What is the Full Property Life Cycle?

Technology has taken multifamily by storm, yet the adoption of advanced solutions remains behind the curve on the maintenance side of operations. Some operators have finally replaced paper work orders and make-ready white boards with an online service request platform, but many continue to relegate other aspects of the physical property life cycle to antiquated methods.

Service request platforms and maintenance workflow solutions have proven invaluable in the day-to-day management of apartment communities, streamlining the process and eliminating much of the opportunity for human error. However, physical care for a property extends far beyond routine resident work orders. Given the current hiring and retention challenges among multifamily maintenance teams, the efficiencies afforded by technology are required across the board.

The industry must take a hard look at opportunities to empower maintenance teams with solutions built to save time, preserve properties, enhance data collection and increase asset value. There are several points in the property life cycle where operators can deploy solutions to support their teams.

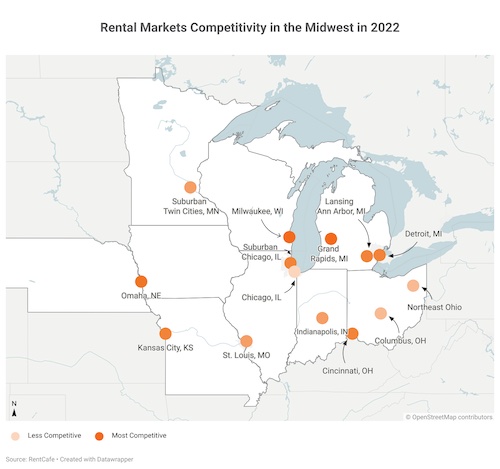

Due Diligence

Comprehensive property inspections are a critical component to assessing the viability of value-add programs, making in-depth due diligence efforts paramount to asset success. Historically, this process has involved paper inspection forms. As with any paperwork system, forms vary due to inspector subjectivity and carry an increased potential for human error. Leading operators have switched to digital, mobile inspection forms that guide inspectors through the process. Customizable digital inspection templates create consistency in the process, as well as immediately accessible data, saving time and improving decision-making.

Procurement

Supply chain issues and increased material costs have created significant procurement issues for property teams in recent years. While visibility into the supply chain remains strained in areas, digital maintenance and inspection platforms reduce pain points associated with the procurement process. For example, using procurement technology, technicians can enter parts and materials needs from the field and link them to specific homes, common areas or amenities. This complete visibility is critical for budgeting purposes and keeps teams organized. Such platforms will soon feature the ability to search parts catalogs and source materials from the field, expediting repair times. They also allow maintenance teams to proactively order parts, appliances and materials in advance to ensure they are on hand when needed.

Asset Tracking

Digital asset tracking systems allow operators to keep a pulse on their communities by logging all property assets, from refrigerators to light bulbs. Searchable asset archives provide the status of warranties, anticipated appliance lifespans, asset replacement histories and backstock inventory, creating a database that bolsters budgeting and efficiency, and takes the guesswork out of property upkeep.

Preventive Maintenance

With everything maintenance teams have on their plates, preventive maintenance often slips through the cracks. In addition to managing the day-to-day duties for maintenance teams, workflow platforms allow operators to schedule preventive maintenance tasks and stave off potential property issues before they occur. A well-executed preventive maintenance program can save a community thousands of dollars simply by averting large-scale maintenance issues. When added to the regular workflow schedule, operators have better oversight of preventative maintenance practices, creating a trackable work history on major property infrastructure and establishing documentation for insurance and compliance verification.

Inspections

No property team looks forward to annual inspections, but the process is shortened and made less painful with the use of digital inspection templates customized for each asset. Also, operators can ensure compliance with a comprehensive inspection platform that requires necessary boxes to be checked. The instant and easily accessible reporting provided through digital inspection platforms also makes it simple for operators to identify and address property needs. It provides transparency at all levels of the organization, keeping everyone informed in real-time.

Disposition

By maintaining electronic documentation throughout an asset’s life cycle, including inspection records, preventive maintenance reports, daily maintenance logs and a comprehensive list of physical assets, the property is well positioned for disposition. When buyers are provided with factual information on the physical status of the property, as well as its maintenance history, it saves them time during their own due diligence process and poises the seller to realize the full value upon sale.

Smart technology solutions exist to support the community upkeep efforts of on-site teams. Maintenance and inspection teams are the first lines of defense against physical property issues, and they shouldn’t be the last to be equipped with the technology needed to do their jobs efficiently and effectively. Digital platforms go beyond saving time and expense by streamlining the routine maintenance workflow. When maximized, they improve budgeting, procurement, troubleshooting, tracking and reporting, reducing overall operating costs and preserving assets in the long run. By taking a holistic approach and empowering teams with comprehensive solutions that account for asset needs throughout the property life cycle, management companies can establish an operational advantage across their portfolios that will benefit them for years to come.

Source: What is the Full Property Life Cycle?

https://www.creconsult.net/market-trends/what-is-the-full-property-life-cycle/ [row]

[col span__sm="12"]

[row]

[col span__sm="12"]

[button text="Register now" expand="true" link="https://share.hsforms.com/1J66iDYvTTHStNTtZ5bOP4w470ju" target="_blank"]

[button text="Register now" expand="true" link="https://share.hsforms.com/1J66iDYvTTHStNTtZ5bOP4w470ju" target="_blank"]