Why should I Sell My Multifamily Property?

There are a number of reasons why people decide to sell their multifamily property, but most can be categorized into three groups: Problems, Opportunities, and Changes.

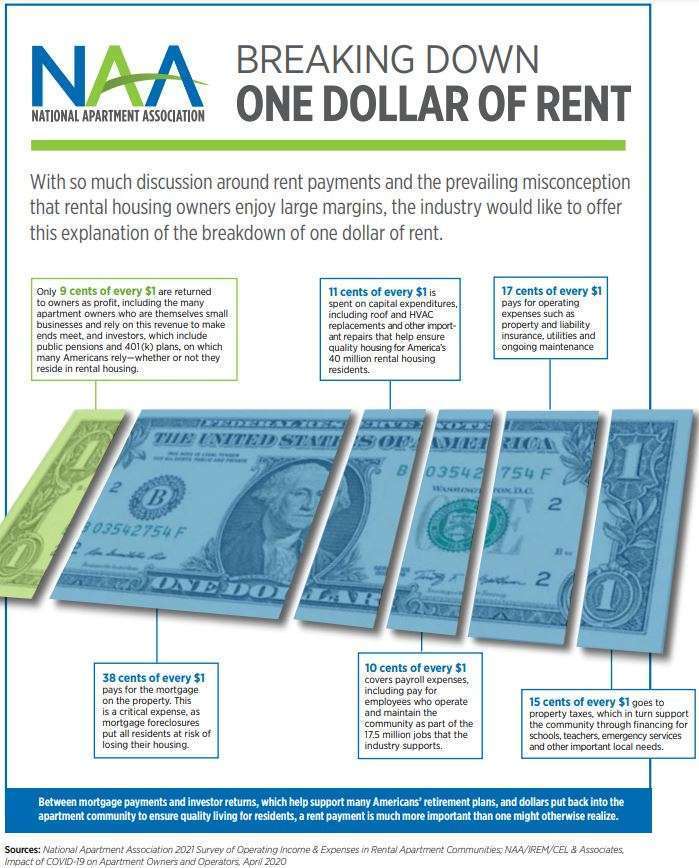

With this decision though comes the consideration of capital gains tax and how to ensure you are getting the most for the sale of your property.

There are several reasons why people do sell:

Problems:

- Management

- Vacancy

- Maintenance

- Stress

- Health

- Debt

- Neighborhood

- Interest Rates

Opportunities:

- Strong Market Values

- Alternate Investment

- End of the Hold Period

- Tax Savings

Changes:

- Divorce

- Death

- Retirement

- Partnership Split

- Relocation

- Consolidation

- Diversification

What do I do with the sales proceeds? I don't want to pay Capital Gains Tax!

There are several options for sellers to defer or minimize capital gains taxes:

- 1031 Exchange

- Delaware Statutory Trust/Deferred Sales Trust (DST)

- Tenancy in Common Investment (TIC)

- Installment Sale

How do I know I am getting the most money for my property?

We not only market properties for sale. We make a market for properties we represent. Each offering is thoroughly underwritten, aggressively priced, and accompanied by loan quotes to expedite the sales process. We leverage our broad national marketing platform syndicating to the top CRE Listing Sites with direct outreach to our investor database and an orchestrated competitive bidding process that yields higher sales prices.

What is my property worth?

Contact Us to discuss what information is needed to complete a Complimentary Commercial Broker Opinion of Value (BOV).

I’m not interested in selling at this time.

This is understandable as only about 5% of the market trades in any given year. We are also happy discuss any purchase or refinance interests and recommend some physical and operational changes you can make to add value to your property you will appreciate when you eventually sell.

Author:

Randolph Taylor MBA, CCIM

(630) 474-6441

rtaylor@creconsult.net

Randolph Taylor MBA, CCIM is a Multifamily Investment Sales Broker in the National Multifamily Division with eXp Commercial. Randolph focuses on the Listing and Sale of Multifamily Properties in the Greater Chicago area and Suburbs. Randolph has over 24 years of Commercial Real Estate experience including Corporate Real Estate, Asset Management, and Commercial Real Estate Brokerage. Randolph’s broad knowledge of the Commercial Real Estate Industry, financial analysis, marketing, and negotiating skills uniquely position him to provide a superior level of service to his clients.

https://www.creconsult.net/market-trends/why-should-i-sell-my-multifamily-property/