eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Saturday, November 4, 2023

1120 E Ogden Ave

eXp Commercial is pleased to present to market 1120 E Ogden Avenue, a highly visible 10,860 square foot retail-office property on 1.26 acres in desirable affluent Naperville, Illinois, along the I-88 E-W corridor approximately 28 miles west of Chicago. The property is currently owner-occupied and will be fully vacated shortly after closing, with the seller seeking approximately 60 days of post-closing possession. Flexible B3 zoning allows for a number of retail and office uses, ideal for an investor, owner-user, or redevelopment of the property.

Listing Broker: Randolph Taylor | rtaylor@creconsult.net

https://www.creconsult.net/retail-office-for-sale-1120-e-ogden-ave-naperville-il-60563/

Friday, November 3, 2023

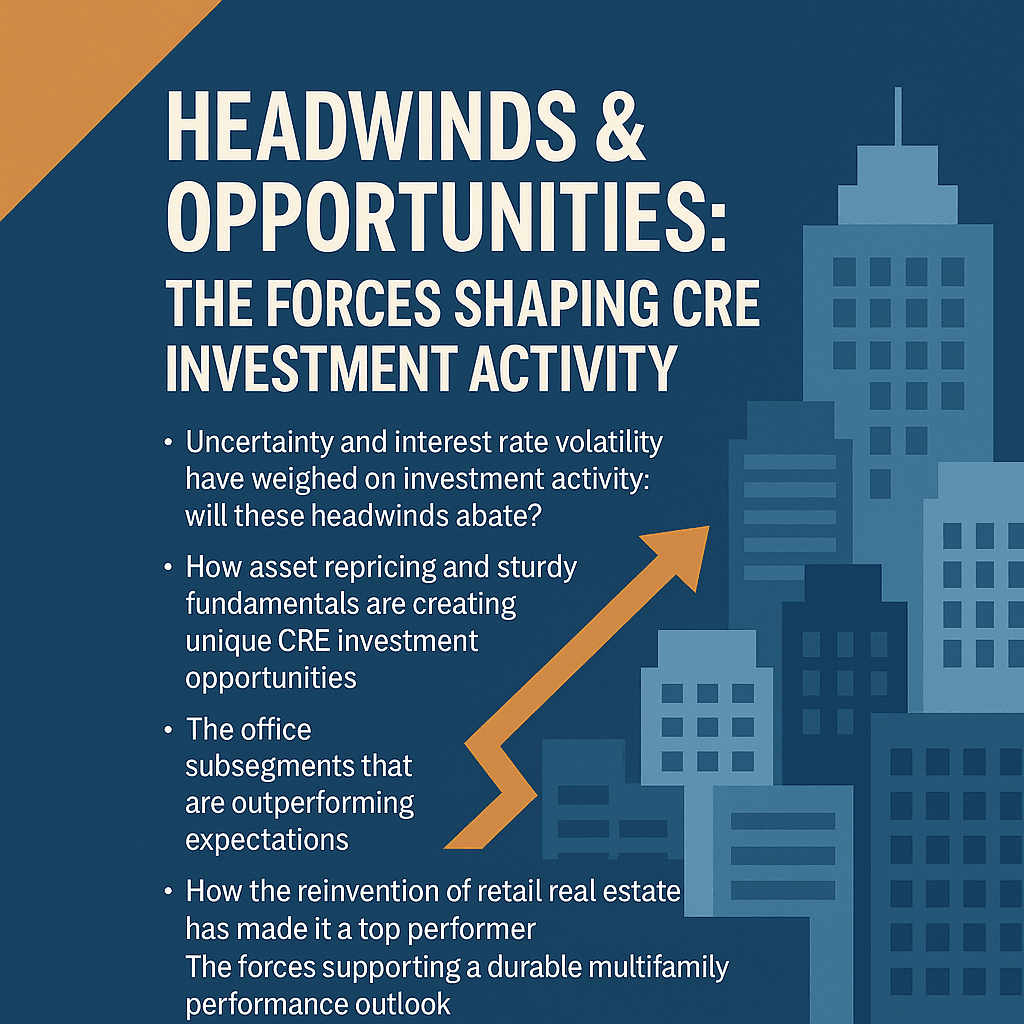

Fourth Quarter Commercial Real Estate Investor Forum

[row]

[col span__sm="12"]

[row]

[col span__sm="12"]

Fourth Quarter Investor Forum

We’re excited to announce the Q4 Investor Forum, presented by eXp Commercial. This virtual event is open to all real estate professionals, investors and clients, and features experts covering everything you need to know as 2023 comes to a close.

We’ll be talking about where the commercial real estate market is headed in 2024, how to get the most out of your adaptive reuse investment, and what the future holds for capital markets. Check out the full agenda below and then click the link to reserve your spot.

Agenda (shown in PT):

11:00 a.m. | Welcome and Intro

James Huang, President, eXp Commercial

11:10 a.m. | 2024 Commercial Market Outlook

Moody's Analytics

11:40 a.m. | Adaptive Reuse: Getting the Most from Your Investments

Pamela Junge, President and CAO, The Junge Group

Tyler Cauble, President, The Cauble Group

Danny Brickey, Designated Managing Broker, eXp Commercial

12:20 p.m. | Beyond the Basics: Advanced Insights into the Future of Capital Markets

Steven Weiss, EVP - Capital Markets, Rosewood Realty Group

Reuben Dolny, Director, Greystone

Thursday, November 2, 2023

940 Lakdside Closed

18,504 SF Net Leased Industrial Property

Akhan Semiconductor

Sales Price: $1,275,000

West Coast 1031X Cash Buyer

Listing Broker: Randolph Taylor, CCIM

rtaylor@creconsult.net | 30.474.6441

Tuesday, October 31, 2023

1120 E Ogden Ave

eXp Commercial is pleased to present to market 1120 E Ogden Avenue, a highly visible 10,860 square foot retail-office property on 1.26 acres in desirable affluent Naperville, Illinois, along the I-88 E-W corridor approximately 28 miles west of Chicago. The property is currently owner-occupied and will be fully vacated shortly after closing, with the seller seeking approximately 60 days of post-closing possession. Flexible B3 zoning allows for a number of retail and office uses, ideal for an investor, owner-user, or redevelopment of the property.

Listing Broker: Randolph Taylor | rtaylor@creconsult.net

https://www.creconsult.net/retail-office-for-sale-1120-e-ogden-ave-naperville-il-60563/

Monday, October 30, 2023

1120 E Ogden

10,680 SF Retail-Office | 1.26 Acres | B3 Zoning

Redevelopment Grants Available: Owner-User, Redevelopment Opportunity

Listing Agent: Randolph Taylor, CCIM

Rtaylor@creconsult.net | 630.474.6441

https://www.creconsult.net/retail-office-for-sale-1120-e-ogden-ave-naperville-il-60563/

Friday, October 27, 2023

1120 E Ogden Ave

eXp Commercial is pleased to present to market 1120 E Ogden Avenue, a highly visible 10,860 square foot retail-office property on 1.26 acres in desirable affluent Naperville, Illinois, along the I-88 E-W corridor approximately 28 miles west of Chicago. The property is currently owner-occupied and will be fully vacated shortly after closing, with the seller seeking approximately 60 days of post-closing possession. Flexible B3 zoning allows for a number of retail and office uses, ideal for an investor, owner-user, or redevelopment of the property.

Listing Broker: Randolph Taylor | rtaylor@creconsult.net

https://www.creconsult.net/retail-office-for-sale-1120-e-ogden-ave-naperville-il-60563/

Thursday, October 26, 2023

Who’s Lending in Multifamily

Who’s Lending in Multifamily

Government-sponsored enterprises are still the big lenders in the field.

In the five-year span from 2015 through 2019, the big lenders for multifamily were government-sponsored enterprises. In the first half of 2023, the same dynamic is again present, according to a report from MSCI.

In that five-year period, the average contribution of the GSEs was 54%, with national banks providing 10% and regional and local banks accounting for 13%. There was also significant lending by insurance companies, commercial mortgage-backed securities, as well as investor-driven lending such as debt funds, though all under 10% each.

In 2022, when heavy market activity was followed by increasing interest rates to battle inflation, only 38% of the lending was from GSEs, with regional and local banks making up 19%, investor-driven rising to 13% and national banks at 12%.

“As other lender groups retreat in the face of banking sector turmoil, these lenders have captured a plurality of the market share for new loans in H1 2023,” MSCI noted. “For most other lender groups, it was not just the share of originations that fell in the first half of 2023, but the dollar volume as well. Total lending to apartments fell 53% from a year earlier in the first six months of 2023. That comparison is a bit off base, however, given the excess liquidity in the market seen in the first half of 2022.”

During the first half of 2023, GSEs came back strongly at 58%, although the deal flow from January through August was down 67%, compared to 2022 and off significantly from the pre-pandemic period, so this was hardly a normal cycle. Regional and local banks provided 16% of financing in the first half, but no other source hit even 10%.

GSE involvement was strongest in garden multifamily, at 68%, with regional and local banks at 15% and nothing else coming close.

Mid- and high-rise was more eventually distributed: 41% from GSEs, 17% local and regional banks, 15% insurance companies and 13% investor-driven.

Student housing had the smallest percentage of GSE funding at 26%, with 13% insurance, 17% national banks, and 29% local and regional banks. Senior housing had a similarly low percentage of GSE participation at 28%, 15% investor-driven, but 41% local and regional bank financing.

But the participation of local and regional banks is likely shifting.

“The shocks to the regional/local banks can be seen in the quarterly trend of originations,” MSCI wrote. “These smaller banks had captured 22% of the market in Q1 2023 and were the second largest source of debt financing for the apartment market behind the GSEs. Never before has the share of originations by regional/local banks fallen so sharply since we started tracking these figures in 2011.”

Source: Who’s Lending in Multifamily

https://www.creconsult.net/market-trends/whos-lending-in-multifamily/Commercial Real Estate Market Trends: 2025 Industry Insights

Introduction In 2025, the real estate world looks different. Warehouses are booming, retail is rebounding, and suburban office spaces are ou...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...