There are three factors driving inflation right now, including a housing shortage.

Supply chain problems, labor shortages, and the housing shortage are all fueling inflation to eye-popping levels – and for CRE investors, that will mean greater competition for assets.

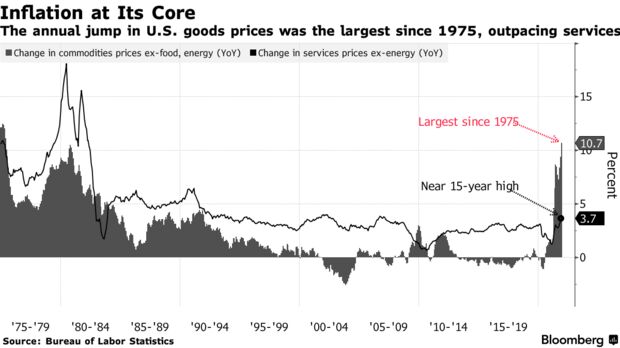

Headline inflation is up 7.1% from last year, the biggest uptick since 1982. And that rising inflationary pressure is forcing the Fed to switch gears and tighten policy. This will in turn put upward pressure on interest rates, raising the cost of capital for CRE investors, says Marcus & Millichap’s John Chang.

Supply chain is the first contributing factor to inflationary pressures: “It’s hard to move products from the manufacturers to the customers,” he says, pointing to shortages in raw materials, limitations on foreign port capacity, shipping container shortages, backlogs at domestic ports like those in Los Angeles and Long Beach, and a shortage of trucks.

“Basically, people want to buy more stuff than our supply chain can handle right now, so there are shortages and that means prices go up,” he says. Retail sales are up 16% over 2019 numbers, while the amount of product moved by trucks in the US is down 5.1% over the same period.

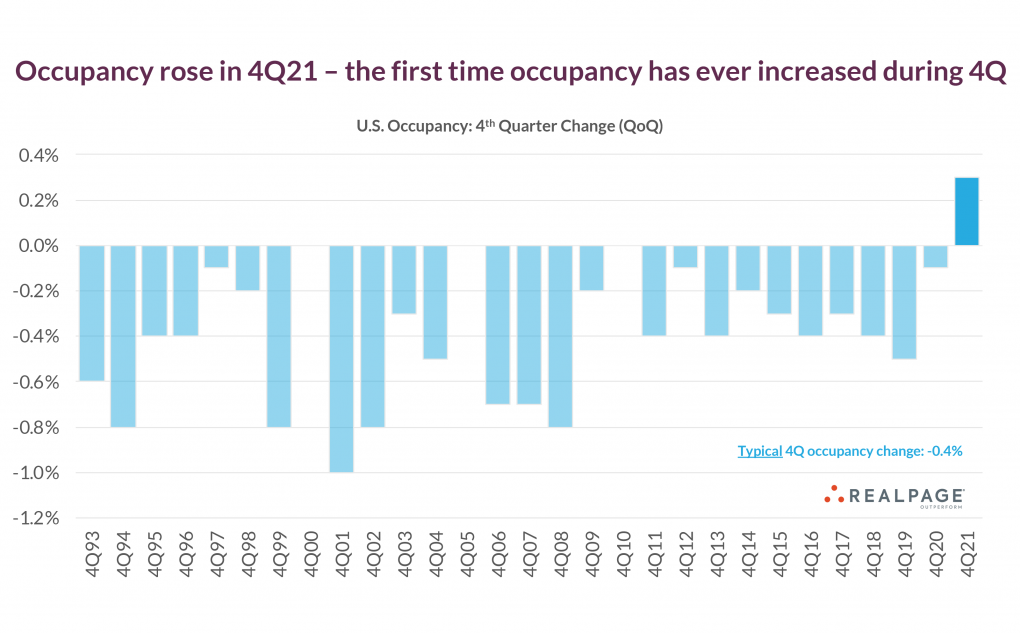

The second issue? Labor shortages, which continue to stoke inflation. Quite simply, “the US has never experienced a labor shortage like this,” Chang says, “at least not in the last 22 years, when records have been kept. As a result, companies are competing for personnel, and that’s driving up wages.” Average hourly earnings are up 5% over last year, and sectors like accommodations and food services have seen labor cost increases of more than 15%. And “rising wages create broad-based long-term inflation,” Chang says.The third challenge is the housing shortage: there are not enough houses to buy or apartments to rent right now, and the problem will likely continue at least in the near term. There are currently about 1 million houses for sale in the US right now, about two months’ worth of supply; typically, four to six months’ worth of supply is required to maintain stability in the market. Housing prices shot up 14.9% last year in response to the shortage.

In addition, there are only about 480,000 apartments available for rent, a vacancy rate of 2.6%, the lowest on record. Rents rose 15.5% last year.“The Fed will be taking action to curtail the rising costs,” Chang says. He notes that Fed Chairman Jerome Powell has already announced plans to accelerate the end of quantitative easing that was put in place during the pandemic, and says this will likely put upward pressure on long-term interest rates. The overnight rate is also on track to increase three times or more this year, which will put upward pressure on short-term interest rates.

As a result, Chang says, interest rates are likely to continue to rise. The ten-year Treasury rate is already up about 30 basis points from the beginning of December to a little over 1.7%.

For investors, this will equate to more competition.“Commercial real estate is viewed as one of the best places to invest money during periods of high inflation, especially properties that can increase rents with the market, like apartments, hotels, and self-storage properties,” Chang says. “Rising interest rates, and increased investor demand, implies that levered yields will compress this year. Basically, more commercial real estate buyer competition will push cap rates lower while the cost of capital, or interest rates, rise. That means CRE levered returns may tighten.”

But several property types still offer higher yields, like well-positioned office assets, retail assets, medical office buildings and some hotels, he says – and properties in softer markets harder-hit by COVID restrictions could also offer higher yields and stronger multi-year returns.