eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Wednesday, November 13, 2024

Join us for a showing of two fully occupied, cash-flowing multifamily properties ideal for investors. Showings are set for Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Property 2: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

These properties have undergone recent upgrades and are located close to major amenities. Don’t miss this opportunity to secure stable, income-producing assets!

Contact to Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

We invite you to join us for showings of two high-potential multifamily properties on Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Thursday, October 31, 2024

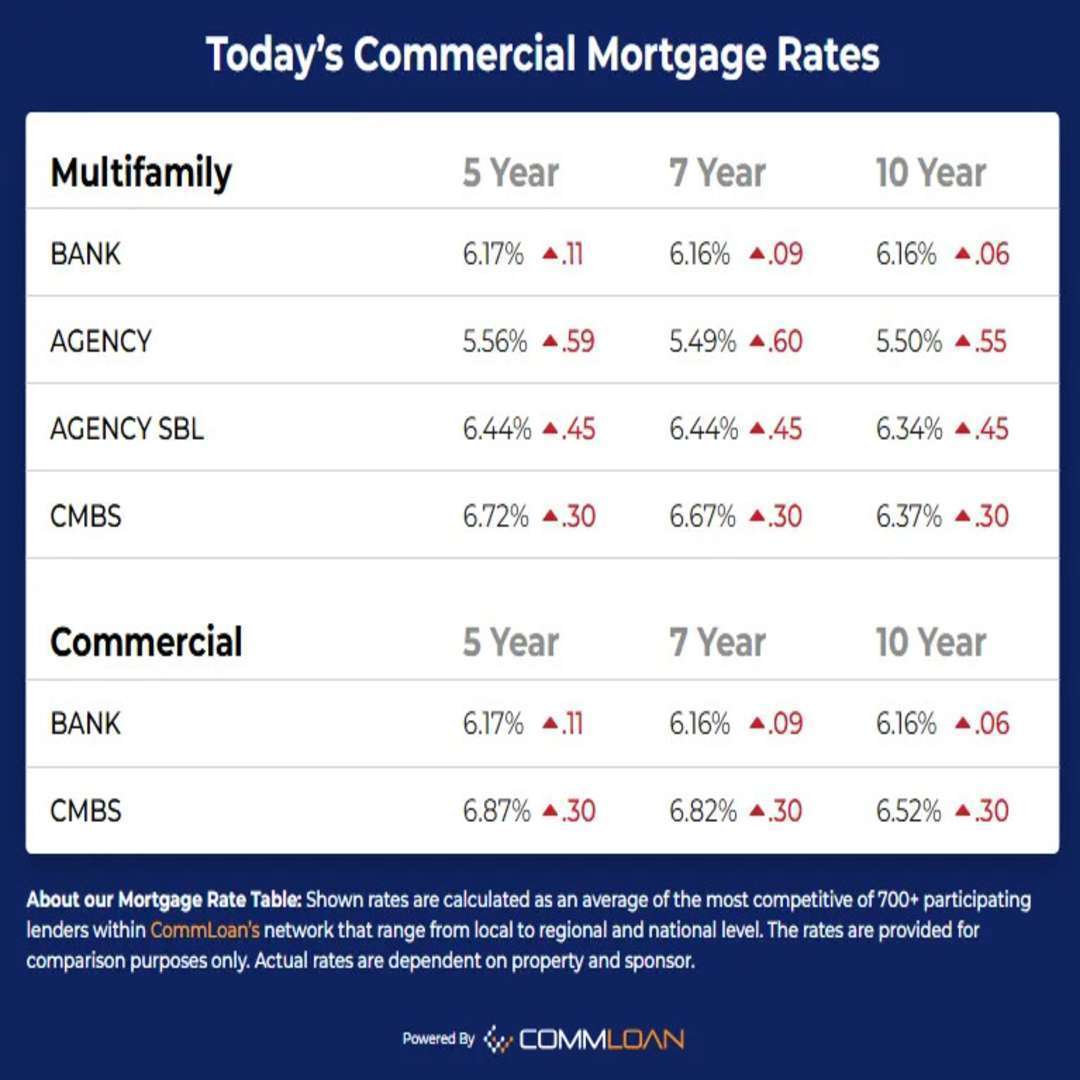

Multifamily Mortgage Rates Chicago | October 2024 Update

October 2024 Multifamily Mortgage Rate Update for Chicago Property Owners

For multifamily property owners in the Chicago area, staying informed on mortgage rate changes is essential when evaluating the timing of a potential sale or acquisition. While our primary focus at eXp Commercial is the listing and sale of multifamily properties, understanding current financing trends can support informed decision-making. Here’s the latest update on multifamily mortgage rates from our Capital Markets partner, CommLoan, and insights on how these rates could influence your investment strategy.

October 2024 Multifamily Mortgage Rates Overview

The latest multifamily mortgage rates have seen notable shifts, presenting both challenges and opportunities:

Bank Loans (5-Year Fixed): Now at 6.17%, up by 11 basis points. Although slightly higher, bank loans remain a solid choice for stable financing options.

Agency Loans: Increased to 5.56% for 5-year terms, up by 59 basis points. Agency loans are ideal for larger, long-term investments, offering stability for property buyers and sellers considering repositioning assets.

Agency SBL Loans: Now at 6.44% for both 5- and 7-year terms, reflecting a 45-basis-point rise. Agency SBL loans are designed for smaller properties, supporting streamlined financing even with the recent rate increase.

CMBS Loans: At 6.72% for 5-year terms, up by 30 basis points. CMBS loans provide flexible repayment options, benefiting more complex or large-scale transactions.

How These Rates Impact Chicago Multifamily Property Dispositions

As Chicago-area multifamily brokers, our primary focus is advising clients on property listings and sales. Current rate trends can impact market demand and timing considerations for dispositions:

Refinancing Prior to Sale: Some owners may consider refinancing to improve cash flow or extend holding periods until market conditions are optimal for listing. Locking in current rates can help stabilize finances while awaiting favorable selling opportunities.

Attracting Buyers: For buyers, the rise in agency and CMBS rates may affect purchasing power, influencing the types of financing they pursue. Understanding rate trends can help sellers better anticipate buyer needs and tailor their listing strategies.

Maximizing Sale Value: Even with rate increases, Chicago’s multifamily market remains competitive. By aligning with a brokerage that provides targeted marketing, expert valuation, and strategic negotiation, sellers can position their property to attract strong offers despite changing financing conditions.

Expert Multifamily Brokerage Services for Chicago Investors

With over 26 years of experience in Chicago’s multifamily market, I specialize in providing tailored solutions that support property dispositions. As a Senior Associate with eXp Commercial’s National Multifamily Division, my services are designed to maximize the value of your property through:

Accurate Valuations: In-depth, market-based assessments that help you understand your property’s current worth and its potential appeal to prospective buyers.

Targeted Marketing: Custom marketing strategies that attract competitive offers and increase the visibility of your listing among qualified investors.

Strategic Negotiation: Skilled negotiation to secure favorable terms and ensure a smooth transaction, maximizing your return on investment.

Backed by eXp Commercial’s national resources and our partnership with CommLoan, I provide my clients with insights into financing options that align with current market trends. This collaboration allows me to offer added value, helping you make informed decisions as you consider selling, refinancing, or holding your multifamily assets.

Ready to Explore Listing Options? Schedule a Call

If you’re considering selling your multifamily property or want to understand how today’s mortgage rates may affect your investment strategy, I’m here to help. Let’s discuss how we can position your property to achieve the best possible outcome in Chicago’s multifamily market.

Schedule a discovery call with Randolph Taylor, MBA, CCIM to explore listing opportunities and get expert guidance on maximizing the value of your investment.

Contact Information

Randolph Taylor, MBA, CCIM

Senior Associate | Multifamily Sales Broker

eXp Commercial | National Multifamily Division

📞 (630) 474-6441

📧 rtaylor@creconsult.net

https://www.creconsult.net/market-trends/2024-multifamily-mortgage-rates-chicago-listing/?fsp_sid=153

Multifamily Mortgage Rates Chicago | October 2024 Update

Explore October 2024 multifamily mortgage rates in Chicago and how they impact property sales and listing strategies for investors.

Wednesday, October 30, 2024

Aurora Naperville Multifamily Market Q3 2024 Trends

Aurora Naperville multifamily market Q3 2024 report: rent trends, vacancy rates, and investments. Download the full report now!

Monday, October 28, 2024

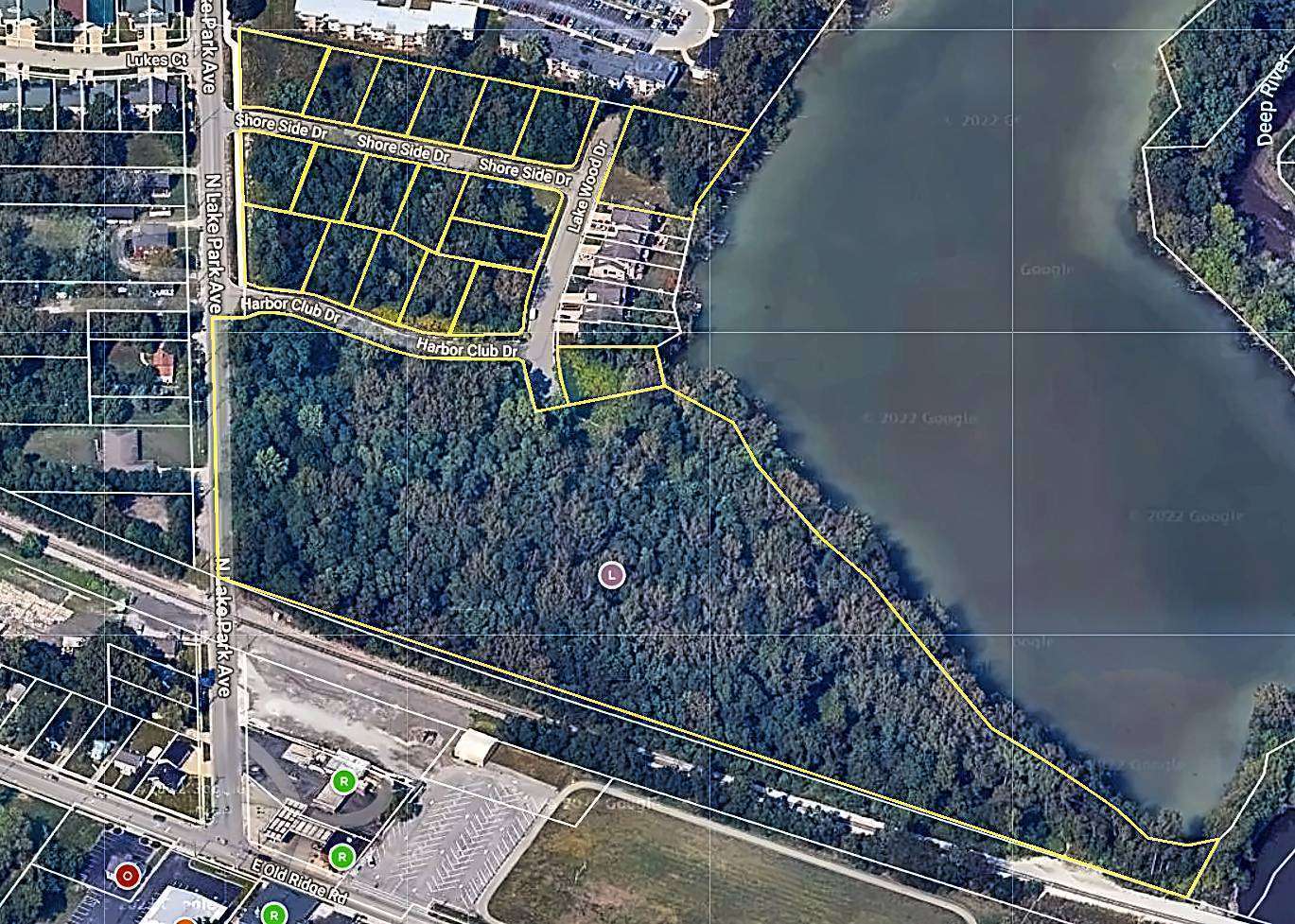

eXp Commercial, led by Randolph Taylor, CCIM, Senior Associate, completed the auction sale of a 17.25-acre property in Hobart, Indiana, for a Chicago client. This transaction highlights our ability to deliver fast and effective solutions through auction strategies, meeting client needs for timing and certainty. Learn how our national reach and multifamily expertise can support your property goals, locally or nationwide.

Randolph Taylor, CCIM

Senior Associate, eXp Commercial

📞 (630) 474-6441 | ✉️ rtaylor@creconsult.net

Press Release: https://www.creconsult.net/transactions/exp-commercial-hobart-indiana-auction/

eXp Commercial Hobart Indiana Auction Sale

FOR IMMEDIATE RELEASE

eXp Commercial Hobart Indiana Auction Sale for Chicago Client

Hobart, Indiana, October 28, 2024 – eXp Commercial successfully completed the auction sale of a 17.25-acre property in Hobart, Indiana, for a Chicago-based client. The transaction, managed by Randolph Taylor, CCIM, highlights eXp Commercial’s national service capabilities. The auction format was chosen to ensure a fast and certain sale, meeting the client’s goals.

The property is located in The Brickyard of Hidden Lake Subdivision and includes 48 platted lots, some with lakefront access. This Hobart Indiana sale aligns with the area’s Mixed Neighborhood Residential use, which supports low- to medium-density developments like single-family homes, attached housing, and multifamily units. This demonstrates eXp Commercial's ability to meet client needs across different states.

Randolph Taylor Leads Hobart Indiana Auction Sale

Randolph Taylor, a Chicago multifamily broker at eXp Commercial, managed the Hobart Indiana auction sale with an integrated platform. This approach ensured a 75-day list-to-close timeline, fulfilling the client’s needs for both speed and liquidity. All auction costs were covered by the buyer, maximizing the seller’s return.

“Our Hobart Indiana auction sale for a Chicago client showcases eXp Commercial’s ability to deliver tailored solutions,” said Randolph Taylor, CCIM. “We offer strategies that work for multifamily properties, whether through traditional sales or auctions.”

Chicago Multifamily Broker Maximizes Property Sales

Randolph Taylor, CCIM, specializes in Chicago multifamily property sales, supported by eXp Commercial’s national network. He helps clients achieve their goals with personalized strategies, whether in Chicago or elsewhere in the U.S.

Learn About eXp Commercial's Auction Services

Find out how eXp Commercial's auction services can benefit your property sales by downloading the eXp Commercial Auctions brochure.

Schedule a Call for Your Property Sale

Explore the best strategy for your property sale, whether traditional or auction-based. Schedule a call with Randolph Taylor, CCIM.

Contact Information:

Randolph Taylor, CCIM

Senior Associate, eXp Commercial Chicago

m: (630) 474-6441 | e: rtaylor@creconsult.net

Schedule a Call

https://www.creconsult.net/transactions/exp-commercial-hobart-indiana-auction/?fsp_sid=101

Midwest Multifamily Market Booming: Is Now the Right Time to Sell?

At the halfway point of the year, Cleveland, Cincinnati, Columbus, and Chicago have all seen rent growth well ahead of the national average....

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...