Staying on top of multifamily mortgage rates is critical for real estate investors seeking to optimize their investments. As of September 2024, notable adjustments in rates present both challenges and opportunities in the multifamily market. Understanding these changes can help property owners make informed decisions, whether they are looking to refinance, acquire new properties, or reassess their current financial strategies.

Key Rate Changes for September 2024

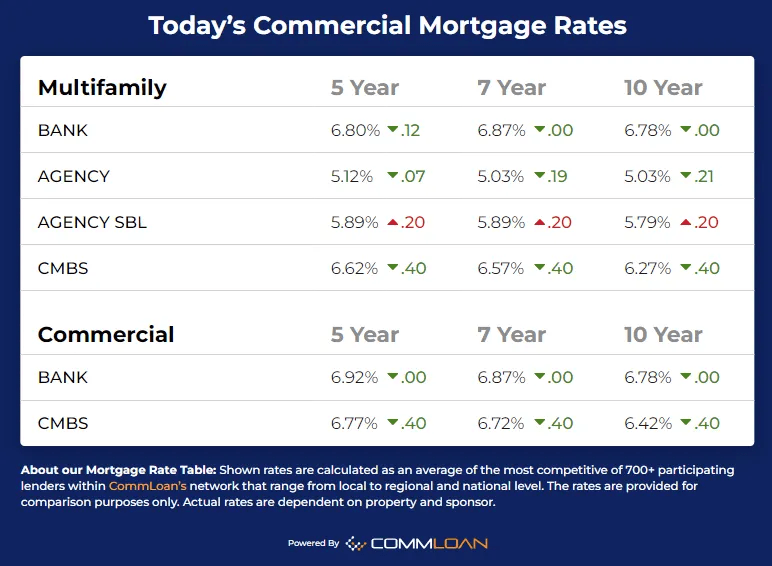

- Bank Rates for 5-year terms have decreased by 12 basis points, now at 6.80%. This presents an opportunity for investors to secure favorable terms for refinancing or new acquisitions.

- Agency Rates have fallen by 7 basis points, now at 5.12%. These rates are typically advantageous for larger properties, providing stability and competitive terms for long-term investments.

- Agency SBL Rates (Small Balance Loans) have increased by 20 basis points, now at 5.89%. These loans target smaller properties and offer an efficient solution for investors dealing with properties under specific loan amounts.

- CMBS Rates dropped by 40 basis points, now at 6.62%. This decrease makes CMBS loans attractive for larger, more complex multifamily deals that require flexible repayment structures.

These shifts in multifamily mortgage rates are important to monitor, as they influence the cost of borrowing and ultimately the profitability of real estate investments.

Understanding Your Loan Options

- Agency loans offer stability with long-term, fixed rates. These are ideal for institutional investors or those looking to hold onto larger properties for extended periods.

- Agency SBL loans target smaller multifamily properties, typically offering competitive rates for properties under certain loan balances. They are designed for more modest-sized assets, but with the same benefits of Agency loans.

- CMBS loans (Commercial Mortgage-Backed Securities) are an excellent choice for investors looking for more flexibility in repayment terms, especially when dealing with larger, more complex deals. These loans are structured through securities and can offer unique advantages for certain financial strategies.

How This Affects Investors

The current changes in multifamily mortgage rates provide an excellent opportunity for investors to review their financing strategies. Whether you’re considering refinancing an existing loan or purchasing a new multifamily property, now might be the time to lock in favorable terms. Given the recent adjustments, working with a knowledgeable capital partner can ensure you make the most of these market conditions.

Next Steps: Schedule a Call

At eXp Commercial, we are committed to helping our clients navigate these market shifts with expert advice and tailored solutions. In partnership with CommLoan, we provide a wide range of financing options suited for multifamily investments. Whether you’re looking to refinance, expand your portfolio, or simply assess your options, we’re here to assist you every step of the way.

Contact us today or schedule a call to discuss your financing needs. Let us help you secure the best terms and maximize the profitability of your multifamily investments.

https://www.creconsult.net/market-trends/multifamily-mortgage-rates-september-2024/

No comments:

Post a Comment