Maximizing Your Success in Multifamily Property Sales in Naperville and Aurora

Introduction

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

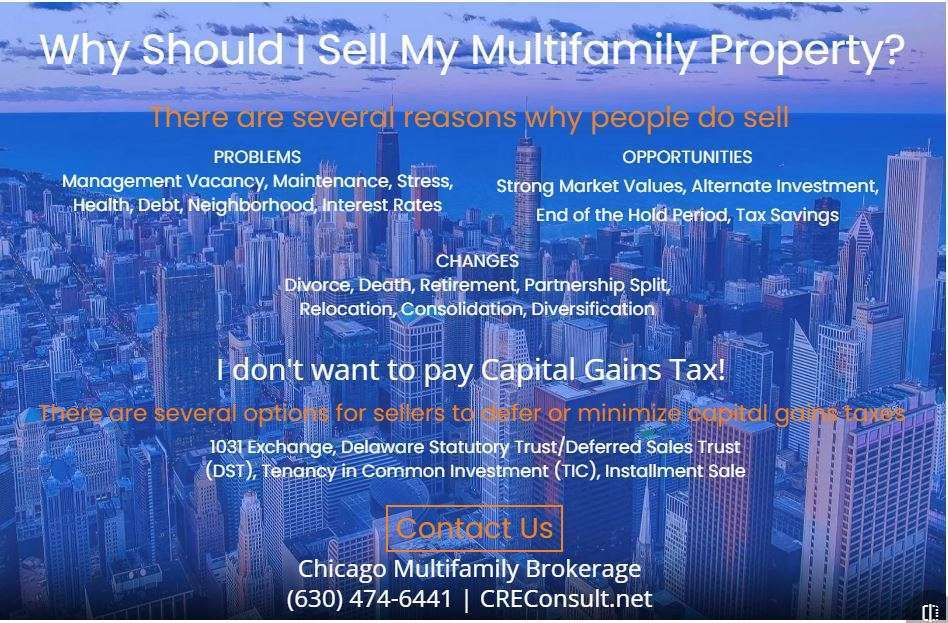

Why eXp Commercial is Your Ideal Partner

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

The eXp Commercial Advantage

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Conclusion

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://meetings.salesmate.io/meetings/#/expcommercial/scheduler/call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/