A recent National Association of Home Builders study of federal government data showed that the percentage of new home construction devoted to build-to-rent single-family houses grew sharply over time.

"According to NAHB's analysis of data from the Census Bureau's Quarterly Starts and Completions by Purpose and Design, there were approximately 18,000 single-family built-for-rent (SFBFR) starts during the first quarter of 2024," wrote NAHB Chief Economist Robert Dietz. "This is 20% higher than the first quarter of 2023, albeit with favorable comps due to a weak start of 2023. Over the last four quarters, 80,000 such homes began construction, which is almost a 16% increase compared to the 69,000 estimated SFBFR starts in the four quarters prior to that period."

The market segment's size is small enough that month-to-month movements are rarely statistically significant. However, the current four-quarter moving average of construction market share of 8% is triple the 1992-2012 historical average of 2.7%.

Dietz writes that this BTR segment "is a source of inventory amid challenges over housing affordability and downpayment requirements in the for-sale market, particularly during a period when a growing number of people want more space and a single-family structure." The buildings tend to differ in home size compared to other single-family homes.

Industrial investor interest in single-family homes has fallen as interest rates have grown. The higher the entire acquisition costs, the more difficult it is for a property to provide the desired return on investment. Nonetheless, builders continue to build smaller projects of built-for-rent homes for their own operation," he wrote.

John Burns Real Estate Consulting has said in the past that BTR is a way to diversify a portfolio and isn't a replacement for other forms of master plan communities (MPCs). Those in the MPC space can find a balance, where different project types are best suited for specific circumstances and environments, allowing better overall business optimization. The same is true for investors. Adding BTR expands portfolio diversity.

As traditional single-family housing pricing and mortgage rates make it more difficult for consumers to purchase homes, the BTR market is likely to continue growing, even if the total market share remains small.

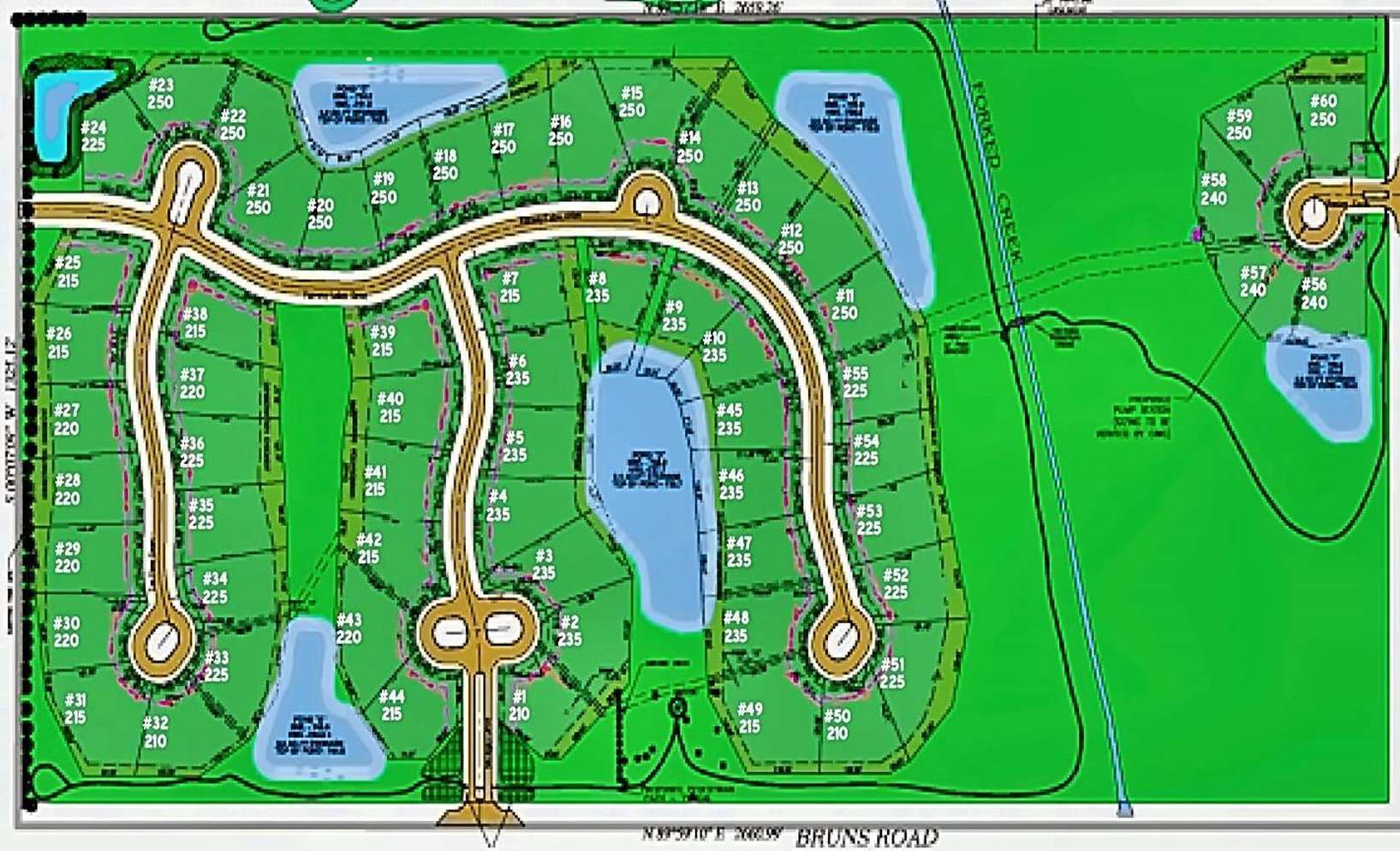

Development Land For Sale:

77 Acres Golf Course Community:

https://www.creconsult.net/fairway-lakes-estates-development-opportunity/

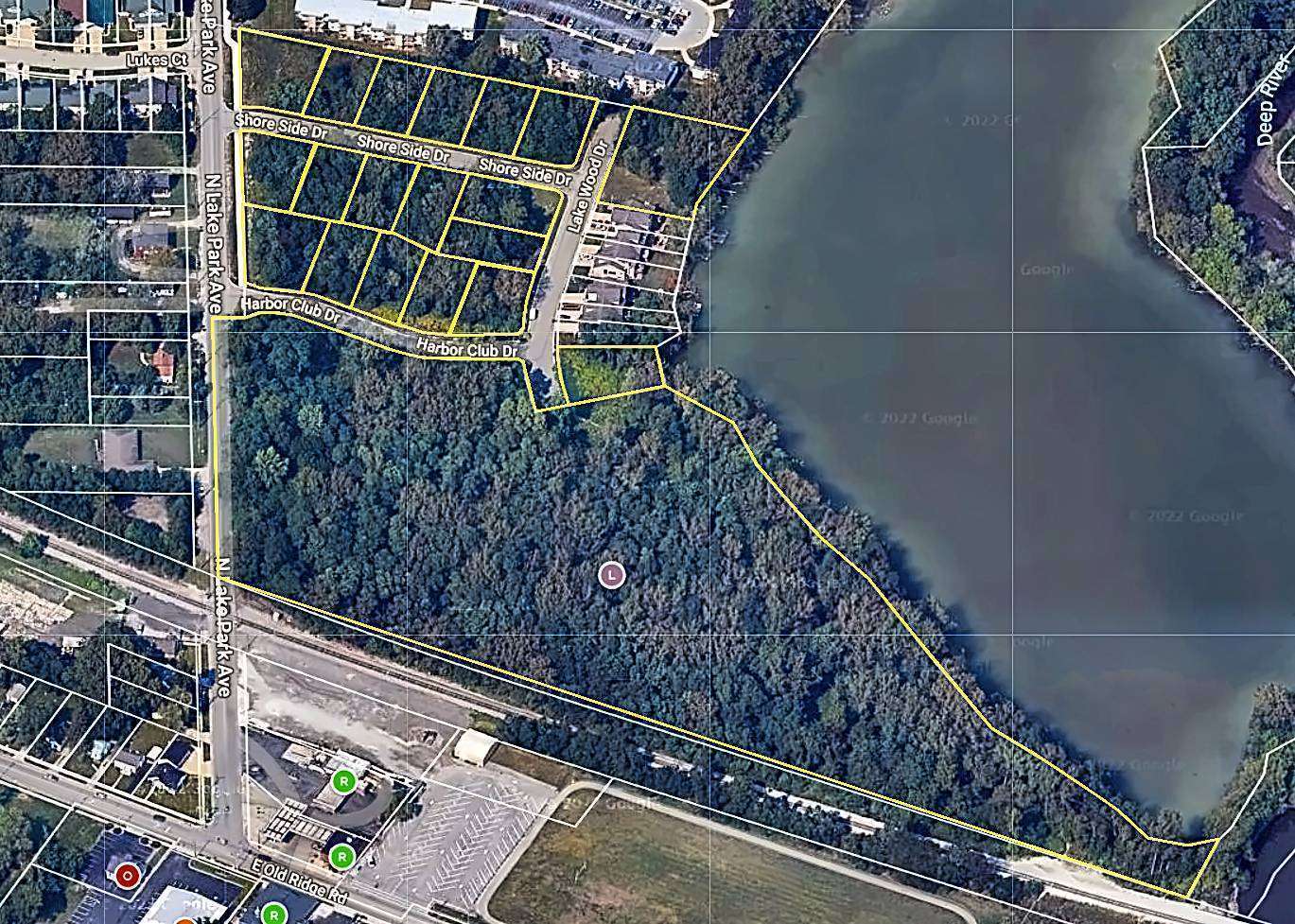

17 Acres Lakefront Community:

https://www.creconsult.net/prime-development-opportunity-northwest-hobart-in/

[caption id="attachment_133221" align="alignnone" width="1369"] Aerial view of development land in Northwest Hobart, Indiana with lakefront lots[/caption]

https://www.creconsult.net/market-trends/build-to-rent-single-family-homes-growth/

Aerial view of development land in Northwest Hobart, Indiana with lakefront lots[/caption]

https://www.creconsult.net/market-trends/build-to-rent-single-family-homes-growth/