Selling a multifamily property can be a complex endeavor that requires a strategic approach to maximize value and ensure a smooth transaction. At eXp Commercial, we follow a proven process designed to create a competitive bidding environment and achieve the best possible outcome for our clients. Here’s an overview of our comprehensive listing and selling process.

1. Establishing a Long-Term Relationship

The foundation of a successful transaction is a strong, long-term relationship based on trust and respect. At eXp Commercial, we prioritize building rapport and credibility with our clients. This relationship is essential for understanding your specific needs and objectives and for ensuring that our strategies are aligned with your goals.

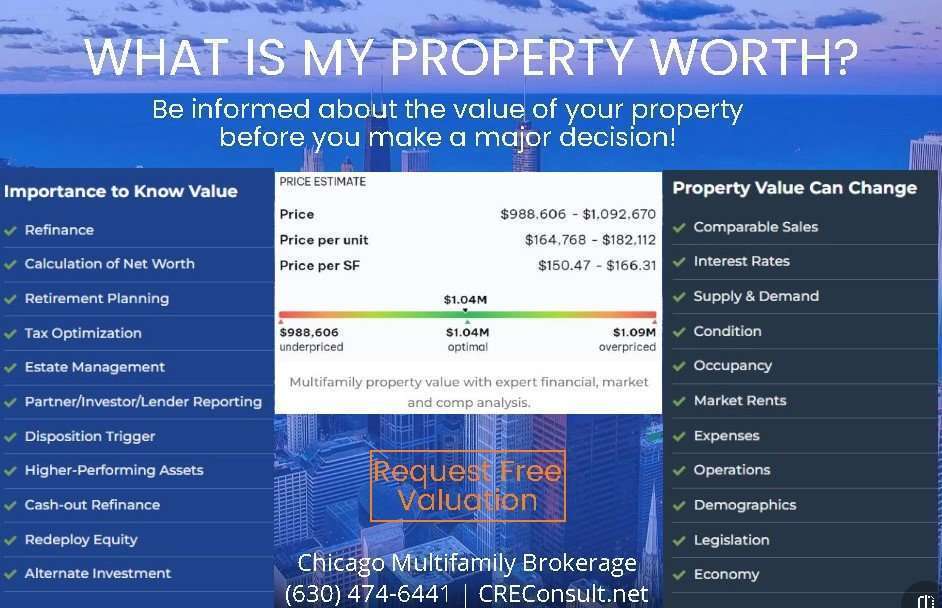

A successful sale begins with a thorough exchange of information. We gather detailed insights into your property, including financial performance, market positioning, and potential opportunities. This information is critical for crafting a tailored strategy that highlights your property’s strengths and addresses any concerns.

3. Determining the Value-Added Strategy

After understanding your needs, we develop a strategy to best utilize our resources to meet your objectives. This involves analyzing market data, comparable sales, and rent comps to position your property competitively. We focus on creating a compelling narrative that showcases the investment potential to prospective buyers.

4. Presentation of the Recommended Strategy

Our team presents the recommended strategy in an organized, credible, and persuasive manner. This presentation includes not just the valuation but also how our approach will achieve your broader goals. We ensure that the proposed price and marketing process align with your objectives and set realistic expectations.

5. Addressing Concerns and Objections

We proactively identify and address any concerns or objections you may have. By fostering an open dialogue, we can adjust our strategy to best suit your needs and ensure you feel confident moving forward. This step is crucial for building trust and ensuring that all parties are on the same page.

6. Creating a Competitive Bidding Environment

Our marketing efforts aim to generate multiple offers, thereby creating a competitive bidding environment. We utilize eXp Commercial’s extensive network and marketing platforms to reach a wide range of qualified buyers. This exposure helps to drive up the price and maximize your net proceeds.

7. Closing the Deal

The closing process involves finalizing all transaction details and overcoming any last-minute objections. We guide you through this stage, ensuring that all paperwork is in order and that the transaction proceeds smoothly. Our goal is to close the deal efficiently while achieving the best possible terms for you.

Detailed Steps in the Listing and Selling Process

Initial Consultation and Market Analysis

The journey begins with an in-depth consultation where we discuss your property and your goals. Our team at eXp Commercial will then conduct a thorough market analysis. This involves studying current market conditions, recent sales of comparable properties, and future market trends. We leverage the extensive market research capabilities to provide a detailed and accurate valuation of your property.

Marketing Plan Development

Once we have a clear understanding of your property’s value and market position, we develop a comprehensive marketing plan. This includes:

- Professional Photography and Videography: High-quality visuals to showcase the property.

- Online Listings: Featuring your property on major real estate platforms and our proprietary database.

- Email Campaigns: Targeted emails to potential buyers and investors.

- Print Media: Brochures, flyers, and advertisements in relevant publications.

- Social Media: Leveraging platforms like LinkedIn, Facebook, and Instagram to reach a broader audience.

Strategic Property Showings

We coordinate and conduct property showings and open houses. Our goal is to present your property to as many qualified buyers as possible. We handle all aspects of the showings, ensuring that your property is always presented in the best light.

Buyer Qualification and Negotiation

As offers come in, we thoroughly vet potential buyers to ensure they are qualified and capable of completing the purchase. We then negotiate on your behalf to secure the best possible terms. Our aim is to create a competitive bidding environment that maximizes your sale price.

Transaction Management

Once an offer is accepted, our team manages the entire transaction process. We coordinate with all parties involved, handle paperwork, and ensure that all deadlines are met. Our goal is to ensure a smooth and efficient closing process, addressing any issues that arise promptly.

Why Partner with Randolph Taylor at eXp Commercial?

Partnering with Randolph Taylor at eXp Commercial means leveraging a proven process that has been refined through years of experience in the industry. Our approach is designed to:

- Maximize Property Value: By creating a competitive bidding environment, we ensure that you receive the highest possible price for your property.

- Streamline the Transaction: Our detailed process minimizes delays and complications, leading to a smoother transaction.

- Provide Expert Guidance: With deep market knowledge and expertise in multifamily investments, we provide valuable insights and strategic advice.

About Randolph Taylor

Randolph Taylor, MBA, CCIM, is a Senior Associate and Multifamily Investment Sales Broker in the National Multifamily Division with eXp Commercial. Randolph focuses on the listing and sale of multifamily properties in the Greater Chicago area and suburbs. With over 25 years of commercial real estate investment sales experience, including corporate real estate, asset management, and commercial real estate brokerage, Randolph is uniquely positioned to provide superior service to his clients. His broad knowledge of the commercial real estate industry, financial analysis, marketing, and negotiating skills ensures the highest standards of service and results for his clients.

Contact Information:

If you’re considering selling your multifamily property, contact Randolph Taylor at eXp Commercial. Let us evaluate your property and demonstrate how our proven process can work for you. Achieve your real estate goals with a trusted partner by your side.y property, contact Randolph Taylor at eXp Commercial. Let us evaluate your property and demonstrate how our proven process can work for you. Achieve your real estate goals with a trusted partner by your side.

https://www.creconsult.net/market-trends/selling-multifamily-property-guide-with-exp-commercial/