Six of the largest multifamily REITs to have released their earnings reports for the third quarter all reported outperforming their year-to-date performance guidance, including Mid-America Apartment Communities, AvalonBay Communities, Equity Residential, Essex Property Trust, UDR and Camden Property Trust. With rents increasing at a dramatic pace and capital availability at historic levels, the biggest landlords in the country are riding high.

Across all of the earnings reports and the calls between the companies’ executives and financial analysts accompanying the reports, common themes emerged within the overall sunny outlook: average occupancy over 96%, cap rates below 4% and an impetus to build new apartment buildings at a greater rate than was expected at the start of the year.

“We continue to aggressively sell our older and less desirable properties at these low cap rates and at prices that exceed our pre-pandemic value estimates, [as well as] acquiring much newer assets in our expansion markets,” Equity Residential President and CEO Mark Parrell said on his company’s earnings call. “We have funded these buys with an approximately equal amount of dispositions of older and less desirable assets.”

The resounding success of the largest landlords stands in stark contrast to the ongoing troubles owners of small numbers of rental units are facing, including being saddled with a disproportionate number of tenants who owe back rent.

The major players still have considerable numbers of tenants who had struggled with rent payments through the pandemic, but they have used their resources to either apply for the federal government’s Emergency Rental Assistance program on their behalf or helped them to apply directly. AvalonBay, Camden, Essex, Equity Residential and UDR all reported receiving more than $10M in ERA payments for their tenants so far this year and all expect to receive further payments before the year is out.

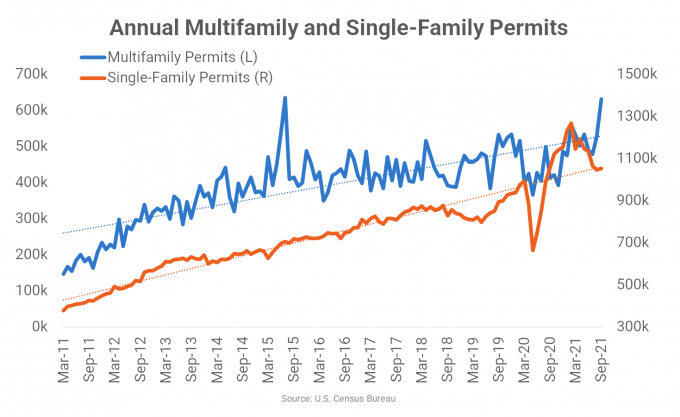

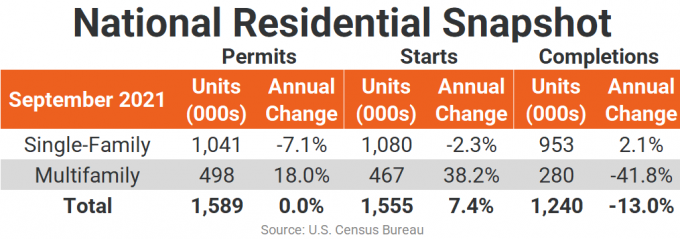

In a similar vein, the widening gap between the demand for single-family homes and the pipeline of new construction counts as good news for the multifamily industry as cost increases and delays in construction serve to drive the price of housing up.

“Price appreciation in the for-sale single-family market and relatively stable multifamily supply both support a healthy near-term outlook for rental rate growth,” AvalonBay Chief Operating Officer Sean Breslin said on his company’s call.

As the lion’s share of units owned by major multifamily REITs are Class-A, executives reported their tenant base as emerging from the pandemic in strong financial positions and with historically high levels of savings, encouraging landlords they can absorb steep rent increases. Loss to lease, the difference between rents paid by in-place tenants and tenants signing new leases today, averaged more than 13% between the largest REITs to have released earnings reports for the third quarter.

Clockwise from top left: Walker & Dunlop CEO Willy Walker, Equity Residential CEO Mark Parrell and Boston Properties CEO Owen Thomas on the Walker Webcast.“This is definitely the highest loss to lease we have ever seen, with such a large majority of leases below market,” Equity Residential Executive Vice President and Chief Operating Officer Michael Manelis said on his company’s earnings call. “And [our] teams are hyperfocused to recapture as much of the loss to lease as possible.”

Camden Property Trust reported its loss to lease as high as 16% in the third quarter, but Executive Vice Chair Keith Oden told analysts that his company will focus on maximizing retention by avoiding raising rents all the way to market rates for renewing tenants. Even without such consideration, all of the six multifamily REITs mentioned reported higher renewal rates this year, with the relative lack of turnover giving landlords more pricing power.

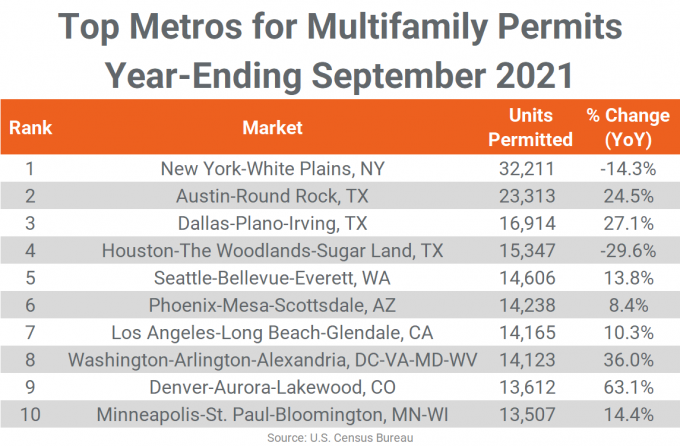

Pricing power is an incredible tool for landlords with enough scale, as MAA, the largest landlord in the country by unit count, is demonstrating. Despite the supply chain and labor market causing shortages and delays across commercial real estate, MAA’s pipeline of developments under construction is currently on time and on budget, CEO Eric Bolton said to analysts.

Even with the various tailwinds the multifamily market is currently enjoying, with values and deal volume hitting record highs, at least some major landlords have used innovations born out of pandemic necessity to cut costs permanently. Executives from Equity Residential and UDR told analysts prospective tenants seem to prefer self-guided tours and digital platforms for services when possible, boasting higher customer satisfaction numbers even as they have cut staff at their properties.

“Since the second quarter of 2018, we have permanently reduced headcount at our communities by 40% on average, thereby providing a strong hedge against elevated inflationary pressures,” UDR Senior Vice President of Property Operations Michael Lacy said. “[We] delivered products and services in the formats our residents prefer, as exhibited by a 24% increase in our resident satisfaction score and an overall 97% usage rate for self-guided prospective resident tours.”

Though thinner on-site teams may be a permanent consequence of the pandemic, major investors are well aware the current environment for raising capital is not likely to remain this friendly for long thanks to continued inflation and predicted changes to monetary policy from the Federal Reserve.

MAA issued $600M in public bonds in Q3, extended the average maturity on its debt to nine years away and raised $210M of forward equity capital, which MAA Chief Financial Officer Albert Campbell told analysts would cover the company’s equity requirements for the next couple of years. UDR agreed to $350M worth of forward agreements for stock purchases in the quarter, added $200M each to its credit facility and commercial paper capacities and extended maturity dates on other loans.