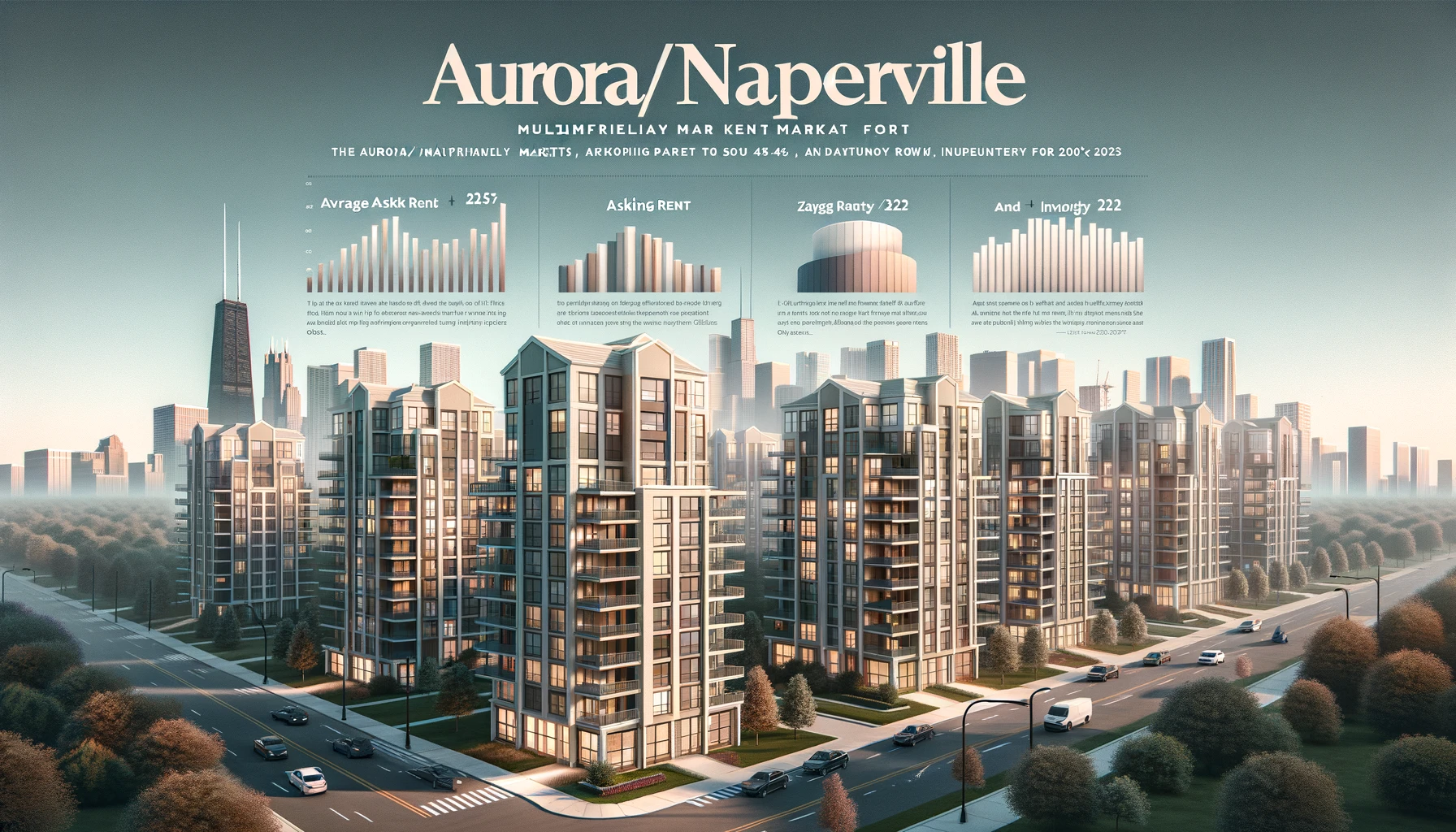

Aurora/Naperville's 2024 Multifamily Market Overview

As we delve into the Aurora/Naperville multifamily market for 2024, a landscape of evolving opportunities emerges for investors. Key insights reveal a slight decrease in asking rents to $1,823 and a vacancy rate adjustment, presenting a nuanced but optimistic outlook for the sector.

Market Dynamics and Opportunities

- Rental Trends: The Aurora/Naperville multifamily market experiences subtle rent adjustments, reflecting the market's responsiveness to current economic conditions.

- Vacancy Insights: A modest increase in vacancy rates indicates a moment of recalibration, offering strategic entry points for investors.

- Growth Projections: With new units slated for delivery, the market is poised for balanced growth, highlighting the steady demand for multifamily living spaces.

Investment Strategies for Success

Furthermore, navigating these market conditions requires a tactical approach:

- Market Analysis: Continuous monitoring of rent and vacancy trends will enable informed investment decisions.

- Strategic Positioning: Adapting to market shifts can uncover competitive advantages for property owners.

- Future Planning: Anticipating market demands and aligning investment strategies accordingly will be crucial for long-term success.

Engage with eXp Commercial Multifamily Brokerage

Partner with eXp Commercial Multifamily Brokerage to leverage our market expertise and strategic insights. Whether evaluating potential sales or seeking guidance on investment opportunities, our team is here to support your goals in the Aurora/Naperville multifamily market.

Take Action

- Explore In-Depth Market Insights: For a comprehensive understanding of the 2024 market forecast, request our full report.

- Get a No-Cost Valuation: Assess the potential of your investment with our expert analysis.

The Aurora/Naperville multifamily market in 2024 presents a dynamic arena for investors. By embracing strategic planning and leveraging expert insights, property owners can navigate this landscape to optimize their investment outcomes.

https://www.creconsult.net/market-trends/aurora-naperville-2024-multifamily-insights/