https://www.creconsult.net/market-trends/exp-commercial-national-meeting/

https://www.creconsult.net/market-trends/exp-commercial-national-meeting/

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Tuesday, June 28, 2022

15 Reasons To Join eXp Commercial

Real estate agents looking to get a foothold into the commercial real estate space could face challenges due to the industry’s entrenchment in tradition and old-school attitudes. That’s why the commercial real estate brokerage space is ripe for change and eXp Commercial has emerged as the CRE brokerage to watch. Here are 15 reasons why eXp Commercial is turning heads in the commercial real estate brokerage space.

- One, Big Brokerage – eXp Commercial is not a franchise. It is one big international brokerage. There is no costly overhead, no desk fees, and no regions.

- Generous Commission & Cap – eXp Commercial agents enjoy an 80/20 commission split with a $20K cap. Once capped, agents can earn 100% commission for the remainder of the anniversary year.

- Revenue Share Program – eXp Commercial agents can receive revenue share income from the sales activity of the productive agents they sponsor into the company. Revenue share is much more lucrative than profit-sharing.

- Equity Plan – eXp agents are awarded or can earn shares of eXp World Holdings stock (EXPI: Nasdaq) after certain milestones such as closing your first transaction, when you fully cap, and when an agent you sponsor closes their first transaction.

- Low Fees and Costs – U.S. agents pay a $250/month tech/cloud fee, a $250 broker review, and $100 risk management fee (capped at $1,000/year) per transaction.

- CRE Software and Tech Tools – Included in the $250 tech fee are world-class CRM, lead share/lead generation, collaboration, co-working, and software tools including Buildout, Reonomy, AgentHub, eXp Enriched Data, Skyslope, AirCRE, and TenantBase.

- Access to Data – eXp Commercial agents have access to 278 million property records for data on valuation, market research, capital markets, sales comps, loan information, owner information, building permits, and Environmental, Social, and Governance (ESG).

- Cloud Campus – eXp does not have brick-and-mortar offices. eXp runs on a virtual metaverse that allows agents and staff to connect 24/7 and work from anywhere they want.

- No Territories – Many CREs are limited to a region or territory, but eXp Commercial agents can take advantage of an instant referral network of over 80,000 eXp agents across the globe and collaborate. (Read why collaboration is a core value at eXp.)

- Online Support – eXp Commercial has an entire support staff such as accounting, human resources, brokerage operations, legal, tech support, brokerage operations, and more. It has everything an agent would need to conduct business – all online.

- Marketing Center – No need to wait to create. Create your own customizable marketing material such as flyers, event kits, business cards, and templates, and find brand items such as logos and helpful documents in the eXp Commercial Marketing Center.

- Weekly Training – eXp University offers about 50 live classes a week covering lead generation, social media, sales training, and technology. All classes are free and in case you miss one, it’s recorded and can be found in eXp University’s ever-growing on-demand library.

- Specialized Training – eXp Commercial offers a four-week program called “eXcelerate” that helps new agents learn the basic fundamentals of starting and building a successful commercial real estate career. An “Advisor” program offers junior agents mentoring.

- Healthcare Program – eXp Agent Healthcare provides U.S. eXp Commercial agents with innovative and low-cost healthcare choices. (Read about four eXp agents who are saving thousands each year with eXp Agent Healthcare.)

- Events and Networking – eXp Commercial has a robust calendar of events and symposiums to help connect agents and share industry information.

Monday, June 27, 2022

CRE activity is growing, as is demand for commercial financing

As activity in the commercial real estate industry continues to rise, commercial lenders are seeing more requests for construction loans, acquisition loans, and refinances. But what kind of properties are developers and investors most interested in? Why are investors so interested in commercial real estate? And what do commercial lenders consider when deciding whether to approve a financing request?

Illinois Real Estate Journal turned to Dan Charleston, Vice President at Colliers Mortgage, and Patrick Tuohy, Senior Vice President at Marquette Bank, to find out.Illinois Real Estate Journal: Are you still seeing a steady stream of financing requests for commercial financing? If so, are you seeing mostly acquisition or development requests?

Charleston: Colliers Mortgage is primarily active in the multifamily business, including Agency lending and community bank lending platforms. Quoting activity is still robust despite higher interest rates, but deals are getting harder to underwrite. We have been seeing both acquisition and development requests, as well as refinancing requests. On the acquisition business, loans are more commonly constrained these days by DSCR (Debt Service Coverage Ration) metrics rather than LTV/LTC forcing borrowers to bring more equity to a transaction. With interest rates having moved from the mid to high 3% range to the high 4% and low 5% range on stabilized apartment assets, the math just gets harder on acquisitions. And on development loans, there is a fair amount of uncertainty about construction costs. On refinancing activity, owners who are interested in keeping their assets longer-term are finding attractive loan proceeds based on values today.

Tuohy: We are still seeing a steady stream of acquisition transactions in multifamily as well as the other asset classes. New development in multifamily has slowed down due to construction costs but there are still a number of new multifamily properties under construction and just breaking ground. Current inflation cost to replace and add new apartment stock has made “quality affordable housing” in the class “B” and “C” very attractive for owners/operators and investors both local and out-of-state operators and investors. Chicago has been on the radar screen for some time for out-of-state investors and continues to be a value play compared to the East and West Coast including Florida and Texas.

Illinois Real Estate Journal: For which commercial sectors are you seeing the most financing requests? Why are those sectors so hot right now?

Charleston: We are particularly active in the Affordable Housing, Market Rate Housing, Seniors Housing, and Manufactured Housing spaces right now. All of the most active multifamily spaces are seeing especially strong rental growth and investor demand due to their ongoing strength and performance both pre and post-pandemic. Agency lenders such as ourselves are also seeing a lot of activity around Affordable housing efforts in all markets nationwide. Our clients are actively seeking acquisition and development activities given the strength of housing markets and the demand for both affordable and market-rate housing.

Tuohy: Over the past year a significant increase in the number of owner/operators and investors have opted to retire/sell and trade into class “A” and class “B” single tenant triple net 1031 exchange investments. Depending on the submarket and tenant mix, e-commerce and changing work/life demands continue to put pressure on retail strip centers and office properties resulting in accelerated vacancy making underwriting these properties a challenge. For exchange buyers, triple net class “A” and “B” retail single tenant is very strong with available product limited. This has compressed CAP rates in the low to 5% range.

Illinois Real Estate Journal: What are investors so interested in investing in commercial real estate? What makes it such a safe investment type?Charleston: Investments in the multifamily space create both current cash flow and value-added growth opportunities for investors as owners/sponsors, and for investors in mortgages, overall returns have been outstanding with significantly less volatility and risk than other asset classes in the current market environment. In light of what’s happening in the stock and bond markets today, the more predictable nature of real estate returns, especially in multifamily assets, is becoming even more attractive. Much of that has to do with the reality that the US needs millions of additional housing units to meet both current and future demand. Well-managed assets can create excellent returns in those types of conditions.

Tuohy: Over the past year the number of multifamily buyers far exceeds the available product in both Chicago and suburban submarkets. This has resulted in multiple offers on any single opportunity pushing values to a record high. I continue to see a decline in the number of listings over the past year which has made this market highly competitive and difficult for the smaller operators to compete and purchase. We continue to see an increase in the amount of out of state buyers who have moved from larger properties and are now competing for smaller properties using local management firms such as Peak Properties and Cagan Management to operate.

Depending on the submarket, astute owner/operators and investors are looking at rental rates running from 5% to 20% above current market rates giving the proforma opportunity justification to pay the current asking prices. There is an increased demand in the multifamily market for rental units that have been upgraded with new finishes and amenities in the class “B” and “C” submarkets. Higher rental rates justify improvements to existing rental stock. Single-tenant credit-based investments in the industrial submarkets have been red hot for the past two years and continue to be so.

Illinois Real Estate Journal: What factors do you look at when considering financing requests? Charleston: We are very focused on the strength of our sponsorship/borrowers, their experience in the market and asset class they’re looking to finance, and the quality of the project they’re proposing, both in terms of location and overall management strategy. The saying in real estate is often “location, location, location”, and that much is true. But in larger-scale commercial real estate investment, that should always be paired with “sponsorship, experience, and strategy”.Tuohy: Factors we look at include location and submarket strength, income and expense operating history, upside potential, exterior and interior asset condition, and operator experience and history.

Sunday, June 26, 2022

What Is Holding Opportunity Zones Back? Industry Experts Weigh In

Investors aren’t always making the connection that Opportunity Zone investments are impact investments – so what can the industry do about it? In March 2022, JTC Americas and OpportunityDb released the results of an in-depth survey on Opportunity Zones. Titled, “Opportunity Zones in 2022: Perception vs. Reality,” the report provided insight into who is investing in OZ and why they do it.

In order to help relevant stakeholders get the most out of the report, JTC Americas hosted a March webinar, “Getting Impact Right: A New Strategy For Opportunity Zones,” where a panel of industry experts discussed what the survey results tell us about investor motivations, how fund managers can raise more capital, and where the industry can take action to improve the perception of Opportunity Zones.

Connecting OZ and Impact

Environmental, Social, and Corporate Governance (ESG) criteria are becoming increasingly important to investors, and Impact Investing is a hot topic among institutional investors as well as individuals. Opportunity Zones are impact investments and should be attractive to investors interested in social impact. But do investors see it that way?

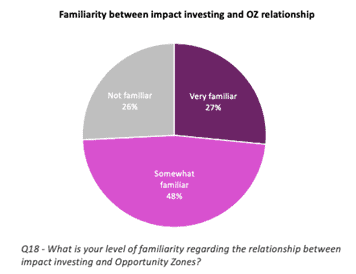

Only 27% of survey respondents, a group that includes both those who have invested in OZ and those who have not, said they were “Very familiar” with the relationship between impact investing and Opportunity Zones. While Opportunity Fund managers may think it’s obvious that OZ investments are impact investments, it seems it isn’t obvious to everyone.

Even among current investors, not everyone seems to realize that OZ and impact go hand in hand. At the webinar, Beth Mullen, CPA, and Partner at CohnReznick, LLP, expressed her belief that OZ and impact should “fit right in the same sentence,” and if that isn’t happening for investors, “maybe we have a little bit more explaining to do.”So why aren’t investors making the connection? The panelists, analyzing the survey results, had a few suggestions about how the industry can do better.

Proactive Outreach from Fund Managers

One of the best aspects of the survey is how in-depth it is regarding respondents’ sources of information. Beyond just asking how they feel about impact and OZ, participants were asked how they learned about the fact that OZ investments are impact investments.

As you can see, the dominant answer was “Conducted my own research.” The survey report singles this out as a major factor as to why investors don’t understand how OZ relates to impact: fund managers aren’t talking about it enough.

“One reason why this might be the case is that many do not hear about impact proactively from OZ fund managers,” the report reads. “Only 4% cited proactive outreach by fund managers.” If an investor is strongly impact-oriented, and the fund manager doesn’t explain that Opportunity Zones are impact investments, they may miss out simply for lack of communication.Jimmy Atkinson, the founder of OppportunityDb, agreed that this number is far too low. “I think we have a little bit of work to do as an industry to promote Opportunity Zones not just as a great tax benefit, but also as a really valid place for impact investing as well.”

For the types of investors who really care about impact, perhaps managers are waiting too long to discuss it with them:

Only 15% of respondents said the social impact was discussed in the first conversation. According to Louis Dubin of Redbrick LMD, that’s not fast enough for young investors who have high expectations for impact.

“Almost to a fault, the under-30, it’s their first question,” he said. Atkinson agreed: “During their conversation with investors, they should make some mention of impact – how is this impacting the local community? How is this driving jobs? How is this driving increased economic activity in a census tract that has been typically underserved?”By proactively talking about impact, fund managers can make it clear that social impact is not just a byproduct of Opportunity Zones, but a central component, and a reason to invest in and of itself. However, direct conversations are not the only way people hear about OZ – they may learn negative things about the initiative before they ever talk about a specific fund.

Reporting in the Media About Opportunity Zones

When survey respondents were asked about what most influenced their perception of OZs, 70% said “Research reports or news articles,” putting it overwhelmingly in the top spot. If potential investors are reading news stories about OZ as a tax scheme for the rich, they may never listen to a fund manager explaining how Opportunity Zones really work.

“My guess is that this is an issue of branding,” said Richard L. Shamos, Counsel, Nixon Peabody LLP. The panelists largely agreed that there was a legislative intent to help communities, and the initiative was meant to do good, but unfortunately, the tax benefits have gotten more attention. So how can the industry combat this misconception?One way to do so is to highlight success stories. As the survey report explains, “A 2020 report by the White House Council of Economic Advisors showed that OZ investments nationwide are on track to decrease the poverty rate by 11 percent and have created at least 500,000 new jobs. And though investments so far have occurred in only about 1,300 of over 8,700 OZ census tracts, this is much greater than some long-established incentives, like the New Markets Tax Credit program, which supported investment in only 400 during the same period.

“In other words, while the OZ program may not be perfect, it’s doing a lot of good in some of our hardest-hit communities. Fund managers and industry groups should continue to highlight these success stories.” What the survey has taught us is that many people don’t realize OZ investments are impact investments and have only been told about the tax benefits. That means there’s an opportunity if the full benefits of OZ are communicated to them, to attract impact-minded investors and grow the industry.Making OZ More Attractive to Impact Investors Through Impact Reporting

When the survey was conducted, respondents were given the chance to write answers to the question of how to make OZ more valuable to impact investors. See if you notice a pattern here:

- “Awareness that there is such a program.”

- “Better reporting”

- “Better understanding of the purpose”

- “Clarity”

- “Better measurement and metrics across the whole program, not all OZ developers are reporting on impact”

- “Clear and improved guidelines on job creation, social impact measure required under OZ program”

- “Clearer metrics on the actual impact that is occurring”

- “Impact reporting”

- “Metrics based on a standardized reporting scheme”

- “More data”

- “More positive stories about the impact of OZ on operating businesses”

- “More transparency on individual projects and better visibility”

- “Press coverage in national media”

- “Required impact reporting”

It seems pretty clear that OZ stakeholders want an accurate measurement of impact. As the report states, “This is aligned with the findings that investors – especially aspirational ones – are compelled to invest in OZs in large part due to their impact on communities.”

There have been efforts to pass legislation that would require reporting on impact. This could help change the conversation around Opportunity Zones by drawing attention to proven success stories and demonstrating the impact OZ investments are having.

At the webinar, John Sciarretti of Novogradac & Company, LLP, stated his belief that by implementing impact reporting at the Congressional level, investors will be more likely to want to participate.

“I think that transparency will double interest in the program,” he said, adding that this will be especially true for institutional investors who have high standards for data and reports.

Shay Hawkins, Chairman and CEO, Opportunity Funds Association, agreed: “Until we can get clear transparency and reporting and impact requirements in place legislatively, we in the industry have to help folks make that connection.”

JTC Americas has been a leader in Opportunity Zones fund administration since the program’s inception. Our award-winning eSTAC technology platform provides real-time impact reporting along with 24/7 access to key documents, and we’ve pioneered methods for measuring and reporting on social impact. While we wait to see how successful legislative efforts will be, JTC is helping our clients stand out from the pack when it comes to impact reporting.Other topics were covered at the webinar, including missed opportunities for private equity firms to invest in operating businesses in OZs and why impact reporting requirements were missing from the original bill. Watch the full webinar to hear from industry experts about the current state of OZ and read the full survey report online.

Saturday, June 25, 2022

Net Operating Income (NOI) & How To Calculate It

What Is Net Operating Income?

The NOI formula allows a real estate investor to determine how profitable a property could be. The formula is straightforward. Subtract all of the operating expenses for the property from the expected revenue it should generate. Expected income may include rental income but also any additional fees or income associated with the use of the space. Operating expenses may include any type of general expenses for the property, such as insurance costs, taxes, and repairs.

With this information, an investor can see if the cost of operating the property is more than the potential earnings from it, making it easy to determine if that investment is appropriate for their goals and financial needs. Often conducted prior to purchase, it may help in making buying decisions between multiple properties. For example, if there is a consideration for purchasing a convenience mart, this calculation would take into consideration all potential avenues of income from that convenience mart. That may include tenant rent as well as any income from the sale of goods. It would also consider all maintenance fees for the property and any other associated costs, such as the attorney the investor uses or the insurance on the property. This is what makes net operating income so valuable. It takes into consideration all of the income and expenditure opportunities for the property in one single calculation. As a result, the investor knows right away if this is the type of investment that fits the investor’s portfolio or not. NOI is calculated before tax. It is often presented on a property’s income and cash flow statement. Typically, it does not include principal and interest payments on loans, depreciation, capital expenditures, or amortization.Why Is Net Operating Income Important?

The key to using NOI is to understand its value. When an investor uses this calculation, it will help provide insight as to the property owner if renting out the property is worth the expense of purchasing it as well as maintaining it over time.Often, this information can help prospective investors determine which property available to them may offer the highest return or fit within their property investment strategy best. It allows the investor to compare several properties with the same metrics, making it easier to see the difference in each.

How to Calculate Net Operating Income

To calculate this information, it is necessary to have all data available (as much as possible). The simplest explanation is to subtract all of the operating expenses required for the property from the revenue the property could generate. Revenue may include:- Rental income

- Service charges

- Vending machines

- Parking fees

- Other sources

- Property management fees

- Insurance costs

- Maintenance and upkeep costs

- Utility costs

- Property taxes

- Repairs

Net operating income formula:

Net operating income = RR – OE

RR: Real estate revenue OE: Operating expensesExample of How NOI Works: Net Operating Income Formula Example

The NOI can be applied to many types of commercial real estate. In every situation, though, the prospective investor needs to consider all avenues for generating an income for that space.Consider the use of a townhome. A prospective investor wants to learn how much of a potential profit they could generate from the rental of the townhome. The property features 4 townhomes under the same roof and would be leased to resident tenants. Here is a basic overview of what could occur.

Calculate the revenue

The first step is to add up all the revenue that comes from owning this townhome and renting it out on a yearly basis.- The total rent collected ($1000 per month per unit equals $4000 per month, for a gross $48,000 in rental income for the 4 properties)

- Garage rental costs ($50 per month per unit, equaling $200 per month, or $2400 per year)

- Laundry machine use ($25 per month, per unit, equaling $100 per month, or $1200 per year.)

Calculate the expenses

The next step is to determine the total cost of operating the townhome property. Some of the costs could include:- Property management fees: $5000 a year

- Property taxes: $10,000 a year

- Maintenance on the property: $10,000 a year

- Expected repair costs: $15,000 a year

- Insurance: $8,000 per year

Evaluating the Potential of a Property

Not every situation produces a positive result. Suppose a property’s NOI shows a negative result. In that case, that could indicate the property would not be profitable to manage, especially if the costs cannot be lowered in any other way. Some potential investors may think of the long-term outlook after they’ve made repairs or updated the property to lease it at a higher rate. However, if that does not happen, the NOI may not be positive.

Borrowing to Buy Commercial Real Estate Relies on NOI Information

While NOI is a very important determinant of the value of any property for investors, it is also an essential factor for lenders. Most creditors and commercial lenders will rely on this information to determine the potential income generation for the property. Suppose the investors hope to secure a loan on the property. In that case, the lender needs to ensure that the income generation potential here meets the financial obligation the borrower is taking on.

It allows commercial lenders to assess the initial value of that property by getting a better idea – or for casting – cash flows for it. If the property presents a positive, profitable NOI, that indicates to the lenders there may be some stability in this loan, and they may be willing to make it. If the property shows a negative NOI, that may mean the lender will reject the loan request because of the high risk for the property. In some situations, property buyers may manipulate this information. For example, they may be able to defer some types of expenses while accelerating costs. This may include altering the rents and other fees they plan to charge to present a more positive outlook for the lender. However, it is critical to consider the accuracy here since this could play a role in just how profitable any investment could be over the long term. What is a good NOI? That depends on the specific situation. NOI is not a percentage but rather a dollar amount. Investors need to take into consideration what level is appropriate for their unique needs. The higher the NOI is, the more profit potential it has. The use of NOI is very important in nearly all commercial real estate investments. It does not take long to calculate once all of the information on operating expenses and potential income is available. It is essential for investors to be as accurate as possible.Friday, June 24, 2022

Apartment Vacancy Has Ticked Up for Seven Consecutive Months

Vacancy rates won’t hit 6 percent until well into next year.

Vacancy levels bottomed in October 2021, and since then, the situation has eased gradually but the market remains historically tight.

Apartment List’s data show vacancy ticked up for seven consecutive months, reaching 5 percent in May. Its rent growth index shows a corresponding trend, as price growth has decelerated this year compared to 2021.

The rental listing site said it’s possible that the easing of vacancies could level off in the coming months due to rapidly rising rents that may incentivize many renters to stay put and renew existing leases rather than look for new ones.

“At the same time, the recent spike in mortgage rates has created yet another barrier to a historically difficult for-sale market, potentially sidelining would-be homebuyers and keeping them in the rental market,” the company said in a release.

Demand Leveling in Hottest Apt Markets

Markets that saw large spikes in vacancies in the early pandemic such as San Francisco, Boston, Seattle, and Washington, D.C., have since seen renters return.

Meanwhile, demand is leveling off in the nation’s hottest markets.

Seattle, Boston, and DC (as well as many other similar cities across the country that were greatly impacted by the pandemic) are seeing their rents back above pre-pandemic levels.

San Francisco is a rarity in that it still is experiencing a pandemic “discount,” but even there, rents are up 20 percent since January 2021.

Availability of vacant units nationally remains notably constrained compared to the pre-pandemic norm. “Even if vacancies continue their gradual easing, it won’t surpass 6 percent until well into next year on its current trajectory, the firm estimated.

Thursday, June 23, 2022

Tech Companies Cast Their Eyes on Apartment Portfolios

Two recent acquisitions have third-party managers’ and industry analysts’ attention.

When it comes to property management companies and technology supplier partners, the script has flipped for some this year as it’s tech companies that are showing greater interest in acquiring rather than serving these firms.

Looking to build their brand, these innovation firms are — “can gain an instant uptick in revenue growth from the acquisition,” as multifamily tool Lighthouse’s head of business development Sterling Weiss put it, having spoken recently with REITs who have been courted by such companies.

For now, technology companies are happy to transact with small- and mid-sized apartment owners and managers.

Twice this year, short-term housing platforms have made this happen. In January, The Guild purchased CREA Management and in March, Alfred purchased RKW Residential. The Brand Guild purchased CREA Management.

Both transactions turned the heads among a few in apartment management circles and many are looking to see what could happen next. Some industry observers see more such deals ahead.

It’s a potential win-win because these technology firms believe they can better drive net operating income at the property level.

They are finding the apartment industry is ripe for innovation and that there’s little better way to incorporate, help develop and test their technology through their own housing portfolio.

Data Scientists Find Niche in Property Management

Alfred reports that today on average, less than 1 percent of a property’s budget is put toward technology, unlike other innovative industries, which invest closer to 10 percent, based on recent research from Statista, McKinsey, and Deloitte.

For RKW Residential, the technology Alfred brought will make operations more efficient, RKW Residential’s Executive Vice President of Marketing, Joya Pavesi said.

“It’s been a bonus because we now have Alfred’s 40+ software engineers working on our behalf – that’s more engineers than what some of the biggest apartment operators employ,” she said.

The merger gives Alfred the chance to have executive oversight into how its technology is being used by its clients to ensure that its capabilities are being fully realized.

‘Keep A Very Close Eye’ on This Trend

Zain Jaffer, Investor, and Entrepreneur, Zain Ventures Jaffer says that these companies have strong incentives to acquire property management companies to scale their portfolios quickly.

“It’s clear that AI has the potential to completely reshape the nature of property management as we know it,” Jaffer said. “As more and more tech companies buy into the property management space, we will start to see some truly accelerated growth. I think this is a trend to keep a very close eye on.”

Todd Butler, Senior Vice President, Flexible Living, RealPage, focused on short-term rental platform Migo, points to “massive” NOI opportunities that owners demand – mixed with the residents’ need for flexibility to live/work/travel post-Covid – are now mutually at odds with “the way it’s always been done.”

Source: Tech Companies Cast Their Eyes on Apartment Portfolios

eXp Commercial Presents: The 2026 CRE Economic Outlook Navigating the 2026 commercial real estate landscape requires a strategy grounded in ...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...