Understanding Net Operating Income (NOI) is essential in commercial real estate. Without a firm grasp of net operating income, commonly referred to as just “NOI”, it’s impossible to fully understand investment real estate transactions. In this article, we’ll take a closer look at net operating income, discuss the components of NOI, and also clear up some common misconceptions.

What is Net Operating Income (NOI)

Net operating income (NOI) is the most widely used performance metric in commercial real estate. What is NOI in real estate? The net operating income is defined as the total operating income for a property minus the total operating expenses for a property.

The net operating income is useful because it describes a property’s ability to generate income without considering its capital structure. Since different owners will have different capital structures and financing costs, the NOI enables evaluation of property performance before taking any of these owner-specific factors into account.

The net operating income is often referred to as “the line” because operating expenses are calculated “above the line” while capital expenditures and leasing costs are “below the line” items.

Net operating income (NOI) is the income generated by a property minus all expenses incurred from operations. The basic net operating income formula is as follows:

Depending on the property type or the parties involved, there is often some nuance in how the net operating income is calculated. For example, a multifamily property will have property-specific line items such as the loss to lease, while an office building will have line items for tenant reimbursements. In any case, at a high level, the net operating income formula is the same and measures operating income minus operating expenses.

NOI Meaning

NOI means Net Operating Income and measures the net income generated by a property before considering any owner-specific expenses such as financing. Net operating income is positive when effective gross income exceeds operating expenses, and negative when operating expenses exceed effective gross income.

For the purposes of real estate analysis, NOI can either be based on historical financial statement data, or instead based on forward-looking estimates for future years, which is also known as a proforma.

Net operating income measures the ability of a property to produce an income stream from operations. Unlike the cash flow before tax (CFBT) figure calculated on a real estate proforma, the net operating income figure excludes any financing or tax costs incurred by the owner/investor. In other words, the net operating income is unique to the property, rather than the investor.

Net Operating Income and Lease Analysis

The vast majority of commercial real estate income is generated by contractual tenant leases. Before we go over each of the components of NOI in more detail, let’s first take a quick detour into the world of commercial real estate leases.

Lease analysis is the first step in analyzing any income-producing property, since it identifies both the main source of income and who pays for which expenses. As you can see from the net operating income formula above, understanding this is essential to calculating NOI.

While there are many industry terms for different real estate leases, such as the modified gross lease, triple net lease, or the full-service lease, it’s important to understand that these terms can have various meanings depending on who you are talking to and which part of the world you are in. That’s why it’s critical to remember that the only way to understand a lease is to actually read it.

At a high level, leases can be viewed on a spectrum of possible structures.

On the one hand, you have absolute gross leases where the owner pays all the operating expenses related to the property. On the other hand, you have absolute net leases, where the tenant is required to pay all operating expenses. Everything else falls in between these two extremes and is considered a negotiated or hybrid lease.

How to Calculate Net Operating Income (NOI)

Calculating net operating income is relatively straightforward once you break out each of the individual components. The major components of net operating income consist of potential rental income, vacancy and credit losses, other income, and operating expenses.

Potential Rental Income – Potential Rental Income is the sum of all rents under the terms of each lease, assuming the property is 100% occupied. If the property is not 100% occupied, then a market-based rent is used based on lease rates and terms of comparable properties.

Vacancy and Credit Losses – Vacancy and credit losses consist of income lost due to tenants vacating the property and/or tenants defaulting (not paying) their lease payments. For the purposes of calculating NOI, the vacancy factor can be calculated based on current lease expirations as well as market-driven figures using comparable property vacancies.

Effective Gross Income – Effective Gross Income (EGI) in the net operating income formula above is simply potential rental income less vacancy and credit losses. EGI is the amount of rental income that the owner can reasonably expect to collect from a property.

Operating Expenses – Operating expenses include all cash expenditures required to operate the property and command market rents. Common commercial real estate operating expenses include real estate and personal property taxes, property insurance, management fees (on or off-site), repairs and maintenance, utilities, and other miscellaneous expenses (accounting, legal, etc.).

Net Operating Income – As shown in the net operating income formula above, net operating income is the final result, which is simply effective gross income minus operating expenses.

Although these are the high-level line items used to calculate NOI, the format of a real estate proforma can vary widely depending on the property type, intended use, sophistication of the parties involved, and more. For more complicated net operating income calculations, you might consider using our commercial real estate analysis software.

What’s Not Included in Net Operating Income

It’s also important to note that there are some expenses that are typically excluded from the net operating income figure.

Debt Service – Financing costs are specific to the owner/investor and as such are not included in calculating NOI.

Depreciation – Depreciation is not an actual cash outflow, but rather an accounting entry, and therefore is not included in the NOI calculation.

Income Taxes – Since income taxes are specific to the owner/investor, they are also excluded from the net operating income calculation.

Tenant Improvements – Tenant improvements, often abbreviated as just “TI”, include construction within a tenant’s usable space to make the space viable for the tenant’s specific use.

Leasing Commissions – Commissions are the fees paid to real estate agents/brokers involved in leasing the space.

Reserves for Replacement – Reserves are funds set aside for major future maintenance items, such as a roof replacement, or air conditioning repair. While the textbook definitions of NOI usually exclude reserves from the NOI calculation, in practice many analysts actually do include reserves for replacement in NOI. For example, most lenders will include reserves for replacement into the NOI calculation for determining debt service coverage and the maximum loan amount. This makes sense because lenders need to understand the ability of a property to service debt, which of course has to consider required capital expenses to keep the property competitive in the marketplace. To see how much confusion and disagreement there is on this, just take a look at all the various answers you see here on this Reddit thread.

Capital Expenditures – Capital expenditures are expenses that occur irregularly for major repairs and replacements, which are usually funded by a reserve for replacement. Note that capital expenditures are major repairs and replacements, such as replacing the HVAC system in a property. This does not include minor repairs and maintenance which are considered an operating expense, such as replacing doorknobs and lightbulbs.

While many of the above items are almost always excluded from net operating income, it’s important to remember that some are open to interpretation depending on the context. Keep this in mind when building your own proformas and when evaluating NOI calculations performed by others.

Introducing CRE Investment Analysis Fundamentals

A complete online course that teaches you the entire commercial real estate investment analysis process

A big picture overview of the commercial real estate investment analysis process

A step-by-step walkthrough of the real estate proforma

How to calculate and interpret simple measures of investment performance

A complete time value of money crash course

A walkthrough of the intuition and calculations behind IRR and NPV

How commercial real estate loans work, including a lender comparison spreadsheet

Office building case study with 5-year proforma, ratios, and discounted cash flow analysis

Fully unlocked Excel models included

60-day money-back guarantee

Net Operating Income Example

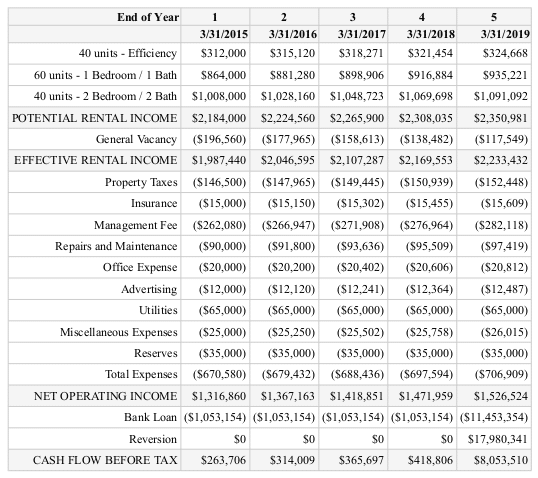

The following is an example of a typical real estate proforma that would be commonly used by lenders, investors, developers, brokers and appraisers. It breaks out how net operating income is calculated and presented for an example warehouse property.

The net operating income line is calculated by deducting vacancy and credit loss from potential gross income, then subtracting out all operating expenses. Notice that the debt service and replacement reserves are not included in the NOI calculation.

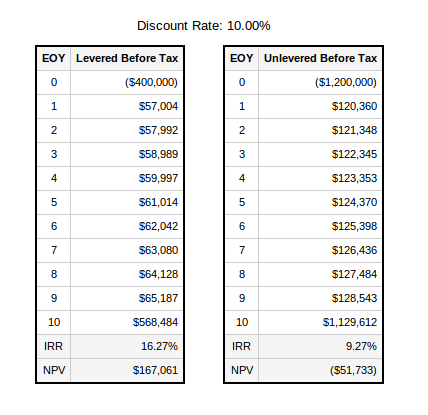

Net operating income projections like this are regularly created by appraisers and other commercial real estate professionals. Once you have a projection of net operating income you can then calculate property level metrics such as the capitalization rate, yield on cost, development spread, IRR, NPV, and more.

Conclusion

Calculating NOI is an important step in evaluating and valuing a property. Once you have an NOI figure, you can begin looking at various measures such as the cap rate or a maximum loan analysis. Then you can also move on to a more detailed analysis that includes a bottom-line cash flow figure and a full discounted cash flow analysis.

Keep the above NOI formula in mind when calculating and reviewing NOI figures, and also be aware of what’s included and excluded from NOI, and you’ll have a good framework for understanding net operating income for any property.