https://www.creconsult.net/partners/

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

We’re going to talk about the economy. I’m not going to make economic predictions here, but I’m going to try to assess where we are (or might be) in this crazy economy.

A lot of experts, pundits, and screaming headlines would say yes.

JP Morgan Chase CEO Jamie Dimon thinks we are headed for a recession. Cantor Fitzgerald doesn’t think the bear market is over. The S&P 500 has lost about 17% year-to-date. With all of these negative headlines, the world seems awfully dark. But just how accurate are they?

Nobel Prize-winning economist Richard Thaler says there’s no recession, despite two straight quarters of negative GDP growth earlier this year. According to Thaler, calling the U.S. economy recessionary is “just funny.”

Besides Thaler, we can always trust the government, right? The Deputy U.S. Treasury Chief predicts a soft landing. He believes the Fed may tame inflation and avoid a recession. Or at least that’s possible. He says we have the capacity to take steps to bring inflation down but also make the needed investments to make sure the economy continues to grow he said.

Lauren Baker of ITR Economics is a distinguished economist who can provide reliable information for the industry. She did a great job explaining at BPCON22 a contextually sensible view of why the economy might not be as bad as people think and why we may have a soft landing. I will show you several slides from her talk with a brief explanation.

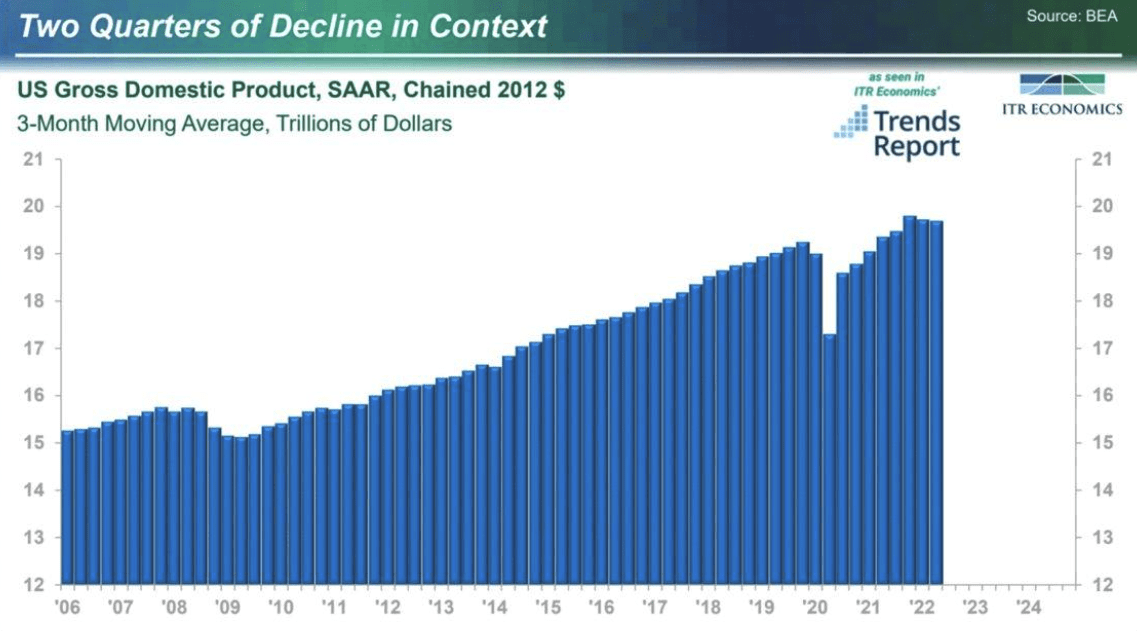

While U.S. GDP declined two quarters in a row, Lauren pointed out that it’s still at near record levels. In fact, these would still be record quarters if the last quarter of 2021 hadn’t been so high. In context, the GDP looks very healthy.

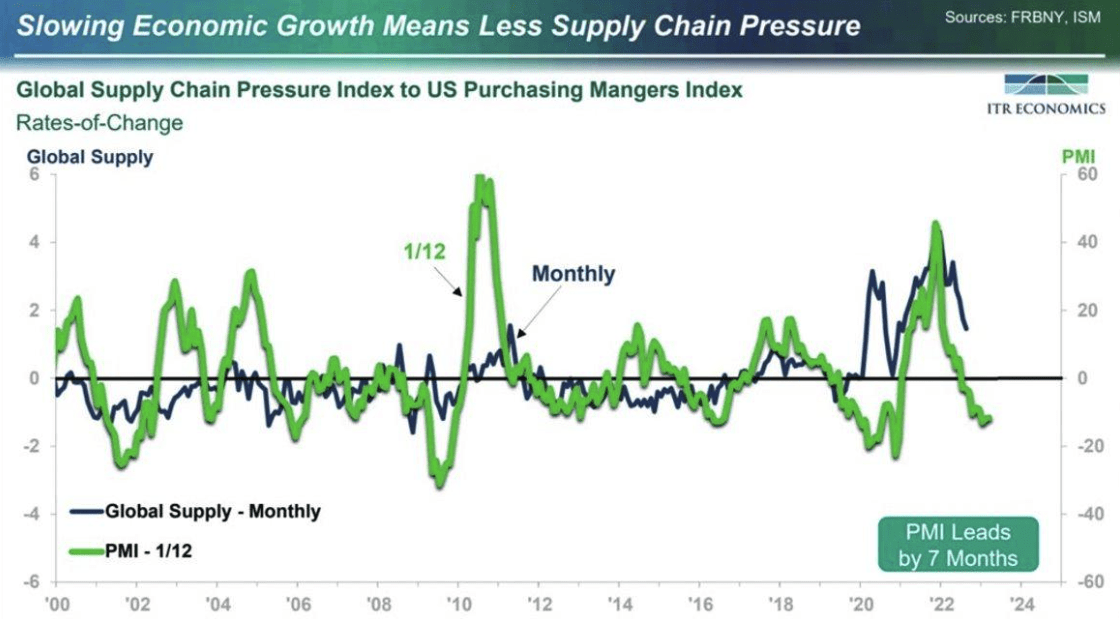

Lauren used the following slide to explain that slowing economic growth will result in less supply chain pressure. Whether you are an investor, a consumer, a house flipper, or a college student, you’ve probably felt the pain of the supply chain issues since Covid started. Lauren explained that slowing economic growth would relieve some of these supply chain issues.

Lauren sure is upbeat! A fact that I really appreciate!

The Producer Price Index, which often leads the Consumer Price Index, showed a sharp decline. This could indicate that the Federal Reserve’s interest rate policies are working.

Government spending usually leads inflation by 23 months. After a record increase during the pandemic, government spending has dropped significantly, as you will see in the next graph. Will the Consumer Price Index follow?

Lauren used the following curve to show past and predict future inflation levels:

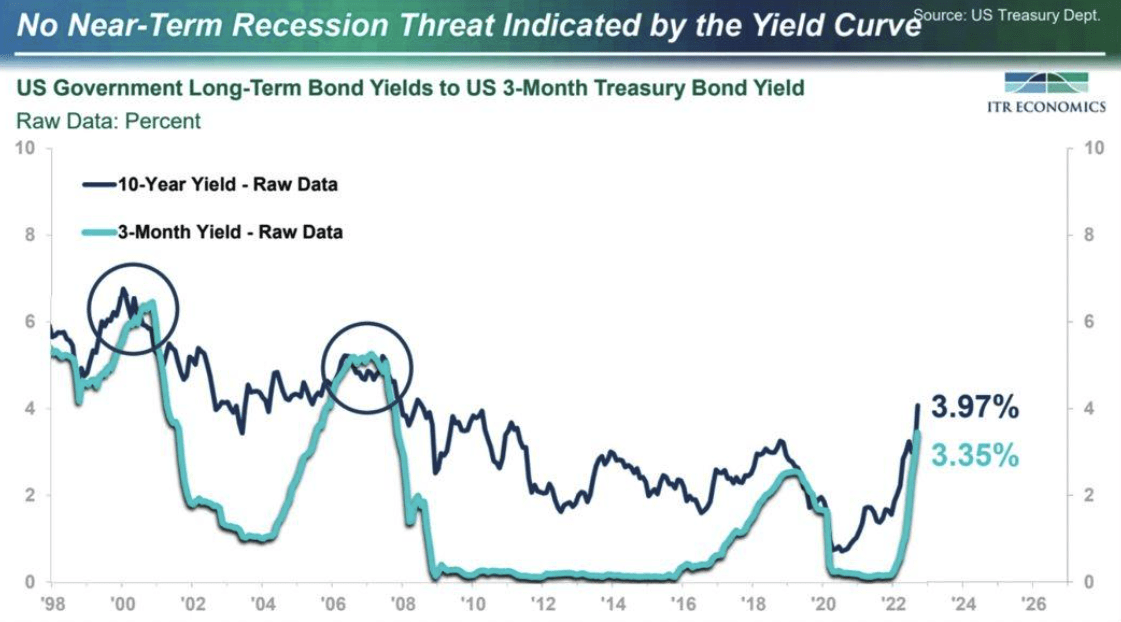

She also discussed the dreaded yield curve inversion. Many of you know that when short-term treasury yields surpass long-term rates, there is “always” a recession on the horizon.

Lauren explained, however, the inverted yield curve we recently saw was only for a few hours one afternoon. It was great for headlines, and newspapers loved it. But does it signal a recession? Lauren also pointed out that there are many yield curves that can be compared. Lauren concluded that this does not necessarily indicate a recession.

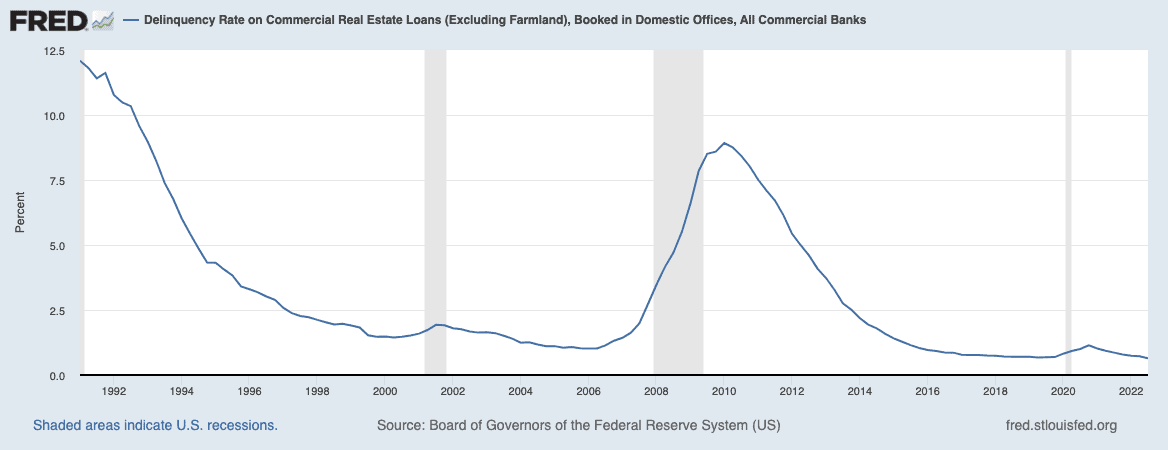

The Federal Reserve shows very low commercial delinquencies, which is great news. This graph going back to the early 1990s is pretty impressive. Banks have every reason to be lending still—right?

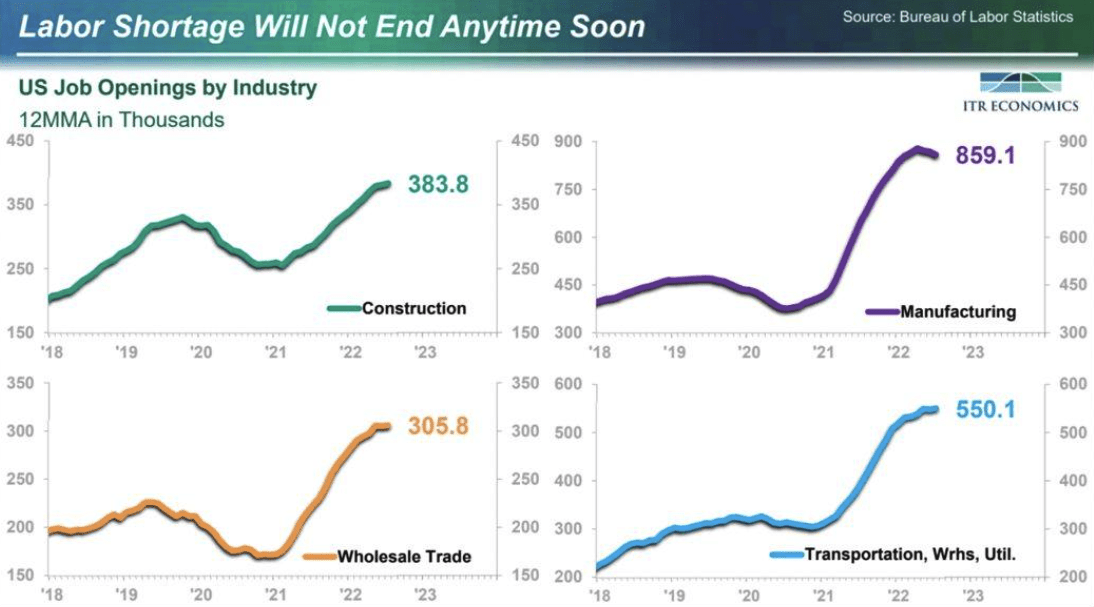

Unemployment is shockingly low, and there are a lot of job openings right now. Lauren explained that the labor shortage would not end anytime soon, with millions of job openings. These four sectors alone have almost 2.1 million job openings.

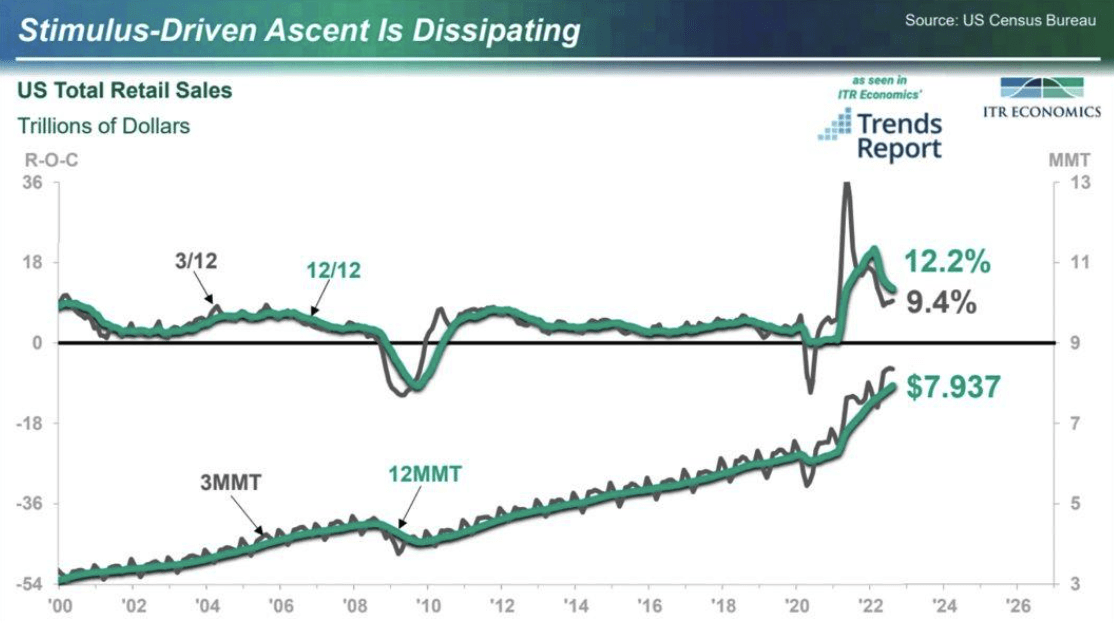

U.S. retail sales are slowing, but they are still near record rates.

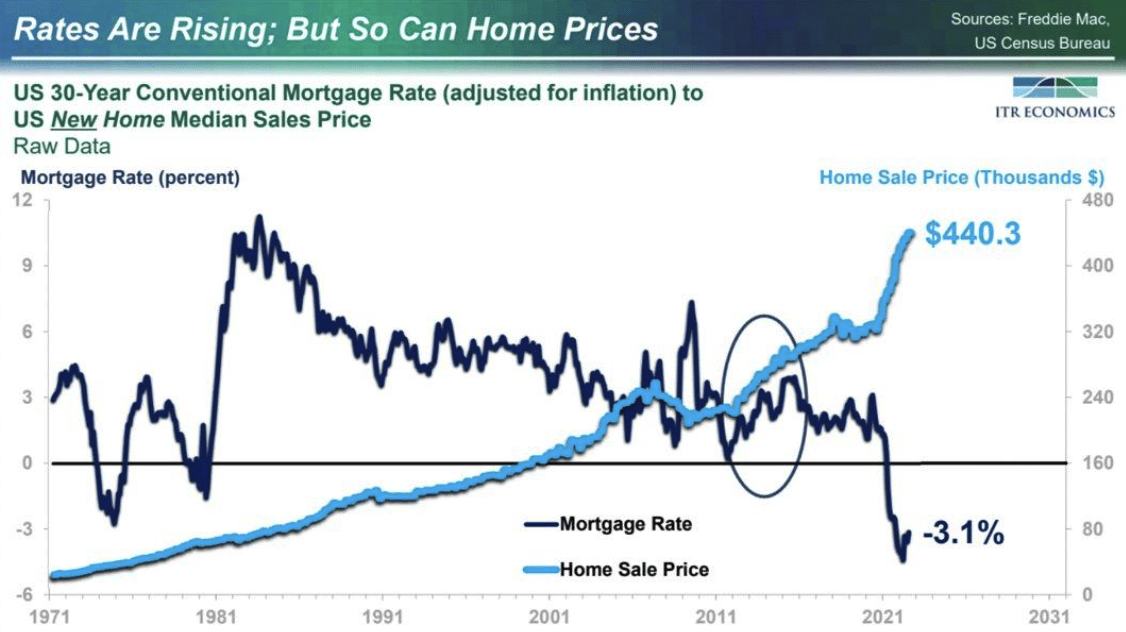

Lauren explained that while interest rates are relatively high now, they are still negative when adjusting for inflation. Meaning that even if you took out a mortgage today, you could look at it like you are making money while borrowing money. Dave Ramsey would hate me for saying that.

Lauren had a lot of great thoughts as she summarized. Here are her three main points on macroeconomic trends:

Lauren concluded that a soft landing is possible. Even likely! That made me very happy, and the audience of about 2,000 in San Diego breathed a sigh of relief.

Not necessarily. Why? Because many factors could cause this economy to topple. The war in Europe is undoubtedly one of them. But there are others. One you might not have thought of—the squeeze on credit markets!

Source: 10 Charts That Summarize The U.S. Economy – Hint: It’s A Mixed Bag

https://www.creconsult.net/market-trends/10-charts-that-summarize-the-u-s-economy-hint-its-a-mixed-bag/

When it comes to selling their investment properties, clients typically ask me,’ Why should I sell?’ Great question. Why should you sell? The obvious answer is that you purchased the investment property as an investment, and it may not be doing as well as other investment opportunities, and after a while, you don’t realize the appreciation and thus maximization of profit from the property until you sell and acquire another investment property. So the question is really, ‘When should I sell? Clients really lose the perspective of the driving reason why they invested in an investment property in the first place. An investment property is just that; an investment. Treated as such, every investment must have a horizon and an exit strategy. If a property was purchased as an investment, then it makes full sense to profit as much as possible from the investment.

The real estate market, like any other market, will go through peaks and valleys. Trying to predict the exact moment of peak or the exact moment the market reaches the bottom is practically impossible. The real estate cycle has four phases; recovery, expansion, hyper supply, and recession. The complete real estate market cycle seems to have an average duration of about 18 years as there is good historical data to support that. So, where are we in that cycle now? How much more upside will we see before we reach the peak? The question really is, ‘What is your appetite for risk?’

Below is a chart of the real estate cycles dating back from the 1800s. The last real estate market crash started at 2006. We are almost 16 years into that cycle. Interest rates are still at all-time lows. Money is cheap, and the threat of inflation is very high. How long can government print money without paying the price down the road? How much road do we have left?

So when is a good time to exit an investment property? As with everything else, real estate is cyclical. Those of us that have been around for some time have witnessed several cycles in the real estate market. Since it is practically impossible to predict the peak of cycles, what strategy should you then use to maximize your investments? Keeping it simple, when evaluating if you should consider selling an investment property, it doesn’t really matter what the current real estate market is like. If you are looking to replace the investment property with another investment property, the ultimate decision to sell should also be based upon if you can increase your returns with the new replacement property, not what state the current market is in now.

There are a number of factors that can impact real estate prices; availability, investment potential, and interest rates, to name a few. Interest rates impact the price and demand of real estate—lower rates bring in more buyers due to the lower cost of money but also expand the demand for real estate, which can then drive up prices. As interests rate starts to inch up, the cost of money increases, and thus the appetite for real estate investments declines.

However, there are many ways that one can still protect their investments. 1031 Exchanges give investors a vehicle to reposition assets and mitigate risk. There are certain asset classes that inherently hold less risk and still perform as an investment vehicle. The questions really come down to; ‘How long do I hold on during this cycle? Do I have the time horizon to outlast another cycle? Is it time to reposition and take advantage of 1031?

As part of the team for our client’s investments, we specialize in building solutions around our client’s needs. We analyze the requirements, crunch the data, and present assets entirely based on their circumstances and the goals they are trying to achieve with their investment.

Source: Should I Sell or Should I Hold? When is the best time for asset repositioning?

https://www.creconsult.net/market-trends/should-i-sell-or-should-i-hold-when-is-the-best-time-for-asset-repositioning/

Washington, D.C. – The Federal Housing Finance Agency (FHFA) announced today that the 2023 multifamily loan purchase caps for Fannie Mae and Freddie Mac (the Enterprises) will be $75 billion for each Enterprise, for a combined total of $150 billion to support the multifamily market. The 2023 caps reflect an anticipated contraction of the multifamily originations market in 2023.

To ensure a strong focus on affordable housing and traditionally underserved markets, FHFA will require that at least 50 percent of the Enterprises’ multifamily business be mission-driven affordable housing.

“The 2023 multifamily loan caps, coupled with a new mission-driven category for workforce housing properties, will continue to ensure that the Enterprises have a strong commitment to addressing the need for affordable housing,” said Director Sandra L. Thompson. “The new workforce housing category will provide incentives for conventional borrowers to maintain rents at affordable levels for extended periods of time.”

In addition, FHFA has changed certain definitions of multifamily mission-driven affordable housing in Appendix A of the Conservatorship Scorecard. In 2023, FHFA will allow loans to finance energy or water efficiency improvements with units affordable at or below 80 percent of AMI to be classified as mission-driven, up from 60 percent AMI in 2022. This increase will allow the Enterprises to expand their effort on energy and water conservation measures at workforce housing properties.

To ensure the Enterprises continue to provide sufficient liquidity and support in the multifamily mortgage market, FHFA will continue to monitor the multifamily mortgage market and will update the multifamily caps and mission-driven requirements if adjustments are warranted. However, to prevent market disruption, if FHFA determines that the actual size of the 2023 market is smaller than was initially projected, FHFA will not reduce the caps.

2023 Multifamily Caps Fact Sheet

2023 Appendix A

Source: FHFA Announces 2023 Multifamily Loan Purchase Caps for Fannie Mae and Freddie Mac

https://www.creconsult.net/market-trends/fhfa-announces-2023-multifamily-loan-purchase-caps-for-fannie-mae-and-freddie-mac/

There is no doubt that the real estate market has been a wild ride since the pandemic changed the normal course of our lives over two years ago. Lending did not escape the effects of Covid-19, and many active investors have learned more about the loan process than they ever did before the pandemic.

In the spring of 2020, some lenders left active investors in a bind, closing their doors or halting lending while they evaluated the new risks in the marketplace. Over two years later, the market is changing again, and investors need to know how to pivot to keep their pipeline flowing. While everyone is watching rates increase, they are taking their eyes off the real question right now: Can they close this loan?

Realizing a preapproval and rate and term sheet are not set in stone will go a long way in the current lending environment. Lenders are changing underwriting criteria, not making as many or any exceptions to lending guidelines, and lowering loan-to-value midstream in the escrow process. Most investors never thought about the source of their capital before March 2020. The most concerning part of the lending process was getting through underwriting and receiving the message that you were approved and cleared to close. Whatever happened behind the scenes inside the lending machine wasn’t a concern to an active investor. As long as money made it to the closing table, they were happy. This strategy worked until the capital never made it to the closing table.

When lenders suddenly turned off the spigot to cheap capital, investors scrambled to save deals any way they could. This pushed private lenders with their own capital to lend to the forefront in the hunt for leverage. Active investors scrambled to find funding or negotiate contract extensions to restart the lending process.

Private lenders who lend their own capital have more control. Large nationwide or even regional lenders have significant strings attached to the capital they lend out, and those strings are pulled by forces outside the lender’s control.

For example, large institutional lenders are often funded by lines of credit from banks or even selling their loans on the secondary market. In both of those cases, there is another entity establishing what they can lend out, where they can lend it, and the pricing of those loans. These lenders require the line of credit to stay open or the capital markets to continue purchasing loans, so they have enough liquidity to keep new loans coming into the pipeline.

What does that mean for you as a borrower? It means that the rates and terms you are quoted may suddenly change, or funding, in general, may be halted at a moment’s notice. So how can you protect your real estate investing business in this period of turbulence?

Start asking questions about how the lender acquires their capital and diversify lending sources based on where they get their capital.

For the sake of simplicity, you can think of capital in one of four buckets for alternative lending: national lenders, regional lenders, local lenders, and private loans from a lender who lends their own capital, including seller financing. While there are many flavors and options within each bucket, knowing the general purpose of each can help you decide what type of financing to use for which project.

Alternative lending automatically means it is not going to be the conforming conventional loans you may have used to purchase your own home. Since they are non-conforming loans, the variables offered are numerous and vary greatly. Having a conversation with your lender about the types of projects they fund and general guidelines for their loan products can go a long way to choosing the right lender for the right project.

National lenders are pretty easy to locate. Their brand and names are spoken widely across online platforms, forums, and even REI meetings. Their business model has the borrower and decision maker for the loan the furthest removed from each other. To these lenders, every application and, ultimately, file on their desk is a series of numbers and check marks. A business model like this shows up to the active investor (borrower) with high single-digit interest rates and lower fees, but those come at the cost of higher documentation requirements, full third-party appraisals, and a longer closing time. This group of lenders is often very sensitive to changes in the capital markets or economic outlooks. If you need a deal to close super quickly with minimal documentation, this may not be the best tool to use. On the other hand, if you have time for the closing such as a refinance into permanent debt, this may be a great option to pursue.

Regional lenders may not have the brand recognition of “the big guys,” but within their markets, they can be relatively well known. Their mid-range interest rates and somewhat higher fees often come with lower requirements for documentation and longer financing timeframes than national lenders. Depending on the lender, they may require a full appraisal or may opt to do an online valuation through a third party. These regional lenders can be a great option for borrowers that have some unique borrowing challenges, such as new employment or acquiring financing as a new business entity.

Local lenders tend to be smaller asset-backed lenders or smaller bank/credit unions in the market. They tend to lend in just a certain area of a state or the entire state if it’s small enough (such as Delaware or Rhode Island). These local lenders usually have higher rates, especially if they are asset-backed, but also usually have low or no documentation requirements. This translates through to a borrower with higher rates and usually higher fees. These asset-based lenders can often close quicker and use some sort of in-house valuation methods for the real estate securing the loan. Credit unions may also use the same valuation tools but often want a higher level of documentation to understand the lending opportunity. For investors operating in one particular market, this classification of lender tends to be the most helpful since they are local. This class of lenders understands the market they are lending in and has experience with other lending opportunities in the same area.

Lastly, we will look at loans that come from individuals, or what we term “private lenders .”These loans come from capital that an individual or their business entity has. These individuals are often seeking to have passive income or put their retirement funds to work in real estate versus the stock market. Depending on the amount of capital they have available to them, they may not always have the liquidity to fund a loan when the capital is needed. Many of these lenders work with established networks of borrowers, sometimes rolling capital from one deal to the next with the same borrower. These lenders may have very low documentation requirements, flexibility on the type of properties they are willing to lend on, and vary in terms of interest rates, fees, and length of the loan. They also can generally close very quickly, sometimes within a few days if needed. While they won’t be the cheapest or longest-term loan out there, the flexibility this type of lender offers more than makes up for it.

As you can see, there is somewhat of a correlation between the documentation and underwriting guidelines and the rate being charged. When you, as a borrower, can show the standards a lender believes are lower risk, you can then be rewarded with a lower rate. In addition, other value-add components can also increase annualized interest rates and fees being charged. If a lender can get a deal closed in three days with minimal documentation, that can be a more expensive loan because the borrower needs to move quickly or is unable or unwilling to go through a more thorough vetting process for the loan.

Understanding what your needs are for financing each property really allows you to find not just a lender but the right lender for the job. The lender’s ability to close the loan is more important than rates and terms right now. Ask questions about the lender’s access to capital and if that access is likely to change in the next several weeks. Depending on the size of the lender you are speaking with, they may not be able to answer that question, but thinking about this as a borrower can never hurt to consider. Keeping another lender in your back pocket that may be able to close quickly, even if it is a higher rate, maybe the difference between closing or not.

[sc name="financing"][/sc]

Source: Do You Know Where Your Money Is Coming From? Navigating Today’s Lending Market

https://www.creconsult.net/market-trends/do-you-know-where-your-money-is-coming-from-navigating-todays-lending-market/

Estimating the value of real estate is necessary for a variety of endeavors, including financing, sales listing, investment analysis, property insurance, and taxation. But for most people, determining the asking or purchase price of a piece of real property is the most useful application of real estate valuation. This article will provide an introduction to the basic concepts and methods of real estate valuation, particularly as it pertains to sales.

Technically speaking, a property's value is defined as the present worth of future benefits arising from the ownership of the property. Unlike many consumer goods that are quickly used, the benefits of real property are generally realized over a long period of time. Therefore, an estimate of a property's value must take into consideration economic and social trends, as well as governmental controls or regulations and environmental conditions that may influence the four elements of value:

Value is not necessarily equal to cost or price. Cost refers to actual expenditures – on materials, for example, or labor. Price, on the other hand, is the amount that someone pays for something. While cost and price can affect value, they do not determine value. The sales price of a house might be $150,000, but the value could be significantly higher or lower. For instance, if a new owner finds a serious flaw in the house, such as a faulty foundation, the house's value could be lower than the price.

An appraisal is an opinion or estimate regarding the value of a particular property as of a specific date. Appraisal reports are used by businesses, government agencies, individuals, investors, and mortgage companies when making decisions regarding real estate transactions. The goal of an appraisal is to determine a property's market value – the most probable price that the property will bring in a competitive and open market.

Market price, the price at which property actually sells, may not always represent the market value. For example, if a seller is under duress because of the threat of foreclosure or if a private sale is held, the property may sell below its market value.

An accurate appraisal depends on the methodical collection of data. Specific data, covering details regarding the particular property, and general data, pertaining to the nation, region, city, and neighborhood wherein the property is located, are collected and analyzed to arrive at a value. Appraisals use three basic approaches to determine a property's value.

The sales comparison approach is commonly used in valuing single-family homes and land. Sometimes called the market data approach, it is an estimate of value derived by comparing a property with recently sold properties with similar characteristics. These similar properties are referred to as comparables, and to provide a valid comparison, each must:

At least three or four comparables should be used in the appraisal process. The most important factors to consider when selecting comparables are the size, comparable features, and – perhaps most of all – location, which can have a tremendous effect on a property's market value.

Comparables' Qualities

Since no two properties are exactly alike, adjustments to the comparables' sales prices will be made to account for dissimilar features and other factors that would affect value, including:

The market value estimate of the subject property will fall within the range formed by the adjusted sales prices of the comparables. Since some of the adjustments made to the sales prices of the comparables will be more subjective than others, weighted consideration is typically given to those comparables that have the least amount of adjustment.

The cost approach can be used to estimate the value of properties that have been improved by one or more buildings. This method involves separate estimates of value for the building(s) and the land, considering depreciation. The estimates are added together to calculate the value of the entire improved property. The cost approach makes the assumption that a reasonable buyer would not pay more for an existing improved property than the price to buy a comparable lot and construct a comparable building. This approach is useful when the property being appraised is a type that is not frequently sold and does not generate income. Examples include schools, churches, hospitals, and government buildings.

Building costs can be estimated in several ways, including the square-foot method, where the cost per square foot of a recently built comparable is multiplied by the number of square feet in the subject building; the unit-in-place method, where costs are estimated based on the construction cost per unit of measure of the individual building components, including labor and materials; and the quantity-survey method, which estimates the quantities of raw materials that will be needed to replace the subject building, along with the current price of the materials and associated installation costs.

Depreciation

For appraisal purposes, depreciation refers to any condition that negatively affects the value of an improvement to real property and takes into consideration the following:

Methodology

Often called simply the income approach, this method is based on the relationship between the rate of return an investor requires and the net income that a property produces. It estimates the value of income-producing properties such as apartment complexes, office buildings, and shopping centers. Appraisals using the income capitalization approach can be fairly straightforward when the subject property can be expected to generate future income and when its expenses are predictable and steady.

Direct Capitalization

Appraisers will perform the following steps when using the direct capitalization approach:

Gross Income Multipliers

The gross income multiplier (GIM) method can be used to appraise other properties that are typically not purchased as income properties, but that could be rented, such as one- and two-family homes. The GRM method relates the sales price of a property to its expected rental income. (For related reading, see "4 Ways to Value a Real Estate Rental Property")

For residential properties, the gross monthly income is typically used; for commercial and industrial properties, the gross annual income is used. The gross income multiplier method can be calculated as follows:

Sales Price ÷ Rental Income = Gross Income Multiplier

Recent sales and rental data from at least three similar properties can be used to establish an accurate GIM. The GIM can then be applied to the estimated fair market rental of the subject property to determine its market value, which can be calculated as follows:

Rental Income x GIM = Estimated Market Value

Accurate real estate valuation is important to mortgage lenders, investors, insurers and buyers, and sellers of real property. While appraisals are generally performed by skilled professionals, anyone involved in a real transaction can benefit from gaining a basic understanding of the different methods of real estate valuation.

Source: What You Should Know About Real Estate Valuation

https://www.creconsult.net/market-trends/what-you-should-know-about-real-estate-valuation/eXp Commercial Presents: The 2026 CRE Economic Outlook Navigating the 2026 commercial real estate landscape requires a strategy grounded in ...