eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Wednesday, December 18, 2024

Discover this full-building opportunity at 2439 Glenwood Avenue, Joliet, IL. Perfect for professional services, this 9,410 SF Class B office property is in excellent condition and just steps away from a major hospital.

✨ Key Highlights:

✅ Fully furnished - ready for immediate use

✅ Renovated in 2017 - modern updates throughout

✅ Prime location near hospital & major amenities

✅ Ideal for medical, professional, or corporate offices

Lease Rate: $20/SF MG

Explore this turnkey space here: 🔗 https://properties.expcommercial.com/2439-glenwood-avenue-joliet-lease?template_id=5

Let’s discuss how this exceptional property can support your business!

📞 Randolph Taylor, CCIM Vice President | eXp Commercial

📱 (630) 474-6441 | 📧 rtaylor@creconsult.net

#OfficeSpaceForLease #JolietIL #NearHospital #CommercialRealEstate #FullyFurnished #eXpCommercial

Tuesday, December 17, 2024

After nearly 27 years in the commercial real estate industry, I am thrilled to share that I’ve been named Advisor, Vice President at eXp Commercial!

This recognition is a reflection of the dedication I’ve put into helping my clients navigate complex multifamily transactions in the Greater Chicago area. It’s been an incredible journey, and I’m thankful for the opportunities to grow with my amazing team at eXp.

As I continue to focus on providing tailored strategies and market insights, I remain committed to helping property owners optimize their investments and maximize returns.

Thank you to my clients, colleagues, and mentors for your continued trust and support. I'm excited about what lies ahead and look forward to even more success together!

If you're looking to evaluate, sell, or maximize the value of your multifamily properties, I’d love to connect and explore how I can assist you in achieving your investment goals.

Randolph Taylor, MBA, CCIM Advisor, Vice President at eXp Commercial

📞 630-474-6441 | ✉️ rtaylor@creconsult.net

#CommercialRealEstate #MultifamilyRealEstate #CRE #RealEstateInvestment #ChicagoRealEstate #InvestmentSales #RealEstateExpert #CREBroker #PropertyInvestment #eXpCommercial #MultifamilyBroker #RealEstateSuccess #ChicagoCommercialRealEstate #CRECommunity #Advisor

Friday, December 13, 2024

December 2024 Multifamily Mortgage Rate Update: Insights from Top Chicago Multifamily Experts

Introduction

For multifamily property owners in the Chicago area, staying informed about mortgage rate changes is critical for making strategic investment decisions. As one of the top Chicago multifamily experts, our team at eXp Commercial specializes in helping clients navigate the complexities of real estate investment. Whether you’re buying, selling, or refinancing, understanding financing trends can directly impact your strategy. Here’s the latest update on multifamily mortgage rates from our Capital Markets partner, CommLoan, and actionable insights from your trusted Chicago multifamily investment broker.

December 2024 Multifamily Mortgage Rates Overview

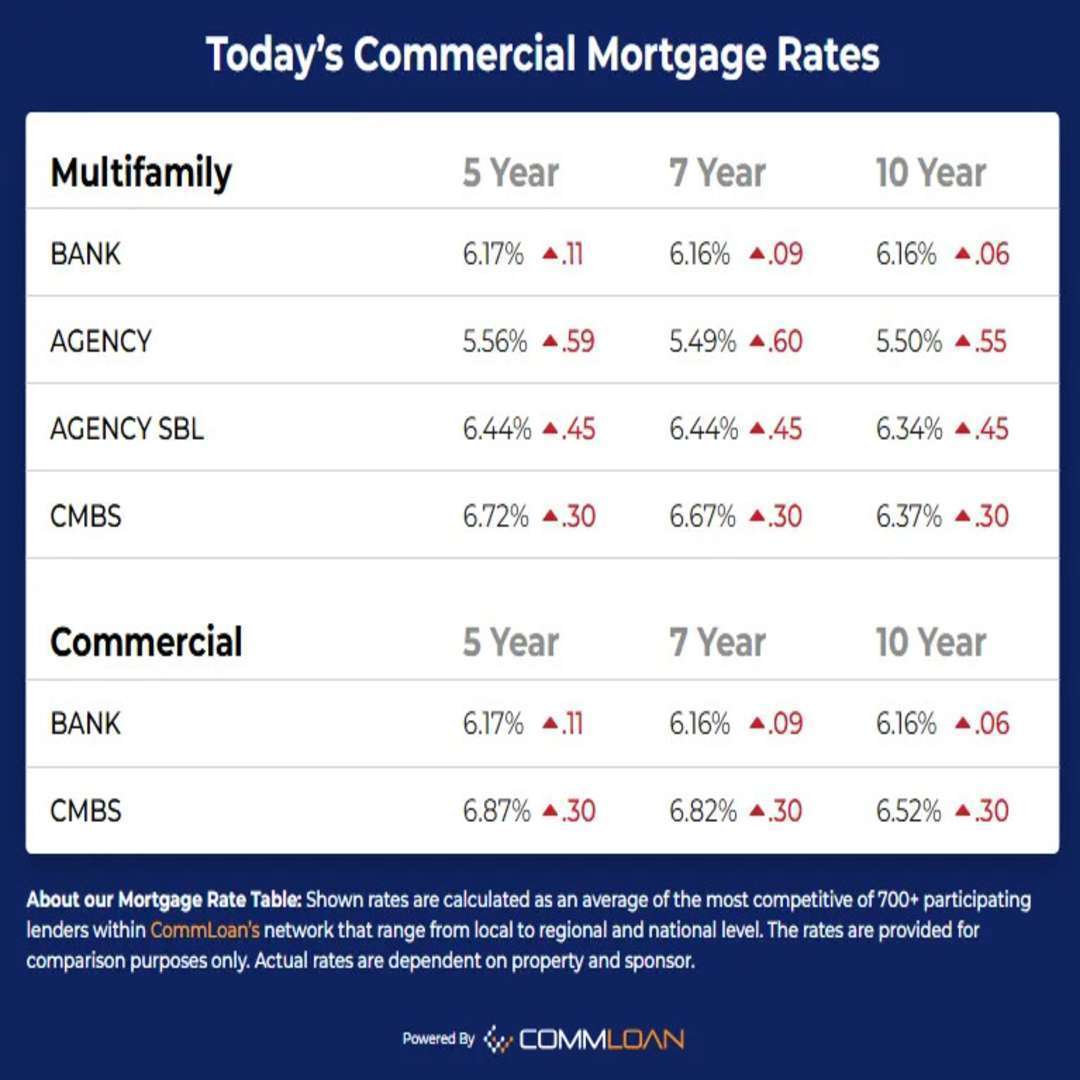

The latest multifamily mortgage rates reveal notable trends that may affect decision-making for property owners and investors:

Bank Loans

- 5-Year Fixed: 6.13%, down by 17 basis points.

- 7-Year Fixed: 6.10%, down by 16 basis points.

- 10-Year Fixed: 6.06%, down by 15 basis points.

Bank loans are a reliable option for medium-term financing, especially with the recent rate decreases.

Agency Loans

- 5-Year Fixed: 5.71%, up by 8 basis points.

- 7-Year Fixed: 5.79%, up by 6 basis points.

- 10-Year Fixed: 5.65%, up by 3 basis points.

Agency loans remain a popular choice for larger, long-term investments, despite slight rate increases.

Agency SBL Loans

- 5-Year and 7-Year Fixed: Both stand at 6.64%, up by 5 basis points.

- 10-Year Fixed: 6.54%, up by 5 basis points.

Designed for smaller properties, Agency SBL loans remain a valuable option, even with minor increases.

CMBS Loans

- 5-Year Fixed: 6.97%, no change.

- 7-Year Fixed: 6.92%, no change.

- 10-Year Fixed: 6.62%, no change.

CMBS loans are ideal for large-scale projects requiring flexible repayment terms.

How These Rates Impact Chicago Multifamily Investments

As one of the top Chicago multifamily experts, we understand how mortgage rate changes influence buying and selling strategies. Here’s how these trends may affect you:

Refinancing Before Selling

With bank rates dropping, some property owners may consider refinancing to improve cash flow or extend their holding periods until the market becomes more favorable for selling.

Attracting Buyers

Rising agency and SBL rates could affect buyer financing options, impacting purchasing power. Sellers can benefit by anticipating these changes and tailoring their listing strategies accordingly.

Maximizing Property Value

Even with rising rates in some categories, Chicago's multifamily market remains highly competitive. Working with a seasoned Chicago multifamily investment broker ensures your property is positioned effectively to attract serious buyers and secure top offers.

Why Work with a Chicago Multifamily Investment Broker?

As a trusted advisor and one of the top Chicago multifamily experts, I offer tailored strategies to maximize the value of your multifamily property. My services include:

- Accurate Valuations: Comprehensive assessments based on real-time market data.

- Targeted Marketing: Campaigns designed to reach motivated, qualified buyers.

- Strategic Negotiation: Expertise in securing the best possible terms while ensuring a smooth transaction process.

In collaboration with CommLoan, I also provide insights into financing solutions aligned with the latest market trends. This ensures my clients make informed decisions whether they’re selling, refinancing, or holding assets.

Schedule a Call with Randolph Taylor, Your Chicago Multifamily Investment Broker

If you’re considering selling your multifamily property or exploring refinancing options, I’m here to help. Let’s discuss how today’s mortgage rates and market trends can shape your investment strategy.

Schedule a discovery call with Randolph Taylor, MBA, CCIM to explore opportunities for listing and maximizing your property value.

Contact Information

Randolph Taylor, MBA, CCIM

Senior Associate | Multifamily Sales Broker

eXp Commercial | National Multifamily Division

📞 (630) 474-6441

📧 rtaylor@creconsult.net

https://www.creconsult.net/market-trends/december-2024-multifamily-mortgage-rate-update-insights-from-top-chicago-multifamily-experts/?fsp_sid=325

Kane County Multifamily Market Report – Q3 2024: Key Trends in Commercial Real Estate Brokerage

Introduction

The Kane County multifamily market in Q3 2024 offers solid opportunities for investors and property owners. As one of the most dynamic submarkets in the Chicago metro area, Kane County continues to attract interest from stakeholders in commercial real estate brokerage, thanks to its stable fundamentals and promising growth. This report highlights key performance indicators, market trends, and investment strategies tailored to multifamily assets in Kane County.

Download the Full Q3 2024 Report Here

Kane County Multifamily Market Overview

Asking Rents

- The average asking rent for multifamily units in Kane County stood at $1,590 in Q3 2024, reflecting a -0.1% quarterly decrease but a 2.4% annual growth rate.

- Unit-Specific Rents:

- Studios: $1,250

- 1-Bedrooms: $1,308

- 2-Bedrooms: $1,558

- 3-Bedrooms: $2,338

Vacancy Rates

The vacancy rate for Q3 2024 was 5.6%, down 10 basis points from Q2. While Kane County's rate remains slightly higher than the Chicago metro average of 5.3%, it still reflects healthy market activity.

Key Metrics Snapshot

| Metric | Kane County (Q3 2024) |

|---|---|

| Average Asking Rent | $1,590 (-0.1% Q/Q) |

| Vacancy Rate | 5.6% (-10 bps Q/Q) |

| 12-Month Rent Growth | +2.4% Y/Y |

| Cap Rates | 5.8% to 6.5% |

What’s Driving Rent Trends in Kane County?

Rent Growth Drivers:

- No New Deliveries in 2024: The lack of new construction has reduced competitive pressure, supporting rent stability.

- Upcoming Supply: Developers plan to deliver 1,554 units between 2025 and 2026, contributing to 16.6% of the Chicago metro’s new inventory.

Investment Opportunities in Kane County – Q3 2024

Kane County remains a prime submarket for investors targeting multifamily assets in the commercial real estate brokerage industry.

Key Highlights:

- Sales Volume: Total Q3 2024 transactions reached $98.3 million across several deals.

- Cap Rates: Averaging between 5.8% and 6.5%, Kane County’s cap rates remain attractive for long-term investors.

Economic Drivers and Market Projections

Economic Highlights:

- Household Income Growth: Income in Chicago’s metro area grew 0.6%, exceeding the national average of 0.5%.

- Job Growth: Metro employment dipped slightly to -0.1%, reflecting broader economic pressures but maintaining tenant demand.

Future Projections:

- Rents: Expected to rise to $1,594 by year-end 2024 and grow at 2.4% annually through 2026.

- Vacancy Rates: Likely to reach 6.2% by 2024, with a slight increase to 7.7% by 2026, as new units are absorbed.

Maximize Your Property Value in Kane County

As an experienced advisor in commercial real estate brokerage, I help property owners achieve top results in the Kane County multifamily market.

My Services Include:

- In-Depth Valuations: Free assessments based on market data.

- Targeted Marketing: Campaigns designed to reach competitive buyers.

- Expert Negotiation: Securing optimal terms and maximizing ROI.

Schedule Your Consultation Today

Ready to explore the opportunities in Kane County multifamily real estate? Let’s connect and discuss how to maximize your investments.

Download the Full Q3 2024 Report Here

https://www.creconsult.net/market-trends/kane-county-multifamily-market-report-q3-2024-key-trends-in-commercial-real-estate-brokerage/?fsp_sid=312

Thursday, December 5, 2024

Navigating the Evolving Landscape of Commercial Real Estate in 2024

In a world where economic factors can swing like a pendulum, understanding the commercial real estate market has never been more critical. Imagine a bustling cityscape, where each office, retail space, and industrial complex holds untold stories of successes and setbacks. As we dive into the third-quarter performance for 2024, we uncover insights that could shape investment decisions and business strategies alike. Join us in exploring how shifting interest rates and evolving consumer behaviors present both challenges and opportunities.

Current Economic Climate and Its Effects on CRE

Understanding Q3 GDP Growth

The landscape of the U.S. economy is continuously evolving. Recent reports show that GDP growth for the third quarter of 2024 has surpassed initial expectations. This improvement is not just a statistical blip; it signifies a broader trend in consumer spending.

- Strengthened Consumer Spending: Increased consumer spending is driving demand, signaling optimism. This applies to both durable and non-durable goods.

- Corporate Profits Rising: In conjunction with this growth, corporate profits are reaching new heights, which can lead to increased investments in real estate.

The Influence of Election Outcomes

The recent elections have resulted in a Republican sweep, and this may have profound implications for the real estate sector.

- Potential Policy Changes: These changes could impact real estate policies and regulations, affecting market dynamics.

- Consumer Behavior: Dr. Thomas LaSalia pointed out the importance of household consumer behavior as a vital component of growth.

So, how might these outcomes shape the commercial real estate (CRE) market? This climate may lead to alterations in tax policies, which could affect investment returns and overall market stability.

Corporate Profits and Investment Decisions

As the economy grows, corporate profits are a crucial factor for real estate investments. With profits rising, companies may decide to invest more in properties.

- Investment Opportunities: A rising profit margin encourages businesses to expand their real estate portfolios.

- Perception of Stability: Strong financial performance often translates into confidence, making it more likely for firms to engage in real estate transactions.

However, it's essential to remain cautious. The CRE sector is witnessing mixed signals. Some asset classes, particularly offices and retail, face challenges unlike any before. Will these sectors stabilize, or will they continue to struggle amidst shifting consumer preferences?

Conclusion: A Mixed Bag for CRE

The current economic climate presents a complex scenario for commercial real estate. With strengthening GDP and consumer spending, there are signs of recovery. Yet, election outcomes and the behavior of corporate profits introduce an element of uncertainty. The market is cautious but hopeful, as it navigates these multifaceted dynamics.

Trends Across Different Property Types

Sector Performances

The Q3 2024 briefing from Moody's lays out a comprehensive view of commercial real estate (CRE) market dynamics. Each property type—office, industrial, retail, and residential—has its unique performance metrics.

- Office Sector: Stability is returning. In Q3 2024, leasing activity saw a rebound. For the first time in a year, there was a positive net absorption. This suggests that businesses are starting to take up space again. However, challenges remain: vacancy rates are stalling, and effective rents are only modestly increasing.

- Industrial Sector: After a slow start this year, the industrial sector shows signs of stabilization. Effective rents improved in Q3, although vacancy rates in warehouse distribution remained unchanged.

- Retail Sector: There's a hint of optimism here. Slight rent growth can be noted, driven by consumers feeling more confident—thanks, in part, to falling interest rates.

- Residential Sector: This sector tells a more complex story. The apartment market is softer, with a 5.9% vacancy rate. This number is alarming, as it approaches levels not seen since the Great Financial Crisis. High vacancy rates and increased concessions are becoming common.

Data Insights and Upcoming Market Shifts

According to Dr. Thomas LaSalia, there’s a cautiously optimistic view for the market. The data indicates a gradual improvement in transaction activities. Dr. LaSalia posits that consumer behavior will be a significant driver in upcoming shifts. Can the economy withstand future shocks? Possibly, thanks to robust household balance sheets. This creates a buffer against uncertainties.

Regional Disparities in Recovery Rates

What about regional recovery? The data suggests significant disparities. Some areas are seeing faster rebounds, particularly in the office and retail sectors, while others bring up the rear. For example, industrial centers might recover quickly due to stable demand, whereas certain regions lag due to local economic factors.

Overall, while the market appears to be on the mend, each property type navigates its own set of challenges and opportunities. Understanding these trends can be key for investors, businesses, and stakeholders within the commercial real estate landscape.

The Impact of Government Policies on CRE

Understanding Government Debt and Economic Health

Government debt plays a significant role in the health of the economy. It can be quite complex, but simply put, high levels of debt usually signal trouble. However, Dr. Thomas LaSalia notes that interest payments on that debt today are lower than in previous decades. This indicates that the U.S. economy has the resilience to handle ongoing costs without dire consequences.

So, what does this mean for commercial real estate (CRE)? When government debt is high, public spending can be impacted, which may lead to slower economic growth. Yet, current dynamics suggest a stable outlook. The correlation between government debt levels and economic growth will be crucial to watch. Is the debt sustainable? Are households still spending? Answering these questions will illuminate the path forward for CRE.

Interest Rate Stabilization and Borrowing Costs

Interest rates are vital for anyone involved in CRE. If rates stabilize, borrowing costs will likely decrease. This could open up avenues for investments and new projects. With banks regaining confidence in lending, the transactions within the market are on the rise. Yet, there are still concerns about certain assets that could fall into distress. High leveraging can be particularly hazardous.

How does one stabilize interest rates? Government policy plays a big part. It can control inflation, which directly influences interest rates. If inflation remains in check, funds can flow more smoothly into the economy. It’s a delicate balance. Decision-makers must consider the wider implications of their actions.

Government Spending on Productivity-Enhancing Initiatives

Looking ahead, expected government spending on productivity-enhancing initiatives could significantly impact the CRE landscape. As Dr. LaSalia emphasizes, spending in strategic areas is crucial for economic progress. With ongoing discussions around fiscal policies, this spending can stimulate demand within specific asset classes.

- Investments in infrastructure could enhance property values.

- Technological advancements may drive new developments, particularly in industrial spaces.

- Consumer behavior remains a critical driver, influenced by governmental actions.

Ultimately, the interplay between governmental policies and the CRE market is intricate and layered. Factors such as debt sustainability, interest rates, and targeted spending will shape the future dynamics significantly. Stakeholders in this sector should remain attentive, as even minor shifts in policy can create substantial ripples throughout the market.

Consumer Behavior and Its Influence on Market Dynamics

1. Examination of Consumer Spending Patterns Post-Pandemic

The landscape of consumer spending has changed dramatically since the pandemic. With much of the population adapting to new lifestyles, spending patterns have evolved. According to the recent economic briefing by Moody's, consumer expenditure has increased markedly.

This shift isn’t merely a blip; it’s strategic. Many people are now prioritizing both durable and non-durable goods. Can a nation thrive if its citizens abandon spending? The answer is a resounding no. As households reclaim stability, consumer activity serves as a major driver for economic growth.

2. How Consumer Debt and Wage Growth Interplay in Property Demand

The relationship between consumer debt and wage growth is intricate. In today's job market, wage growth is described as non-inflationary, indicating a healthy labor environment. Yet, when debt levels rise, it can impact future property transactions.

- High consumer debt constrains disposable income.

- Wage growth combats the effects of inflation.

- Understanding this interplay is vital for predicting property demand.

Dr. Thomas LaSalia noted that although household balance sheets remain stable, ongoing monitoring is essential. What implications does this have for prospective buyers? They may face challenges navigating high debts while trying to invest in properties.

3. Future Implications of Changing Consumer Habits on the CRE Market

The Commercial Real Estate (CRE) market must adapt to evolving consumer preferences. The demand remains tepid, driven by uncertainty and shifts in lifestyle choices. For example, the office sector, once plagued by remote work trends, is witnessing a rebound in leasing activity.

“A slight recovery in the office sector reflects changing consumer habits,” emphasizes Dr. Erman Gard Jabber during the briefing.

Further, areas such as retail have shown resilience amid consumer optimism, alluding to a less chaotic transaction environment. Will the self-storage market also bounce back? Experts suggest that its fate hinges on mortgage rate improvements.

Ultimately, understanding consumer behavior is crucial for stakeholders in the CRE sector. A strategic focus on these dynamics will likely shape the future of real estate investment and development efforts. Staying informed on these trends can be the game-changer needed for navigating the returning market.

Looking Ahead: What 2024 Holds for CRE

The landscape of Commercial Real Estate (CRE) is evolving. As we step into 2024, stakeholders must grasp the trends shaping this sector. Recent data outlines a cautiously optimistic outlook. It’s essential to dive into key areas affecting property types, interest rate movements, and demographic shifts.

Prognosis for Property Types in Light of Current Data

The sentiment within the CRE sector is mixed. Various property types are experiencing different levels of resilience. For example:

- Office Spaces: There are signs of recovery after several quarters of challenges. In Q3 2024, leasing activity showed positive net absorption. This is the first notable increase in a while.

- Industrial Properties: Stabilization is evident. Effective rent growth has seen a modest uptick.

- Retail Property: Retail has shown more stability, buoyed by consumer optimism and slight rent growth.

However, challenges remain, especially in the office segment. Some assets continue to show distress due to obsolescence or high leverage.

Insights into Expected Interest Rate Movements

Interest rates have a profound impact on lending and CRE dynamics. As noted by Dr. Thomas LaSalia of Moody’s, a clearer economic landscape is emerging. Banks are gaining confidence in lending, an encouraging sign for market behavior.

What will happen next?

- With expected increases in interest rates likely stabilizing, borrowing costs may rise, affecting transaction volumes.

- However, low debt service costs remain a positive sign, suggesting cautious optimism.

This evolving interest rate environment will necessitate careful financial planning for both investors and tenants.

How Demographic Shifts Might Alter Supply and Demand Dynamics

Demographic trends are shifting. Understanding these changes is critical for anticipating demand in CRE. For instance:

- The aging population's needs will influence the housing market, particularly in senior housing.

- Younger generations favor urban living, creating demand for multifamily units in city centers.

These shifts signal potential areas of growth, while challenges such as affordability must be addressed.

In conclusion, as 2024 unfolds, the CRE sector presents both opportunities and challenges. The interplay of interest rates, demographic shifts, and property performance will define market strategies moving forward. Stakeholders must remain vigilant and adaptable. The data from Q3 2024 indicates a sector in transition, ready for evolution. Continuous engagement with current trends will be essential for navigating this complex landscape.

https://www.creconsult.net/market-trends/navigating-the-evolving-landscape-of-commercial-real-estate-in-2024/?fsp_sid=299

Monday, November 25, 2024

Join us for a showing of two fully occupied, cash-flowing multifamily properties ideal for investors.

Showings are set for Monday, November 25th, from 11:00 AM to 12:00 PM.

Property 1: Lyons, IL Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Property 2: Chicago Ridge, IL Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

These properties have undergone recent upgrades and are located close to major amenities. Don’t miss this opportunity to secure stable, income-producing assets! Contact to

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

We invite you to join us for showings of two high-potential multifamily properties on Monday, November 25th, from 11:00 AM to 12:00 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Tuesday, November 19, 2024

Join us for a showing of two fully occupied, cash-flowing multifamily properties ideal for investors. Showings are set for Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24 Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Property 2: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18 Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

These properties have undergone recent upgrades and are located close to major amenities. Don’t miss this opportunity to secure stable, income-producing assets!

Contact to Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

We invite you to join us for showings of two high-potential multifamily properties on Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Friday, November 15, 2024

Unlocking the Potential of Industrial Real Estate: 1150 McConnell Road

Picture yourself strolling through a lively industrial area, where the sounds of machinery and teamwork fill the air. This is the reality at 1150 McConnell Road in Woodstock, Illinois. This expansive manufacturing and distribution center is not just a building; it opens doors to endless possibilities for those in the industrial field. Let’s explore what makes this facility a standout find in the real estate market.

TL;DR: 1150 McConnell Road is a prime 73,245 sq ft industrial facility in Woodstock, IL, featuring modern office space, extensive loading capabilities, and excellent access to major highways, making it perfect for various industrial operations.

The Impressive Features of 1150 McConnell Road

Located in Woodstock, Illinois, the property at 1150 McConnell Road is a major opportunity for businesses looking to expand or invest. Covering a generous area of 73,245 sq ft of heavy-duty construction, the facility is designed to meet the demands of various industries.

Heavy-Duty Construction

The robust construction of this property is particularly noteworthy. With a combination of partial block and steel frame, it's made to withstand the rigors of industrial use. Can you imagine the peace of mind that comes with knowing your facility can handle high-demand operations?

Renovated Office Spaces

One of the standout features is the renovated office spaces. Spanning approximately 10,000 square feet, these spaces are thoughtfully designed for productivity. Equipped with modern offices, collaborative cubicles, and comfortable conference rooms, they aim to attract today’s workforce. Imagine working in a setting that not only looks good but also maximizes productivity.

Well-appointed offices

Employee kitchen

ADA-compliant restrooms

Fitness center

These amenities cater to the diverse needs of employees, making the workspace a more inviting place.

Rail Access for Efficient Distribution

For companies involved in manufacturing and logistics, rail access is crucial. The property provides this key feature, ensuring efficient distribution of goods. This aspect may mean lower transportation costs and faster delivery times. Doesn’t that sound appealing for logistics efficiency?

Robust Power Capabilities

In addition to its structural advantages, 1150 McConnell Road boasts robust power capabilities. This is essential for industrial operations, particularly for enterprises that require significant electrical resources.

This combination of features positions 1150 McConnell Road as not just a building but a fully equipped solution tailored to modern business needs. If you are interested in exploring this exceptional opportunity, visit the property listing for more information.

Understanding the Strategic Location

Location, location, location. This saying plays a crucial role in real estate and business success. Why? Because the right location can significantly influence a company’s operations and bottom line. Situated in Woodstock, IL, just 50 miles from downtown Chicago, this area presents an incredible opportunity for businesses looking to thrive.

Accessibility Matters

One of the most prominent features of Woodstock is its easy access to major transportation routes. Businesses can quickly connect with clients and suppliers via:

US Route 14

US Route 47

Think about it—shift access to highways and routes saves time and boosts efficiency. It also enhances logistics operations. For those engaged in distribution or manufacturing, this feature can't be overstated.

Cost-Effectiveness

The operational costs in Woodstock are notably competitive compared to larger metropolitan areas. Why is that important?

In cities like Chicago, expenses can skyrocket. For many businesses, cutting costs while maintaining quality is essential. Woodstock provides an appealing alternative, allowing companies to invest their savings back into growth and innovation.

Skilled Labor Availability

Another significant advantage is the presence of a skilled labor force. The region isn’t just about affordable costs; it’s also home to established manufacturers like Other World Computing and Medsior. These companies contribute to a pipeline of skilled workers ready to meet the demands of various industries.

Moreover, the supportive business environment further strengthens this location's appeal. Woodstock promotes pro-business policies that encourage growth. This creates a momentum that attracts even more businesses and talent to the area.

In summary, the strategic location of Woodstock, its accessibility, and its skilled workforce make it a prime spot for businesses. The opportunity to engage in a thriving community that is beneficial from both a logistical and financial standpoint is a game changer.

For those intrigued by this unique property offering, the industrial property at 1150 McConnell Road in Woodstock is an opportunity not to be missed. Explore the details further at this link.

.png)

Why Invest in Industrial Real Estate Now?

The landscape of industrial real estate is rapidly evolving. The post-pandemic world has ignited a growing demand for manufacturing spaces. As businesses adapt and expand, investing in industrial properties is no longer just an option; it’s a strategic necessity.

1. Growing Demand for Manufacturing Spaces

Following the pandemic, companies in various sectors are reshaping their operational needs. Factors contributing to this demand include:

Increased E-Commerce: The surge in online shopping has driven businesses to optimize logistics. They now need more warehouse and distribution space.

Reshoring Production: Many firms are relocating manufacturing back to domestic grounds, seeking spaces that meet modern safety and efficiency standards.

The result? A race for viable industrial spaces that can accommodate these evolving needs.

2. Advantages of Versatile Spaces

Investors can find unique value in properties designed for multifunctional use. Properties like the one located at eleven fifty McConnell Road in Woodstock, Illinois, exemplify this flexibility. Such sites are ideal for:

Multi-Industry Usage: From electric car repair to semiconductor production, versatility means attracting diverse tenants.

Customization Potential: Spaces can be tailored to meet specific industry requirements without extensive renovations.

With these advantages in mind, investors can appeal to a broader audience and reduce vacancy rates.

3. Significant ROI Potential

Another compelling reason to invest now is the potential for significant returns on investment (ROI). Consider the options:

Owner-Occupied: Purchasing a property for personal business use can eliminate rental costs and build equity over time.

Tenant Scenarios: Leasing the space to multiple tenants offers a steady revenue stream and reduces overall risk.

This flexibility ensures that investors can maximize their investment's potential, adapting to market demands as needed.

As Randolph Taylor from eXp Commercial states, "Investing in well-located and versatile properties allows for long-term growth and stability.

Today's market presents a wealth of opportunities for savvy investors. With a property like eleven fifty McConnell Road, the combination of strategic location, robust features, and versatile use beckons to be explored. Don’t miss out on this unique opportunity!

Highlighting the Unique Office Space Offering

In today’s competitive market, the right office space can make all the difference. Recently renovated, this attractive office space boasts a generous 10,000 sq ft layout, providing ample room for creativity and productivity. But what truly sets this space apart? Let’s dive into the remarkable features that appeal to a modern workforce.

Modern Amenities

Today’s employees seek more than just a place to sit and work. They desire an environment that fosters collaboration and well-being. This office space includes:

A state-of-the-art fitness center—ideal for quick workouts and stress relief.

Collaborative areas: designed to encourage teamwork and creativity.

Imagine stepping into your office and having the option to take a refreshing break at the gym or meeting a colleague in a vibrant collaborative area. Isn't that an intriguing thought?

An Office Designed for the Modern Workforce

Today’s workforce craves more than just a desk. They want spaces that inspire them. This office has been thoughtfully designed with this in mind.

Well-appointed offices that promote focus and productivity.

Accessible restrooms are ADA compliant, ensuring inclusivity.

Conference rooms are perfect for meetings and brainstorming sessions.

It’s not just about aesthetics; it’s about creating an environment where employees can thrive. Wouldn't you want to work in such an inspiring space? By prioritizing comfort and functionality, this office space meets the needs of today’s dynamic workforce.

Why Choose This Office Space?

Incorporating modern amenities with a focus on employee satisfaction makes this office one to consider. It’s a unique opportunity for businesses looking to attract top talent. Additionally, the layout encourages collaboration and well-being.

To explore this exceptional offering further, head to the property listing for more details: Property Listing. Interested parties can also reach out for an opportunity to see the space firsthand. Don’t miss out on what could be the next perfect office location!

Taking the Next Step: Viewing and Inquiries

When considering your next investment, it’s important to gather all relevant information. The industrial property known as eleven fifty McConnell Road is not just a location; it’s an opportunity.

Explore the Property's Detailed Listing

Start by checking out the detailed listing link. This website offers insights into the expansive seventy-three thousand square feet facility located in Woodstock, Illinois. Imagine a place that’s only fifty miles from downtown Chicago, equipped with essential rail access and modern office spaces. It’s like finding a gem in a city full of them.

Contact the Listing Broker

For any inquiries, don’t hesitate to reach out to the listing broker, Randolph Taylor. He brings expertise in the commercial real estate market and can provide tailored answers to your questions. You can contact him directly at six three zero four seven four six four four one. Could there be a better resource for understanding this property’s potential?

Investment Opportunity or Operating Site

This property is more than just a building; it’s a dual-purpose investment. Not only does it present a significant chance for those looking to generate income or host a tenant, but it’s also suitable for those wanting to establish their manufacturing or distribution operation. Think of it as a blank canvas ready for your vision.

The architectural design, featuring durable block and steel frame construction, caters to a variety of high-demand industries. Whether it’s rail car repair, semiconductor production, or electric car maintenance, this facility has the infrastructure to support those needs. With the added bonus of a recently renovated office space, you can create the ultimate environment for productivity and success.

In summary, eleven fifty McConnell Road in Woodstock offers an attractive mix of strategic location, functionality, and modern amenities. This is not just another property; this is a chance to step into a thriving industrial sector. So, why wait? Explore the possibility of this unique offering today. Your next big move starts here.

https://www.creconsult.net/market-trends/unlocking-the-potential-of-industrial-real-estate-1150-mcconnell-road/?fsp_sid=218

Wednesday, November 13, 2024

Join us for a showing of two fully occupied, cash-flowing multifamily properties ideal for investors. Showings are set for Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Property 2: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

These properties have undergone recent upgrades and are located close to major amenities. Don’t miss this opportunity to secure stable, income-producing assets!

Contact to Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

We invite you to join us for showings of two high-potential multifamily properties on Wednesday, November 20th, from 11:00 AM to 12:30 PM.

Property 1: Chicago Ridge, IL

Address: 9826 Sayre Ave

Price: $2,450,000

Units: 18

Cap Rate (Year 1): 7.95%

Details: sl.creconsult.net/CR

Property 2: Lyons, IL

Address: 4337 Prescott Ave & 7821 43rd St

Price: $3,100,000

Units: 24

Cap Rate (Year 1): 8.13%

Details: sl.creconsult.net/L

Both properties are fully occupied and offer stable cash flow with recent renovations. This is an ideal opportunity for investors seeking income-producing assets in prime locations.

Confirm Your Appointment:

Randolph Taylor, CCIM

📞 630.474.6441

📧 rtaylor@creconsult.net

Thursday, October 31, 2024

Multifamily Mortgage Rates Chicago | October 2024 Update

October 2024 Multifamily Mortgage Rate Update for Chicago Property Owners

For multifamily property owners in the Chicago area, staying informed on mortgage rate changes is essential when evaluating the timing of a potential sale or acquisition. While our primary focus at eXp Commercial is the listing and sale of multifamily properties, understanding current financing trends can support informed decision-making. Here’s the latest update on multifamily mortgage rates from our Capital Markets partner, CommLoan, and insights on how these rates could influence your investment strategy.

October 2024 Multifamily Mortgage Rates Overview

The latest multifamily mortgage rates have seen notable shifts, presenting both challenges and opportunities:

Bank Loans (5-Year Fixed): Now at 6.17%, up by 11 basis points. Although slightly higher, bank loans remain a solid choice for stable financing options.

Agency Loans: Increased to 5.56% for 5-year terms, up by 59 basis points. Agency loans are ideal for larger, long-term investments, offering stability for property buyers and sellers considering repositioning assets.

Agency SBL Loans: Now at 6.44% for both 5- and 7-year terms, reflecting a 45-basis-point rise. Agency SBL loans are designed for smaller properties, supporting streamlined financing even with the recent rate increase.

CMBS Loans: At 6.72% for 5-year terms, up by 30 basis points. CMBS loans provide flexible repayment options, benefiting more complex or large-scale transactions.

How These Rates Impact Chicago Multifamily Property Dispositions

As Chicago-area multifamily brokers, our primary focus is advising clients on property listings and sales. Current rate trends can impact market demand and timing considerations for dispositions:

Refinancing Prior to Sale: Some owners may consider refinancing to improve cash flow or extend holding periods until market conditions are optimal for listing. Locking in current rates can help stabilize finances while awaiting favorable selling opportunities.

Attracting Buyers: For buyers, the rise in agency and CMBS rates may affect purchasing power, influencing the types of financing they pursue. Understanding rate trends can help sellers better anticipate buyer needs and tailor their listing strategies.

Maximizing Sale Value: Even with rate increases, Chicago’s multifamily market remains competitive. By aligning with a brokerage that provides targeted marketing, expert valuation, and strategic negotiation, sellers can position their property to attract strong offers despite changing financing conditions.

Expert Multifamily Brokerage Services for Chicago Investors

With over 26 years of experience in Chicago’s multifamily market, I specialize in providing tailored solutions that support property dispositions. As a Senior Associate with eXp Commercial’s National Multifamily Division, my services are designed to maximize the value of your property through:

Accurate Valuations: In-depth, market-based assessments that help you understand your property’s current worth and its potential appeal to prospective buyers.

Targeted Marketing: Custom marketing strategies that attract competitive offers and increase the visibility of your listing among qualified investors.

Strategic Negotiation: Skilled negotiation to secure favorable terms and ensure a smooth transaction, maximizing your return on investment.

Backed by eXp Commercial’s national resources and our partnership with CommLoan, I provide my clients with insights into financing options that align with current market trends. This collaboration allows me to offer added value, helping you make informed decisions as you consider selling, refinancing, or holding your multifamily assets.

Ready to Explore Listing Options? Schedule a Call

If you’re considering selling your multifamily property or want to understand how today’s mortgage rates may affect your investment strategy, I’m here to help. Let’s discuss how we can position your property to achieve the best possible outcome in Chicago’s multifamily market.

Schedule a discovery call with Randolph Taylor, MBA, CCIM to explore listing opportunities and get expert guidance on maximizing the value of your investment.

Contact Information

Randolph Taylor, MBA, CCIM

Senior Associate | Multifamily Sales Broker

eXp Commercial | National Multifamily Division

📞 (630) 474-6441

📧 rtaylor@creconsult.net

https://www.creconsult.net/market-trends/2024-multifamily-mortgage-rates-chicago-listing/?fsp_sid=153

Multifamily Mortgage Rates Chicago | October 2024 Update

Explore October 2024 multifamily mortgage rates in Chicago and how they impact property sales and listing strategies for investors.

Wednesday, October 30, 2024

Aurora Naperville Multifamily Market Q3 2024 Trends

Aurora Naperville multifamily market Q3 2024 report: rent trends, vacancy rates, and investments. Download the full report now!

Monday, October 28, 2024

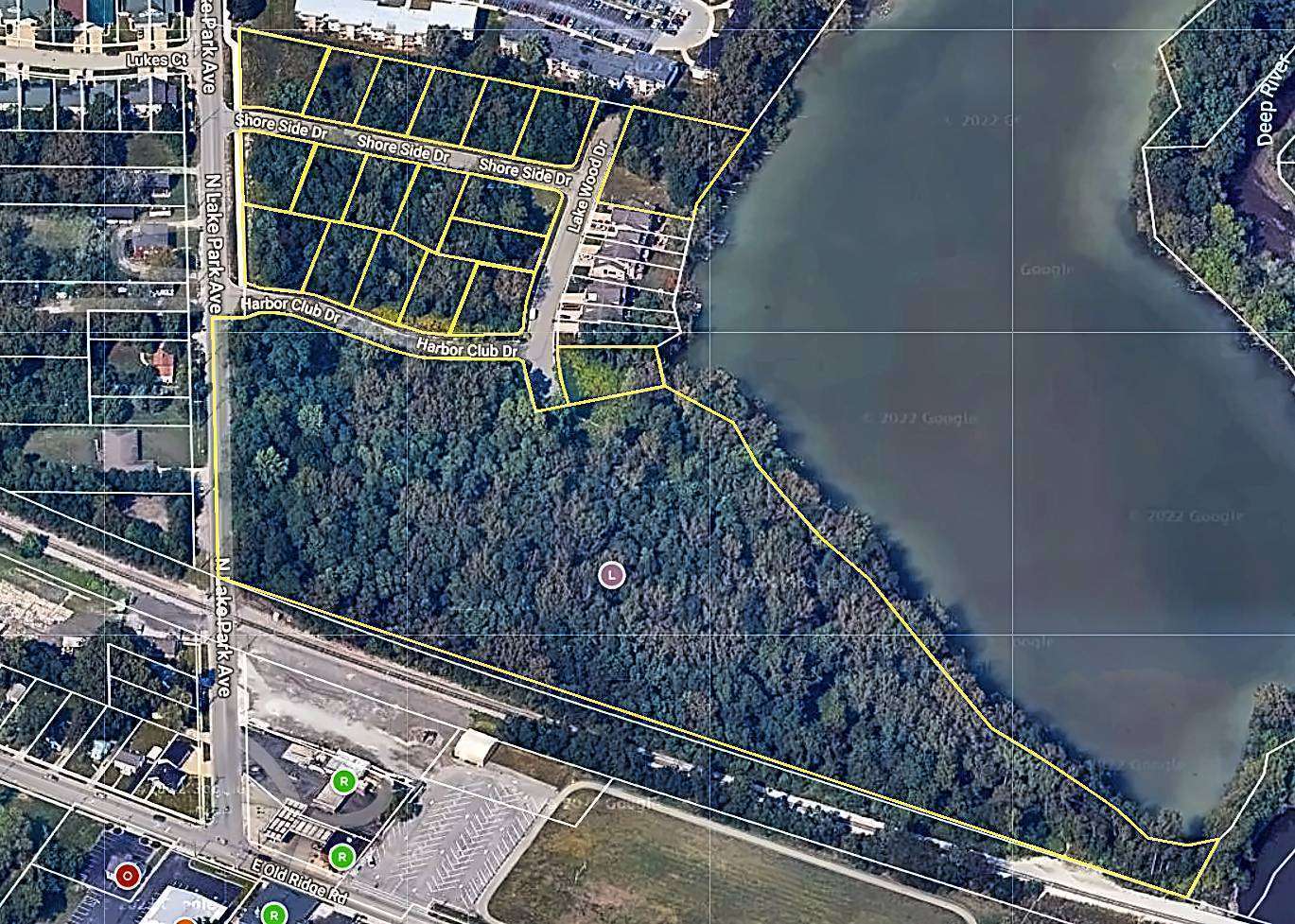

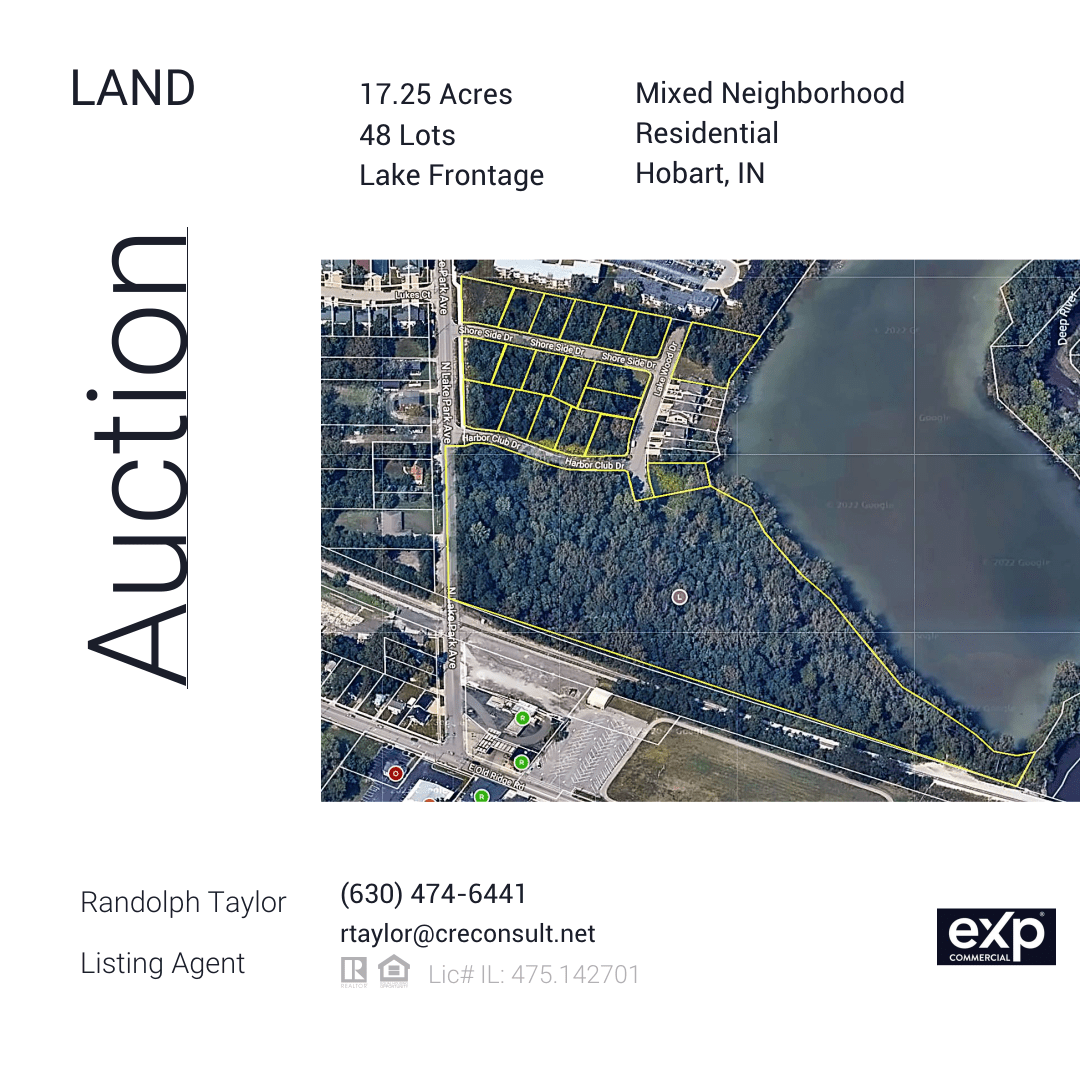

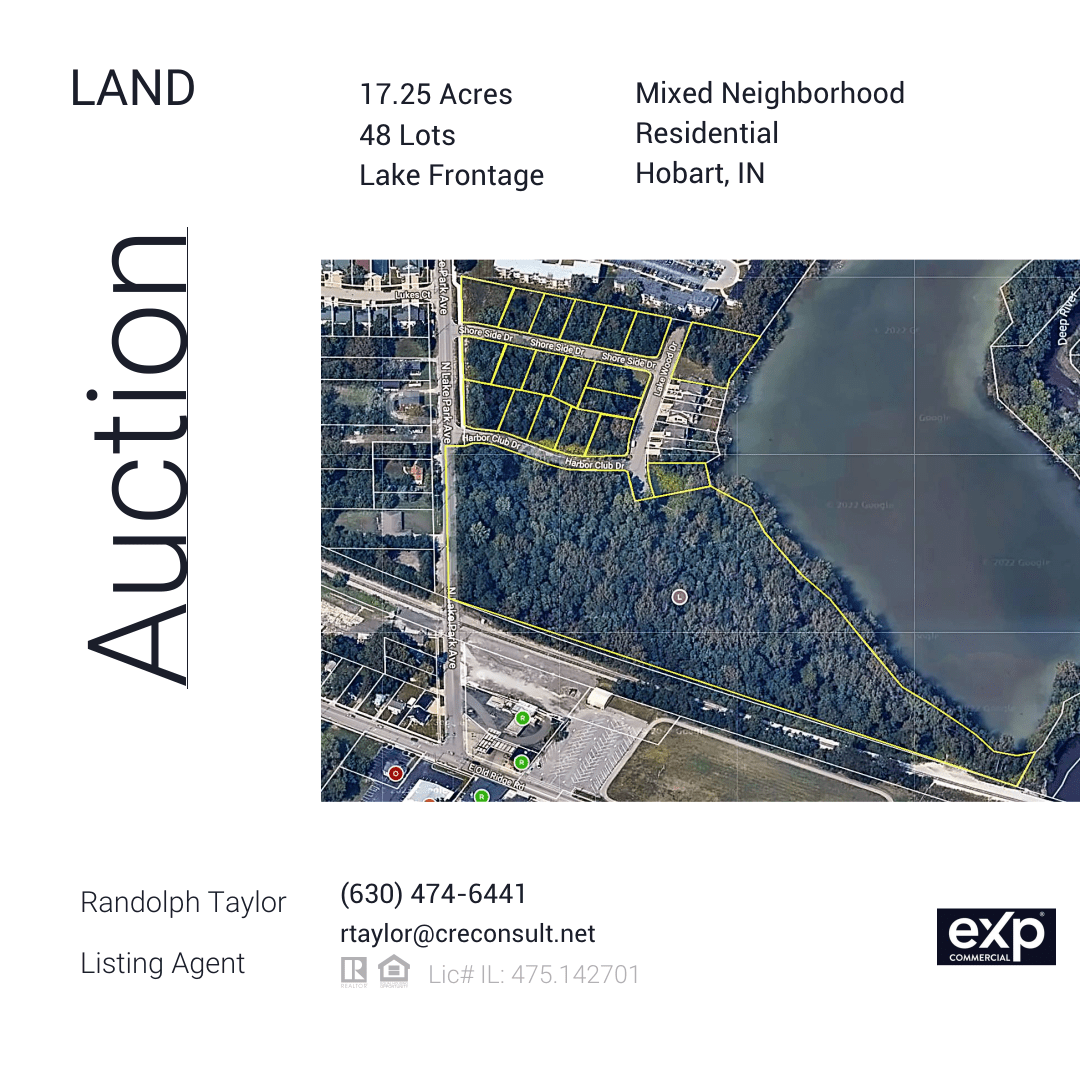

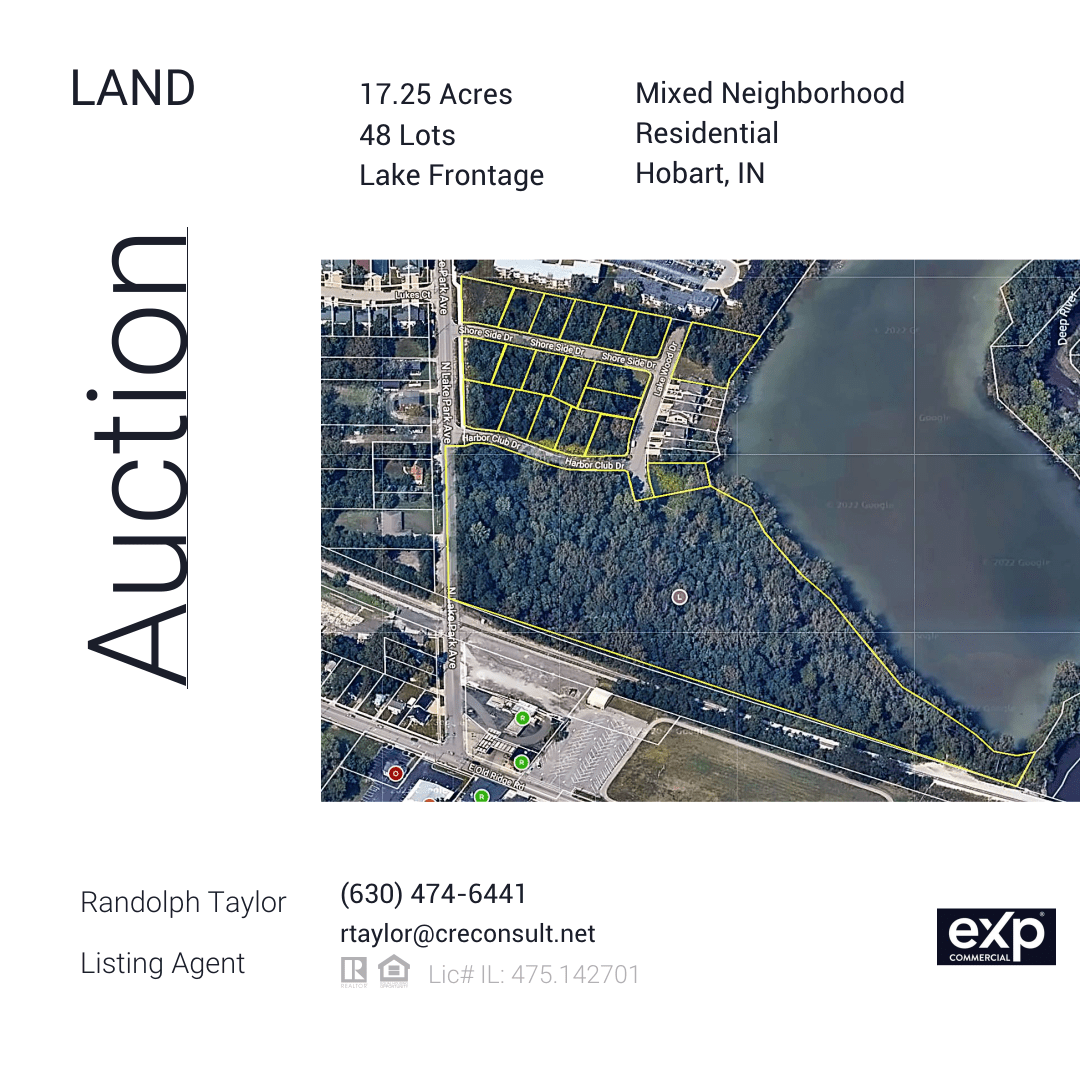

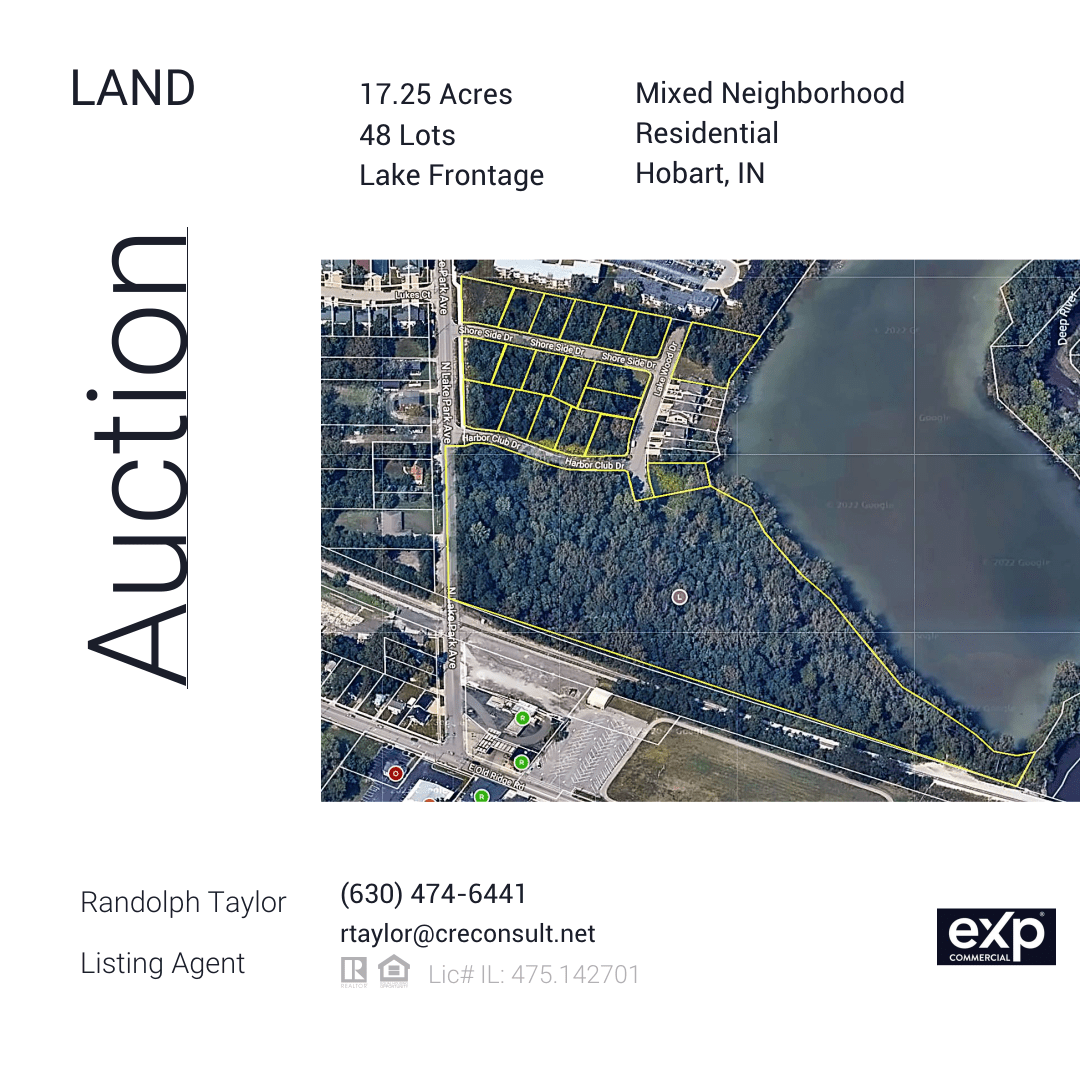

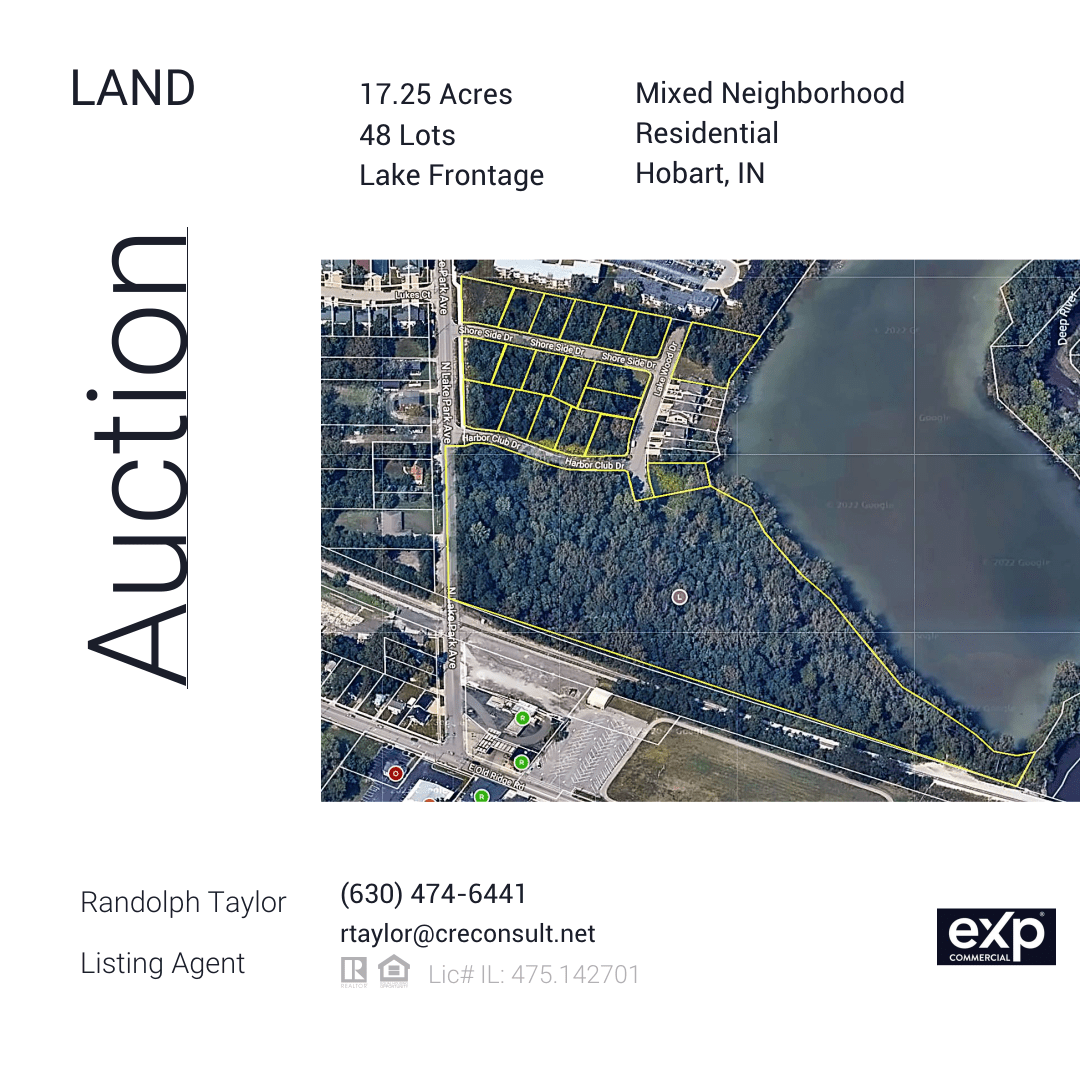

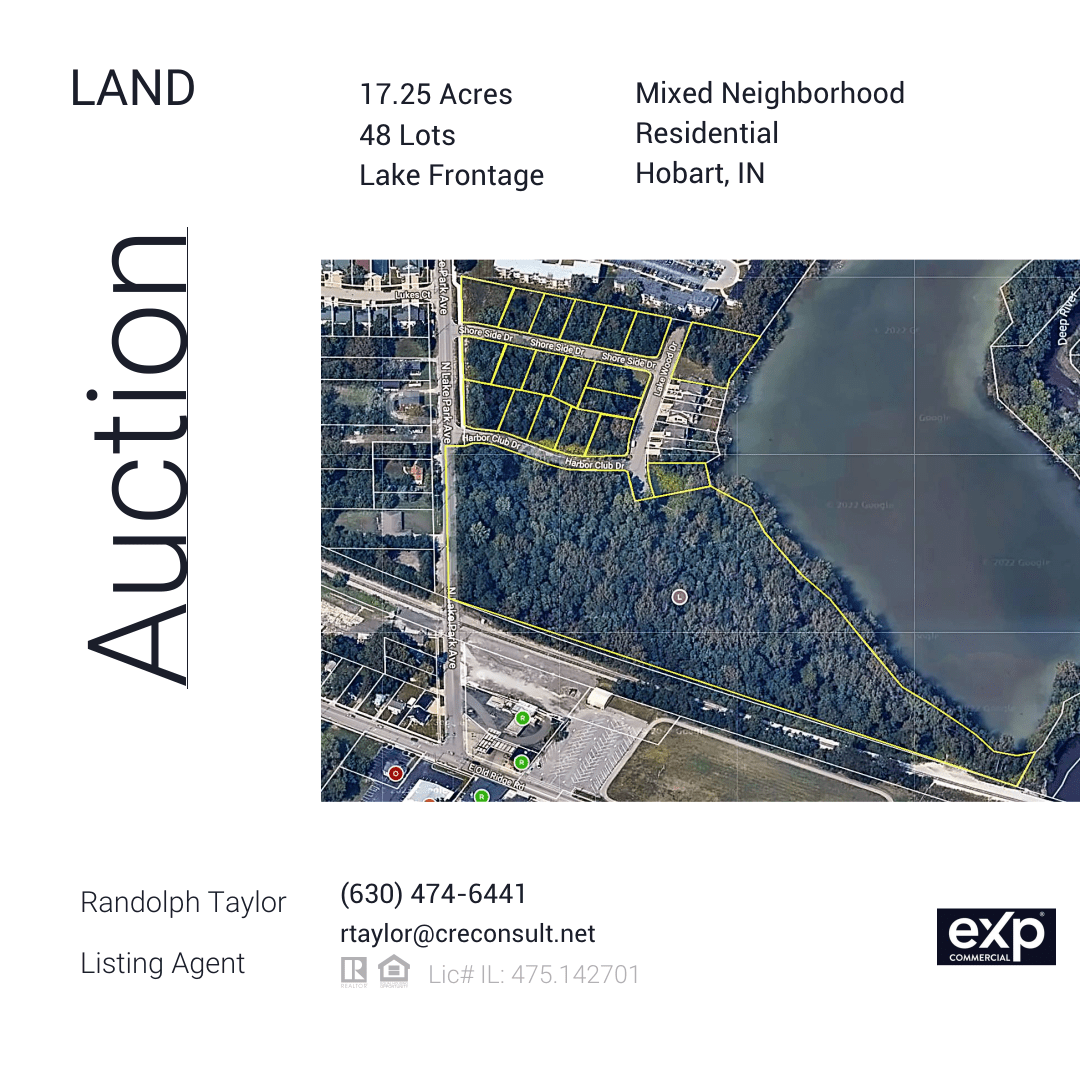

eXp Commercial, led by Randolph Taylor, CCIM, Senior Associate, completed the auction sale of a 17.25-acre property in Hobart, Indiana, for a Chicago client. This transaction highlights our ability to deliver fast and effective solutions through auction strategies, meeting client needs for timing and certainty. Learn how our national reach and multifamily expertise can support your property goals, locally or nationwide.

Randolph Taylor, CCIM

Senior Associate, eXp Commercial

📞 (630) 474-6441 | ✉️ rtaylor@creconsult.net

Press Release: https://www.creconsult.net/transactions/exp-commercial-hobart-indiana-auction/

eXp Commercial Hobart Indiana Auction Sale

FOR IMMEDIATE RELEASE

eXp Commercial Hobart Indiana Auction Sale for Chicago Client

Hobart, Indiana, October 28, 2024 – eXp Commercial successfully completed the auction sale of a 17.25-acre property in Hobart, Indiana, for a Chicago-based client. The transaction, managed by Randolph Taylor, CCIM, highlights eXp Commercial’s national service capabilities. The auction format was chosen to ensure a fast and certain sale, meeting the client’s goals.

The property is located in The Brickyard of Hidden Lake Subdivision and includes 48 platted lots, some with lakefront access. This Hobart Indiana sale aligns with the area’s Mixed Neighborhood Residential use, which supports low- to medium-density developments like single-family homes, attached housing, and multifamily units. This demonstrates eXp Commercial's ability to meet client needs across different states.

Randolph Taylor Leads Hobart Indiana Auction Sale

Randolph Taylor, a Chicago multifamily broker at eXp Commercial, managed the Hobart Indiana auction sale with an integrated platform. This approach ensured a 75-day list-to-close timeline, fulfilling the client’s needs for both speed and liquidity. All auction costs were covered by the buyer, maximizing the seller’s return.

“Our Hobart Indiana auction sale for a Chicago client showcases eXp Commercial’s ability to deliver tailored solutions,” said Randolph Taylor, CCIM. “We offer strategies that work for multifamily properties, whether through traditional sales or auctions.”

Chicago Multifamily Broker Maximizes Property Sales

Randolph Taylor, CCIM, specializes in Chicago multifamily property sales, supported by eXp Commercial’s national network. He helps clients achieve their goals with personalized strategies, whether in Chicago or elsewhere in the U.S.

Learn About eXp Commercial's Auction Services

Find out how eXp Commercial's auction services can benefit your property sales by downloading the eXp Commercial Auctions brochure.

Schedule a Call for Your Property Sale

Explore the best strategy for your property sale, whether traditional or auction-based. Schedule a call with Randolph Taylor, CCIM.

Contact Information:

Randolph Taylor, CCIM

Senior Associate, eXp Commercial Chicago

m: (630) 474-6441 | e: rtaylor@creconsult.net

Schedule a Call

https://www.creconsult.net/transactions/exp-commercial-hobart-indiana-auction/?fsp_sid=101

Tuesday, October 22, 2024

Exclusive Golf Sumac Medical Offices Sale | eXp Commercial

Des Plaines, IL – October 21, 2024 – The Golf Sumac Medical Offices sale was successfully completed by eXp Commercial Chicago. Exclusively listed by Randolph Taylor, this medical office building sold for $3.2 million on October 21, 2024. This transaction demonstrates eXp Commercial’s effectiveness in listing and selling investment properties.

Press Release:https://www.creconsult.net/transactions/exclusive-golf-sumac-sale-exp-commercial/?fsp_sid=88

Friday, October 18, 2024

Looking for an industrial space with excellent logistics potential? We're excited to present 1150 McConnell Rd, now available at a reduced price of **$3.95M (down from $4.75M)**. This 73,245 SF facility offers heavy power capacity, rail access, and recently renovated office space. Just an hour from Chicago, it's perfectly situated for businesses seeking regional and national distribution reach.

🔑 Key Highlights:

• 73,245 SF of industrial space

• 5.2 acres with ample room for operations

• Zoned M1 for versatile industrial uses

• Heavy Power: 2400A/480V/3-phase

• Rail Access for optimized logistics • 10,000 SF Office Space

• Prime access to US-14 and Route 47

• Low vacancy rate in McHenry County (0.8%)

• Vacant in 90 Days – Ideal for Owner-User or Investor

📈 Investment benefits: Close proximity to the Chicago metro area with strong connectivity, projected rent growth, and favorable national market trends.

📥 Download the Offering Memorandum: https://www.creconsult.net/wp-content/uploads/2024/10/1150-McConnell-OM.pdf

🎥 Watch Property Video: https://www.creconsult.net/wp-content/uploads/2024/10/1150-MdConnell.mp4

🌐 View Property Details: https://www.creconsult.net/industrial-property-for-sale-73245-sf-in-woodstock-il/

Contact for more info:

Randolph Taylor, CCIM

Investment Sales Broker

📧 rtaylor@creconsult.net

📞 (630) 474-6441

#CommercialRealEstate #IndustrialRealEstate #RealEstateInvestment #CRE #ChicagoRealEstate #Logistics #RailAccess #Manufacturing #InvestmentOpportunity #WarehouseSpace #PropertyForSale #RealEstateDeals

Friday, October 11, 2024

🏢 For Sale: 4337 Prescott Ave & 7821 43rd St, Lyons, IL

💰 Sale Price: $3,100,000

eXp Commercial is excited to present this exclusive 24-unit multifamily portfolio, offering a stable investment opportunity in Lyons, just 13 miles from downtown Chicago.

🔑 Property Highlights:

* 24 Units Across 2 Properties: 12 units per property with a mix of 1-bed/1-bath and 2-bed/1-bath units

* Fully Occupied: Immediate cash flow potential

* Recent Upgrades: New heating systems, HD security cameras, and updated units

* Cap Rate: 6.23% (Current) | 8.13% (Year 1)

* Amenities: On-site laundry, off-street parking, individual heating controls

📍 Prime Lyons Location: Close to major routes, Metra, and PACE bus stops, with nearby retail, dining, and entertainment options like Brookfield Zoo.

👉 Learn More & View Full Offering: https://www.creconsult.net/chicago-multifamily-listings/lyons-il-multifamily-portfolio-for-sale/

Contact me for more information or to schedule a tour: 📞 Randolph Taylor MBA, CCIM

💼 Investment Sales Broker, National Multifamily Division, eXp Commercial – Chicago

📱 630.474.6441

✉️ rtaylor@creconsult.net

Don’t miss out on this prime investment opportunity in a thriving rental market! #MultifamilyForSale

#RealEstateInvestment #LyonsIL #eXpCommercial #InvestmentOpportunity

🏢 For Sale: 9826 Sayre Ave, Chicago Ridge, IL 60415 💰 Sale Price: $2,450,000

eXp Commercial is excited to bring to market this fully occupied 18-unit multifamily property in the thriving suburb of Chicago Ridge, just 14 miles from downtown Chicago.

🔑 Property Highlights:

* 18 Units: 8 one-bedroom & 10 two-bedroom units

* 6 Renovated Units with potential for rent growth

* Current Cap Rate: 6.56% | Cap Rate (Year 1): 7.95%

* Recent Improvements: High-efficiency boiler, HD video security system

* Amenities: On-site laundry, private patios/balconies, ample parking

* Strategic Location: Close to Metra, major highways, and retail hubs

📍 Why Chicago Ridge? Strong rental demand, low vacancy rates, and convenient access to urban amenities make this a stable investment with room for growth. Positioned for increased cash flow through further renovations.

👉 Learn More: Property Details https://www.creconsult.net/chicago-multifamily-listings/chicago-ridge-il-multifamily-property-for-sale/

Don't miss out on this incredible opportunity! Contact us today for more information. 📞

#CommercialRealEstate #Multifamily #InvestmentOpportunity #ChicagoRidge #eXpCommercial #PropertyForSale

Friday, October 4, 2024

Now $1,150,000 (Reduced from $1,200,000)

This fully occupied 16,000 SF industrial property in Woodstock, IL is a great investment opportunity with stable tenants and excellent flexibility for future use.

Property Details:

📐 16,000 SF industrial building

📏 Lot size: 1 acre

🏢 Zoning: M1

💰 NOI: $86,552

📊 Cap Rate: 7.53%

✅ Fully occupied with established tenants

Key Features:

🏗️ Steel construction / steel roof

⬆️ 14′ clear heights

🚪 2 dock-high doors

🚪 1 grade-level door

🔥 Fully sprinklered and monitored

Located 50 miles from downtown Chicago with easy access via US-14 and Route 47.

View Full Listing https://www.creconsult.net/occupied-industrial-property-woodstock-sale/

#PriceReduction #IndustrialProperty #WoodstockIL #CRE #eXpCommercial #InvestmentProperty

Thursday, October 3, 2024

For Sale: Industrial Property | 1150 McConnell Rd, Woodstock, IL 60098

💰New Price: $4,450,000 (was $4,750,000)

📏 Building Size: 73,245 SF

🏞 Lot Size: 5.2 Acres

⚡️ Zoning: M1

🔌 Heavy Power: 2400Amp/480V/3-Phase

eXp Commercial is excited to present this versatile industrial manufacturing and distribution facility. This property offers rail access, newly renovated offices, and exceptional power capabilities for high-demand industries. Whether you need space for manufacturing, storage, or repair, this property has it all.

Located just 50 miles from downtown Chicago with easy access via US-14 & Route 47, this is a prime opportunity for owner-users or investors.

✨ Features include:

* 5 Dock-High Doors

* 1 Grade-Level Door

* 14-foot Clear Heights

* Fully Renovated Offices (10,000 SF)

* Heavy Floor Load (9” Concrete)

* Rail Spur Access

Don't miss out on this incredible deal! Contact us for more details or visit the link below:

🔗 https://www.creconsult.net/industrial-property-for-sale-73245-sf-in-woodstock-il/

#IndustrialRealEstate #ForSale #PriceReduction #eXpCommercial #WoodstockIL #InvestmentOpportunity #ManufacturingFacility #RailAccess #CRE

Wednesday, September 25, 2024

Hobard Auction

** Bidding Closes TODAY 12:20 PM CST**

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Hobard Auction

** Bidding Closes TODAY 12:20 PM CST**

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Friday, September 20, 2024

Hobard Auction

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Friday, September 13, 2024

Hobard Auction

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Monday, September 9, 2024

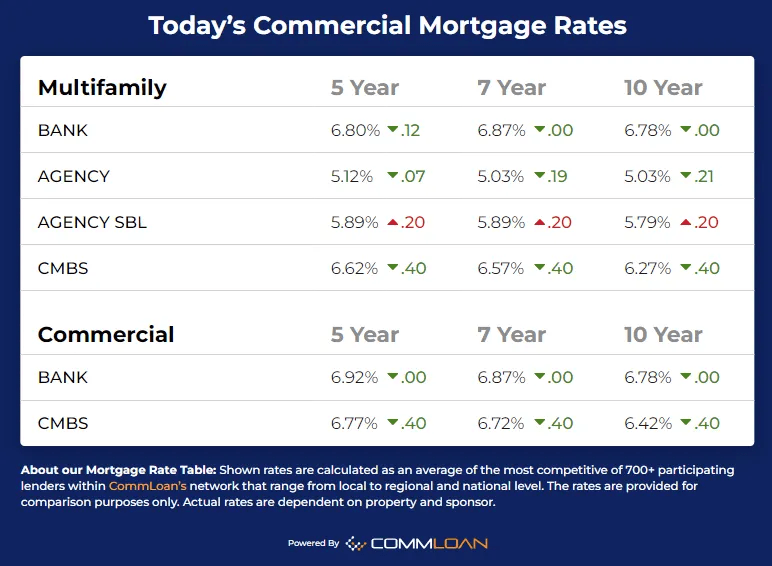

Multifamily Mortgage Rates – September 2024 Update

Staying on top of multifamily mortgage rates is critical for real estate investors seeking to optimize their investments. As of September 2024, notable adjustments in rates present both challenges and opportunities in the multifamily market. Understanding these changes can help property owners make informed decisions, whether they are looking to refinance, acquire new properties, or reassess their current financial strategies.

Key Rate Changes for September 2024

- Bank Rates for 5-year terms have decreased by 12 basis points, now at 6.80%. This presents an opportunity for investors to secure favorable terms for refinancing or new acquisitions.

- Agency Rates have fallen by 7 basis points, now at 5.12%. These rates are typically advantageous for larger properties, providing stability and competitive terms for long-term investments.

- Agency SBL Rates (Small Balance Loans) have increased by 20 basis points, now at 5.89%. These loans target smaller properties and offer an efficient solution for investors dealing with properties under specific loan amounts.

- CMBS Rates dropped by 40 basis points, now at 6.62%. This decrease makes CMBS loans attractive for larger, more complex multifamily deals that require flexible repayment structures.

These shifts in multifamily mortgage rates are important to monitor, as they influence the cost of borrowing and ultimately the profitability of real estate investments.

Understanding Your Loan Options

- Agency loans offer stability with long-term, fixed rates. These are ideal for institutional investors or those looking to hold onto larger properties for extended periods.

- Agency SBL loans target smaller multifamily properties, typically offering competitive rates for properties under certain loan balances. They are designed for more modest-sized assets, but with the same benefits of Agency loans.

- CMBS loans (Commercial Mortgage-Backed Securities) are an excellent choice for investors looking for more flexibility in repayment terms, especially when dealing with larger, more complex deals. These loans are structured through securities and can offer unique advantages for certain financial strategies.

How This Affects Investors

The current changes in multifamily mortgage rates provide an excellent opportunity for investors to review their financing strategies. Whether you’re considering refinancing an existing loan or purchasing a new multifamily property, now might be the time to lock in favorable terms. Given the recent adjustments, working with a knowledgeable capital partner can ensure you make the most of these market conditions.

Next Steps: Schedule a Call

At eXp Commercial, we are committed to helping our clients navigate these market shifts with expert advice and tailored solutions. In partnership with CommLoan, we provide a wide range of financing options suited for multifamily investments. Whether you’re looking to refinance, expand your portfolio, or simply assess your options, we’re here to assist you every step of the way.

Contact us today or schedule a call to discuss your financing needs. Let us help you secure the best terms and maximize the profitability of your multifamily investments.

https://www.creconsult.net/market-trends/multifamily-mortgage-rates-september-2024/Friday, September 6, 2024

Hobard Auction

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Thursday, September 5, 2024

Chicago Multifamily Market Q2 2024: Key Insights for Property Owners

The Chicago multifamily market in Q2 2024 remains stable, offering property owners opportunities for strong rental performance, low vacancy rates, and sustained investor demand. Whether you’re considering refinancing, holding your property, or exploring a potential sale, these insights will help you understand the current market conditions.

Key Metrics for Chicago Multifamily Properties

1. Consistent Rent Growth

Rents in the Chicago metro market have continued to grow steadily. In Q2 2024, average asking rents rose to $1,780 per unit, marking a 3.6% increase year-over-year. This sustained growth reflects strong tenant demand across the metro area. Projections suggest rents will continue to rise, reaching $1,796 per unit by the end of 2024, offering further potential for income optimization.

2. Low Vacancy Rates Support Cash Flow Stability

Vacancy rates across the Chicago metro market have improved to 4.7%, ensuring steady occupancy and cash flow for property owners. The lower vacancy rate in Class B/C properties (at 2.9%) indicates particularly high demand for mid-tier assets, while Class A properties experience slightly higher vacancies at 8.6%. This difference highlights opportunities to maximize returns in properties catering to the broader rental market.

3. Investment Activity and Sales Trends

The Chicago multifamily market continues to attract significant investor interest. In Q2 2024, total transaction volume reached $442.79 million, with notable deals in key metro locations. The average cap rate for multifamily properties is 5.9%, indicating competitive bidding for quality assets. Major transactions include 1326 S Michigan Ave ($144 million) and 850 N Lake Shore Dr ($79.75 million), reflecting strong market confidence.

4. Limited New Construction Prevents Oversupply

New construction in the Chicago multifamily market remains restrained, with only 0.3% annual inventory growth. This minimal growth helps maintain a healthy balance between supply and demand, ensuring that existing properties face less competition from new developments. This trend supports rent increases and maintains occupancy stability, providing property owners with a favorable market environment.

Market Outlook for the Rest of 2024

Looking ahead, rental demand in the Chicago metro market is expected to remain strong, with projected rent growth pushing average asking rents to $1,796 by year-end. Vacancy rates are likely to stay stable at around 5%, creating a favorable outlook for property owners. Investors remain active, providing opportunities to assess your asset's value for refinancing or potential sale.

For more in-depth insights, download Moody’s CRE report here. A partner of eXp Commercial, Moody's CRE, has provided this report.

How We Can Help

At eXp Commercial, we provide tailored guidance to multifamily property owners in the Chicago metro area. Whether you’re considering buying, holding, refinancing, or selling, we offer the insights you need to make the most of your property. Schedule a discovery call or contact us to discuss your property’s next steps.

https://www.creconsult.net/market-trends/chicago-multifamily-market-q2-2024/Tuesday, September 3, 2024

Sequence 8

View our Blog To Keep Up To Date On

The Multifamily Market

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

https://www.creconsult.net/blog/

Friday, August 30, 2024

Hobard Auction

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Wednesday, August 28, 2024

Essential Insights for Chicago Multifamily Investors: Q2 2024 CRE Webinar

The Q2 2024 CRE webinar hosted by Moody’s and eXp Commercial is a key event for Chicago multifamily property owners. This webinar will dive into crucial insights about the current commercial real estate landscape, emphasizing how economic shifts impact the multifamily sector. Attending this event will equip you with the knowledge needed to navigate these changes effectively.

Why Attend the Q2 2024 CRE Webinar

This CRE webinar will feature industry experts from Moody’s and eXp Commercial, discussing the latest trends affecting the real estate market. Whether you're dealing with shifting vacancy rates, assessing rent growth opportunities, or understanding broader economic impacts, this session provides the essential information you need to make informed decisions about your investments.

Key Takeaways from the Webinar

- Vacancy Rates and Rent Trends: Learn how current market shifts affect your Chicago multifamily investments.

- Economic Impacts: Understand how changes in interest rates and other economic factors influence your properties.

- Strategic Opportunities: Discover opportunities for acquisition, disposition, or refinancing to optimize your portfolio.

This session isn’t just about data; it’s about delivering insights that can directly impact your investment strategy.

Align Your Strategy with Market Trends

Moody’s, a trusted research provider, and eXp Commercial bring their expertise to this CRE webinar. The information shared will be vital for aligning your investment strategy with the latest market intelligence. You’ll gain actionable insights to better manage your multifamily investments in Chicago.

Curious about how these insights apply to your properties? After the webinar, schedule a call with us to discuss your investment goals and how we can assist with your acquisition, disposition, and financing strategies.

Reserve Your Spot Today

Don’t miss this opportunity to gain insights that can influence your investment strategy. Register now to secure your spot in the Q2 2024 CRE webinar and stay ahead in the competitive Chicago market.

https://www.creconsult.net/events/q2-2024-cre-webinar-chicago-multifamily/Sequence 7

No Matter Where You Are In The Investment Cycle

with Your Multifamily Property

We Can Help You!

Buy | Sell | Hold | Finance

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

https://www.creconsult.net/

Tuesday, August 27, 2024

Sequence 6

Expert Property Tax Evaluation to Estimate The

Potential to Appeal Your Property Taxes

REQUEST: https://www.creconsult.net/resources/

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

Friday, August 23, 2024

Hobard Auction

I’m excited to announce that a prime 17.25-acre residential development property at 150 Harbor Club Dr, Hobart, IN, is going to auction! 🏘️ This is a rare opportunity to acquire land within The Brickyard of Hidden Lake Subdivision, featuring 48 platted lots, including coveted lakefront property. 🌊

Key Highlights:

* Mixed Neighborhood Residential Zoning: Perfect for low- to medium-density housing.

* Prime Location: Just 39 miles southeast of Chicago.

* Thriving Market: Hobart is experiencing strong demand and growth, with a median home price of $237,300.

📅 Auction Bidding Starts: September 23 at 11:00 AM.

Don’t miss out on this incredible development opportunity! Click the link to learn more and register to bid.

https://www.crexi.com/properties/1646245/indiana-the-brickyard-of-hidden-lake

Contact Information:

Randolph Taylor, CCIM

Commercial Real Estate Broker

eXp Commercial-Chicago

📞 630-474-6441

📧 rtaylor@creconsult.net

#realestate #auction #developmentopportunity #HobartIN #investment #commercialrealestate #eXpCommercial

Wednesday, August 21, 2024

Sequence 5

Current Market Rents For Your Multifamily Property

Estimate Potential Rental Income

REQUEST: https://www.creconsult.net/resources/

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

Tuesday, August 20, 2024

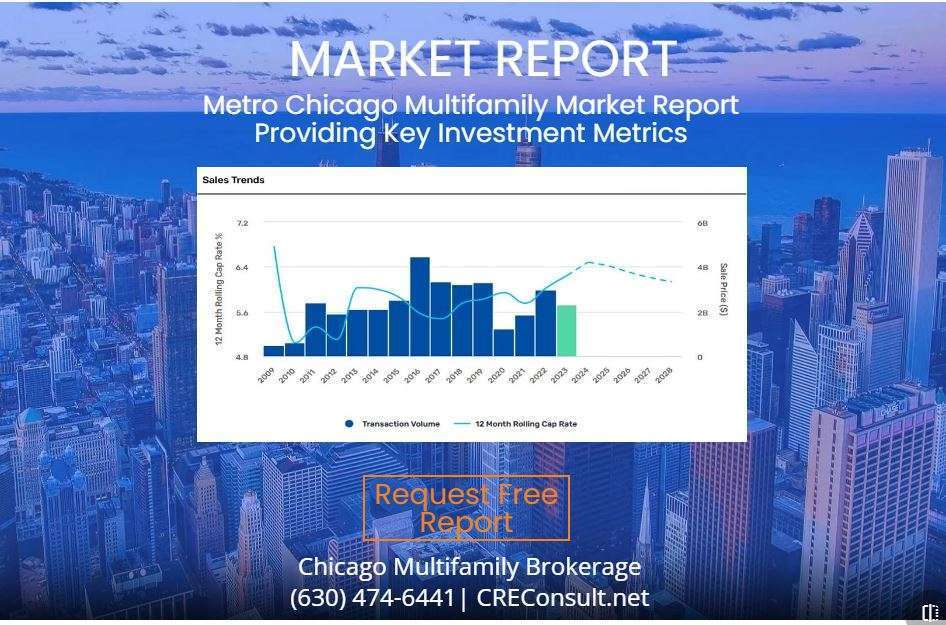

Sequence 4

Metro Chicago Multifamily Market Report

Providing Key Investment Metrics

REQUEST: https://www.creconsult.net/resources/

Randolph Taylor

Multifamily Investment Sales Broker - Chicago

eXp Commercial | National Multifamily Division

(630) 474-6441 | rtaylor@creconsult.net

Monday, August 19, 2024

Optimize Multifamily Property Value for Top Market Price

Introduction:

In multifamily real estate, Multifamily Property Value Optimization is essential to securing a top market price. By optimizing your property’s value, you can maximize your return on investment and attract premium offers.

How to Optimize Your Multifamily Property Value

Why Optimize Your Multifamily Property Value?

There are numerous reasons why property owners decide to sell their multifamily assets. These reasons generally fall into three categories: problems, opportunities, and changes. However, no matter the reason for selling, ensuring your property is operating at its optimum level will maximize your return on investment.

Common Reasons for Selling:

- Problems:

- Management Challenges: Difficulty in managing the property or dealing with problematic tenants can lead to burnout.

- Vacancy Issues: Persistent vacancies can drain resources and reduce income.

- Maintenance Costs: Aging properties often require expensive repairs, impacting profitability.

- Neighborhood Decline: Changes in the surrounding area can decrease property value.

- Interest Rate Increases: Rising interest rates can impact your mortgage payments, squeezing your cash flow.

- Opportunities:

- Strong Market Values: A booming market might present an ideal time to sell.

- Alternate Investments: You may want to diversify your portfolio or move into other investment types.

- Tax Savings: Taking advantage of tax incentives or 1031 exchange opportunities can make selling advantageous.

- End of Hold Period: If you’ve reached the end of your intended hold period, it may be time to realize your gains.

- Changes:

- Life Events: Divorce, retirement, or the passing of a partner can necessitate a sale.

- Relocation: Moving to a different area might prompt you to sell your property.

- Partnership Splits: Disagreements or changes in partnerships often lead to property sales.

Key Strategies for Multifamily Property Value Optimization

- Enhance Curb Appeal: First impressions matter. Invest in landscaping, exterior paint, and lighting to make your property more attractive to potential buyers.

- Increase Operational Efficiency: Implement energy-efficient systems, reduce utility costs, and streamline management processes. A well-run property is more appealing to investors.

- Update Units: Renovate kitchens, bathrooms, and common areas. Modern, updated units can command higher rents and attract more tenants, boosting your NOI (Net Operating Income).

- Optimize Rent Levels: Conduct a rent analysis to ensure you’re charging market rates. Gradually increasing rents over time can significantly boost your property’s value.

- Reduce Vacancy Rates: Keep your occupancy high by ensuring your units are desirable and well-maintained. Address tenant concerns promptly to maintain a positive relationship.

- Implement Professional Management: A professional property management team can increase efficiency, reduce vacancies, and ensure your property is well-maintained, all of which increase value.

How to Minimize Capital Gains Tax When Selling

When selling a multifamily property, capital gains tax can significantly impact your profits. However, there are strategies available to defer or minimize this tax:

- 1031 Exchange: Defer capital gains by reinvesting proceeds into another like-kind property.