Consumers Feeling More Confident, Inspiring Apartment Demand |

|

|

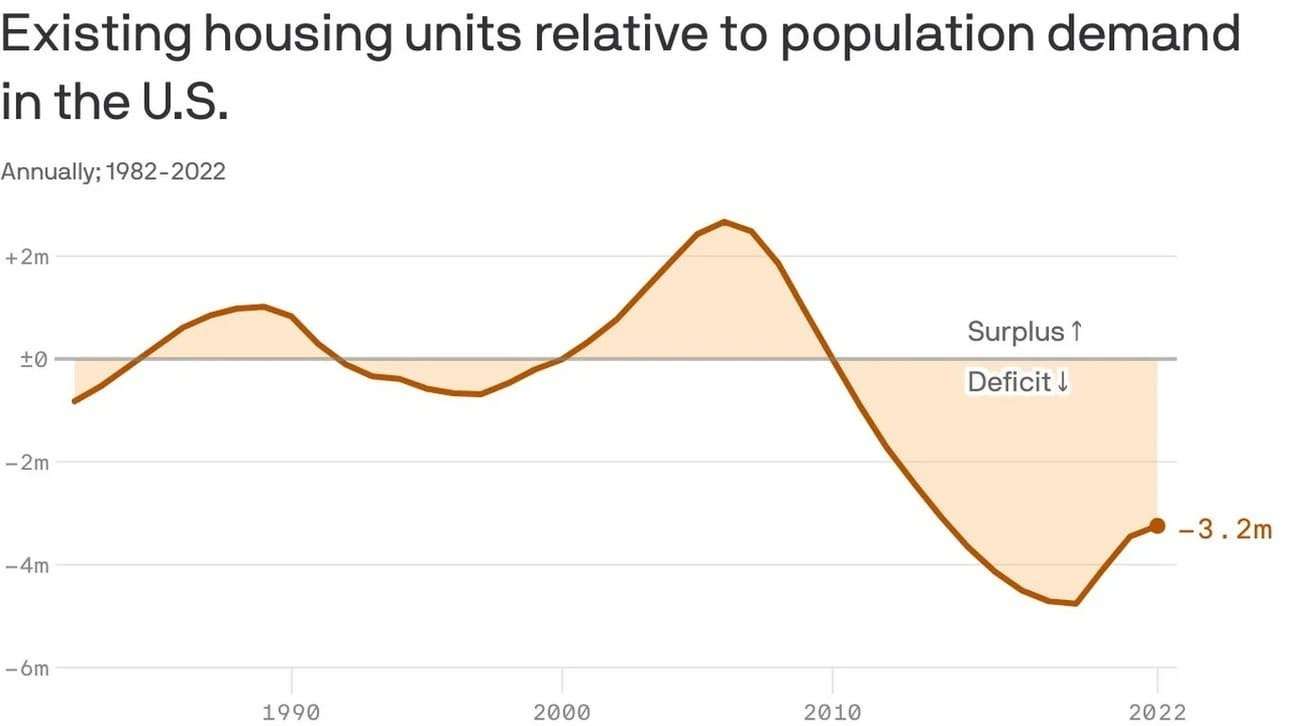

Over the last decade, U.S. consumer confidence and apartment demand have varied considerably. With the economy improving, consumer sentiment has recently increased, boosting apartment demand. |

|

|

By the numbers: Consumer confidence is closely linked to apartment demand. When consumers are optimistic about the economy, apartment demand increases, as seen in recent trends. Conversely, in times of economic uncertainty or perceived trouble, people tend to limit their spending and mobility, leading to decreased demand for apartments. This pattern was evident during the COVID-19 pandemic and the periods of economic fluctuation that followed. |

|

|

|

|

|

Apartment demand: The U.S. apartment market absorbed over 90,800 units in the 3rd quarter, a significant number but lower than the pre-pandemic averages. This uptake marks a recovery from the net move-outs in 2022, coinciding with a record low in consumer sentiment. The University of Michigan's Consumer Sentiment Index, which tracks American spending confidence, had fluctuated dramatically from 2011 to 2023, with a notable dip during the pandemic and a partial recovery thereafter. |

|

➥ THE TAKEAWAY |

|

|

Why it matters: Despite a stable economy, consumer sentiment in 2022 fell to near 30-year lows due to rising inflation and interest rates. However, 2023 witnessed a positive shift in consumer confidence as inflation eased and economic stability seemed more assured. This improvement in sentiment is not yet at pre-pandemic levels but is on an upward trajectory, leading to increased household formation and, consequently, a boost in apartment demand. |

[row]

[col span__sm="12"]

[row]

[col span__sm="12"]