9301 West Golf Rd | Des Plaines, IL 60016

Broker: Randolph Taylor rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/golf-sumac-professional-building-medical-office-space-for-lease-9301-golf-rd-des-plaines-il-60016/

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Chicago’s multifamily sector currently enjoys strong market fundamentals highlighted by healthy occupancy rates and continued rental rate growth. The current core apartment rents average over $4 per square foot, which is higher than previous peak pricing.

After the pandemic, rental rates between late 2021 to 2022 recorded 10 to 15 percent growth, which is substantially ahead of the historical norms. Currently, the Chicago rental market is experiencing more stable rent growth in the 3 to 4 percent range.

Chicago remains one of the most affordable major markets to rent an apartment when looking at the current average effective rents as a percentage of median household income. This affordability will allow owners to continue to push rental rates in the future.

One of the major factors leading to strong operating fundamentals in the Chicago market is the lack of new supply. The supply in Chicago is currently 1 percent of the inventory, which is quite low in comparison to other markets where there could be as much as 10 to 12 percent of the inventory under construction.

In the city, there are just over 7,000 units under construction slated for delivery between 2023 and 2024. The majority of new development is located in two submarkets, which are Fulton Market and Gold Coast/Near North. In the suburbs, there are nearly 6,000 units slated for delivery through 2024. Suburban deliveries have remained consistent in recent years as investors continue to believe in the fundamentals outside of the urban core.

Spring and summer are typically the strongest leasing seasons in the Windy City and with a very limited supply of new construction in the pipeline, the market is well-positioned for continued strong rent rate growth as well as high absorption.

Investment sales activity in 2022 was $3.2 billion, with the majority occurring during the first half of the year, before the Federal Reserve’s rate increases really took hold and caused a lack of stability in the capital markets.

Among the key transactions to take place last year include the sale of The Elle, formerly known as Alta Roosevelt, in the South Loop to Waterton Associates. The property sold for $170 million, which is approximately $343 per unit or $341 per square foot. The transaction closed in November 2022 and was the largest transaction to take place in the downtown market.

In the suburbs, Ellyn Crossing in Glendale Heights sold to Turner Impact Capital. This 1,155-unit residence sold for $137 million, which is $118,615 per unit and $193 per square foot, and was among the largest transactions to occur in the suburbs last year.

In terms of investment activity, many of the large institutions remain on the sidelines thereby creating a great opportunity for the private capital to acquire assets in the Chicago market. In fact, downtown acquisitions by private investors have continued to increase year-over-year demonstrating their desire to transact with yield premiums and significant discount to replacement cost.

There is plenty of liquidity in the financing markets for multifamily. Agencies continue to provide liquidity during this choppiness in the capital markets, committing $150 billion in dry powder for 2023 volumes. Buyers today are actively seeking neutral leverage and will not settle for negative leverage. Therefore, they are very focused on their going-in cap rate.

Based on what is currently on the market, 2023 is on par with or well-positioned to exceed the activity recorded in 2022. Buyers and sellers are both capitulating, and as both move toward a middle ground, we expect the second half of the year to have even more transactions.

Today is a great time to be an investor and an operator in the Chicago market as the fundamentals have never been better, and pricing is at an above-average yield today with a significant discount to replacement costs.

Source: Chicago’s Multifamily Sector Boasts Healthy Occupancy Rates, Strong Rent Growth

https://www.creconsult.net/market-trends/chicagos-multifamily-sector-boasts-healthy-occupancy-rates-strong-rent-growth/

Real estate investors typically diversify their geographic footprint to reduce their overall portfolio risk profile. But what if investors dug deeper and proactively diversified their property-level rent roll to minimize risk exposure for a given asset? Multifamily owners could soften the impact of market downturns on their portfolio and potentially take a more bullish approach to other risk levers in the portfolio, such as leverage or geographic concentration if high conviction opportunities presented themselves.

Portfolio Theory

"A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies." - Harry Markowitz.

Portfolio Theory is a framework for investing. It states that if you combine assets with low or negative correlations, you reduce the overall risk of your portfolio. An example could be oil company stocks and airline stocks, which typically move in opposite directions as the price of oil changes (since oil is a significant expense for airlines).

Potential Multifamily Applications

Multifamily risks are likely higher than many investors realize. This asset class benefits from government-subsidized financing, which encourages higher leverage due to the lower interest rates. High leverage increases the risk profile of the investment, and when combined with higher pricing from the surge in investor interest in multifamily properties in recent years, the financial risk profile of multifamily is increasing.

Tenant rent roll curation can lower risk at the individual property level. For example, in an economic downturn, your property performance could be higher than the overall market or submarket (lowering your property's beta) because you, the owner, have proactively selected tenants that collectively reduce your risk profile. Your rents may still fall, but at lower rates than the submarket.

Additionally, the proactive tenant curation model can offer valuable insights into the risk profile of your tenant base, allowing for more accurate forecasting and portfolio-level risk assessments.

How It Works

Let's consider a multifamily property in Las Vegas.

Las Vegas was one of the most impacted markets during the Great Recession of the late 2000s. The employment loss was significant, and investors suffered from lower rents and decreasing values.

However, not all employment sectors fared equally.

Source: Bureau of Labor Statistics

The Education and Health sector (defined by the BLS) performed much stronger than the broader employment trend. The Education and Health segment never reached year-over-year negative job losses as the industry was insulated from the broader economic trends of the day. This sector comprised 10.7% of the Las Vegas employee market as of June 2022.

Property in Las Vegas (a highly cyclical market) with a high proportion of tenants from stable employment sectors should have improved performance compared to comparable properties with tenants from more volatile sectors.

Great. I’ll buy a property next to a medical center.

The Great Recession was one of the most severe recessions in recent times (before Covid-19) and could be a helpful benchmark in the absence of a global pandemic.

Yes, you can invest in an asset adjacent to a medical center where investors can benefit from these strong and stable employment trends. But market participants already know this - thus, the price will likely command a premium. Intuitively, many investors assume that medical or educational employers (like universities or hospitals) are anchor employers that offer growth opportunities and stabilize the surrounding job market.

Yes, you can acquire it, but you'll pay a premium for the luxury of tenants with stable employment bases.

There Is Another Solution – Remote Work

The Covid-19 pandemic has offered employers (and employees) an experiment in remote work. Millions of people are no longer geographically tied to their employers. From a real estate perspective, they have become free agents.

The distribution of these remote workers is still shifting as employees assess their options. According to McKinsey, an estimated 35% of employees can work from home five days a week, which offers the possibility of migration to a better lifestyle or financial opportunities.

Since remote workers are not tied to their geography, they can tap into the national remote labor market, which is much larger. Although data on the topic seems sparse (since it’s a new phenomenon), it seems possible that skilled remote workers could benefit from lower overall unemployment rates since their employment pool is deeper and more liquid.

We are likely at the beginning of an unprecedented sorting wave as the population assesses their options across national and international borders. Multifamily investors can take advantage of this process by targeting remote workers directly. They can use remote workers as the portfolio management tool to curate their rent roll and position it for success according to their goals.

How To Do It?

Organize your property to appeal to the target audience. Remote workers likely value the basic amenities, such as high-speed and reliable internet access, as well as community-focused amenities, such as expansive WeWork-style common areas, since they don’t have physical meetings with colleagues.

A disproportionate investment in amenities that appeal to the target audience is a solid signal to the target market that they are sought-after.

Additionally, financial incentives can be tailored to the target audience. For example, multifamily owners have long used tools such as preferred employer discounts to entice residents to rent their units. Unfortunately, these discounts are usually expensive (3% of gross rent) and lack precision (targeting only the largest employers in the area). Instead of ongoing discounts, upfront cash incentives can be used as a lower-cost option.

Much more can be done to attract and retain these targeted residents, and these ideas need to be crafted into a distinct marketing strategy.

The Potential Impact

The above example, based on Indeed.com job listing data (for Pre-Covid and May 2022), illustrates the potential diversification benefits of remote worker hubs at multifamily properties. The nationalization of the tenant risk profile from (9.4% to 40%) should reduce the overall risk exposure – possible without reducing the property’s Net Operating Income.

However, investors would not need to immediately target this proportion of units to the strategy to experience benefits. Instead, a step-by-step approach could be implemented with a handful of units being tested until the strategy has been proven.

The addition of high-income tenants who don’t rely on the local labor market can be used to bolster valuations. Additional monetization opportunities could be researched to capture a higher wallet share of the target tenant base.

Summary

Portfolio management can move from macro to micro through the proactive use of job category targeting across individual property rent rolls and overall diversification benefits from lower reliance on local labor markets. This curation can unlock significant additional value above and beyond the expected return from a multifamily property in that location (your beta).

We are in the early innings of remote worker sorting across the country. It will present opportunities for investors and workers to create more win-win dynamics as new needs are recognized and satisfied in the market.

Source: Multifamily Rent Roll Curation – Next Steps in Portfolio Management

https://www.creconsult.net/market-trends/multifamily-rent-roll-curation-next-steps-in-portfolio-management/

Multifamily brokers frequently hear this comment from apartment property owners: “I don’t want to list, but you can bring me a buyer.” Their reasons sometimes include previous bad experiences, fear of getting “tied up” in a formal agreement, tenants finding out the building is for sale and making anxious calls to management, thinking the commission will be halved, or not really being interested in selling. Whatever the reluctance, the reality is that if an investor wants or needs to sell, the best thing they can do is hire a broker. Let’s address a few of those common objections first.

If you had a previous bad experience, more than likely, you hired the wrong broker. The specific agent you hire or the firm they work for should have experience in both the geographic market and transaction size — ask for their track record. While you’re at it, ask for references from clients, and make sure at least one is for a listing that did not sell. These simple steps will give you insight into whether you’re working with a pro.

As for getting “tied up” or having anxious tenants because the building is selling, a professional broker typically allows you a cancellation right for the listing. If there are deadlines you need to meet, make sure your broker understands. And while no broker can guarantee tenants won’t find out the building is being sold, experienced brokers can modify marketing by limiting showings to only vacant units, specific hours for low visibility, limiting digital footprint tenants might see, etc., to reduce the probability of tenants finding out.

That said, the best course is simply to announce to tenants that the building has been listed for sale, explain the sale may not be successful, and assure them that their lease runs with the building, not the owner, and is their protection during the lease term against rent increases or being forced to move.

These are certainly not the only reasons clients are reluctant to list but whatever is yours, talk to your broker about your real concerns. A seasoned broker will most likely have previously faced a similar challenge and should be able to address your concern. But this only addresses your concerns about why you shouldn't hire a broker — it doesn’t explain why you should.

The first benefit is understanding the value of your property. A professional, qualified broker who specializes in your asset or area will be able to give you a price range to expect so that you can decide whether selling makes sense. If you move forward, this specialist will also have databases of the most qualified, active investors in the market and have relationships and influence with them. The ultimate buyer of your property will more than likely come from one of these relationships. But a broker won’t rely exclusively on these relationships. A good broker will also create a professional marketing plan with appropriate amounts of promotion across email, mail, websites, and listing services.

All this leads to the most important part of hiring a broker: competition. Trying to sell your building by letting a broker “bring you a buyer” is like having an auction for a painting, and one person shows up to bid. If the building is priced correctly, a professional marketing plan will create a competitive environment for investors so that the process itself determines not what the market wants to bid but what the market is willing to bid.

Larger portfolio owners might be reluctant to list with a specific broker because they have relationships with numerous brokers or firms in the market, and they don’t want to offend anyone by choosing a competitor. Instead, they tell every relationship to “bring me a buyer.” If this is you, think a few more steps down the chain of events.

First, this may only create chaos. You not only have brokers racing each other to bring clients, but each is advocating to you why their buyer is the best so that they can get the commission. Then you ultimately have to pick one buyer/broker anyway and disappoint the others after they’ve put work in. Alternatively, a listing agreement assures a commission for the listing agent if the property sells; therefore, there is no incentive to advocate for any one specific buyer.

An additional benefit of listing a property with a broker comes after a sale contract is signed. Any number of unexpected or challenging issues can arise during the escrow period of a sale. A seasoned broker has probably experienced something similar before. This person will also quarterback the entire process of due diligence, appraisal, and loan approval.

The most important benefit of exclusively listing your property with a broker is representation. You will have a hired gun with a fiduciary obligation to advocate for your best position in a deal. A professional broker will be ethical, transparent, and fair but will also be your personal fighter in the arena of marketing, negotiation, and escrow management.

This short list does not address every objection an owner would have for not listing, nor every benefit you receive from hiring a professional broker, but hopefully, it gives you a few things to consider. If you want to maximize your price and minimize your anxiety with the selling process, hire a broker. The benefits far outweigh the cost.

eXp Commercial Chicago Multifamily Brokerage focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

We don’t just market properties; we make a market for each property we represent. Each offering is thoroughly underwritten, aggressively priced, and accompanied by loan quotes to expedite the sales process. We leverage our broad national marketing platform syndicating to the top CRE Listing Sites for maximum exposure combined with an orchestrated competitive bidding process that yields higher sales prices for your property.

https://www.creconsult.net/market-trends/if-youre-hesitant-to-hire-a-broker-for-your-multifamily-property-read-this/

We’re going to talk about the economy. I’m not going to make economic predictions here, but I’m going to try to assess where we are (or might be) in this crazy economy.

A lot of experts, pundits, and screaming headlines would say yes.

JP Morgan Chase CEO Jamie Dimon thinks we are headed for a recession. Cantor Fitzgerald doesn’t think the bear market is over. The S&P 500 has lost about 17% year-to-date. With all of these negative headlines, the world seems awfully dark. But just how accurate are they?

Nobel Prize-winning economist Richard Thaler says there’s no recession, despite two straight quarters of negative GDP growth earlier this year. According to Thaler, calling the U.S. economy recessionary is “just funny.”

Besides Thaler, we can always trust the government, right? The Deputy U.S. Treasury Chief predicts a soft landing. He believes the Fed may tame inflation and avoid a recession. Or at least that’s possible. He says we have the capacity to take steps to bring inflation down but also make the needed investments to make sure the economy continues to grow he said.

Lauren Baker of ITR Economics is a distinguished economist who can provide reliable information for the industry. She did a great job explaining at BPCON22 a contextually sensible view of why the economy might not be as bad as people think and why we may have a soft landing. I will show you several slides from her talk with a brief explanation.

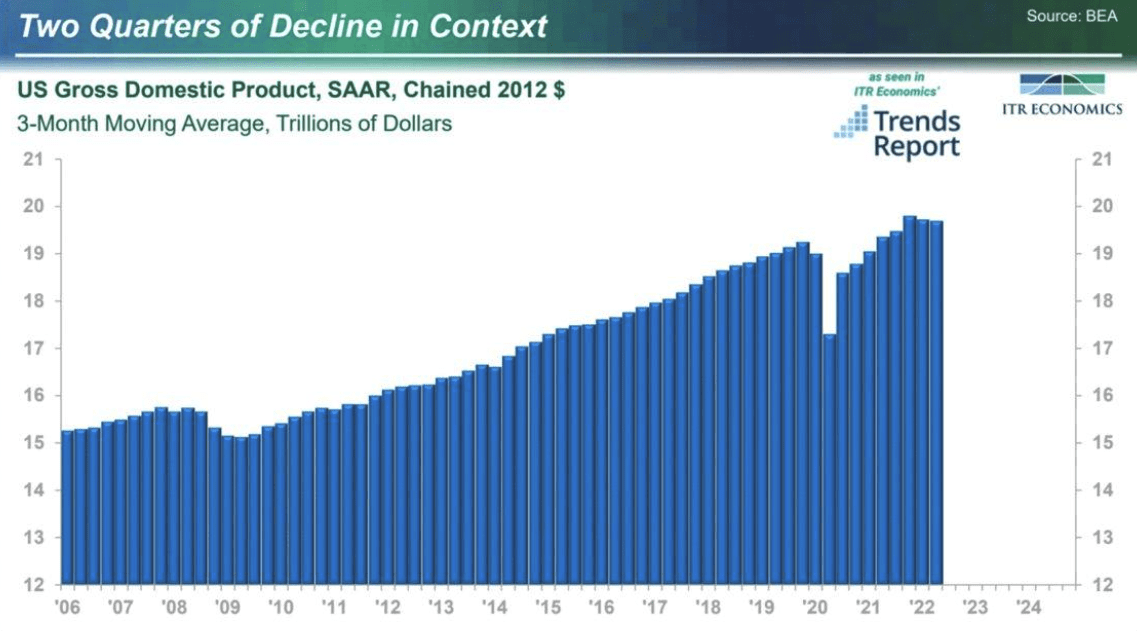

While U.S. GDP declined two quarters in a row, Lauren pointed out that it’s still at near record levels. In fact, these would still be record quarters if the last quarter of 2021 hadn’t been so high. In context, the GDP looks very healthy.

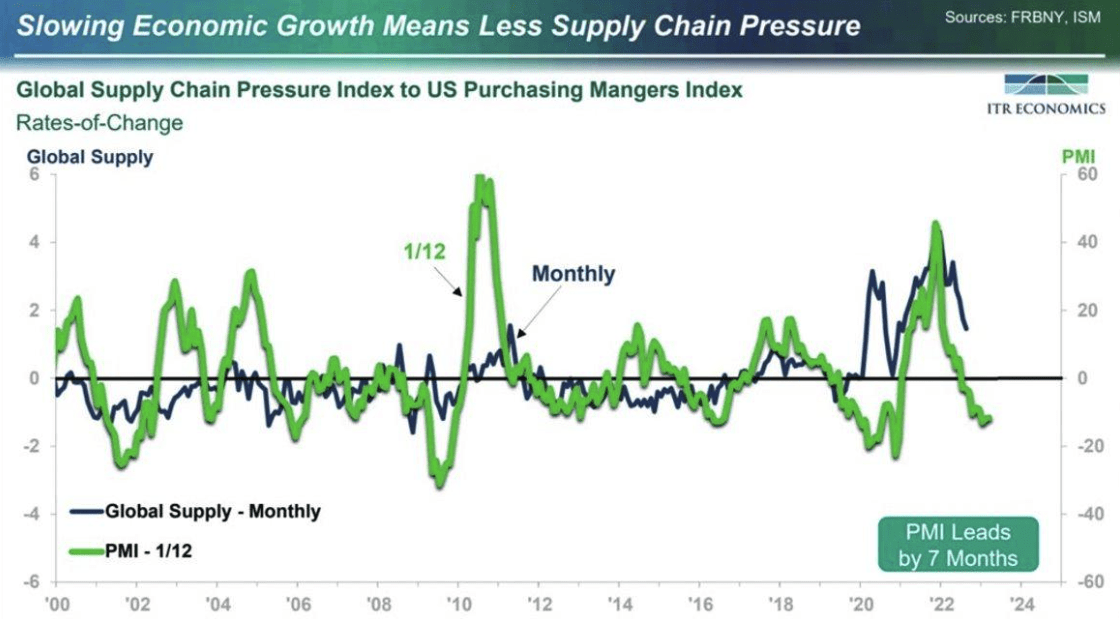

Lauren used the following slide to explain that slowing economic growth will result in less supply chain pressure. Whether you are an investor, a consumer, a house flipper, or a college student, you’ve probably felt the pain of the supply chain issues since Covid started. Lauren explained that slowing economic growth would relieve some of these supply chain issues.

Lauren sure is upbeat! A fact that I really appreciate!

The Producer Price Index, which often leads the Consumer Price Index, showed a sharp decline. This could indicate that the Federal Reserve’s interest rate policies are working.

Government spending usually leads inflation by 23 months. After a record increase during the pandemic, government spending has dropped significantly, as you will see in the next graph. Will the Consumer Price Index follow?

Lauren used the following curve to show past and predict future inflation levels:

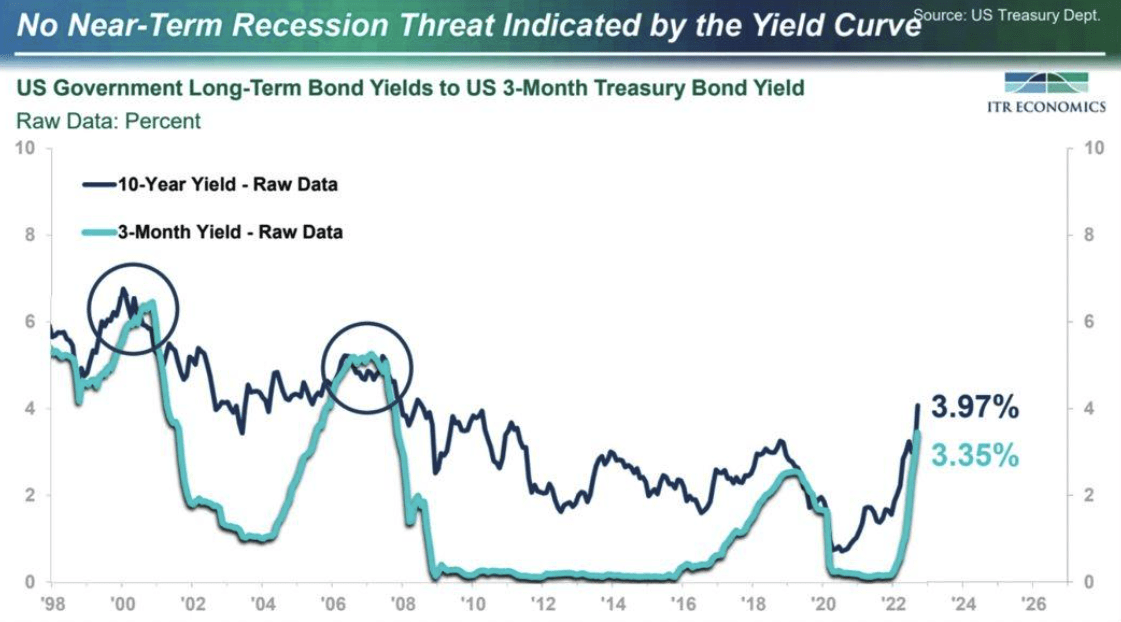

She also discussed the dreaded yield curve inversion. Many of you know that when short-term treasury yields surpass long-term rates, there is “always” a recession on the horizon.

Lauren explained, however, the inverted yield curve we recently saw was only for a few hours one afternoon. It was great for headlines, and newspapers loved it. But does it signal a recession? Lauren also pointed out that there are many yield curves that can be compared. Lauren concluded that this does not necessarily indicate a recession.

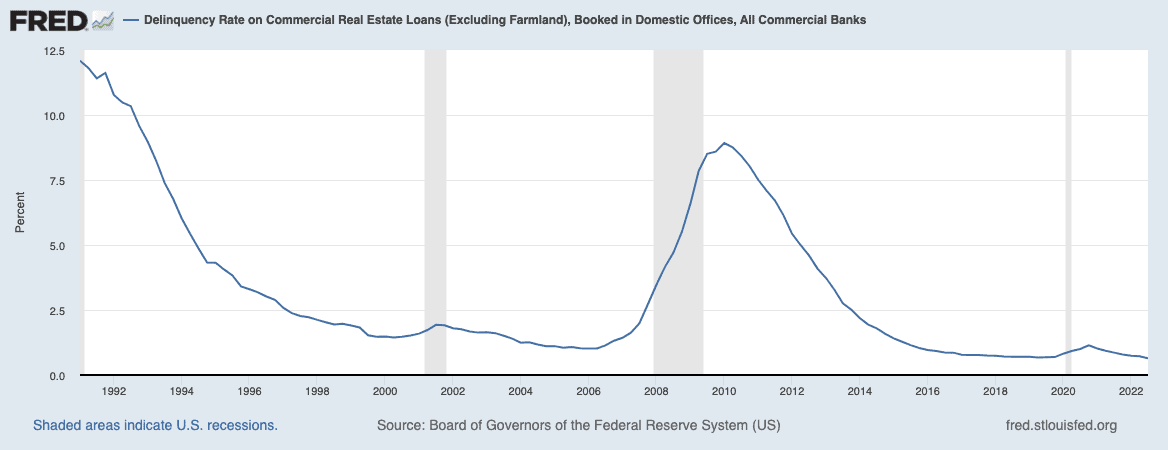

The Federal Reserve shows very low commercial delinquencies, which is great news. This graph going back to the early 1990s is pretty impressive. Banks have every reason to be lending still—right?

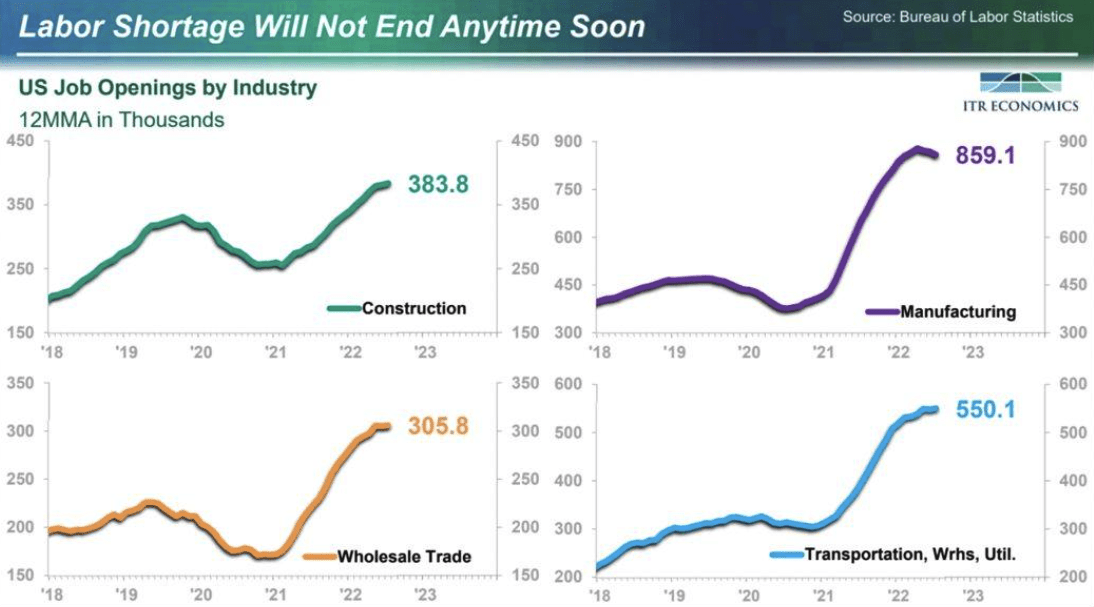

Unemployment is shockingly low, and there are a lot of job openings right now. Lauren explained that the labor shortage would not end anytime soon, with millions of job openings. These four sectors alone have almost 2.1 million job openings.

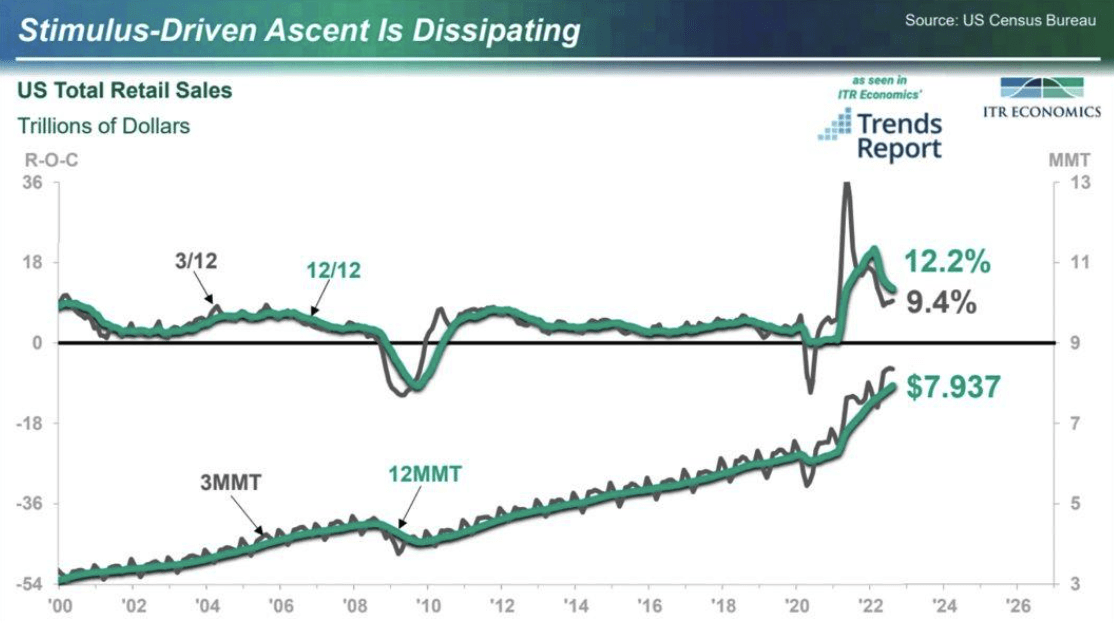

U.S. retail sales are slowing, but they are still near record rates.

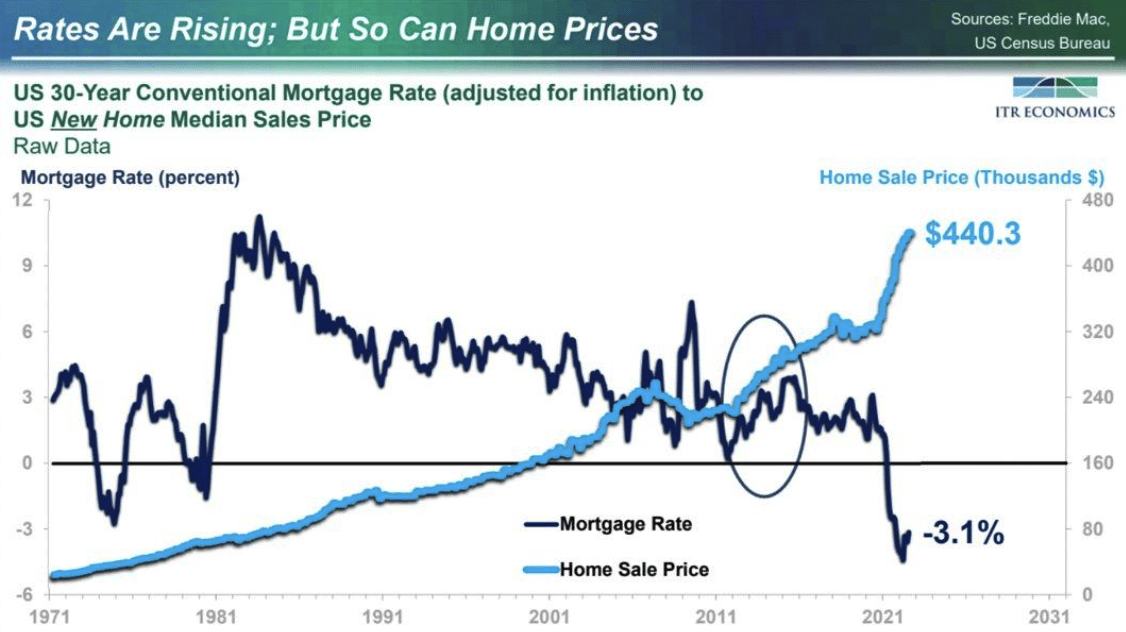

Lauren explained that while interest rates are relatively high now, they are still negative when adjusting for inflation. Meaning that even if you took out a mortgage today, you could look at it like you are making money while borrowing money. Dave Ramsey would hate me for saying that.

Lauren had a lot of great thoughts as she summarized. Here are her three main points on macroeconomic trends:

Lauren concluded that a soft landing is possible. Even likely! That made me very happy, and the audience of about 2,000 in San Diego breathed a sigh of relief.

Not necessarily. Why? Because many factors could cause this economy to topple. The war in Europe is undoubtedly one of them. But there are others. One you might not have thought of—the squeeze on credit markets!

Source: 10 Charts That Summarize The U.S. Economy – Hint: It’s A Mixed Bag

https://www.creconsult.net/market-trends/10-charts-that-summarize-the-u-s-economy-hint-its-a-mixed-bag/Stabilizing Debt Costs Create Tactical Opportunities for Apartment Owners Updated: February 2026 Chicago multifamily mortgage rates are stab...