eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Wednesday, May 21, 2025

📍 4337 Prescott Ave | Lyons, IL

Fully Leased | Income-Producing | Upside

Final opportunity in a 3-property stabilized portfolio.

Renovated 12-unit building with proven cash flow and long-term rental upside.

🔹 Offered at: $1,520,000

🔹 Units: 12 (Strong 2BR/1BR mix)

🔹 Income (Actual): $188,292 Gross | $103,891 NOI

🔹 Cap Rate: 6.83% Actual | 8.53% Pro Forma

🔹 Parking, upgrades, and tenant-paid heat

📄 Offering Memorandum & Full Details:

👉 sl.creconsult.net/L

📞 Contact: Randolph Taylor, CCIM

rtaylor@creconsult.net | (630) 474-6441

Vice President | Multifamily Broker, eXp Commercial

#MultifamilyForSale #ChicagoRealEstate #ApartmentInvesting #CommercialRealEstate #ValueAdd #PassiveIncome #CRE #eXpCommercial

Monday, May 19, 2025

Commercial Real Estate Distress 2025 Trends

Introduction

Commercial real estate distress 2025 is taking center stage—but it’s not the crisis many assume. Just ask John Chang, Senior VP at Marcus & Millichap, whose on-the-road market update brings clarity and candor. His perspective captures the volatility of the market—and its resilience.

The Delinquency Decipher: Is CRE in Crisis?

Is this a wave or just ripples? CMBS delinquency rates rose 50 basis points in 2025—now 200 basis points higher than 2024. But the story is nuanced:

Office: 10.3%, still elevated, but below late 2024.

Industrial: 0.5%, near-zero distress.

Retail: 7.1%, improving from COVID-era highs.

Lodging: 7.9%, elevated but not alarming.

This isn’t a full-scale meltdown. It's targeted market friction.

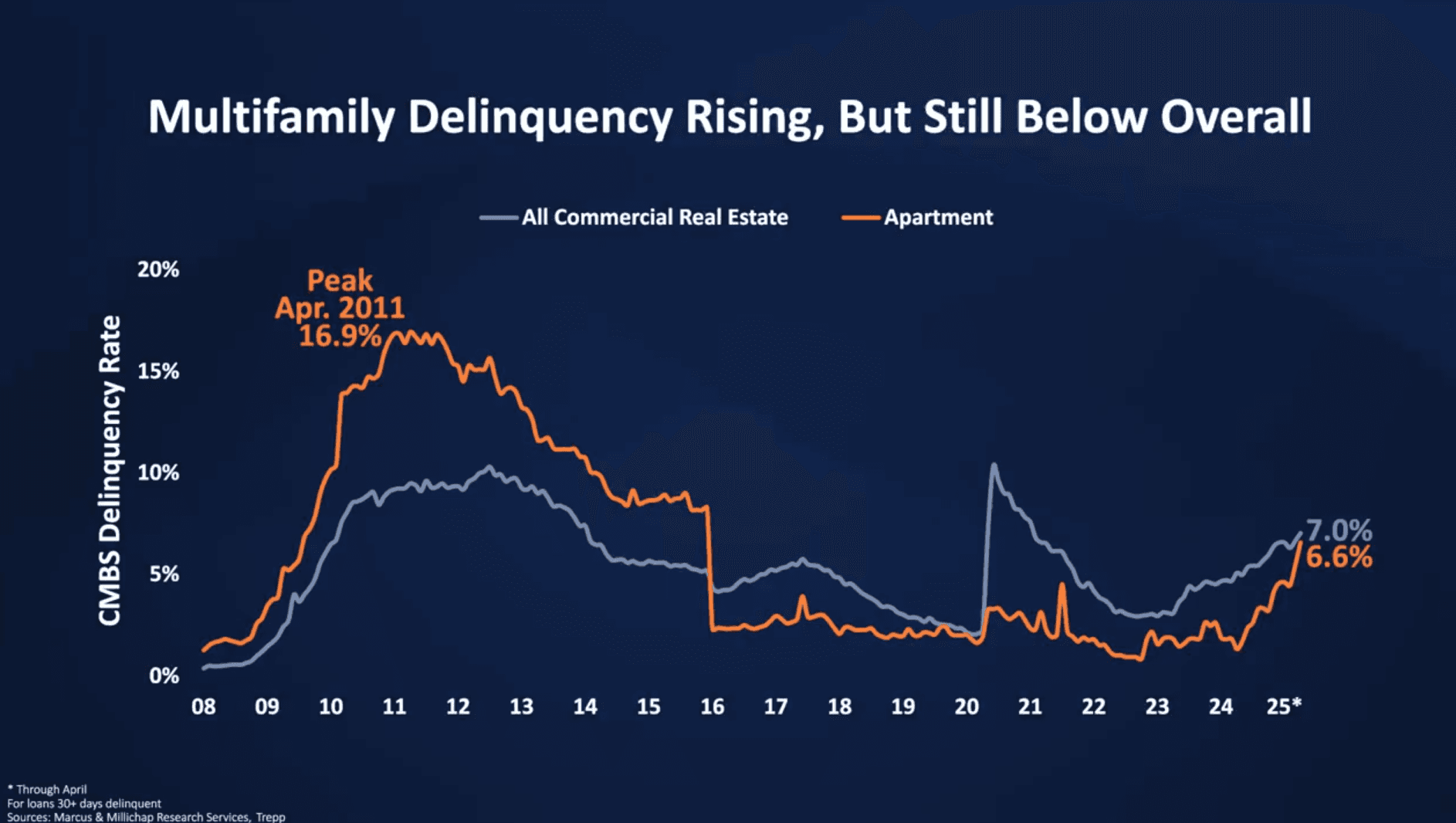

Multifamily Sector: Where Pressure Is Building

The multifamily delinquency rate has reached 6.6% in 2025—up significantly, but still far from the 16.9% seen in 2010–2011. The pressure is localized:

Sunbelt metros like Dallas, Phoenix, and Florida

Properties acquired at peak pricing with low-interest debt

Inexperienced operators now facing loan maturity

Chang notes, “This isn’t widespread failure. It’s a matter of misaligned projections and tighter lending.”

Lenders Shift Gears: Less Forgiveness, More Action

For years, lenders extended terms or deferred payments. In 2025, that flexibility is gone:

Loans must be refinanced or sold

Notes are changing hands

Foreclosure starts are ticking up

Distress is entering the market slowly—but firmly.

Sector Snapshots: Comparing 2025 CRE Delinquency

Office: Still Volatile

10.3% delinquency. Tenant downsizing and hybrid work persist.

Industrial: Strong and Steady

0.5% delinquency. Demand remains robust across logistics and warehouse properties.

Retail: Mixed Outlook

7.1% delinquency. Results vary by submarket and tenant strength.

Lodging: Gradual Rebound

7.9% delinquency. Some assets remain distressed due to slower recovery and rising costs.

Multifamily: Watch the Sunbelt

6.6% delinquency. Still manageable, but the Sunbelt faces investor retrenchment.

Investor Psychology: Headlines vs. Reality

Distress doesn’t mean discounts. Many troubled properties require capital, repositioning, or involve legal headaches. “Extend and pretend” is fading, but buyers must remain cautious.

The hype? Overstated. The opportunity? Real—but complicated.

Conclusion: Context is Everything in 2025

Commercial real estate distress 2025 is a market reality—but not a repeat of 2008. Each sector is reacting differently, and smart investors are responding accordingly. The fundamentals remain strong where underwriting was sound.

“Distress isn’t a wave sweeping across the industry—it’s a trickle, highly localized and sector-specific.” — John Chang

Source: https://www.linkedin.com/feed/update/urn:li:activity:7330275843224625152/

https://creconsult.net/commercial-real-estate-distress-2025/?fsp_sid=902

Friday, May 16, 2025

3217–3229 W Montrose Ave | Albany Park, Chicago

Offered at $995,000 | ±4,000 SF

Fully leased six-unit ground-floor retail property featuring a mix of service, food, and professional tenants. Flexible MTM and short-term leases provide near-term repositioning potential. Current rents average ~$20/SF, with market rates estimated at ~$28/SF MG—offering clear value-add upside. Located on high-traffic Montrose Avenue with 21,000+ vehicles per day, strong CTA access, and a low 3.1% submarket retail vacancy.

View the full listing:

https://creconsult.net/chicago-multifamily-listings/montrose-retail-strip/

Contact:

Randolph Taylor, CCIM

Vice President | eXp Commercial

rtaylor@creconsult.net

630.474.6441

www.creconsult.net

#ChicagoRetail #CommercialRealEstate #AlbanyPark #RetailInvestment #eXpCommercial #CRE #ValueAdd #MontroseAve #RealEstateInvestment

Thursday, May 15, 2025

Multifamily Redevelopment Opportunity – 100 W Roosevelt Rd, Wheaton, IL

An exceptional opportunity to reposition two existing office buildings into a 22-unit multifamily community in one of Wheaton's most desirable corridors. Approved zoning and redevelopment plans are in place, supported by strong apartment demand and excellent site visibility along Roosevelt Road.

Key Highlights:

Approved for 22 multifamily rental units

R5 Residential Zoning | Approved PUD

1.51 Acres | 23,864 SF Total

Surface parking with 38 spaces

High-visibility location near downtown Wheaton

Offered at $1,650,000 with a projected valuation of $4,950,000 and an estimated 8.8% cap rate based on stabilized pro forma.

Learn more and view the full Offering Memorandum:

https://creconsult.net/park-place-wheaton-redevelopment/

For more information, contact:

Randolph Taylor, CCIM

Vice President | Investment Sales Broker

eXp Commercial – Chicago

Email: rtaylor@creconsult.net

Phone: 630-474-6441

Website: https://creconsult.net

#MultifamilyRedevelopment #WheatonIL #CRE #InvestmentOpportunity #ApartmentDevelopment #RealEstateInvestment

Wednesday, May 7, 2025

Stabilized apartment portfolio across three well-maintained assets in Lyons & Chicago Ridge, IL — fully occupied with strong in-place income and rental upside.

🔹 42 Units Across 3 Stabilized Assets

🔹 Well-Maintained with Recent Renovations

🔹 Current CAP Rate: 6.90% | Pro Forma: 8.42%

🔹 Significant Upside Through Rent Increases

🔹 Strong Tenancy | Turnkey Management

🔹 Ideal for 1031 Exchange or Private Portfolio Buyer

📍 Portfolio Includes:

12 Units – 4337 Prescott Ave, Lyons

🔗 sl.creconsult.net/L

12 Units – 7821 43rd St, Lyons

🔗 sl.creconsult.net/7821

18 Units – 9826 Sayre Ave, Chicago Ridge

🔗 sl.creconsult.net/CR

📩 Contacts:

Randolph Taylor, CCIM – rtaylor@creconsult.net | (630) 474-6441

Dave Snehal, CCIM – dave.snehal@expcommercial.com | (773) 230-8055

#multifamily #chicagorealestate #cre #1031exchange #realestateinvesting #suburbanchicago #multifamilyportfolio #valueadd #expcommercial

Tuesday, May 6, 2025

Near St. Joseph Medical Center | Joliet, IL

2435 & 2439 Glenwood Ave

2435: ±10,311 SF | $1,295,000

2439: ±9,410 SF | $1,100,000

✅ Recently Renovated

✅ Both Delivered Vacant

✅ Fully Furnished (Optional)

✅ Elevator Access (2435)

✅ Ideal for Office, Professional, Medical

Two professionally updated office buildings are located just off Larkin Ave. in Joliet, adjacent to Ascension St. Joseph Medical Center. Offered individually or as a rare ±19,721 SF portfolio opportunity.

View full listings & OMs:

2435 Glenwood Ave: https://creconsult.net/office-building-for-sale-joliet

2439 Glenwood Ave: https://creconsult.net/2439-glenwood-office-sale-joliet

Randolph Taylor, CCIM

Vice President, Broker – eXp Commercial

rtaylor@creconsult.net | (630) 474-6441

#CRE #OfficeForSale #MedicalOffice #JolietIL #Turnkey #CommercialRealEstate #eXpCommercial

Friday, May 2, 2025

3 STABILIZED MULTIFAMILY ASSETS

42 Units | Chicago Ridge & Lyons, IL

Fully occupied, recently updated buildings with rental upside.

Available individually or as a portfolio.

Property Links:

4337 Prescott Ave – sl.creconsult.net/L

7821 43rd St – sl.creconsult.net/7821

9826 Sayre Ave – sl.creconsult.net/CR

Contact for OM or tour scheduling:

Randolph Taylor, CCIM

Multifamily Broker | eXp Commercial

(630) 474-6441 | rtaylor@creconsult.net

#Multifamily #CRE #eXpCommercial #ChicagoRealEstate #CallForOffers #InvestmentProperty

Commercial Real Estate Market Trends: 2025 Industry Insights

Introduction In 2025, the real estate world looks different. Warehouses are booming, retail is rebounding, and suburban office spaces are ou...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...

-

🚨 Auction Alert 🚨 I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is g...