We’re going to talk about the economy. I’m not going to make economic predictions here, but I’m going to try to assess where we are (or might be) in this crazy economy.

- Are we in a recession?

- Are we about to enter a recession?

- What is the biggest risk to our financial future?

Are We in a Recession?

A lot of experts, pundits, and screaming headlines would say yes.

JP Morgan Chase CEO Jamie Dimon thinks we are headed for a recession. Cantor Fitzgerald doesn’t think the bear market is over. The S&P 500 has lost about 17% year-to-date. With all of these negative headlines, the world seems awfully dark. But just how accurate are they?

“Recession” Comes Up More Often, But Do the Headlines Match Reality?

Nobel Prize-winning economist Richard Thaler says there’s no recession, despite two straight quarters of negative GDP growth earlier this year. According to Thaler, calling the U.S. economy recessionary is “just funny.”

Besides Thaler, we can always trust the government, right? The Deputy U.S. Treasury Chief predicts a soft landing. He believes the Fed may tame inflation and avoid a recession. Or at least that’s possible. He says we have the capacity to take steps to bring inflation down but also make the needed investments to make sure the economy continues to grow he said.

Lauren Baker of ITR Economics is a distinguished economist who can provide reliable information for the industry. She did a great job explaining at BPCON22 a contextually sensible view of why the economy might not be as bad as people think and why we may have a soft landing. I will show you several slides from her talk with a brief explanation.

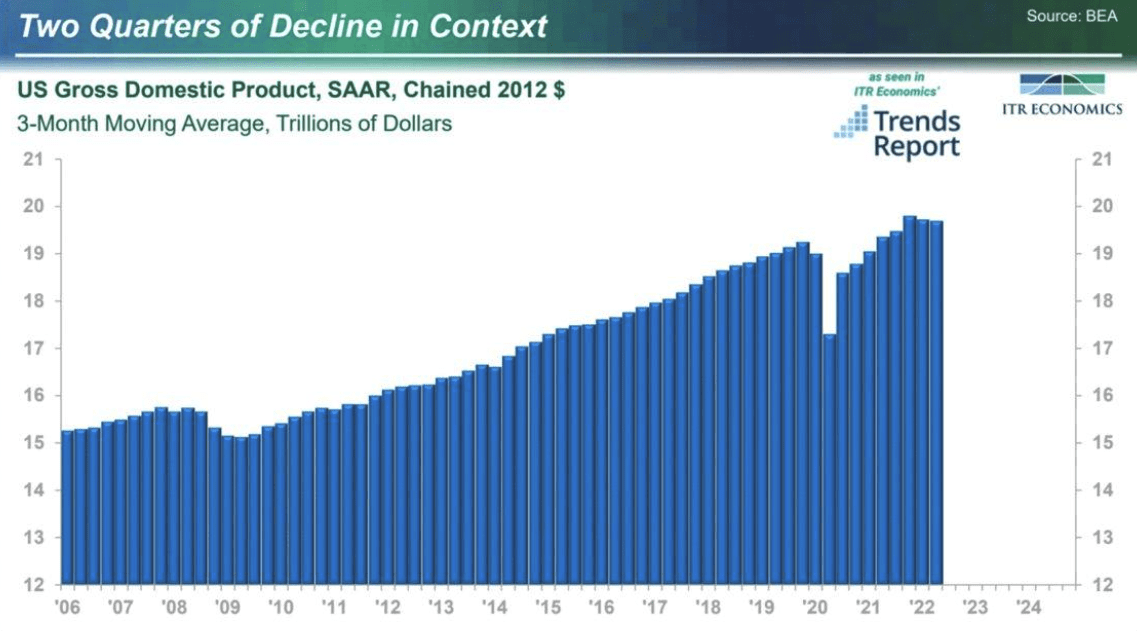

While U.S. GDP declined two quarters in a row, Lauren pointed out that it’s still at near record levels. In fact, these would still be record quarters if the last quarter of 2021 hadn’t been so high. In context, the GDP looks very healthy.

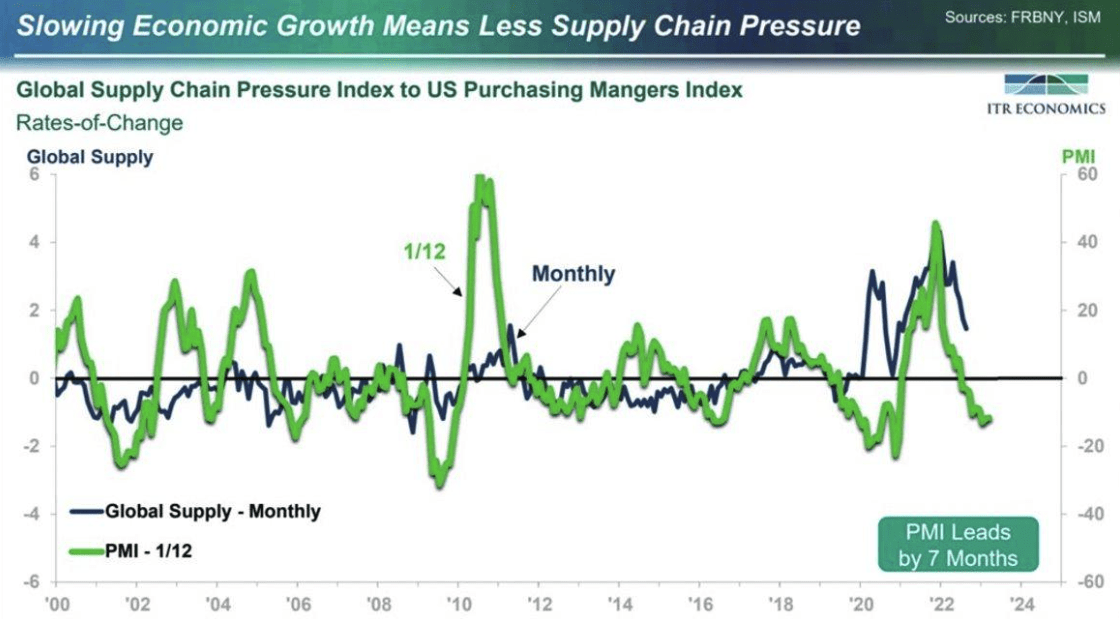

Lauren used the following slide to explain that slowing economic growth will result in less supply chain pressure. Whether you are an investor, a consumer, a house flipper, or a college student, you’ve probably felt the pain of the supply chain issues since Covid started. Lauren explained that slowing economic growth would relieve some of these supply chain issues.

Lauren sure is upbeat! A fact that I really appreciate!

The Producer Price Index, which often leads the Consumer Price Index, showed a sharp decline. This could indicate that the Federal Reserve’s interest rate policies are working.

Government spending usually leads inflation by 23 months. After a record increase during the pandemic, government spending has dropped significantly, as you will see in the next graph. Will the Consumer Price Index follow?

Lauren used the following curve to show past and predict future inflation levels:

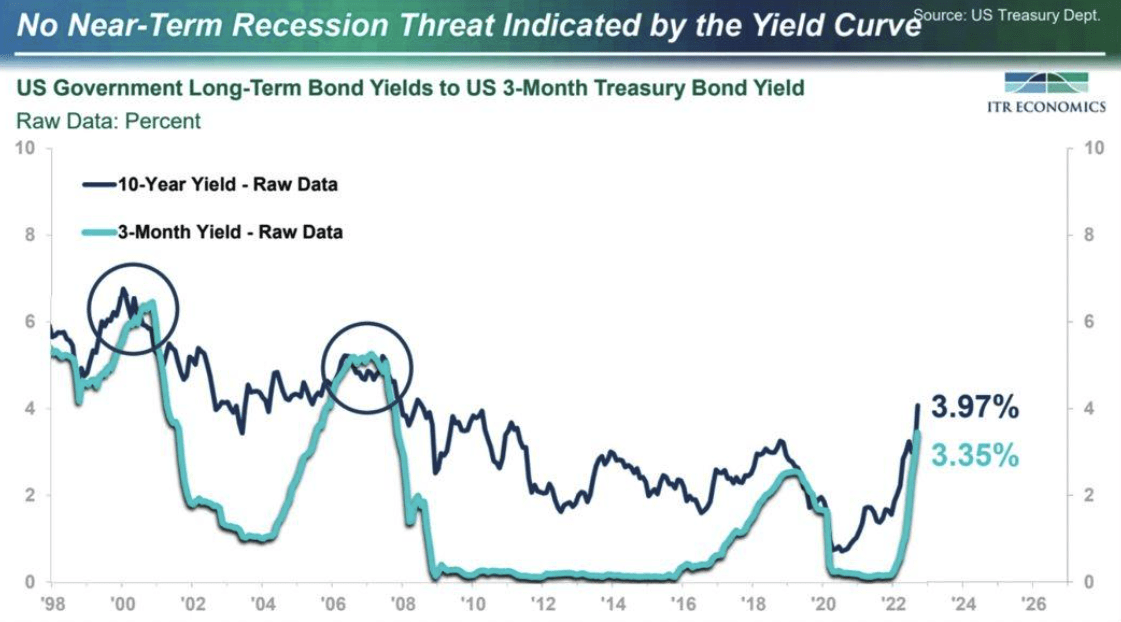

She also discussed the dreaded yield curve inversion. Many of you know that when short-term treasury yields surpass long-term rates, there is “always” a recession on the horizon.

Lauren explained, however, the inverted yield curve we recently saw was only for a few hours one afternoon. It was great for headlines, and newspapers loved it. But does it signal a recession? Lauren also pointed out that there are many yield curves that can be compared. Lauren concluded that this does not necessarily indicate a recession.

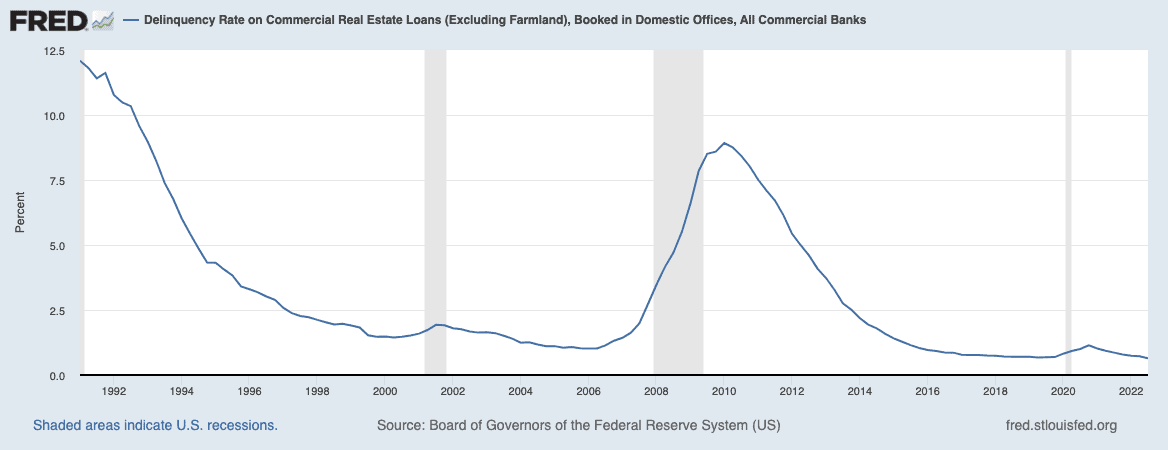

The Federal Reserve shows very low commercial delinquencies, which is great news. This graph going back to the early 1990s is pretty impressive. Banks have every reason to be lending still—right?

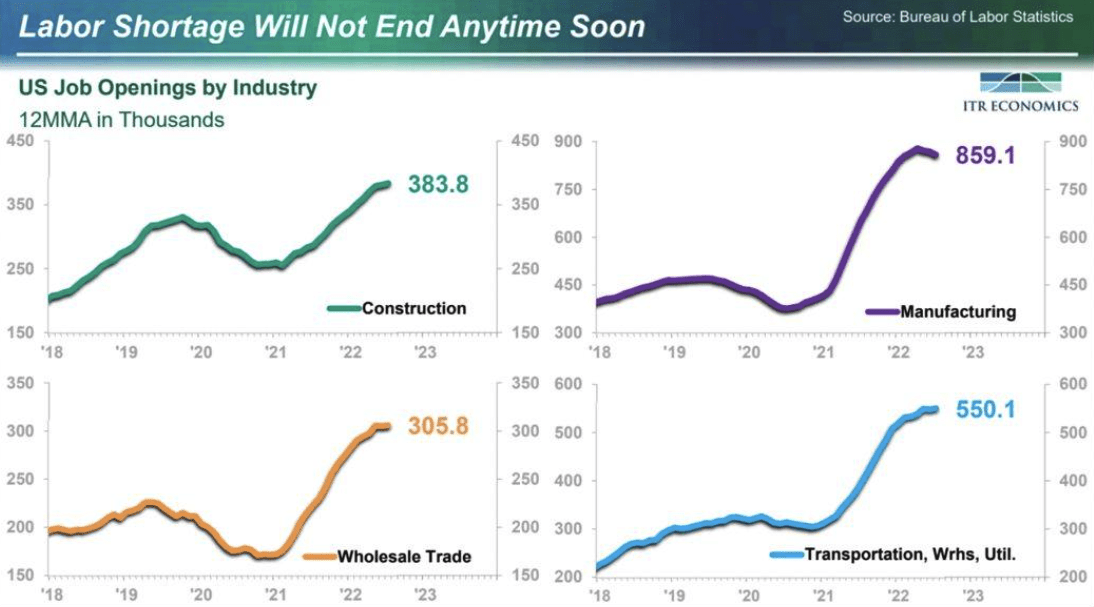

Unemployment is shockingly low, and there are a lot of job openings right now. Lauren explained that the labor shortage would not end anytime soon, with millions of job openings. These four sectors alone have almost 2.1 million job openings.

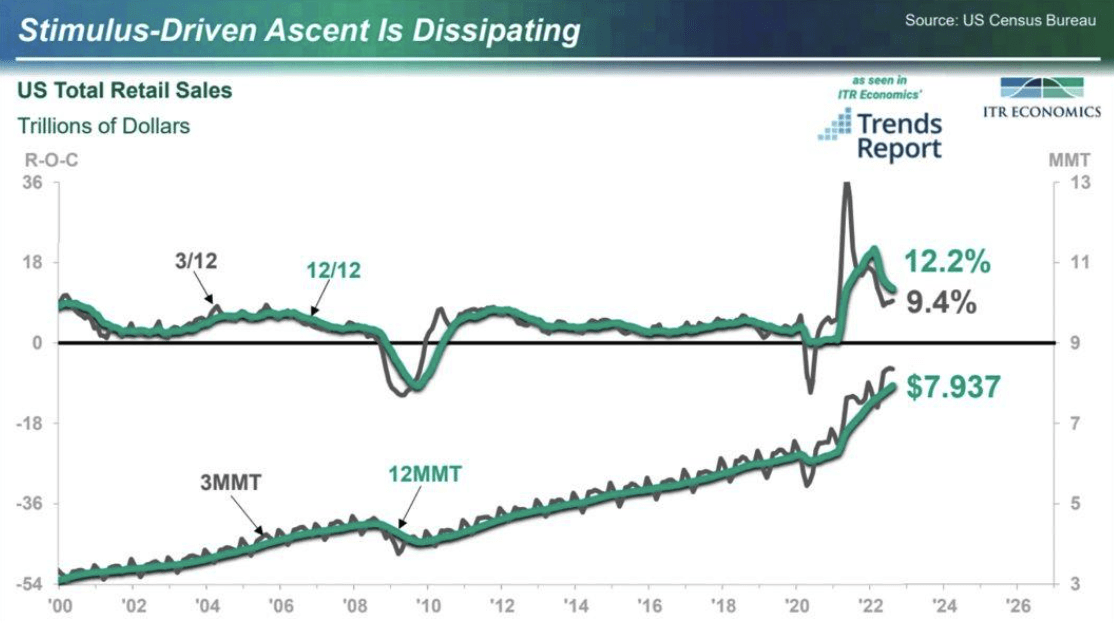

U.S. retail sales are slowing, but they are still near record rates.

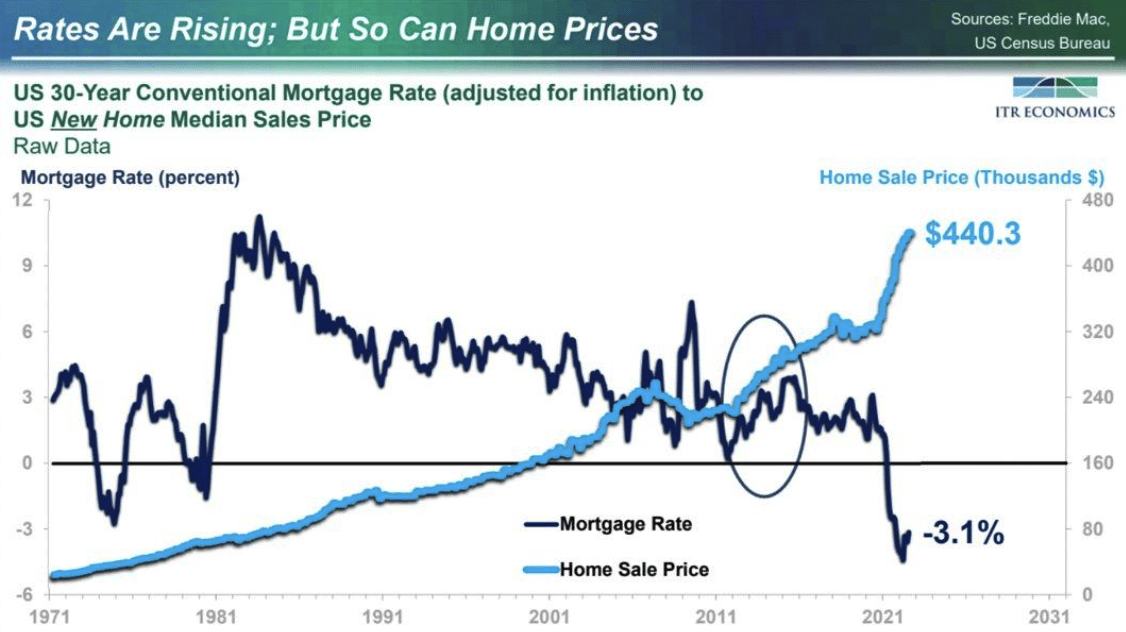

Lauren explained that while interest rates are relatively high now, they are still negative when adjusting for inflation. Meaning that even if you took out a mortgage today, you could look at it like you are making money while borrowing money. Dave Ramsey would hate me for saying that.

Lauren had a lot of great thoughts as she summarized. Here are her three main points on macroeconomic trends:

- U.S. economic growth is dissipating into a “soft landing.”

- Underlying fundamentals suggest commodity prices should stabilize: War is a risk

- Supply chain issues to improve

Lauren concluded that a soft landing is possible. Even likely! That made me very happy, and the audience of about 2,000 in San Diego breathed a sigh of relief.

Should You Take Comfort in this Potential Soft Landing?

Not necessarily. Why? Because many factors could cause this economy to topple. The war in Europe is undoubtedly one of them. But there are others. One you might not have thought of—the squeeze on credit markets!

Source: 10 Charts That Summarize The U.S. Economy – Hint: It’s A Mixed Bag

https://www.creconsult.net/market-trends/10-charts-that-summarize-the-u-s-economy-hint-its-a-mixed-bag/