9301 West Golf Rd | Des Plaines, IL 60016

Broker: Randolph Taylor rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/golf-sumac-professional-building-medical-office-space-for-lease-9301-golf-rd-des-plaines-il-60016/

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

@properties Christie’s International Real Estate is going into wartime mode with a new fee on agent commissions, The Real Deal has learned.

The Chicago-based brokerage’s co-CEOs Thad Wong and Mike Golden told agents Wednesday it’s tacking on an agent services fee of 1 percent of gross commission income, according to a company-wide email reviewed by TRD.

The move applies to all transactions closed on or after April 1, and comes during a sustained market slowdown in an era of high-interest rates, an environment in which many residential brokerages have been pushed into tough decisions.

“Brokerage revenues are down, and expenses are way up,” Golden and Wong said in the company-wide email. “Inflation has hit everyone, including @properties, and today it costs significantly more to run a large brokerage firm than it did just a couple of years ago.”

The agent services fee will come off the top of all transactions and will be shared between the agent and the company depending on previously established splits. For example, if the commission was $100, the additional fee would be $1, but if the agent’s split is 75/25, the agent would only pay 75 cents.

“While we never thought we would have to institute a fee, it is the most responsible thing we can do, and we think it is very fair given the value @properties provides,” the email said. “We also worked incredibly hard to keep this fee as low as possible.”

The fee only applies to company-owned @properties offices, not its franchises or franchisees of Christie’s International Real Estate, whose brand rights are owned by @properties.

In an interview Thursday, Wong said the company is preparing for a declining market.

“I don’t know if we’ve seen the worst, or if the worst is coming — you have to be prepared,” he said. “If you’re not talking about your plans when things slow down, you’re making a mistake.”

“[Fees are] not uncommon in the industry — it’s uncommon for us,” he added.

The company is also increasing its MLS fee for transactions that include an outside broker to $495 from $250, a move which @properties says will bring it in line with other brokerages. The MLS fee for transactions with the company’s agents on both sides remains at $250.

This earnings season has shown how great the challenge is for residential brokerages.

Anywhere Real Estate — the parent company of Corcoran, Coldwell Banker, Century 21 and Sotheby’s International Realty — and Redfin posted big losses in the fourth quarter, with signals that the first quarter this year will be much of the same. Compass posted a net loss of $158 million in the fourth quarter, up from $154 million in the third quarter but slightly improved over the $175 million lost in the same period of 2021.

Source: @properties Implements 1% Broker Fee On Transactions

Top Frequently Asked Questions on Selling a Multi-family in Chicago

Here are some of the most frequently asked questions we get from clients looking to sell multifamily properties in Chicago.

If you’ve sold an investment property before, you’ll be familiar with the ins and outs of selling a multi-family. However, if it’s your first time, you’ll learn that the process works differently than it would with a single-family or condo.

A large part of a multi-family’s sale appeal will lie in its cash flow. Buyers looking for a multi-family are looking for more than just a home: they will want to see a property that generates good rental income, rents easily, and provides a financial incentive for them to buy. This could be in the form of easy upgrades they can make to boost rental income or as an empty unit for them to occupy and offset their own living expenses.

Of course, we’re biased...but we do recommend working with a broker who is experienced in the multi-family market in your neighborhood. Not only will they be able to pull good comps and provide a market analysis of how you should price the property, but an experienced agent will know how to show the proeprty to different types of buyers, whether they are experienced investors or first-time multi-family buyers who want some supplemental income. Brokers who work in multi-family markets are also in the know about rent prices and trends, which will help them sell your home at the right price.

Some buyers look for multi-families with units that could benefit from some updating because they see it as an opportunity to raise the rent using some sweat equity. Your agent should be knowledgeable of the renter’s and buyer’s market for your area and property type and will have good recommendations of what types of updates to make before selling.

Making simple upgrades around the property and in common areas like hallways and entryways can be an easy way to boost the property’s curb appeal that won’t break the bank, whether it’s through new fixtures or a fresh coat of paint.

One of the most important parts of getting ready to list your property is confirming the number of legal units in the building. In a city full of old homes like Chicago, many apartment units have been created in old basement spaces or have been de-converted into larger single unit. If you sell your property with an incorrect number of legally recognized units, you could face legal issues down the road. To get the most accurate picture of how your property should be valued and listed, get in touch with the local village to confirm the number of legal units listed in their records.

Buyers and their lenders will typically appraise a multi-family home using the income approach method instead of simply using comps in the area to compare values. This means that the appraiser will look at the cost of property maintenance and rental income to evaluate a property’s cash flow. To price your multi-family, you should do appraise a building’s income and use comps in the area to accurately represent what someone might want to pay for it.

One of the trickiest parts of selling a multi-family is to make sure that you are aware of your tenants’ legal rights and that you make the selling process as effortless for them as possible.

An experienced Broker will know the ins and outs of how to show a property with occupied units (which is one of the biggest reasons why you should take your time to find a good agent). The most important concern when it comes to showing units is to make sure that the tenant is aware of the appointment sufficiently ahead of time. Check your lease agreement to see if there are already guidelines in place, or contact your tenant prior to listing the process to come to an agreed-upon amount of days or hours before the showing when they should be contacted.

Source: Selling an Apartment Building FAQ’s

Estimating the value of real estate is necessary for a variety of endeavors, including financing, sales listing, investment analysis, property insurance, and taxation. But for most people, determining the asking or purchase price of a piece of real property is the most useful application of real estate valuation. This article will provide an introduction to the basic concepts and methods of real estate valuation, particularly as it pertains to sales.

Technically speaking, a property's value is defined as the present worth of future benefits arising from the ownership of the property. Unlike many consumer goods that are quickly used, the benefits of real property are generally realized over a long period of time. Therefore, an estimate of a property's value must take into consideration economic and social trends, as well as governmental controls or regulations and environmental conditions that may influence the four elements of value:

Value is not necessarily equal to cost or price. Cost refers to actual expenditures – on materials, for example, or labor. Price, on the other hand, is the amount that someone pays for something. While cost and price can affect value, they do not determine value. The sales price of a house might be $150,000, but the value could be significantly higher or lower. For instance, if a new owner finds a serious flaw in the house, such as a faulty foundation, the house's value could be lower than the price.

An appraisal is an opinion or estimate regarding the value of a particular property as of a specific date. Appraisal reports are used by businesses, government agencies, individuals, investors, and mortgage companies when making decisions regarding real estate transactions. The goal of an appraisal is to determine a property's market value – the most probable price that the property will bring in a competitive and open market.

Market price, the price at which property actually sells, may not always represent the market value. For example, if a seller is under duress because of the threat of foreclosure or if a private sale is held, the property may sell below its market value.

An accurate appraisal depends on the methodical collection of data. Specific data, covering details regarding the particular property, and general data, pertaining to the nation, region, city, and neighborhood wherein the property is located, are collected and analyzed to arrive at a value. Appraisals use three basic approaches to determine a property's value.

The sales comparison approach is commonly used in valuing single-family homes and land. Sometimes called the market data approach, it is an estimate of value derived by comparing a property with recently sold properties with similar characteristics. These similar properties are referred to as comparables, and to provide a valid comparison, each must:

At least three or four comparables should be used in the appraisal process. The most important factors to consider when selecting comparables are the size, comparable features, and – perhaps most of all – location, which can have a tremendous effect on a property's market value.

Comparables' Qualities

Since no two properties are exactly alike, adjustments to the comparables' sales prices will be made to account for dissimilar features and other factors that would affect value, including:

The market value estimate of the subject property will fall within the range formed by the adjusted sales prices of the comparables. Since some of the adjustments made to the sales prices of the comparables will be more subjective than others, weighted consideration is typically given to those comparables that have the least amount of adjustment.

The cost approach can be used to estimate the value of properties that have been improved by one or more buildings. This method involves separate estimates of value for the building(s) and the land, considering depreciation. The estimates are added together to calculate the value of the entire improved property. The cost approach makes the assumption that a reasonable buyer would not pay more for an existing improved property than the price to buy a comparable lot and construct a comparable building. This approach is useful when the property being appraised is a type that is not frequently sold and does not generate income. Examples include schools, churches, hospitals, and government buildings.

Building costs can be estimated in several ways, including the square-foot method, where the cost per square foot of a recently built comparable is multiplied by the number of square feet in the subject building; the unit-in-place method, where costs are estimated based on the construction cost per unit of measure of the individual building components, including labor and materials; and the quantity-survey method, which estimates the quantities of raw materials that will be needed to replace the subject building, along with the current price of the materials and associated installation costs.

Depreciation

For appraisal purposes, depreciation refers to any condition that negatively affects the value of an improvement to real property and takes into consideration the following:

Methodology

Often called simply the income approach, this method is based on the relationship between the rate of return an investor requires and the net income that a property produces. It estimates the value of income-producing properties such as apartment complexes, office buildings, and shopping centers. Appraisals using the income capitalization approach can be fairly straightforward when the subject property can be expected to generate future income and when its expenses are predictable and steady.

Direct Capitalization

Appraisers will perform the following steps when using the direct capitalization approach:

Gross Income Multipliers

The gross income multiplier (GIM) method can be used to appraise other properties that are typically not purchased as income properties, but that could be rented, such as one- and two-family homes. The GRM method relates the sales price of a property to its expected rental income. (For related reading, see "4 Ways to Value a Real Estate Rental Property")

For residential properties, the gross monthly income is typically used; for commercial and industrial properties, the gross annual income is used. The gross income multiplier method can be calculated as follows:

Sales Price ÷ Rental Income = Gross Income Multiplier

Recent sales and rental data from at least three similar properties can be used to establish an accurate GIM. The GIM can then be applied to the estimated fair market rental of the subject property to determine its market value, which can be calculated as follows:

Rental Income x GIM = Estimated Market Value

Accurate real estate valuation is important to mortgage lenders, investors, insurers and buyers, and sellers of real property. While appraisals are generally performed by skilled professionals, anyone involved in a real transaction can benefit from gaining a basic understanding of the different methods of real estate valuation.

Source: What You Should Know About Real Estate Valuation

After 17 years with General Electric Capital, closing on more than $11 billion in transactions, Charles Rho was recruited by CBRE in 2014 to launch a new division for commercial business lending.

Big stuff, but the right man for the job.

Since then, Rho started his own lending firm, VelocitySBA, which has risen to the Top 50 out of 1,600 small business lenders in the United States. His next goal is to put VelocitySBA in the Top 5 nationwide of all small business lenders.

In a recent conversation with Jim Huang, President of eXp Commercial, Rho laid out advice about how any market – even a recession – can be navigated successfully, as long as you are prepared.

Here are the key points Charles Rho made about handling the coming market shift during his talk with Jim Huang:

We Are Entering a Recessionary Period Right Now

“If you look at all the indicators right now with the interest rate movement, inflation, GDP, you will see a general consensus that we are headed for a downturn. Top leaders in banking and other industries acknowledge this is happening. They’re tightening their expenses, starting to lay off employees as well. We've had a number of national banks lay off quite a few workers and really start to get ready for the recession. That's forthcoming,’’ he said.

“My view is that we will probably get into a recessionary period starting (in January 2023) through March. And I believe that the recession will last at a minimum probably 12 to 16 months. So for the next two years, I think we are headed for some tough times,’’ he said.

“That’s why being out in front of your customers, being out in front of your people and directing the organization by making sure you have controls in place will be absolutely critical.”

Understand Your Numbers, Have Control of Expenses and Cash Reserves

“As small business owners, whether you're brokers or you're representing a small business owner who's looking to purchase another small business or looking to purchase real estate, we all need to prepare just as the larger institutions are preparing.

“I'm not advocating that we go out and lay off a bunch of folks, but we do need to understand our numbers. We need to have good control of our expenses, good control of our cash reserves to make sure that we are prepared for the next 12, 18 and 24 months. That may be a bit of a challenging time for all of us.”

GE Capital Taught Rho How To Be Nimble

“While GE is a huge conglomerate, the reason GE was very successful, including GE Capital Businesses, was that each business unit was its own balance sheet. Each business was able to operate like a small business. We were able to react quickly. We were able to pivot in the market based on market conditions. We were able to quickly launch products, and that entrepreneurial spirit was able to propel GE Capital's Businesses to become very specialized and to become No. 1 or No. 2 in their specialty finance area.”

Identify Your Strategic Advantage

Everyone needs a sound business plan when they launch, but Rho said that’s not enough.

“A business plan should be an ongoing process, updated on an annual basis so that you're always projecting out 3-to-5 years. This helps you to align your focus where you know and direct the business to where you need to go. This is what I do on an annual basis. Sometimes we update the business plan once or twice a year if we need to pivot because of a changing environment,’’ he said.

Identifying your strategic advantage is the key to developing your business plan.

“We all have competitors. And we all have to understand who our audience is. What is it that you're selling? And based on that, what is my strategic advantage? That is a key component that I sometimes see is missing from business owners. They don’t understand what their key advantage is and they don't understand who their competition is. That’s how to take a business to the next level. What is my strategic advantage?”

Review Everyone in Your Organization

Rho said ranking every employee based on their experience and skill set is a key part of creating a 3-to-5-year business plan. You have to know what their capacities are, what their potential is. These are the people upon whom your business plan rests. This is your team.

Always Consider Your Economic Climate

Given the projected downturn, Rho said it is critical to understand your profit and loss statement, and to have your cash-flow projections. Rho said he did that for his business, with scenarios that kept revenue “normal” to a worst-case scenario projecting a 50% downturn in revenue.

“You need to go through some case scenarios or assumptions. If there’s a downturn and my revenue falls off by 30%, what does that do to my cash? What if the revenue falls by 50%, how does that impact my cash flow, my income statement?”

Key Factors To Survive a Recession

Be liquid. Preserve cash. Understand your P&L and how your revenues may be impacted. You need to then understand how much cash and liquidity is needed to survive through a recession.

Expense control. If your revenues fall by 30%, are you able to maintain your expenses as it lies today or do you need to trim expenses?

Secure a line of credit. If you own real estate, if you own a business, Rho said you should “immediately secure a line of credit before the real estate devalues further.” Acting swiftly means you can secure credit against today’s values before your business potentially suffers a revenue decline.

Watch out for government stimulus: Depending on how deep the recession may get, the government could mirror its use of the SBA program during the Covid pandemic, when they introduced the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) and PPP loans (Paycheck Protection Program).

Be opportunistic. If you expense control and secure credit, you will be able to be opportunistic and be able to transact on deals that may exist in the market, or create deals in the market.

When Banks See Distressed Portfolios, Tap Into SBA Lenders for Better Terms

Rho said commercial real estate agents should make sure their borrowers or buyers are prepared and ready to go.

“It happens in every recession. Bank lenders pull back from lending because they're concerned about their portfolio. They go into portfolio management mode, making sure their portfolio of loans stay healthy and that loans don't go delinquent,’’ he said.

Look for lenders who will continue to provide SBA financing during the downturn. These tend to be lenders willing to work within the community for more favorable terms.

“If you're financing the acquisition of a business, or you're looking for working capital equipment loans, those are going to be typically done on a 10-year term. Real estate is going to be a 25-year maximum term. What you'll notice if you're used to working with banks, bank loans have a much shorter term,’’ Rho said.

“The advantage of SBA loan is that you have a longer term and that allows the small business owner or the borrower to really reduce the monthly payment so that you can focus more cash flow into the business rather than into the debt payment.’’

Tips For Helping People Secure Loans From SBA Lenders

“There are individuals at this Score program that mentor, that help write business plans and help secure financing based on the needs of the small business owners. So take a look at these resources. These are available for anyone who are interested in finding out about what all the resources are available through the federal agencies,’’ Rho said.

“There are also state agencies, like Calcap in California, or the Texas Economic Development office. There are resources,’’ Rho said.

Opportunities Exist for Businesses Positioned and Prepared to Play Offense

When real estate agents or business owners realize the market is shifting, Rho said there are plenty of ways to be prepared, like having a strategic plan and knowing what resources are out there.

“I think what's critically important is to really understand where your business is, where your operation resides today and where it needs to go in the next 12, 24 months, and 36 months. Take a look at what the potential downside and the upside can be during a recession. And I will tell all of you guys right now I am expecting a recession,’’ Rho said.

“But there are two ways you can play this, at least as a lending company: Hunker down and play defense, or try to play offense and look for opportunity. That means understanding what your strategy is and what’s your competition.Those who can control their expenses will survive through a recession. And not only will they survive, they will come out stronger and essentially your field of competitors will shrink in a recession.’’

Source: Lending Guru Charles Rho Gives Advice on How to Prepare During a Down Market

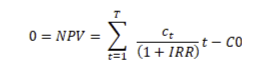

Source: Cash on Cash Return vs IRR: Understanding the Difference

As of October, when interest rates were 7%, the average household income needed to cover a mortgage for a Chicago starter home was $63.4K. But the average income of renters was $43.6K, according to Point2Homes research.

That means Chicago renters make only 69% of the income needed to become first-time homeowners, according to Axios reporting on the study.

Source: Chicago Renters Only Make 69% Of The Income Needed To Afford Starter Homes

At the halfway point of the year, Cleveland, Cincinnati, Columbus, and Chicago have all seen rent growth well ahead of the national average....