Contact Us if you would like to attend this informative event:

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Contact Us if you would like to attend this informative event:

General Information Thursday, January 27, 2022 Register Now >>

Summary Join us for a lively discussion with the Honorable Henry M. Paulson, Jr. The CEOs of Marcus & Millichap, TruAmerica Multifamily and ICSC are honored to host the former CEO of Goldman Sachs and 74th Secretary of the United States Treasury. The conversation will span the economic outlook, inflation, Federal Reserve Policy, and factors impacting commercial real estate.

Featuring Henry M. Paulson, Jr., 74th Secretary of the United States Treasury/Former Chairman & CEO, Goldman Sachs Robert E. Hart, President & CEO, TruAmerica Multifamily Tom McGee, President & CEO, ICSC

Hosted By: Hessam Nadji, President & CEO, Marcus & Millichap

Are you looking to Buy, Sell, or Finance/Refinance Multifamily Property?

U.S. consumer prices are likely to extend their eye-popping gains after soaring last year by the most in nearly four decades, further burdening Americans and ramping up pressure on policymakers to act.

The consumer price index climbed 7% in 2021, the largest 12-month gain since June 1982, according to Labor Department data released Wednesday. The widely followed inflation gauge rose a faster-than-expected 0.5% over the month. Investors took a relatively sanguine view of the data, which were broadly in line with expectations.

Though many economists anticipate inflation to moderate to around 3% over the course of 2022, consumers are likely months away from a meaningful respite, especially as the omicron variant of the coronavirus worsens labor shortages and prevents goods from reaching store shelves.

If signs fail to materialize that inflation is moderating, Federal Reserve policymakers could be forced to embark on a steeper path of interest-rate hikes and balance-sheet shrinkage. It would also make it even tougher for President Joe Biden and Democrats to retain their congressional majorities in November’s midterm elections or pass their tax-and-spending package.

“The breadth of gains in recent months gives inflation inertia that will be difficult to break,” said Sarah House, senior economist at Wells Fargo & Co. “We expect the CPI to remain close to 7% the next few months.”

The report did offer some comfort to American families. Energy prices fell last month for the first time since April, and food prices -- while still rising -- moderated somewhat as the cost of meat fell. Biden said that reflected “progress” from his administration while acknowledging there’s more work to be done

Workers’ wages are simply not keeping up. Despite a slew of robust pay raises last year as businesses sought to fill a multitude of open positions, inflation-adjusted wages were down 2.4% in December from a year earlier.

Whether inflation falls as expected will depend on supply chains normalizing and energy prices leveling off. However, higher rents, robust wage growth, subsequent waves of Covid-19, and lingering supply constraints all pose upside risks to the inflation outlook.

While moderation is expected in some categories like vehicle prices and apparel, there’s “no particular reason to expect much of a cooling for the rest of the core,” Stephen Stanley, chief economist at Amherst Pierpont Securities LLC, said in a note.

“Sure, there will be goods categories that cool off once supply bottlenecks begin to ease later this year, but at the same time, the pressure from wages to prices is only going to ramp up,” Stanley said.

Omicron is poised to further disrupt already-fragile supply chains, due in part to quarantines and illness that have prevented many people from working. It’s also curbed demand for services like dining out. Bloomberg Economics’ daily gross domestic product tracker suggests activity was down sharply in the first week of 2022.

With omicron hitting the supply side of the economy through staffing, “inventory levels are likely to take even longer to normalize as a result, keeping upward pressure of goods prices through the year,” House said. That’s likely to be coupled with stronger services inflation, she said.

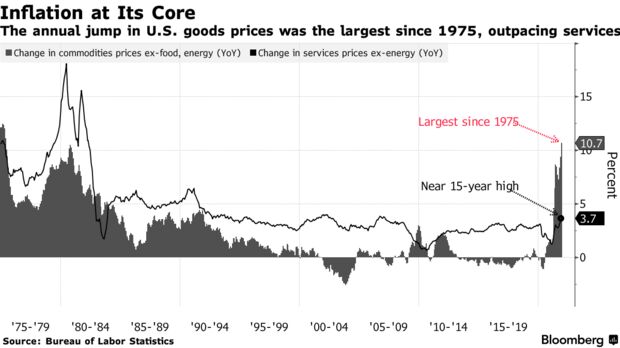

Last year, the increase in the CPI was largely due to high goods inflation. Excluding food and energy, the agency’s price index of goods surged 10.7% last year, the largest 12-month advance since 1975. Services costs climbed 3.7%.

But this year, economists expect service inflation to pick up steam as housing costs become a main driver of inflation.

Shelter costs, which were already one of the largest contributors to December’s gain, are expected to accelerate this year, offering an enduring tailwind to inflation. Other gauges of home prices and rents surged last year, but the full extent of those increases has yet to be reflected in the government’s measure.

Cities and states have accelerated their distribution of Emergency Rental Assistance funds, leaving less extra money than expected in the pool for those who need it most.

The Treasury Department announced the first round of reallocations under the ERA program on Jan. 7, with $1.1B to change hands from jurisdictions that couldn’t or wouldn’t send their respective chunks of federal funding to those who either have run out of funds or will soon. The vast majority of the reallocations, about $875M, come in the form of voluntary transfers within individual states.

Only the first pool of ERA funds, just under $24B when accounting for administrative spending, was eligible to be reallocated, the announcement stated. Further reallocations from the ERA1 pool, as the agency labeled it, are forthcoming over the next few months, with the next deadline for requests being Jan. 21. The process of reallocating the second pool of rental assistance funds, or ERA2, is not legally allowed to begin until March 31.

The largest single transfer of funds was the state of North Dakota returning $149M of the $352M it received from ERA1 to the federal pool, which did not include any cities or counties within North Dakota among the reallocation recipients. North Dakota officials explained the decision by noting that a huge portion of the 120,000 renters in the state were not aware of the program, the Grand Forks Herald reports.

The most significant transfers of funds were from states to some of their largest jurisdictions. The highest dollar transfer came in Indiana, with the state transferring more than $91M to the city of Indianapolis. Wisconsin gave the cities of Milwaukee and Madison $61M and $35M respectively, with another $50M going to Milwaukee County. Nebraska gave the cities of Omaha and Lincoln $50M and $30M respectively, while Arizona sent $39M to Phoenix’s Maricopa County and Louisiana sent over $34M to New Orleans.

Of the money distributed directly by the Treasury Department to states, counties, and cities, the state of California was the biggest beneficiary, receiving over $50M. New York, where ERA distribution was notoriously slow to get off the ground, received $27M, while New Jersey, which fared considerably better, received $42M.

Only 21 jurisdictions had funds involuntarily recaptured by Treasury: seven states, 13 counties, and one city. The agency prioritized jurisdictions with demonstrated need within the same state when deciding where to reallocate those recaptured funds, but no data was publicly released laying out where exactly those funds wound up, unlike voluntary transfers within states. The Treasury Department declined to comment on the reallocation process beyond the press release, it told Bisnow through a representative.

The state of Idaho had $33M recaptured, while the only in-state recipients on Treasury’s list, the city of Boise and Ada County, received $7.2M and $3.7M, respectively. The rest of the recaptured $33M, the largest sum in the list of involuntary recaptures presumably went out of state.

Delaware, Montana, Ohio, South Dakota, Vermont, and West Virginia were the other states from which Treasury recaptured ERA money, with Laredo, Texas, being the only city to have funds recaptured in that fashion. Counties that had funds recaptured included Tuscaloosa in Alabama, five Texas counties, and New Jersey’s Union County, which sits across the Hudson River from New York and counts the key port city of Elizabeth as its largest municipality.

Only jurisdictions that requested additional funding and had obligated over 65% of their ERA1 allocations by the first application deadline of Oct. 15 were eligible to receive reallocations, and Treasury used both demonstrated need and effectiveness in spending ERA1 funding to prioritize recipients. But it couldn’t even come close to meeting the need in some jurisdictions.

The city of Philadelphia asked for $400M in reallocation funds based on the number of applicants and the average payout, which has been about $11K per applicant, said Rachel Mulbry, an assistant program manager for the Philadelphia Housing Development Corp. tasked with overseeing the city’s distribution. Treasury reallocated $8.4M to the city, which it has yet to receive, Mulbry and PHDC CEO David Thomas told Bisnow.

“The information we received from Treasury is that they anticipate us receiving the funding in the coming weeks,” Mulbry said.

The same day the reallocation data was released, Philly was forced to close its rental assistance application portal due to a lack of funds. Only a small portion of those who already applied will wind up getting assistance, even with the extra $8M, which would cover about 750 applicants at an average of $11K per household.

“It seemed unfair to have people’s expectations out there looking for relief when we couldn’t provide it,” Thomas said. “We were hoping not to close, and we were hoping legislators would figure out how to reallocate more funds, but it just hasn’t materialized.”

Even if Philly were to somehow receive the entire $400M it requested, it likely wouldn’t meet the demand if the city program were to reopen, though PHDC would probably attempt to open it if it received such a sum, Thomas said.

The divide between the need for rental assistance and the available funds still looms over the horizon, even as jurisdictions set a new high-water mark for money sent out the door in the month of November, according to Treasury data. Using November data to project forward, the agency estimates that $25B to $30B was distributed to tenants by the end of last year from the combined $46B available from ERA1 and ERA2.

The nature of the federal coronavirus relief packages was to treat the economic conditions caused by the pandemic as an acute crisis that demanded short-term funding to see people through to the other side. Though the economy has not shut back down through the emergence of the variants, the lost income that catching the disease could cause are still immediate dangers to housing stability, said Michael Spotts, a senior visiting research fellow at the Urban Land Institute’s Terwilliger Center of Housing. That includes unexpected burdens like remote learning when families don’t have daytime childcare options.

“People might have exhausted the minimal savings they had or taken on more debt to pay rent,” said Spotts, who authored a research report published in December for ULI about housing stability and the rental market. “The pre-existing conditions that contribute to [housing] insecurity will likely have worsened for a lot of people. So there will be a continued need for emergency rental assistance for people who suffer shocks going forward.”

The U.S. apartment sector has experienced a rebound in both deal volume and asset pricing, but the performance varies across markets. The strongest growth in asset pricing tends to be concentrated in the Non-Major Metros, as shown in the chart below.

The simple average of annual price growth in the Non-Major Metros outpaced that of the 6 Major Metros in Q3 2021. Across the non-major areas, the average price growth stood at 14.8% while that across the 6 Major Metros averaged 4.5%.

In the 6 Major Metros, there is a loose relationship between the rebound in the pace of sales of individual buildings — the bedrock of the market — and subsequent price growth. Even with a triple-digit rebound in sales volume, some of these markets were still experiencing price declines in the third quarter. Markets such as San Francisco and Manhattan have faced stronger headwinds.

When the COVID-19 pandemic hit the U.S. in the spring of 2020, few could have imagined that the virus would still be impacting daily lives for the rest of the year, let alone nearly two years later. And when lockdowns started and 20-plus million jobs were lost, the dominant theme in the multifamily market was how to mitigate the damage.

However, as we start 2022, multifamily rents are coming off record-breaking highs in 2021 with an optimistic outlook for the year ahead. Between March 2020 and December 2021, asking rents in Matrix’s top 30 metros rose by an average of $194, or 13.5 percent. During that period, asking rents increased by 20 percent or more in nine of the 30 largest metros and 10 percent or more in 19 of the top 30. Meanwhile, in only four metros—large coastal centers San Jose, San Francisco, and New York, as well as Midland, Texas—were asking rents below pre-pandemic levels.Looking at the universe of 147 metros tracked by Yardi Matrix, asking rents increased by 20 percent or more in just over one in five (29) and by 10 percent or more in almost three quarters (79). The only metros that remain below pre-pandemic asking rent levels are in the Bay Area (San Francisco and San Jose), New York City, and Midland/Odessa, Texas, where rents are down by 22.5 percent.

The changes in rent since the pandemic started reveal much about demand and where growth could be concentrated going forward. Sheltering in place and working from home has loosened the link between home and work and limited the cultural advantages of large cities. That led to a migration from high-cost coastal centers starting in the spring of 2020. Where households are going can be seen by rent growth data.

The top choice is the South and Southwest. Between March 2020 and December 2021, asking rents grew by 34.5 percent on the Southwest Florida Coast; 31.1 percent in Phoenix; 28.5 percent in Tampa; 28.2 percent in Las Vegas; 27.2 percent in Boise, Idaho; 25.0 percent in Asheville, N.C.; 22.9 percent in Atlanta; 21.4 percent in Orlando; 20.7 percent in Raleigh-Durham; and 20.6 percent in Charlotte. These secondary and tertiary markets feature a lower cost of living than gateway metros, attractive weather, and geography, and a growing base of jobs as corporations expand there.

Another type of migration occurred between expensive coastal markets and nearby secondary markets that are less expensive. Asking rents since the pandemic started grew by 25.4 percent in the Inland Empire, 20.2 percent in Sacramento, and 18.3 percent in Orange County. In this type of migration, people move farther from job centers but within occasional commuting distance for flexible jobs. Or they are willing to make longer commutes in exchange for larger or less expensive apartments. Other metros that reflect this type of migration include Baltimore (11.7 percent), Colorado Springs (14.7 percent), Northern New Jersey (8.9 percent), and Long Island (8.6 percent).

The struggles of San Jose (-4.8 percent), San Francisco (-2.1 percent), and New York (-0.1 percent) reflect the high cost of housing in those markets and decline of office usage, especially among the technology jobs in the Bay Area metros. Some renters have become either unable or unwilling to pay high rents for small apartments in urban areas.

Even so, gateway cities can take heart from the fact that demand is rapidly returning. Year-over-year through November, occupancy of stabilized apartments is up 3.2 percent in New York, 2.9 percent in Chicago, 2.5 percent in San Jose, and 2.0 percent in San Francisco. As the pandemic gets nearer to its end phase, more companies are asking employees to come back to the office, if not full time at least more often. What’s more, as cities reopen, young workers from other parts of the country want to experience the cultural and lifestyle benefits of gateway centers.

🏙️ eXp Commercial Facilitates $1.475M Multifamily Redevelopment in Wheaton, Illinois Proud to share our latest Chicagoland multifamily rede...