What the Construction Lull Means for the Apartment Sector

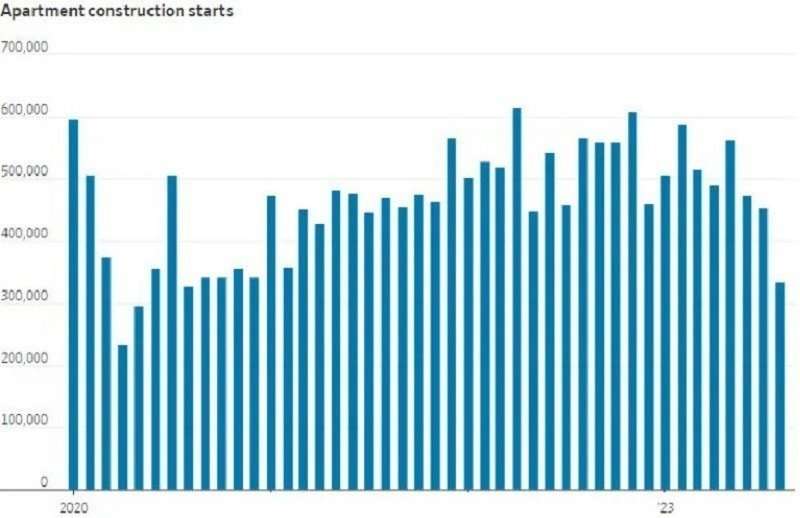

This year sees a marked decline in new apartment construction, attributed to elevated interest rates, reduced rents, and overbuilding worries in select regions.

Higher Rates and Falling Rents Spark a Decline in New Apartment Developments

Construction of new apartments has experienced a significant decline this year due to higher interest rates, declining rents, and concerns about overbuilding in some areas.

By the numbers: According to the Census Bureau, apartment building starts fell by 41% in August, compared to the same month the previous year, reaching a seasonally adjusted annual rate of 334K units. This decline, only seen once since the subprime housing crisis, is expected to result in approximately two years of reduced building, as Greg Willett, first vice president at Institutional Property Advisors, predicted.

Construction pause: The market is expecting a surge in rental building openings for the next two years, the highest since the 1980s. This influx of new supply has caused apartment vacancies to rise and rent growth to flatten or decline in several areas. As a result, apartment builders are pausing construction in order to assess the profitability of their projects compared to safer investments, as well as to evaluate the impact of existing buildings in the market.

Financing freeze: The cost and scarcity of construction financing have become significant obstacles for builders. Banks, now holding increased reserves to support troubled property loans, are lending less frequently and tightening standards. Interest rates for construction loans have doubled, climbing from 4–8%. This financing crunch has made it difficult for developers to raise equity from investors uncertain about the future value of completed projects.

Regional impacts: The decline in multifamily starts is most evident in areas that experienced substantial construction during the pandemic. Denver, for example, saw a 66% drop in starts for new apartments in 2Q23 compared to the quarterly average since 2021. This drop in new construction is attributed to stagnant asking rents and the uncertain potential for rent inflation before completion. Additionally, developers in the Dallas metro area have scaled back in untested neighborhoods.

➥ THE TAKEAWAY

Slowly slowing down: The future of apartment buildings heavily depends on interest rate fluctuations. If rates stabilize or fall more in coming quarters, developers and lenders will likely gain confidence and resume stalled construction plans. Another factor favoring the apartment building market is the continuous increase in the price of for-sale homes. This rising affordability gap should drive demand towards rentals for the foreseeable future.

Source: What the Construction Lull Means for the Apartment Sector

https://www.creconsult.net/market-trends/what-the-construction-lull-means-for-the-apartment-sector/