Highlights of the forecast include an uptick in average rent and as much as $380 million in deal volume.

Top and Bottom 10 Metros by Gross Income Growth for 2024. Image courtesy of Freddie Mac

Construction and supply

The construction pipeline is expected to be robust in 2024, with just under 1 million units being built and most of them delivered in the new year. However, some timelines will extend into 2025 due to construction delays, which is likely to prolong the impact elevated supply has had on multifamily performance. Despite a busy year for deliveries, vacancy rates are expected to remain relatively stable, resulting in stabilized cap rates and property values, according to the report. The vacancy rate for 2024 is forecast at 5.7 percent, 40 basis points higher than the 2000–2022 average.

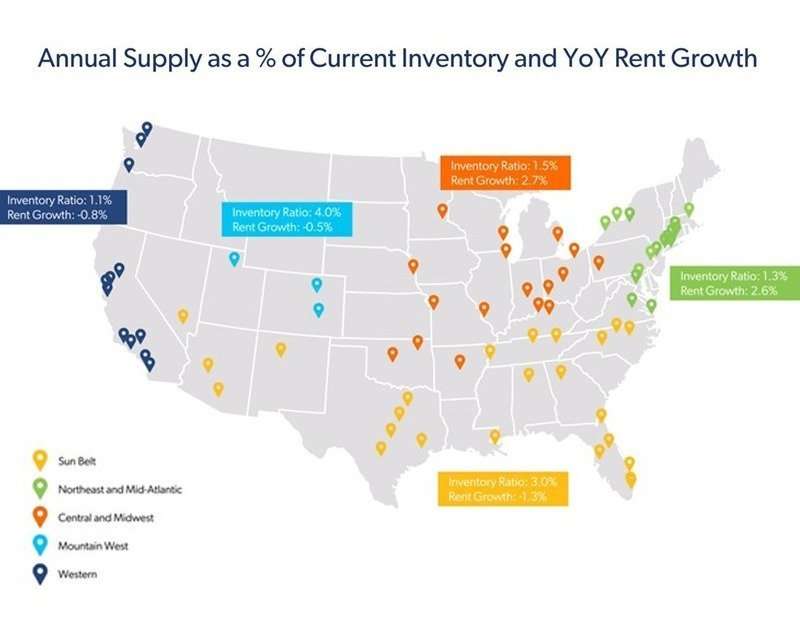

Annual Supply as a percentage of Current Inventory and YoY Rent Growth. Image courtesy of Freddie Mac and The RealPage

Interest rates are unchanged but high

As the year ends, economic conditions appear to be moderating, and there may be a soft landing after all. The outlook expects job, wage, and GDP growth to slow but remain positive and inflation to continue to decrease. However, Sara Hoffmann, director of multifamily research at Freddie Mac, said in a prepared statement that there may still be a bit of a bumpy road throughout the next year, including continued higher interest rates. While it appears the Federal Reserve has finished raising interest rates this cycle, many economists expect the higher-for-longer interest rate environment to continue throughout 2024. When the Federal Open Market Committee held its final meeting of 2023 last week, the Federal Reserve left interest rates unchanged for the third consecutive meeting after a year of steep increases. It’s unclear when rate cuts may come. Also cause for concern for investors, the 10-year Treasury rate changes have been volatile in recent months. The report notes it moved between 3.5 percent and 4 percent for the first half of 2023, then increased and peaked at nearly 5 percent in October. The rate has been just under 4 percent so far this week. The report notes that any additional cap rate increases will put downward pressure on property values. While the rate of property value decline slowed in the second and third quarters of 2023, valuations have declined 13.3 percent since the peak in valuations in the second quarter of 2022.Source: Freddie Mac Outlook for 2024: Moderate Growth

https://www.creconsult.net/market-trends/2024-multifamily-market-forecast/

No comments:

Post a Comment