National Year-Over-Year Multifamily Rent Growth at 8.4%, Down from 9.4% in June

WASHINGTON – Today, Apartments.com – a CoStar Group company – released an in-depth report of multifamily rent growth trends for July 2022 backed by analyst observations.

“Throughout the month of July, while multifamily yearly rents continued to perform well above historical averages, the deceleration of rent growth quickened at a time when markets typically post their best results,” said Jay Lybik, National Director of Multifamily Analytics, CoStar Group. “The deteriorating rent situation highlights a significant collapse of demand in the sector when new unit deliveries are projected to hit 230,000 in the second half of 2022.”

SUNBELT MARKETS REMAIN IN TOP 10, START SEEING DRAMATIC PULLBACK

According to Apartments.com, Sunbelt cities dominated the top 10 rent growth markets in July with eight out of 10 located within the region. Florida continued boasting seemingly strong demand with four of the five top markets located in the state, including Orlando, Fla.; Miami, Fla.; Fort Lauderdale, Fla.; and Palm Beach, Fla.

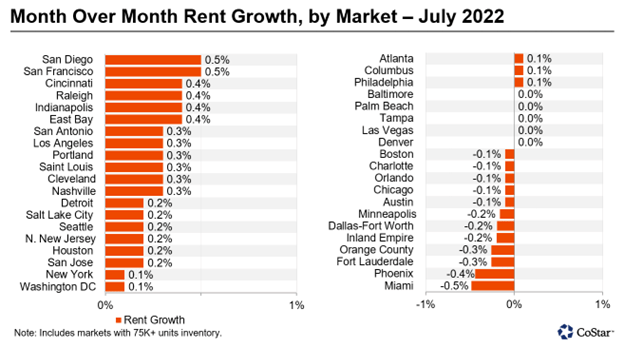

However, the markets with the fastest growing rent in 2021 are now experiencing the quickest pullback. For example, Palm Beach has seen a dramatic slowing of growth with year-over-year asking rents decreasing from 30.6% in Q4 2021 to 12.7% at the end of July 2022. Tampa and Las Vegas have also seen rents retreat by over double digits so far this year. BAY AREA MARKETS BUCK DOWNWARD TREND On the flip side, the San Francisco and East Bay markets challenged the downward rent growth trend. San Francisco’s average asking rents are now just $18 below their all-time peak of $3,116 in Q2 2019 as rents rose 40 basis points over the past 30 days to 5.0%. The East Bay also held strong at 5.5% throughout the month of July. MONTH OVER MONTH DATA PAINTS A DETERIORATING RENTAL MARKET PICTURE Analysts have found that looking sequentially, 12 markets saw absolute asking rents decline over the past month, the first occurrence since 2020. Miami led the charge with average asking rents down $11 during July, in addition to five markets that reported no change in rents over the last 30 days.

No comments:

Post a Comment