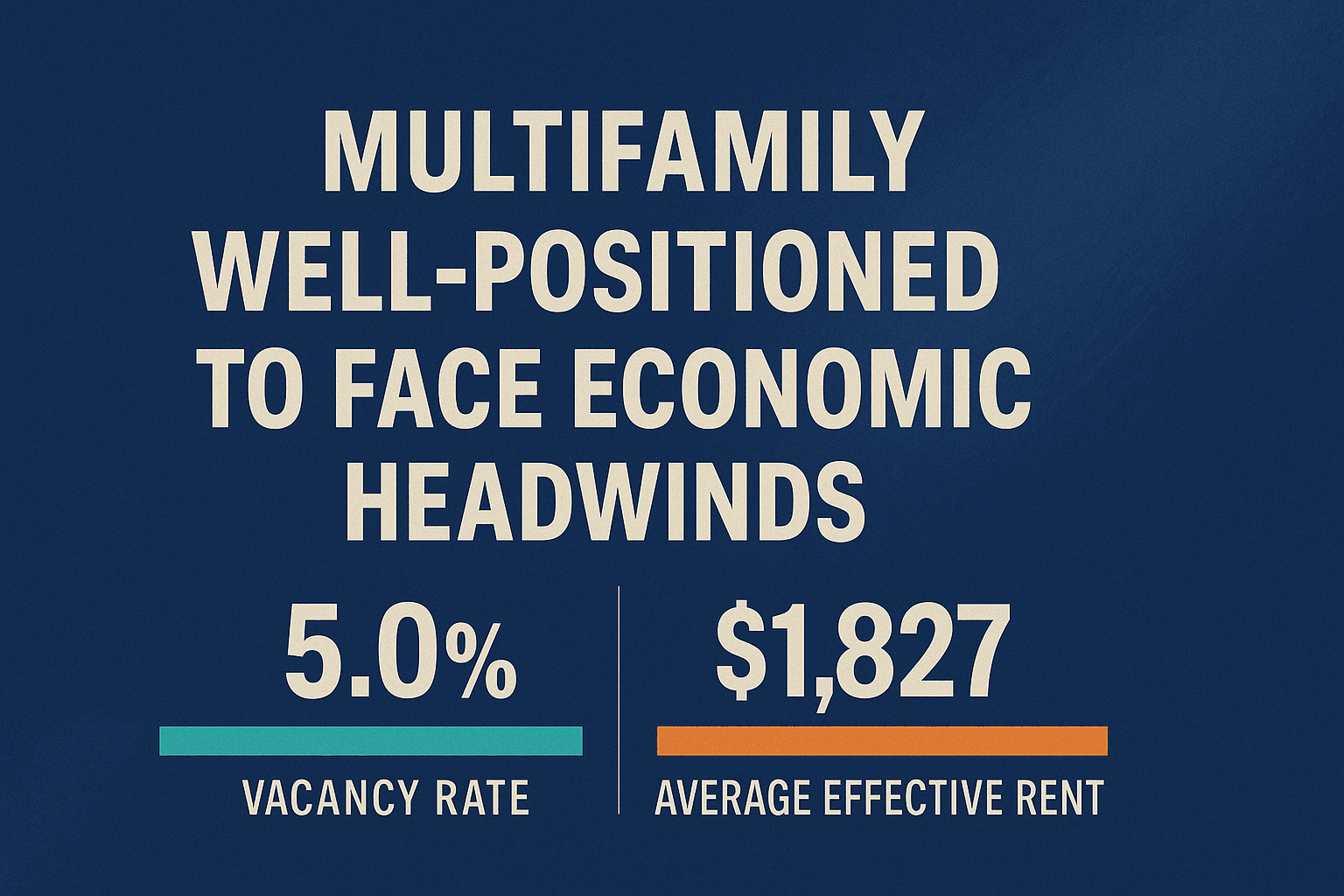

The results revealed a significant shift in market dynamics. For the first time in ten quarters, the Market Tightness Index reached a score of 52. This indicates tighter market conditions, which is a notable change from the previous trend of softening. Specifically, 24% of respondents acknowledged improvements in market conditions compared to three months prior, while 21% felt the market was loosening. Interestingly, 54% believed conditions remained unchanged.

Market Tightness Index at 52 Indicates Tighter Conditions

The Market Tightness Index is a crucial indicator for multifamily property owners and investors. A score of 52 suggests a shift towards a more competitive market. This change can influence decisions regarding property sales, valuations, and repositioning strategies. The index reflects the sentiment that demand is beginning to outpace supply, which is essential for property owners to consider.

Moreover, the Debt Financing Index scored favorably at 65, indicating a more favorable borrowing climate. About 45% of respondents felt it was a better time to secure loans, while only 14% disagreed. This could be encouraging news for those looking to finance new acquisitions or refinance existing properties. However, the Equity Financing Index reported a slightly negative score of 49, indicating a more divided opinion on equity conditions.

Trends in Demand and Occupancy Rates

The webinar also highlighted trends in demand and occupancy rates. With the market tightening, there are signs of increased leasing activity, particularly in the Northeast and Midwest regions. However, the Sunbelt areas are experiencing high vacancy levels due to an oversupply of new constructions. This discrepancy in regional performance is critical for investors to understand, as it can impact their investment strategies.

As the discussion progressed, it became clear that job growth is vital for sustaining apartment demand. Higher mortgage rates may delay home purchases, keeping more renters in the apartment market. However, concerns about declining consumer confidence and potential economic slowdowns were raised. Economists have voiced a 50% chance of a recession, which could further affect demand for rental properties.

In addition, the panel discussed the impact of rising construction costs and economic uncertainty on developer decisions. These factors could influence the overall demand for housing, making it essential for property owners to stay informed about market conditions.

As multifamily property owners and investors in the Chicago metropolitan area consider their next steps, understanding these market conditions is crucial. The tightening market presents both challenges and opportunities. By staying informed about the latest trends and survey results, they can make more strategic decisions regarding their investments.

Financing Framework: Equity vs. Debt

In the multifamily real estate market, understanding the dynamics of financing is crucial. Recently, the National Multifamily Housing Council (NMHC) hosted a webinar that shed light on the current state of financing options. The discussion, led by Chris Bruin and Greg Willett, focused on two key financing metrics: the Debt Financing Index and the Equity Financing Index.

Understanding the Debt Financing Index at 65

The Debt Financing Index scored a solid 65. This score indicates a favorable borrowing climate for multifamily property owners and investors. A score above 50 suggests that more respondents believe it’s a good time to secure loans. In fact, 45% of those surveyed felt it was a better time to procure loans, compared to only 14% who disagreed. This positive sentiment is significant, especially in a market that has seen fluctuations in recent years.

Why does this matter? A higher Debt Financing Index means that lenders are more willing to provide loans. It reflects confidence in the market. When borrowing is easier, property owners can invest in improvements or expansions. This can lead to increased property values and better returns on investment.

Equity Financing Barely Under the Neutral Mark at 49

On the other hand, the Equity Financing Index was reported at 49, just shy of the neutral mark. This indicates a more cautious outlook among investors regarding equity financing. The responses were nearly split. Some viewed conditions as less favorable, while others saw potential for improvement. This uncertainty can be attributed to various factors, including rising construction costs and economic fluctuations.

What does this mean for property owners? With equity financing being less favorable, investors might hesitate to raise capital through equity. They may prefer to rely on debt financing, which is currently more accessible. However, this could lead to challenges if the market shifts again. Investors need to be strategic in their financing decisions.

Impact of Economic Conditions on Financing Availability

The economic landscape plays a significant role in financing availability. The NMHC webinar highlighted how economic conditions can influence both debt and equity financing. For instance, rising treasury yields have affected perceptions of debt financing. As these yields increase, borrowing costs may rise, making loans less attractive.

Moreover, economic uncertainty can dampen investor confidence. The webinar noted concerns about potential recession risks, with economists suggesting a 50% chance of a downturn. Such projections can lead to hesitance in making significant financial commitments. Property owners need to stay informed about economic indicators and adjust their strategies accordingly.

In addition, the discussion pointed out that job growth is essential for sustaining demand in the apartment market. If job creation slows down, it could lead to higher vacancy rates and decreased rental income. This is particularly concerning for multifamily property owners who rely on steady occupancy rates.

In summary, the current financing framework reveals a complex landscape for multifamily property owners and investors. The Debt Financing Index shows promise, while the Equity Financing Index indicates caution. Economic conditions will continue to shape the availability of financing options. As property owners navigate these challenges, staying informed and adaptable will be key to success in the multifamily market.

Leasing Trends and Strategies

Analysis of Leasing Activity and Its Effect on Occupancy

Leasing activity is a critical indicator of market health. It reflects how many units are being rented and can significantly impact overall occupancy rates. In the recent NMHC webinar, Chris Bruin highlighted a Market Tightness Index of 52. This is a notable improvement, indicating tighter market conditions for the first time in over two years. What does this mean for property owners? Simply put, it suggests that demand is on the rise.

When leasing activity increases, occupancy rates typically follow suit. A higher occupancy rate means more income for property owners. Conversely, if leasing activity slows, it can lead to higher vacancy rates, which can be detrimental to a property's financial health. The survey indicated that 24% of respondents saw improvements in market conditions, while only 21% felt it was loosening. This shift can create a more competitive environment, making it essential for property owners to stay informed and agile.

Challenges Faced by New High-End Properties

New high-end properties face unique challenges in today’s market. While they often boast modern amenities and attractive designs, they also contend with high vacancy rates, particularly in regions where supply exceeds demand. For instance, many Sunbelt areas are experiencing this phenomenon. The influx of new developments has outpaced the demand for luxury rentals, leading to increased competition.

Moreover, rising construction costs and economic uncertainty can further complicate matters for new developments. As noted in the webinar, the economic outlook is clouded with risks, including potential recession. This uncertainty can deter potential renters who may opt for more affordable options. Property owners must navigate these challenges carefully, ensuring their offerings stand out in a crowded marketplace.

Tips for Optimizing Lease-Up Rates

Optimizing lease-up rates is essential for maintaining healthy occupancy levels. Here are some strategies that property owners can implement:

- Understand Your Market: Conduct thorough market research to understand local demand and pricing trends. Tailoring your offerings to meet the needs of potential renters can make a significant difference.

- Enhance Online Presence: In today’s digital age, a strong online presence is crucial. Invest in professional photography and engaging virtual tours to attract prospective tenants.

- Offer Incentives: Consider offering move-in specials or discounts for longer lease terms. These incentives can entice renters who may be on the fence.

- Focus on Resident Experience: Create a community atmosphere that encourages tenant retention. Host events and provide amenities that enhance the living experience.

- Utilize Technology: Leverage data analytics to track leasing trends and resident preferences. This information can guide decision-making and improve operational efficiency.

As the NMHC webinar emphasized, job growth remains a crucial factor for apartment demand. Higher mortgage rates may keep potential buyers in the rental market longer, which can benefit property owners. However, it’s essential to remain vigilant about economic indicators and consumer confidence. The landscape is ever-changing, and adaptability is key.

In conclusion, understanding leasing trends and implementing effective strategies can significantly impact occupancy rates. Property owners need to stay informed about market conditions and be proactive in addressing challenges. By optimizing lease-up rates, they can ensure their properties remain competitive and financially viable.

Navigating Economic Uncertainty

In today's fast-paced world, economic uncertainty looms large. It affects everyone, from individual consumers to large corporations. Understanding the factors at play is crucial for making informed decisions. This blog will explore potential economic downturn risk factors, the relationship between consumer confidence and demand, and strategic responses to fluctuating market conditions.

Potential Economic Downturn Risk Factors

Economic downturns can arise from various sources. Here are some key risk factors:

- High Inflation: When prices rise rapidly, consumers may cut back on spending. This can lead to decreased demand for goods and services.

- Rising Interest Rates: Higher borrowing costs can discourage both consumers and businesses from taking loans. This can stifle growth.

- Global Events: Natural disasters, geopolitical tensions, or pandemics can disrupt supply chains and economic stability.

- Consumer Debt Levels: As debt rises, consumers may feel financially strained. This can lead to reduced spending.

These factors create a precarious environment. They can lead to a ripple effect, impacting various sectors of the economy. For instance, if consumers are worried about their financial future, they might hold off on making significant purchases. This behavior can slow down economic growth.

Consumer Confidence and Its Correlation with Demand

Consumer confidence is a vital indicator of economic health. When people feel secure in their jobs and finances, they tend to spend more. This increased spending drives demand for products and services.

But what happens when confidence wanes? A decline in consumer confidence can lead to:

- Reduced Spending: If consumers are uncertain about their financial future, they may choose to save rather than spend.

- Lower Demand: Businesses may see a drop in sales, leading to potential layoffs or reduced hours.

- Stagnant Growth: A prolonged period of low consumer confidence can stall economic growth.

As noted by economists, “Consumer confidence is like a barometer for the economy. When it’s high, the economy tends to thrive. When it’s low, we often see a slowdown.” This correlation highlights the importance of fostering a positive economic environment.

Strategic Responses to Fluctuating Market Conditions

In the face of economic uncertainty, businesses must adapt. Here are some strategic responses that can help navigate these turbulent waters:

- Diversification: Companies should consider diversifying their product lines or services. This can help mitigate risks associated with downturns in specific sectors.

- Cost Management: Keeping a close eye on expenses is crucial. Businesses may need to streamline operations to maintain profitability.

- Market Research: Understanding market trends and consumer behavior can provide valuable insights. This knowledge allows businesses to pivot quickly in response to changing conditions.

- Investment in Technology: Leveraging technology can enhance operational efficiency. It can also improve customer engagement, which is vital during uncertain times.

As Chris Bruin, a senior director of research, pointed out in a recent webinar, “The market is always changing. Those who adapt will thrive.” This statement rings true across industries.

In conclusion, navigating economic uncertainty requires vigilance and adaptability. Understanding potential risk factors, monitoring consumer confidence, and implementing strategic responses can help businesses weather the storm. The future may be unpredictable, but with the right strategies, companies can position themselves for success. As the economic landscape continues to evolve, staying informed and proactive is essential for sustainable growth.

The NMHC Q2 2025 webinar provided essential insights on market conditions, maintaining investor confidence amidst uncertainties, and strategies for leasing and financing in the evolving multifamily market in Chicago.

https://creconsult.net/chicago-multifamily-market-q2-2025/?fsp_sid=729