5 Trends to Watch in Real Assets for 2024 |

||

|

2023 was a challenging year for real estate, with widespread declines in asset values and reduced transaction volumes. Looking ahead, investors are hopeful for stabilized prices and a return to normal market activity. Here are five key trends to watch, according to the MSCI research team. |

||

|

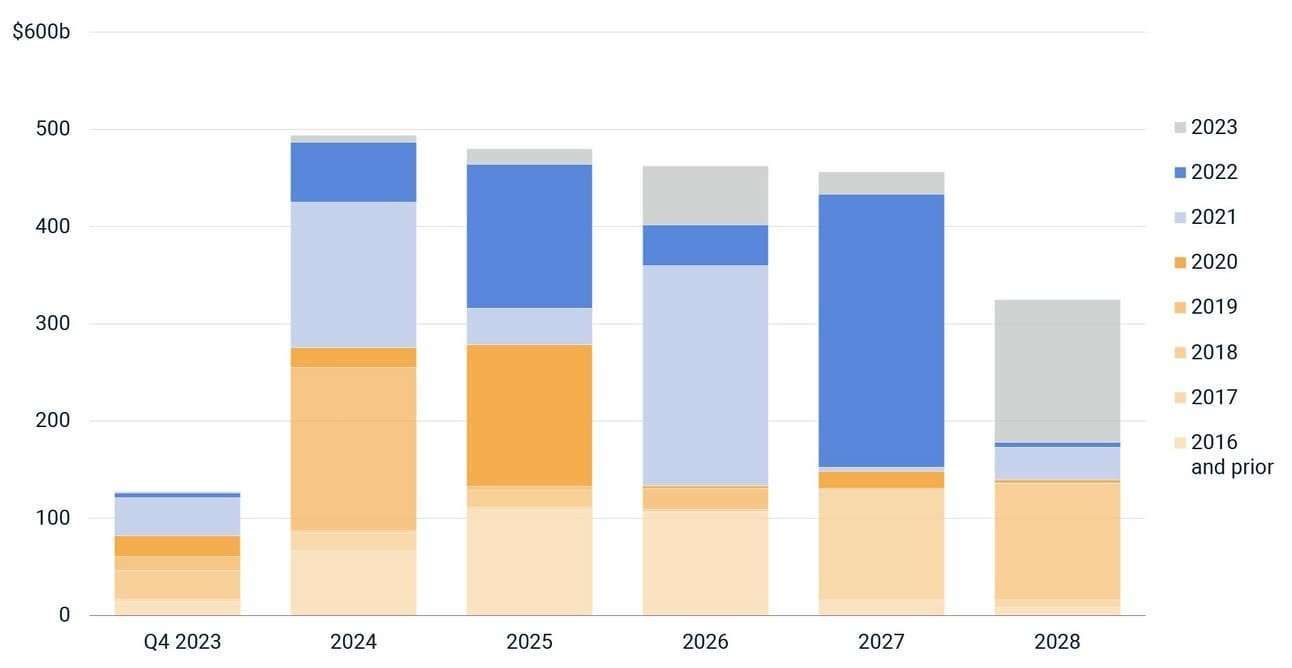

1) Anticipating distressed sales: In 2023, distressed sales in the U.S. real estate market were only 1.7% of investments, despite growing distress since 2022. With many loans from 2021 and 2022 nearing maturity and facing higher interest rates and lower valuations, more forced sales are expected. The current lending environment is more conservative, with declining loan-to-value ratios. Over USD 2 trillion in loans will mature by 2027, creating opportunities for investors. This downturn differs from post-2008, offering more flexibility for lenders and borrowers due to new investment strategies. |

||

|

Looming US loan maturities |

||

|

||

|

2) Mind the gap: Global real estate transactions are currently stalled due to a significant gap between buyer and seller price expectations, exacerbated by rising interest rates. This gap, particularly notable in European and North American office markets, has widened significantly, as shown by the MSCI Price Expectations Gap. Market liquidity will only improve with more consensus on property pricing, likely dependent on clearer expectations about future interest rates. Until then, caution is advised in this uncertain market. |

||

|

Gap in buyers’ and sellers’ pricing has widened |

||

|

||

|

3) Expect a double dip: The recent volatility in commercial real estate makes predicting market trends difficult. A potential second downturn, influenced by high interest rates and global economic slowdown, is particularly evident in the office sector. The MSCI Price Expectations Gap indicates that many market segments, especially offices, may need further price reductions to regain liquidity. This could lead to additional valuation declines. Markets like Australia and Ireland, heavily invested in offices, might see significant impacts on capital growth if these adjustments occur and transactions increase. |

||

|

First dips in property performance already experienced |

||

|

||

|

4) Shifting risk/return landscape: In the last 18 months, global real estate investment has shifted, with economic and financing changes affecting values across asset classes. These shifts, influenced by debt financing, interest rates, and rising risk-free-rate benchmarks, have led investors to reassess their capital allocations. There's a focus on the varied impact on different market segments and the risk spectrum from core to opportunistic strategies. |

||

|

Core investments have lagged so far in the current downturn |

||

|

||

|

5) Rising insurance costs: Climate change is increasingly affecting real estate investments, with 2023 poised to be the warmest year on record. The MSCI Climate Value-at-Risk Model indicates that up to 5.5% of the MSCI Global Annual Property Index faces transition risk, and 3.0% is at risk from physical impacts in the coming years. A direct consequence for investors is rising insurance costs due to more frequent and severe weather events. Data from the MSCI U.S. Quarterly Property Index shows insurance costs more than doubling in five years to September 2023, particularly in high-risk states like Florida and California. |

||

|

US insurance costs have increased, particularly in high-risk states |

||

|

||

➥ THE TAKEAWAY |

||

|

The big picture: The 2024 commercial real estate market is navigating a mix of challenges and opportunities. Expectations of increased distressed sales due to maturing high-risk loans and a notable pricing gap, especially in office markets, are key issues. The office sector might see further declines, influencing the broader market. Shifting investment dynamics are altering risk-return profiles, compounded by escalating insurance costs impacting property values and expenses. Despite these hurdles, clearer interest rate trends offer hope for renewed market liquidity and balanced property pricing. |

Source: 2024 Trends to Watch in Real Assets

https://www.creconsult.net/market-trends/2024-trends-to-watch-in-real-assets/

No comments:

Post a Comment