eXp World Holdings Reports Record Full-Year 2021 Revenue of $3.8 Billion

2021 Marks Highest Revenue and Profit Year in Company History, Driven by a 72% Increase in Agent Growth

Company Declares Cash Dividend for Q1 2022 of $0.04 per Share of Common Stock

BELLINGHAM, Wash., Feb. 24, 2022 (GLOBE NEWSWIRE) — eXp World Holdings, Inc. (Nasdaq: EXPI), (or the “Company”), the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises, today announced financial results for the fourth quarter and full-year ended Dec. 31, 2021.

Fourth Quarter and Full-Year 2021 Financial Highlights as Compared to the Same Year-Ago Period:

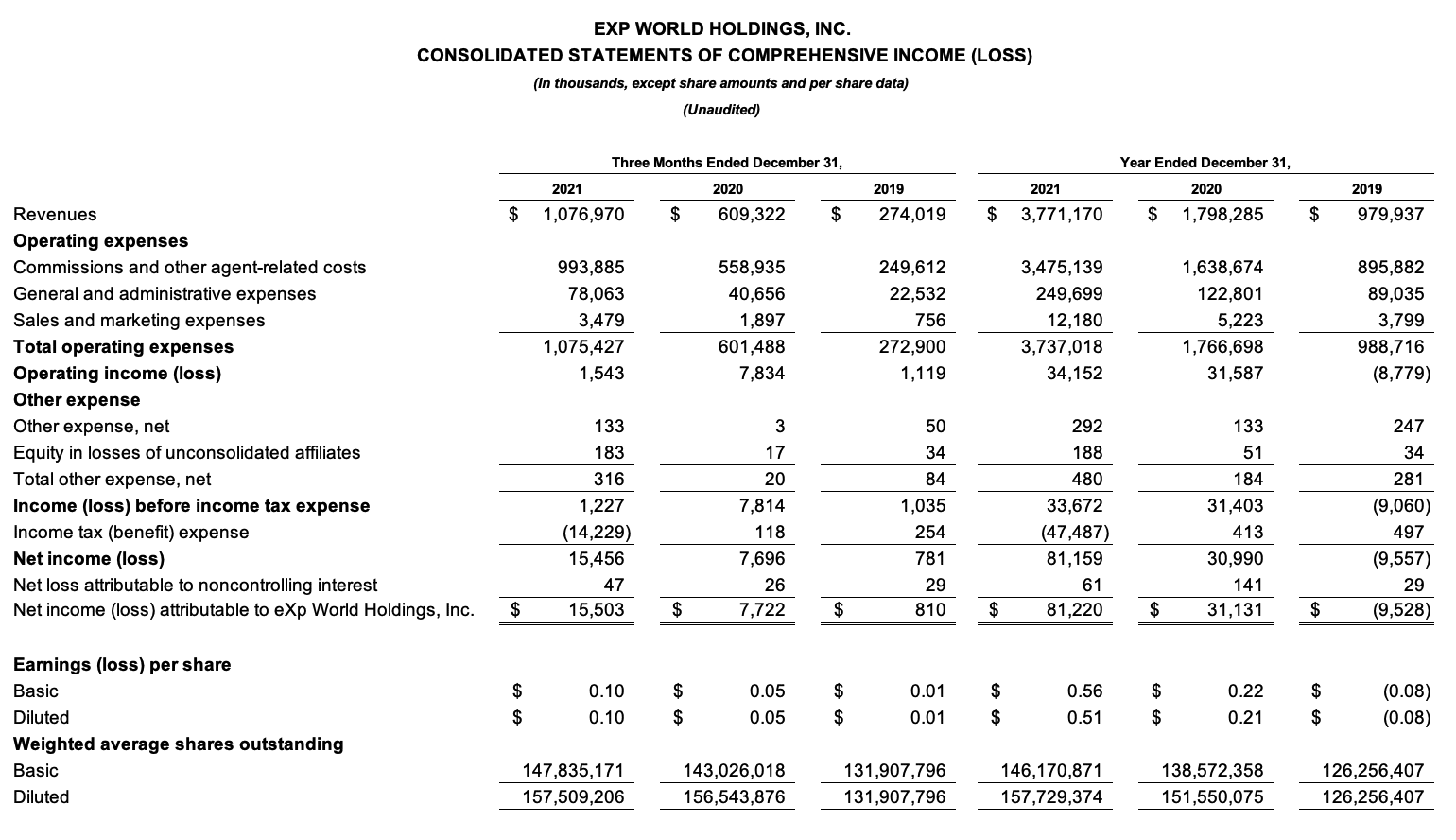

- Revenue increased 110% to $3.8 billion in 2021 and increased 77% to $1.1 billion in the fourth quarter of 2021.

- Gross profit increased 85% to $296.0 million in 2021 and increased 65% to $83.1 million in the fourth quarter of 2021.

- Net income increased 162% to $81.2 million in 2021 and increased 101% to $15.5 million in the fourth quarter of 2021. An income tax provision benefit of $47.5 million and $14.2 million, respectively, is included in the full year and the fourth quarter 2021 net income.

- Earnings per diluted share increased 143% to $0.51 in 2021 and increased 100% to $0.10 per diluted share in the fourth quarter of 2021.

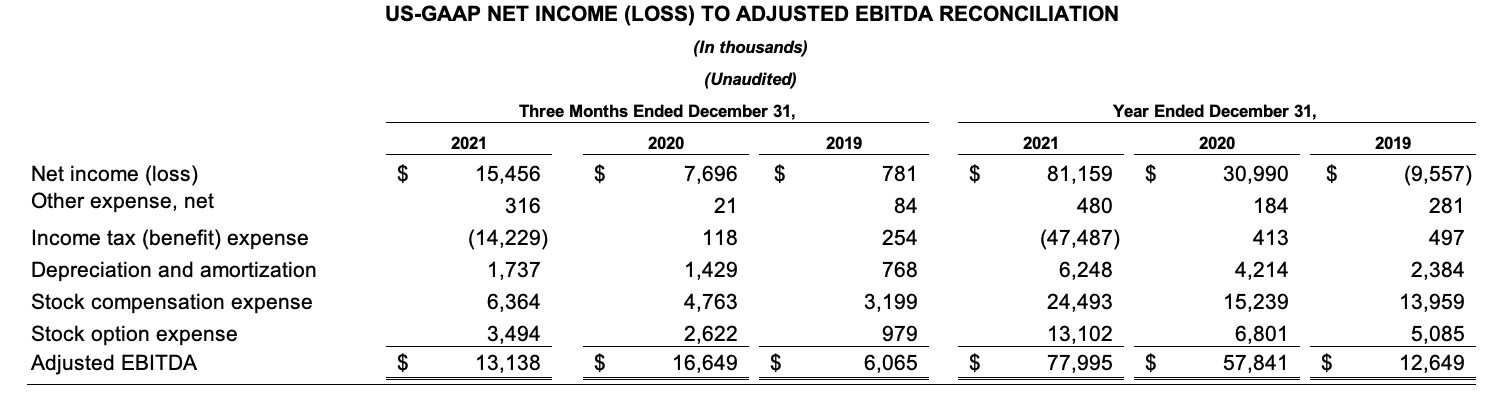

- Adjusted EBITDA (a non-GAAP financial measure) increased 35% to $78.0 million in 2021. Adjusted EBITDA was $13.1 million in the fourth quarter of 2021 compared to $16.6 million in the fourth quarter of 2020. Excluding a $10 million one-time legal settlement in the fourth quarter, adjusted EBITDA increased 52% to $88.0 million in 2021, and increased 39% to $23.1 million in the fourth quarter of 2021.

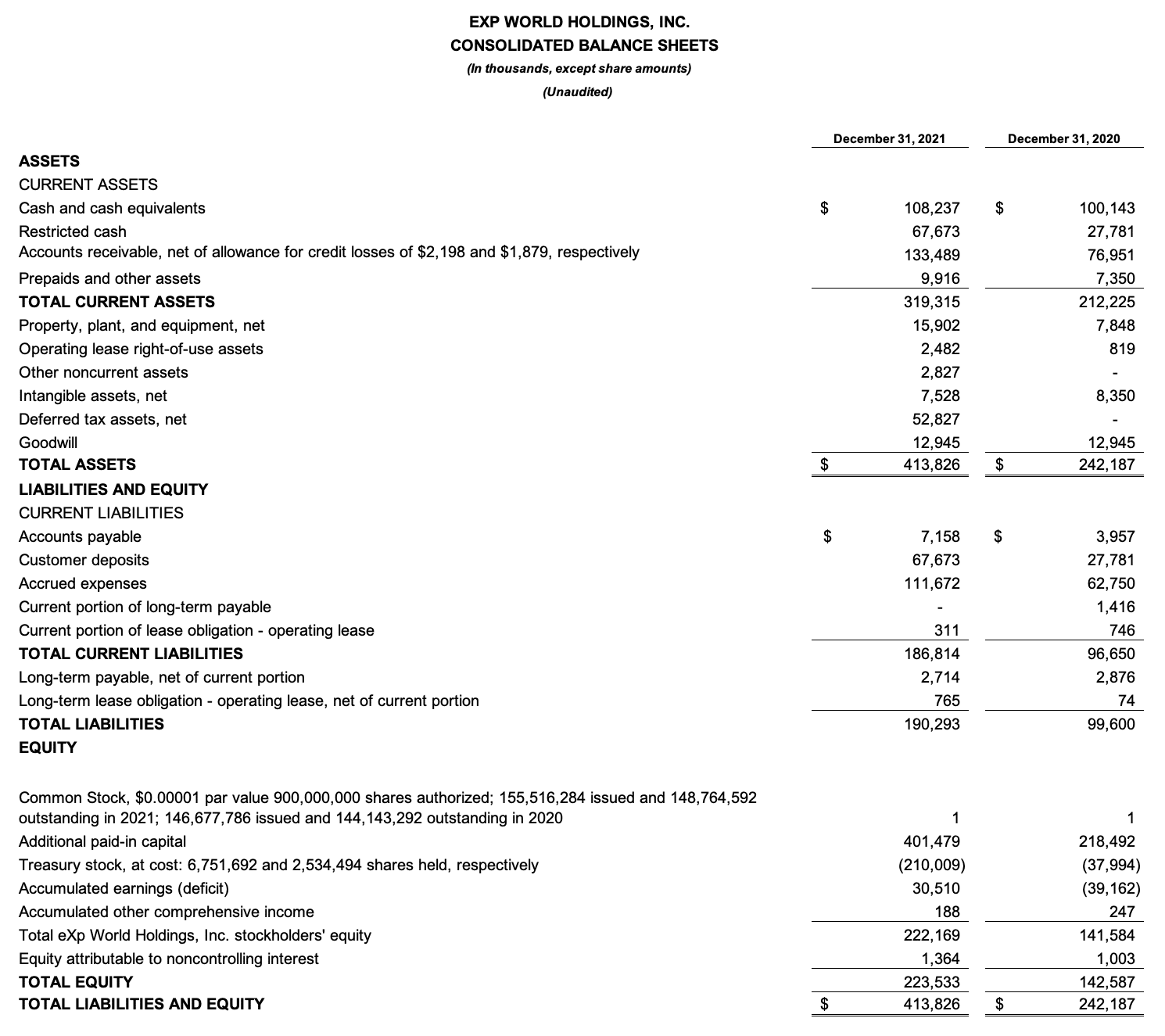

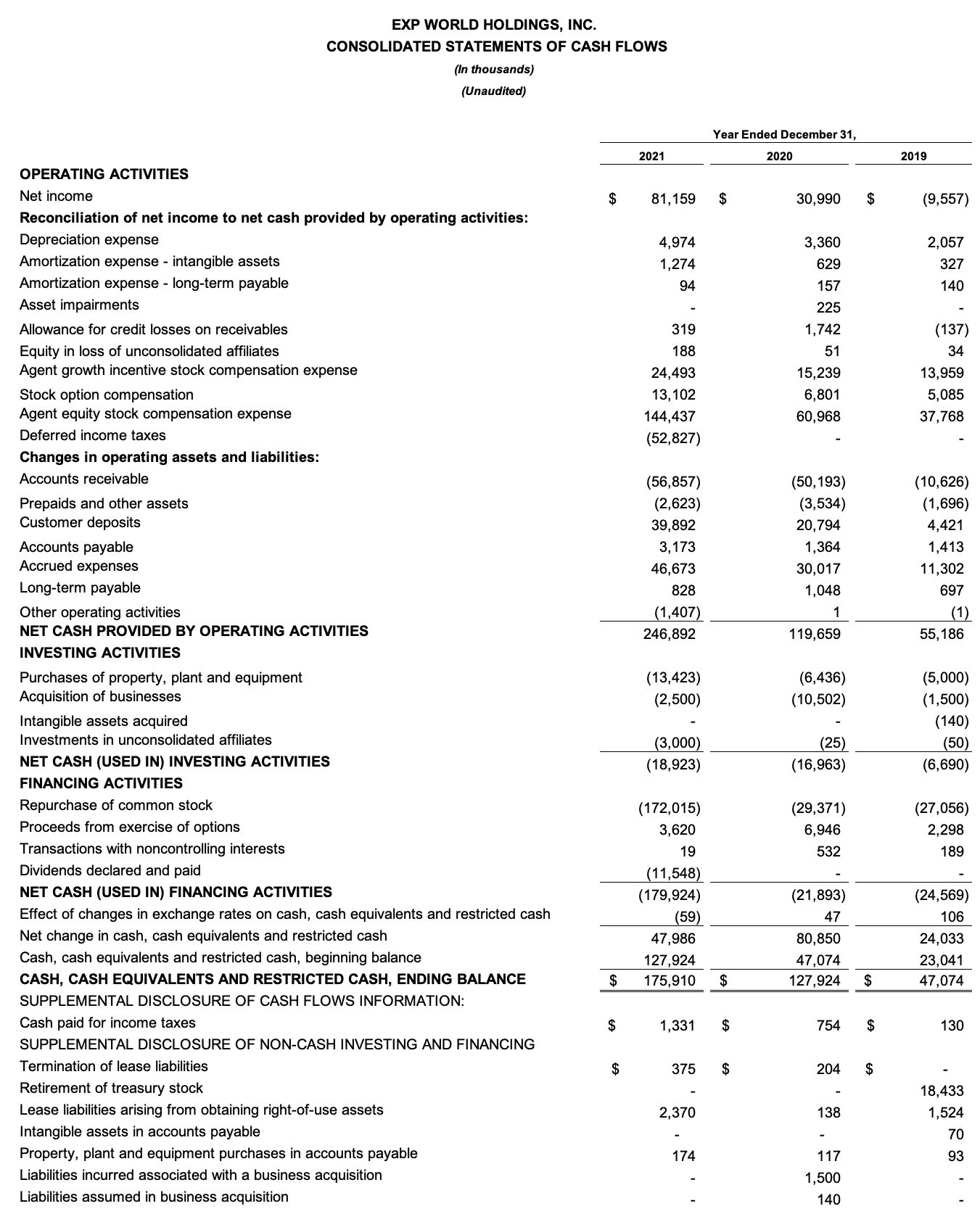

- As of Dec. 31, 2021, cash and cash equivalents totaled $108.2 million, compared to $100.1 million as of Dec. 31, 2020. The Company repurchased approximately $172.0 million of common stock during 2021.

- The Company paid a cash dividend for the fourth quarter of 2021 of $0.04 per share of common stock on Nov. 15, 2021. On Feb. 17, 2022, the Company’s Board of Directors declared a cash dividend of $0.04 per share of common stock for the first quarter of 2022 expected to be paid on March 31, 2022 to shareholders of record on March 11, 2022.

“2021 was another year of tremendous growth for eXp, as our core focus on innovation enabled us to welcome nearly 30,000 new agents across six continents to eXp,” said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings. “As real estate professionals increasingly turn to technology-based solutions for productivity and collaboration, our cloud-based platform has given us a first-mover advantage to scale our brokerage at the fastest rate in the industry. We attract top agents that value freedom, compensation and community.”

“We evolved our robust suite of products and services last year as we made preparations to launch SUCCESS Lending, a synergistic mortgage solution that aims to provide greater efficiencies and clearer communication between agents and their customers. To deepen our commitment to developing and inspiring our community of real estate professionals, we launched SUCCESS Coaching, our new business that provides a results-driven approach to personal development. Looking ahead, we believe there is a significant opportunity to capture additional market share in the real estate and adjacent industries as people and companies adapt to a digital future. We will remain focused on fostering collaboration and building an unparalleled network of industry professionals around the world,” concluded Sanford.

“In 2021, we achieved a record $3.8 billion in revenue by focusing on our growing, global community of real estate agents,” said Jeff Whiteside, CFO and Chief Collaboration Officer of eXp World Holdings. “Our year-over-year increase in transaction volume proves that the eXp model is resonating with top-producing agents and our ability to maintain this momentum underscores the strength of our competitive position. Reinvesting incremental cash flows generated by our business in products, services and technologies that further enhances the eXp platform for agents remains a priority as we scale, both within our existing markets and globally.” Fourth Quarter and Full-Year 2021 Operational Highlights as Compared to the Same Year-Ago Period:- Agents and brokers on the eXp Realty platform increased 72% to 71,137 as of Dec. 31, 2021.

- Real estate transactions closed increased 86% to 444,367 in 2021 and increased 52% to 125,029 in the fourth quarter of 2021.

- Real estate transaction volume increased 116% to $156.1 billion in 2021 and increased 82% to $44.9 billion in the fourth quarter of 2021.

- eXp Realty expanded into nine new international locations in 2021, including Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama and Germany. In February 2022, the Company successfully launched in the Dominican Republic and announced plans to establish operations in Greece and New Zealand in the first quarter of 2022.

- SUCCESS® Lending, LLC – a residential lending joint venture with Kind Lending, LLC – was established and SUCCESS Coaching™ – a coaching program for entrepreneurs and business professionals – was launched.

- eXp Realty ended 2021 with a global Net Promoter Score of 71, a measure of agent satisfaction as part of the Company’s intense focus on improving the agent experience.

The Company will hold a virtual fireside chat and investor Q&A with eXp World Holdings Founder and CEO Glenn Sanford and CFO Jeff Whiteside on Thursday, Feb. 24, 2022 at 8:30 a.m. PT / 11:30 a.m. ET. The discussion will be moderated by Tom White, Managing Director and Senior Research Analyst at D.A. Davidson.

The investor Q&A is open to investors, current shareholders and anyone interested in learning more about eXp World Holdings and its companies.

Date: Thursday, Feb. 24, 2022 Time: 8:30 a.m. PT / 11:30 a.m. ET Location: EXPI Campus. Join at https://expworldholdings.com/contact/download/ Livestream: expworldholdings.com/events About eXp World Holdings, Inc. eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises.eXp Realty is the fastest-growing real estate company in the world with more than 75,000 agents in the United States, Canada, the United Kingdom, Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany and the Dominican Republic and continues to scale internationally. As a publicly traded company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including its innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by Virbela, an immersive 3D platform that is deeply social and collaborative, enabling agents to be more connected and productive. SUCCESS® Enterprises, anchored by SUCCESS® magazine and its related media properties, was established in 1897 and is a leading personal and professional development brand and publication.

For more information, visit https://expworldholdings.com. Use of Non-GAAP Financial Measures To provide investors with additional information regarding our financial results, this press release includes references to Adjusted EBITDA, which is a non-U.S. GAAP financial measure and may be different than similarly titled measures used by other companies. It is presented to enhance investors’ overall understanding of the company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.The company’s Adjusted EBITDA provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to a key metric used by management for financial and operational decision-making. Adjusted EBITDA helps identify underlying trends in the business that otherwise could be masked by the effect of the expenses that are excluded in Adjusted EBITDA. In particular, the company believes the exclusion of stock and stock option expenses, provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations.

The company defines the non-U.S. GAAP financial measure of Adjusted EBITDA to mean net income (loss), excluding other income (expense), income tax benefit (expense), depreciation, amortization, impairment charges, stock-based compensation expense, and stock option expense. Adjusted EBITDA may assist investors in seeing financial performance through the eyes of management, and may provide an additional tool for investors to use in comparing core financial performance over multiple periods with other companies in the industry.Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of Adjusted EBITDA compared to Net Income (Loss), the closest comparable U.S. GAAP measure. Some of these limitations are that:

- Adjusted EBITDA excludes stock-based compensation expense and stock option expense, which have been, and will continue to be for the foreseeable future, significant recurring expenses in the business and an important part of the compensation strategy; and

- Adjusted EBITDA excludes certain recurring, non-cash charges such as depreciation of fixed assets, amortization of acquired intangible assets, and impairment charges related to these long-lived assets, and, although these are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future.