At the halfway point of the year, Cleveland, Cincinnati, Columbus, and Chicago have all seen rent growth well ahead of the national average.

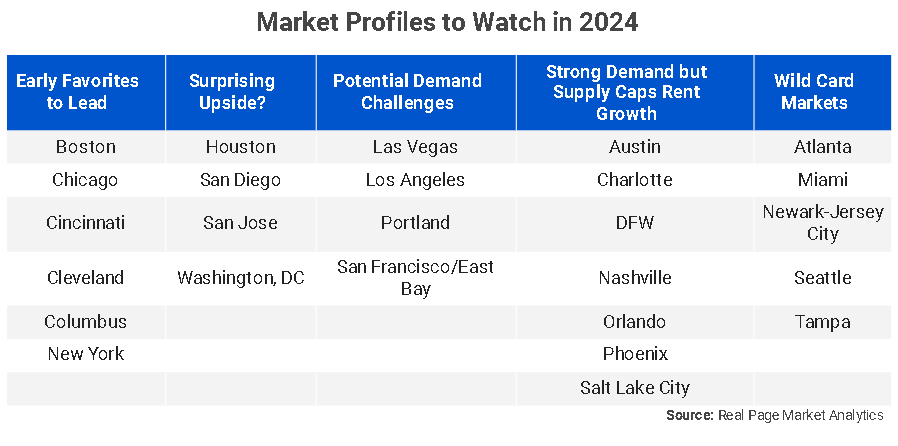

RealPage economists have picked several apartment markets that they expected would perform well in 2024 earlier this year. Those markets included Boston, Chicago, Cincinnati, Cleveland, Columbus, and New York. At the halfway point of the year, the firm took a look at its picks to see how they were doing.

RealPage's picks shared a common theme: limited supply pipelines. That kept many of its top markets ahead of the pack six months into the year. Strong demand is also bolstering Cleveland, Cincinnati, Columbus, and Chicago, all of which have seen rent growth well ahead of the national average.

San Jose and Washington, D.C., which RealPage predicted would show surprising upside at the start of the year, also have experienced rent growth outpacing national norms. San Jose may be on the cusp of re-securing some job growth due to AI-driven tech improvement, and migration flowing back into the nation's capital has helped support revenue growth, said RealPage.

The firm picked Las Vegas, Los Angeles, Portland, and San Francisco as markets that would face some potential demand challenges. As of mid-year, its predictions have experienced mixed results. Los Angeles and Portland both have struggled to maintain any traction in 2024 as locally sluggish economic growth appears to be holding the markets back, and Portland's annual job loss ranks second-worst among the nation's 50 most populous metro areas. However, Los Angeles has seen modest 0.6% growth despite extremely elevated turnover in Downtown LA and Mid-Wilshire. Los Angeles saw 52% turnover among leases expiring in June 2024, the fourth highest in the country.

The Austin and Dallas-Fort Worth markets both ranked within the nation's top 3 markets for absorption to start the year, pointing to strong demand in those markets. However, at mid-year, rent growth has not materialized in the Texas markets due to large supply volumes. Phoenix also ranks in the top 5 for absorption, yet it has seen persistent rent cuts. Nashville has outperformed to some degree considering the massive local supply figures, said RealPage.

Among its original picks for wild card markets, Atlanta and Tampa have seen performance significantly trail the national average. Atlanta's performance has been impacted by weak rent collections and oversupply, as well as softness in local lease-up properties, with more than a 50% drop in per-property per-month absorption in the first six months of 2024. Newark/Jersey City continues to impress as it appears new supply delivering along the waterfront is attracting some renters who work in Manhattan but are pulled in by the lower rents of Jersey City, according to RealPage.

Is Now the Time to Sell Your Multifamily Asset?

This positive outlook suggests that now might be an opportune moment to consider listing and selling your multifamily asset. By capitalizing on the current market strength, you can potentially maximize your return on investment.

Ready to Discuss Your Options?

eXp Commercial, a leading Chicago-based brokerage specializing in multifamily properties, can help you navigate the selling process. Their team of experienced professionals can offer valuable insights into the market and guide you towards achieving your goals. Contact eXp Commercial today to discuss your plans and explore your options for selling your multifamily property.

Source: RealPage Evaluates Its 2024 Apartment Market Picks

https://www.creconsult.net/market-trends/midwest-multifamily-market-booming-sell-property/

No comments:

Post a Comment