Signals Emerge It's Prime Time to Invest in Multifamily

With strong fundamentals, new construction starts, and a sizable amount of capital on the sidelines, the multifamily sector is attracting the attention of eager investors.

'Enormous' Amount of Capital on Sidelines Means Now Is Time to Buy Multifamily

With strong fundamentals, new construction starts, and a sizable amount of capital on the sidelines, the multifamily sector is attracting the attention of eager investors, saying now is the time to start deploying capital.

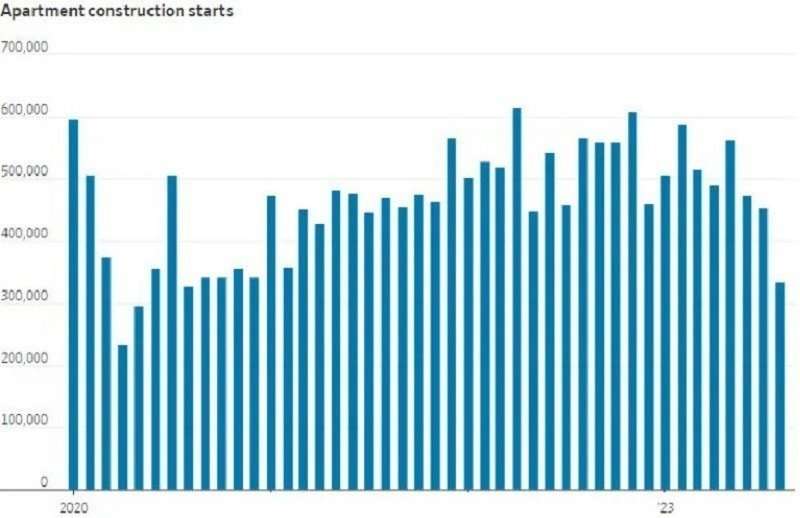

Market dynamics: According to John Sebree, the senior vice president and national director of the Multi Housing Division at Marcus & Millichap, the market is seeing an occupancy surge, consistent rent growth, and a housing shortage. Over the recent years, there's been an influx of new market deliveries, although multifamily starts have decreased by more than 50% from Q4 2022 to Q3 2023. This has led to a minor spike in vacancy rates, but as new units get absorbed, an imminent scarcity will likely drive rents higher.

Capital on deck: Sebree emphasized the vast capital awaiting an opportune moment to re-enter the market. Quoting Lloyd Blankfein, he stressed that investors shouldn't wait for a market bottom signal but act proactively. With limited deals, he anticipates intensified competition as sidelined capital re-engages. For eager investors, Sebree advised determining their expected cap rates, hinting they'd likely be between 5.5 and 6 in the current market.

Shifting investor interest: Global investors are also considering a shift from the US office sector to residential properties. The American Federation of International Real Estate (AFIRE) predicts investors will increasingly focus on multifamily due to changing market dynamics and the allure of stable returns. This shift reflects growing optimism in the multifamily market and its potential for long-term growth.

➥ THE TAKEAWAY

New investment horizons: With high occupancy rates, robust rent growth, and the housing shortage, multifamily properties continue to provide stable returns. While challenges such as high interest rates and constrained debt markets persist, the significant amount of capital waiting on the sidelines offers an opening for eager investors to enter the market. As regional market preferences shift towards suburban areas, multifamily assets in these locations may present lucrative investment opportunities for those seeking long-term growth.

Source: Signals Emerge It’s Prime Time to Invest in Multifamily

https://www.creconsult.net/market-trends/signals-emerge-its-prime-time-to-invest-in-multifamily/