eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Friday, October 27, 2023

1120 E Ogden Ave

eXp Commercial is pleased to present to market 1120 E Ogden Avenue, a highly visible 10,860 square foot retail-office property on 1.26 acres in desirable affluent Naperville, Illinois, along the I-88 E-W corridor approximately 28 miles west of Chicago. The property is currently owner-occupied and will be fully vacated shortly after closing, with the seller seeking approximately 60 days of post-closing possession. Flexible B3 zoning allows for a number of retail and office uses, ideal for an investor, owner-user, or redevelopment of the property.

Listing Broker: Randolph Taylor | rtaylor@creconsult.net

https://www.creconsult.net/retail-office-for-sale-1120-e-ogden-ave-naperville-il-60563/

Thursday, October 26, 2023

Who’s Lending in Multifamily

Who’s Lending in Multifamily

Government-sponsored enterprises are still the big lenders in the field.

In the five-year span from 2015 through 2019, the big lenders for multifamily were government-sponsored enterprises. In the first half of 2023, the same dynamic is again present, according to a report from MSCI.

In that five-year period, the average contribution of the GSEs was 54%, with national banks providing 10% and regional and local banks accounting for 13%. There was also significant lending by insurance companies, commercial mortgage-backed securities, as well as investor-driven lending such as debt funds, though all under 10% each.

In 2022, when heavy market activity was followed by increasing interest rates to battle inflation, only 38% of the lending was from GSEs, with regional and local banks making up 19%, investor-driven rising to 13% and national banks at 12%.

“As other lender groups retreat in the face of banking sector turmoil, these lenders have captured a plurality of the market share for new loans in H1 2023,” MSCI noted. “For most other lender groups, it was not just the share of originations that fell in the first half of 2023, but the dollar volume as well. Total lending to apartments fell 53% from a year earlier in the first six months of 2023. That comparison is a bit off base, however, given the excess liquidity in the market seen in the first half of 2022.”

During the first half of 2023, GSEs came back strongly at 58%, although the deal flow from January through August was down 67%, compared to 2022 and off significantly from the pre-pandemic period, so this was hardly a normal cycle. Regional and local banks provided 16% of financing in the first half, but no other source hit even 10%.

GSE involvement was strongest in garden multifamily, at 68%, with regional and local banks at 15% and nothing else coming close.

Mid- and high-rise was more eventually distributed: 41% from GSEs, 17% local and regional banks, 15% insurance companies and 13% investor-driven.

Student housing had the smallest percentage of GSE funding at 26%, with 13% insurance, 17% national banks, and 29% local and regional banks. Senior housing had a similarly low percentage of GSE participation at 28%, 15% investor-driven, but 41% local and regional bank financing.

But the participation of local and regional banks is likely shifting.

“The shocks to the regional/local banks can be seen in the quarterly trend of originations,” MSCI wrote. “These smaller banks had captured 22% of the market in Q1 2023 and were the second largest source of debt financing for the apartment market behind the GSEs. Never before has the share of originations by regional/local banks fallen so sharply since we started tracking these figures in 2011.”

Source: Who’s Lending in Multifamily

https://www.creconsult.net/market-trends/whos-lending-in-multifamily/Wednesday, October 25, 2023

More than Half of All Renters Are "Cost-Burdened" According to New Census Data

Although rent growth has cooled significantly over the past year, the national median rent is still 23 percent higher than it was just three years ago, and in some markets, the increase has been even more substantial. Newly released data from the U.S. Census Bureau shows that these rapid increases in housing costs have been taking a meaningful toll on affordability.

According to the most commonly accepted measure of housing affordability, a household is considered to be “cost-burdened” if housing costs eat up more than 30 percent of gross household income. Households that spend more than 50 percent of their household income on monthly housing costs are considered to be “severely” cost-burdened.

The latest estimates from the Census American Community Survey, based on data collected in 2022,1 show that the share of American renters who are cost-burdened has risen to the highest level since 2012, erasing improvements made in the decade preceding the pandemic. The majority of this increase is attributable to a surge in the number of severely burdened households who spend more than half their incomes on rent.

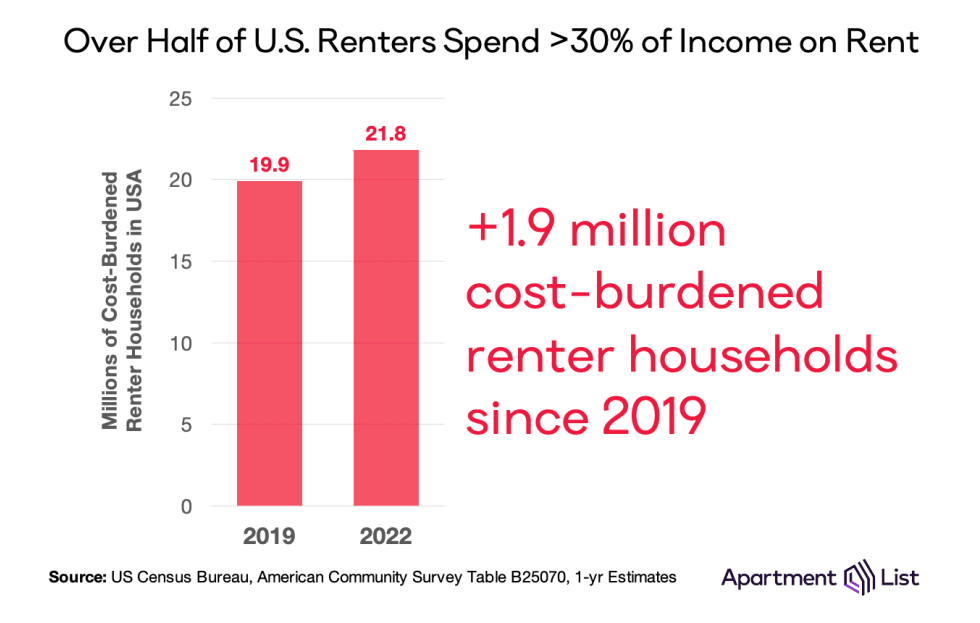

Number of Cost Burdened Renters up 1.9 Million Since 2019

In the five years preceding the pandemic, from 2014 to 2019, the number of cost-burdened renter households fell by 826,000, while the number of renter households who could comfortably afford their rent increased by 1.9 million. But in the following three years, that dynamic has been flipped on its head - the number of cost-burdened renter households has spiked by 1.9 million from 2019 to 2022, while the number of non-burdened renter households fell by 957,000.

As of 2022, there are 21.8 million rent-burdened households, more than ever before. Just over half are severely cost-burdened, and that group has seen the biggest increase in recent years. The number of households that spend more than half of their income on rent spiked by 1.5 million from 2019 to 2022, an increase of 15 percent.

More than half of all renter households qualify as cost-burdened – the cost burden rate rose to 51.9 percent in 2022, the highest level since 2012. After peaking in 2011 in the aftermath of the Great Recession, cost burden rates had been gradually declining for nearly a decade, and the 48.4 percent rate in 2019 was the lowest of any year going back to 2005. But after the housing market was upended in the pandemic era, the cost burden rate jumped to 51.1 percent in 2021 and increased again in 2022.2

The share of renters who are moderately cost-burdened – those spending between 30 and 50 percent of household income on rent – has risen slightly, from 24.7 percent in 2019 to 25.2 percent in 2022. Unfortunately, most of the recent increase has come from severely-burdened households who struggle most acutely with their housing costs. The share of severely-burdened renter households increased from 23.7 percent to 26.7 percent from 2019 to 2022.

Given the flurry of homebuying activity in late-2020 and 2021, it may be natural to wonder if the increase in renter cost burden is attributable to a compositional effect, as some wealthier renters became homeowners. However, that is not the case. In fact, while the cost burden rate is much lower for homeowners, it has also been rising in recent years due to skyrocketing prices and mortgage rates. As of 2022, 27.9 percent of homeowners with a mortgage are cost-burdened, up from 26.6 percent in 2019.

Cost Burden Rates Are Highest in Florida and California Markets

While housing cost burden is a growing concern in virtually all parts of the country, there is also meaningful regional variation. The map below shows 2022 renter cost burden rates for the 250 largest metros in the U.S.; red shading indicates a cost burden rate above the national average, while blue indicates a rate below the national average.

Generally speaking, markets throughout the South and along the coasts tend to have higher cost burden rates, while the middle of the country fairs a bit better. Florida and California, in particular, jump out as hot spots. Miami has the nation’s highest cost burden rate among the 50 largest metros in the U.S. at 64.6 percent. The top five is rounded out by Orlando, FL (60.6 percent); Riverside, CA (60.2 percent); Sacramento, CA (59.1 percent); and San Diego, CA (58.3 percent). At the state level, Florida leads the way with 60.3 percent of renter households burdened by their housing costs, followed by Hawaii (57.8 percent), Nevada (57.3 percent), California (56 percent) and Louisiana (55.8 percent).

Rent Burden Has Worsened in 94 of the Nation’s 100 Largest Metros

Even in markets with below-average cost burden rates, the affordability picture is worsening. All but six of the nation’s 100 largest metros saw rent burden worsen from 2019 to 2022, with rates exceeding 50 percent in 65 of those metros.

The sharpest increase has been in the Spokane, WA metro, where the renter cost burden rate spiked from 44.8 percent in 2019 to 56.3 percent in 2022. It should come as no surprise that a market experiencing a rapid surge in rents would see affordability wane. Spokane was one of the original “Zoomtown” destinations when remote work first took hold in the early stages of the pandemic, and according to our latest estimates, rent prices for new leases in the Spokane metro are currently 34 percent higher than they were in March 2020. Phoenix serves as another clear example of this same trend playing out in a larger market. As the pandemic accelerated an ongoing influx of new households to the region, rents are up 28 percent and the share of cost-burdened renter households has risen from 46.6 percent in 2019 to 53.9 percent in 2022.

Some readers may be surprised to notice that famously expensive metros such as San Francisco; Washington, D.C.; and Seattle actually have rent burden rates that fall below the national average. While rents are certainly very high in these markets, so too are incomes. Furthermore, as affordability has worsened in these regions, some households have been priced out and left these metros entirely. As an example, consider that the Stockton, CA metro – which sits on the far periphery of the San Francisco Bay Area – is home to the nation’s largest population of “super commuters” who travel 90-plus minutes to work each way. For this reason, the cost burden rate, while a crucial indicator, does not always paint a holistic view of local housing affordability on its own.

Cost Burden Is Driven by Rents Rising Faster Than Incomes

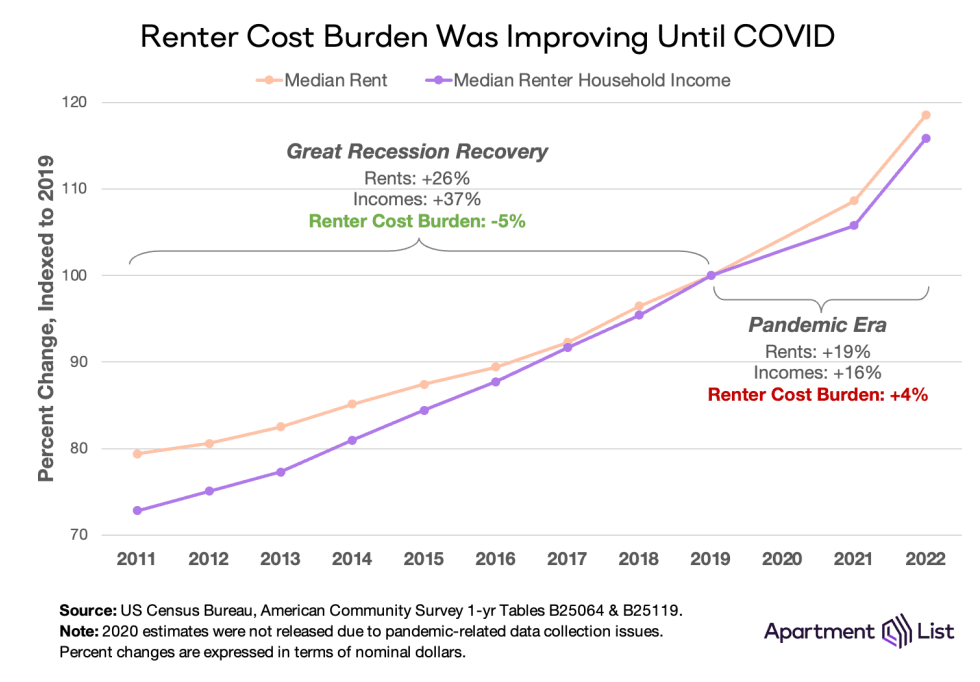

The increasing cost burden rate of recent years is rooted in a fairly intuitive cause – rent prices have been growing faster than incomes can keep pace, a notable change to the dynamic of pre-pandemic years.

Renter cost burden peaked at 53.4 percent in 2011 during the fallout of the Great Recession. But as the economy recovered, so too did renter incomes, particular in relation to rent prices. From 2011 to 2019, the nationwide median rent rose 26 percent, while the median renter household income jumped 37 percent.3 Cost burden gradually improved as a result, falling five percentage points to 48.4 percent.4

The chart below plots nominal rent growth from 2019 to 2022 against nominal renter income growth over the same period. Each marker represents one of the nation’s 100 largest metros, sized by population, and shaded based on the change in the metro’s cost burden rate during those same years, with red indicating worsening cost burden and green signaling improvement. In metros sitting above the diagonal line, rents have grown faster than incomes in recent years, whereas in metros below the diagonal, incomes have grown faster than rents.

Notably, in 74 of the 100 largest metros, rents have been growing faster than incomes, and in 94, cost burden has worsened since 2019. Phoenix, seen toward the top center of the chart, again serves as a clear example: the metrowide median rent increased 36 percent from 2019 to 2022 according to Census estimates, while the median income of renter households increased by just 24 percent, driving one of the nation’s sharpest increases in cost burden.

Looking ahead

Cost burden worsened through the pandemic, from 48 percent of renter households in 2019 to 52 percent in 2022. This is a function of rent growth exceeding income growth; from 2019 to 2022, nominal rents rose 19 percent while renter incomes rose just 16 percent. In 2023 and beyond, this pattern would need to reverse to see an impactful improvement in cost burden.

On one hand, income growth does appear to be accelerating. Preliminary data from the Bureau of Labor Statistics shows that incomes in the second quarter of 2023 are up 5.7 percent year-over-year (1.7 percent after adjusting for inflation). And while these statistics are not available for renters specifically, other breakdowns show that recent wage growth is higher for lower-earners and non-white workers, who are both more likely to rent.

However, rent growth may also continue on an upward trajectory. This may come as a surprise to astute readers who know that rents are currently down year-over-year according to the latest Apartment List Rent Index. But remember that our index considers rents paid only by households who are moving and signing new leases, while marketwide rents that go into cost burden calculations consider all households, including the majority who stay put each year and continue with their existing leases. This is the main difference between our data and CPI inflation data, and while the latter does show annual rent growth starting to decline, it has remained elevated in the 7 to 9 percent range throughout 2023 year-to-date. Our data provide strong evidence that marketwide rent measures will continue to fall, but this may not happen quickly enough to trigger an immediate turnaround in cost burden rates.

Taken as a whole, this data emphasizes the scale of the housing affordability crisis in the U.S. For more than half of all renter households, monthly rent payments are eating up a large enough share of their income to put financial stability at risk. And more than one-in-four renter households spend more than half of their income on rent – a level which can often necessitate extreme measures such as overcrowding and cutting back on spending on other basic needs. Thankfully, policymakers have demonstrated an increased focus on this issue in recent years, but solutions are still urgently needed.

Source: More than Half of All Renters Are “Cost-Burdened” According to New Census Data

https://www.creconsult.net/market-trends/more-than-half-of-all-renters-are-cost-burdened-according-to-new-census-data/Tuesday, October 24, 2023

Steady Fundamentals, Stability Highlight Medical Office Sector

Though the healthcare landscape continues to shift, the buildings in which medicine is practiced provide “welcome stability,” according to Marcus & Millichap. In its 2H 2023 Medical Office National Report, analysts noted that vacancy remained steady and investors liked the sector’s stability, though the interest-rate environment impacted deal flow.

Stable Property Fundamentals

According to Marcus & Millichap analysts, "medical offices were not as affected by the pandemic as other facets of the health care system." As a result, vacancy rates have remained steady. The June rate was 50 basis points above the long-term average. Additionally, development slowed due to increasing construction costs. “As of September, medical office space accounted for just 10.7% of the total office pipeline,” the report said.

Transaction Volume Falls

Similar to what’s happening in other CRE sectors, a higher interest rate environment has impacted the MOB deal flow. Transaction volume fell by over 30% during the trailing 12 months ending in June 2023. The average sales price fell, too, dropping by 3% from its high in 2022 to $295 per square foot.

Attractive Performances

Investors like the medical office sector because it provides steady property cash flow and favorable lease terms with limited turnover. The Marcus & Millichap analysts also noted that the sector has provided “consistent year-over-year rent gains.” The future looks bright for medical offices. “Demand for health care services on a macro level is unlikely to decrease in any meaningful way, ensuring a stable tenant base, barring external challenges that arise from the tight health care labor market,” the analysts commented.

Source: Steady Fundamentals, Stability Highlight Medical Office Sector

https://www.creconsult.net/market-trends/steady-fundamentals-stability-highlight-medical-office-sector/Friday, October 13, 2023

Fannie Mae Launches New Workforce Housing Program

Fannie Mae has launched a new financing program to support the creation and preservation of workforce housing for middle-income renters.

The agency created the new Sponsor-Dedicated Workforce product in an effort to build and preserve workforce housing by incentivizing borrowers to place rent restrictions on properties for the life of the loan, according to a press release.

The program will be offered to borrowers who agree to make at least 20% of units at a multifamily property affordable to households earning between 80% and 120% of the area median income. Compliance will be confirmed annually by Delegated Underwriting and Servicing lenders.

Workforce housing continues to be one of the least-built affordable housing options. A report published in October 2022 by Fannie Mae says the New York and Los Angeles metro areas have a combined shortage of 1.25 million workforce units, while they lack 911,000 units of affordable and low-income housing.

Fannie Mae has secured five SDW loans in the past two months, CoStar reported. The loans total $80.1M and are backed by 867 units in the Dallas, Chicago and Washington, D.C., areas. The largest loan was a $31.8M refinancing of the 384-unit Green Oaks Apartments in the Chicago suburb of Palos Hills, Illinois.

"Affordability continues to be a significant challenge for multifamily renters as rent increases have outpaced income growth," Michele Evans, head of multifamily at Fannie Mae, said in the release. "Fannie Mae is addressing the need for workforce housing by providing innovative, attractive programs that create and preserve affordable multifamily units while enabling socially responsible investment opportunities for investors."

Source: Fannie Mae Launches New Workforce Housing Program

https://www.creconsult.net/market-trends/fannie-mae-launches-new-workforce-housing-program/Thursday, October 12, 2023

Morrison Closed

The property is located at 631 E Lincolnway Rd., Morrison, IL The property consists of 23 multifamily rental units comprised of ten studio apartment, eleven one-bedroom units and two two-bedroom units

Randolph Taylor, CCIM Senior Associate and Multifamily Investment Sales Broker with the eXp Commercial Chicago office, brokered the deal and represented both the buyer and seller.

Randolph can be contacted at rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/company-news/just-sold-23-unit-multifamily-property-morrison-il/

Thursday, October 5, 2023

Grand Prairie 2nd

eXp Commercial is pleased to present to the market a fully built-out, free-standing 4,408-square-foot medical/dental office building in Grand Prairie, Texas, centrally located 22 miles southwest of downtown Dallas and 26 miles southeast of downtown Fort Worth. Though the current use is for a dental office, the property is zoned PD267A (commercial development), allowing for a variety of medical and dental uses. The property is owner-occupied and will be vacated at closing, providing an ideal opportunity for another dental practice or any number of medical office users to utilize the property for their practice or an investor who works with medical office tenants to take advantage of an investment opportunity.

Listing Brokers:

Tyson Grona | tyson@tysongronagroup.com | 936.444.3635

Randolph Taylor | rtaylor@creconsult.net | 630.474.6441

https://properties.expcommercial.com/1253332-sale

Midwest Multifamily Market Booming: Is Now the Right Time to Sell?

At the halfway point of the year, Cleveland, Cincinnati, Columbus, and Chicago have all seen rent growth well ahead of the national average....

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...