Introduction: Tracking Chicago Multifamily Mortgage Rates in June 2025

Chicago multifamily mortgage rates have dropped across most products in June 2025. These movements directly impact refinancing, investment acquisition, and underwriting strategies in the city’s multifamily sector. In this post, we break down the numbers and help you act on them.

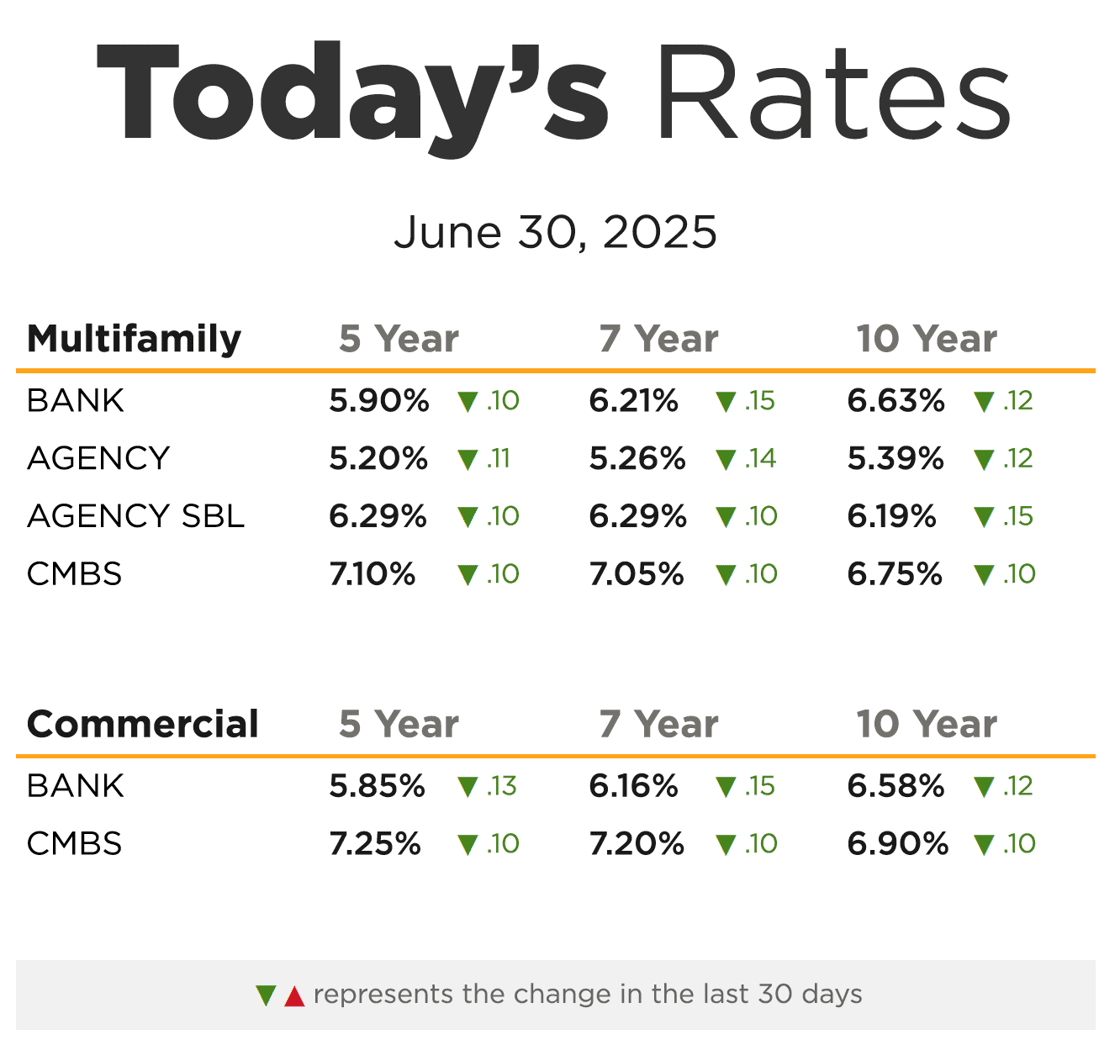

Multifamily Mortgage Rates – June 2025 Overview

| Loan Type | 5‑Year | 7‑Year | 10‑Year |

|---|---|---|---|

| Bank Loans | 5.90% ▼ 0.10 | 6.21% ▼ 0.15 | 6.63% ▼ 0.12 |

| Agency Loans | 5.20% ▼ 0.11 | 5.26% ▼ 0.14 | 5.39% ▼ 0.12 |

| Agency SBL | 6.29% ▼ 0.10 | 6.29% ▼ 0.10 | 6.19% ▼ 0.15 |

| CMBS Loans | 7.10% ▼ 0.10 | 7.05% ▼ 0.10 | 6.75% ▼ 0.10 |

📌 Source: eXp Commercial Capital Markets

Why June 2025 Chicago Multifamily Rates Matter

With Chicago multifamily mortgage rates down this month, property owners and investors may want to reassess their lending strategies. Lower costs can open refinancing options, extend hold periods, or enable more aggressive acquisitions.

Key Lending Trends Impacting Chicago’s Market

1. Bank Loan Rates Provide Lower Entry

5‑Year rate: 5.90%, down from May.

Opportunity: Ideal for owners targeting short- to mid-term value.

2. Agency Loans Offer Stability

5‑Year rate: 5.20%, a notable decrease.

Best Use: Long-hold strategies for stabilized, higher-end assets.

3. Small Balance (SBL) Loans Trending Down

June 2025 multifamily SBL rates dropped 10 bps.

Use Case: Great fit for owners of smaller, workforce housing assets.

4. CMBS Remains Niche but Active

7-Year CMBS Rate: 7.05%

Strategic Use: Complex asset types, especially with portfolio-level financing.

Chicago Multifamily Investors: What to Do Now

Refinance if your current rate is over 6%.

Lock in loans before rates potentially rebound.

Partner with brokers who understand lending volatility and its effect on cap rates.

Chicago Multifamily Market Resilience

Despite rate fluctuations, Chicago’s fundamentals remain strong:

Demand for Class B and C properties is rising.

Submarkets like Bridgeport, Albany Park, and Bronzeville are attracting interest.

Broad employment base supports rental income stability.

Need Guidance on Chicago Multifamily Mortgage Rates?

With over two decades of experience, I help owners and investors navigate every rate shift with precision. From property valuation to debt strategy, I provide insights that maximize ROI.

📞 (630) 474‑6441

📧 rtaylor@creconsult.net

🌐 More multifamily insights

https://creconsult.net/?p=135668&fsp_sid=1118

No comments:

Post a Comment