Apartment and Industrial Changed Course, Office Entered Uncharted Territory, and Retail in Holding Pattern

The year 2023 ended on a generally positive macroeconomic note: inflation has made solid progress, with year-over-year growth of the CPI (consumer price index) down as shelter receded to the same level in November 2019. The labor market dialed back its pace but remained steady. There are still 1.3 jobs per every unemployed person, higher than 1.2 pre-pandemic. The unemployment rate also fell to 3.7% in November, well below its long-run average. Real GDP growth stayed above the US's potential for most of the year and accelerated in the third quarter, attributed to consumer spending and inventory investment. The long-feared recession did not materialize, and the hawkish Federal Reserve subtly pivoted, hinting at the peak of the current rate hike cycle.

While the broader economy seems to be heading towards a soft landing, much of the commercial real estate (CRE) world is stuck in limbo. Why?

- The multifamily and industrial sectors experienced sudden shifts in supply and demand dynamics

- Rising insurance costs increasingly pressured net operating income

- The office and multifamily sectors led the CRE market in value declines, characterized by a few high-profile fire sales

- High interest rates compressed capital funding and elevated refinance risks

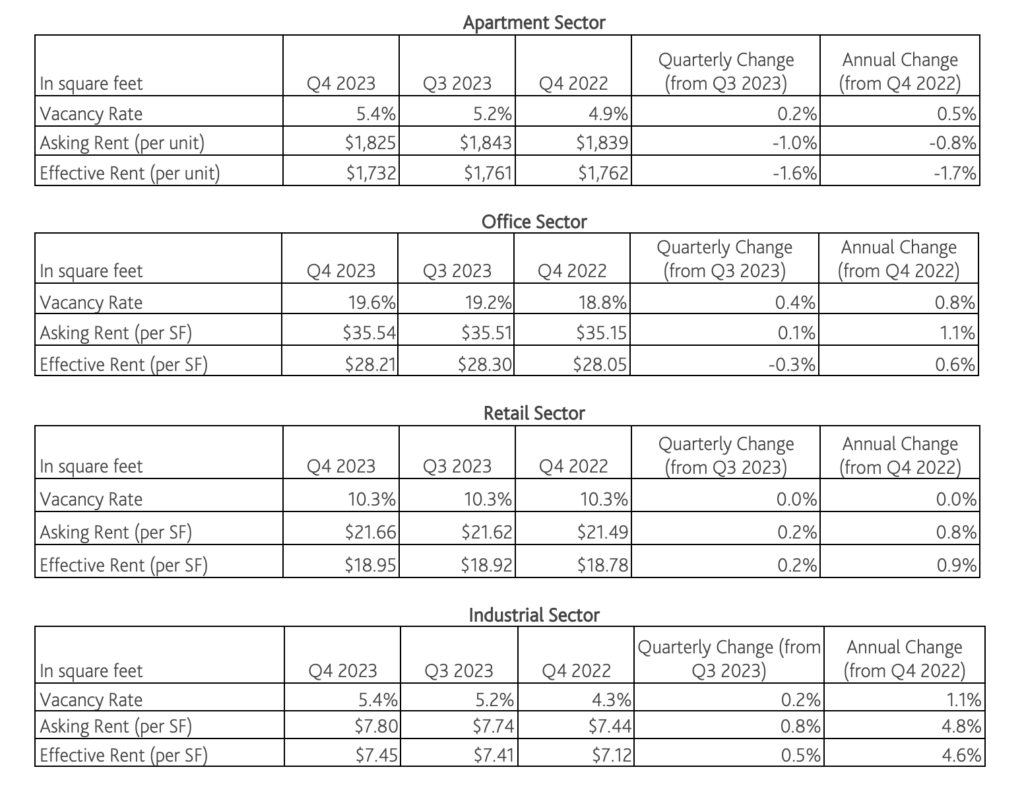

While many events were indeed idiosyncratic or metro-specific, others may well be part of regime changes or even leading indicators of a new equilibrium. Moody’s Analytics Q4 data shows where the core CRE sectors’ (multifamily, office, retail, and industrial) conditions stand as we conclude 2023.

Multifamily

Multifamily performance changed course in the fourth quarter, with net absorption plummeted from an average of over 45,000 units in the previous quarters to less than one fifth (or 8,973 units) nationwide, making Q4 another quarter with less than 10,000 units of net move-ins this year. Year-to-date, total net absorptions were only a third of their pre-pandemic highs, driven by the stabilization of demographics and the lock-in effect on the substitutional single-family housing market. While the journey to homeownership slowed, household formation was also challenged by a persistent rent burden especially on the lower end of the renter distribution.

Construction delivery over the investable space (20 units and above) fell short of initial estimates, with slightly over 40,000 units verified for the fourth quarter so far. According to the National Multifamily Housing Council’s quarterly construction survey, economic uncertainty, availability of construction financing, and economic feasibility are among the top reasons for project delays cited by the leading multifamily construction and development firms. We do expect upward revisions as we continue validating project completions over the next few weeks, but the glut of new supply significantly pressured the overall market performance.

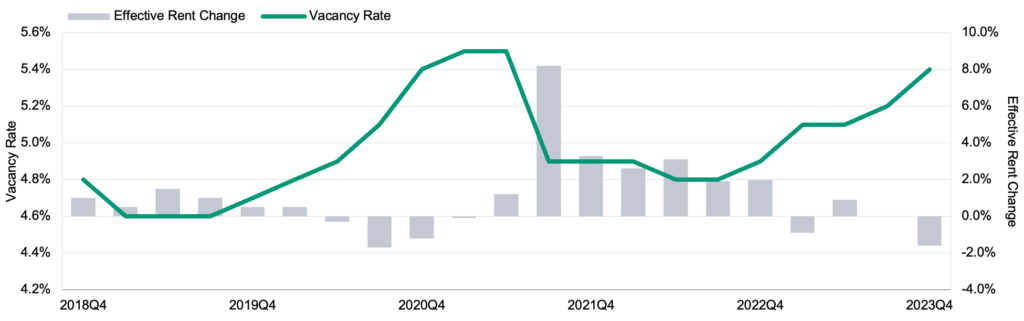

The national apartment vacancy rate went up 20 basis points (bps) to 5.4%, half a percentage point higher than last year’s and inching closer to its recent pandemic peak of 5.5%. A temporary imbalance of supply and demand compressed rent growth, with both asking and effective rent declining continuously in the last three months of the year. At the national level, asking rent was down to $1,825 while effective rent closed at $1,732, 0.8% and 1.7% lower than their respective year-ago levels. It is striking to see the widened gap between asking rent and effective rent, which grew at a record speed over the second half of the year from 4.1% to 5.1%, a level not seen since 2010.

Figure 1: Apartment Rent and Vacancy Trend: Effective Rents Declined as the Vacancy Rate Climbed in 2023

Office

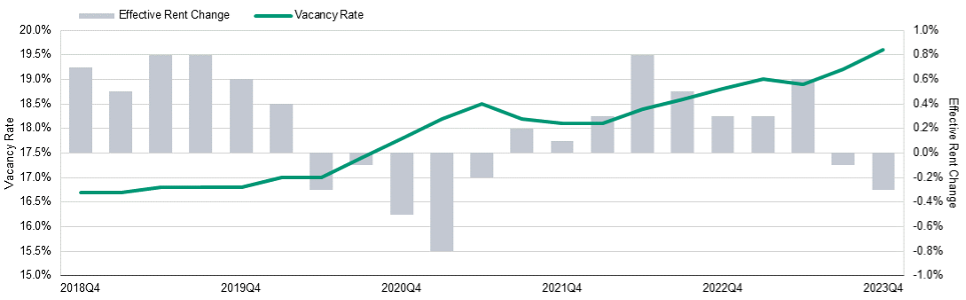

The national office vacancy rate rose 40 basis points to a record-breaking 19.6%, shattering the previous record of 19.3% set twice previously: once in 1986, driven by a five-year period of significant inventory expansion, and the other in 1991, during the Savings and Loans Crisis. This surge represented the largest quarterly increase since Q1 2021, setting the latest office vacancy 280 bps higher than its pre-pandemic level.

New construction has added 24,474,000 square feet (sqft) of office space since the beginning of the year, well below our initial estimate and the lowest since 2012. With annual inventory expansion currently sitting at 0.54%, new Class A properties that offer flexible or smaller configurations are particularly attractive to tenants who decide to keep the physical office footprint for branding, purposeful gathering, training, and collaboration purposes. Suburban offices also fared better due to their proximity to local communities and, in some cases, shorter commute times.

Despite the increasingly optimistic consensus on the likelihood of a soft macroeconomic landing along with positive news from the labor market, the permanence of dynamic hybrid models has effectively muted office demand, making the year 2023 the most downbeat since the Great Financial Crisis (GFC). Net absorption has stayed consistently negative since July 2023 and finished Q4 at -12,965,000 sq ft, driving the end-of-year total to -18,320,000 sq ft. Subleases also absorbed some level of office demand as the market continued to adapt to the regime changes. Asking rents rose by 0.1% in Q4, but effective rents declined for a second straight quarter by -0.3% due to considerably high vacancies.

Figure 2: Office Rent and Vacancy Trend: Historic Vacancy Levels Lead to Declines in Effective Rent in Q4

Retail

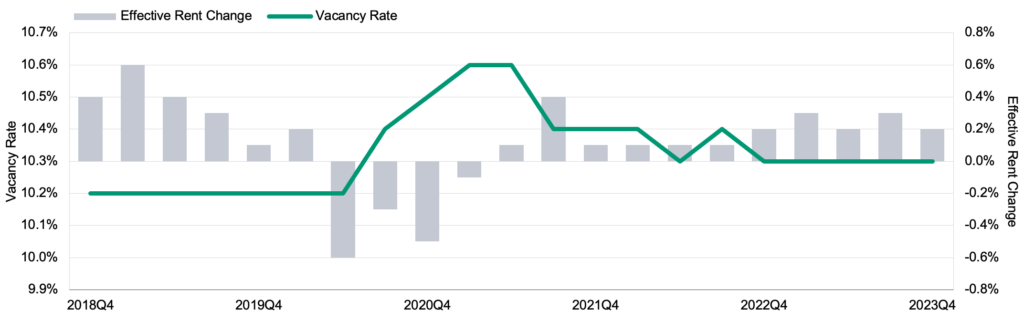

The retail sector remained largely steady throughout 2023, as the vacancy rate stayed flat at 10.3% in Q4. Asking rents rose by 0.2% to $21.7/sqft, while effective rents were up by 0.2% to $19/sqft in Q4. Early holiday season figures suggest consumers have continued spending, and retailers that have adopted omnichannel methods are in a better position to meet consumer needs by fusing in-person experiences with the ease and accessibility of online shopping. As consumers continue to subtly shift their preference from goods to services, physical experiences still have a place in the retail sector.

New retail construction grew by 583,000 sqft in Q4, bringing the preliminary year-end total to 5.7 million sqft, or 0.3% of inventory expansion. New construction faced many of the same financing and economic challenges as other sectors, but ongoing adjustment to a new equilibrium has lagged behind the consistent slowness in construction. While retail data indicates stagnation, a nuanced study shows persistent shuffling of winners vs. losers in the physical space. Elevated interest rates put many potential expansions, franchising opportunities, or even mergers and acquisitions on hold.

Bifurcated consumer spending habits challenged retailers that failed to adapt as the missing middle phenomenon persisted in 2023. Despite these significant headwinds, closer integration of live-work-play communities will save the retail form that used to heavily rely on commuting workers.

Figure 3: Retail Rent and Vacancy Trends: National Rent and vacant Levels Remained Mostly Flat as Retailers Navigated Uncertainty

Industrial (Warehouse/Distribution Center)

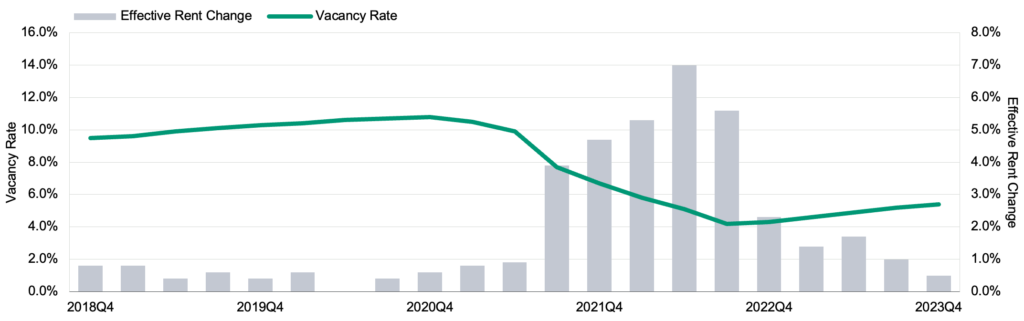

The industrial sector has enjoyed exceptional growth over the past few years, driven in part by the continued strength of e-commerce as a share of total retail sales and the impact of manufacturing reshoring and nearshoring initiatives. Construction has ramped up quickly since the beginning of the COVID-19 pandemic in response to intense demand. The annual rate peaked at 283 million square feet by mid-2023. As the market grew more balanced, construction started to slow amid higher interest rates and cooling demand. Completions declined steadily from 85 million sq ft at the end of last year to only 24.3 million sq ft in Q4, down more than half from just a quarter ago.

Demand for warehouse and distribution center space cooled as consumption shifted from goods to services, and high interest rates challenged inventory management. Net absorption in the fourth quarter was down 65% from the quarter ago to 8.8 million sq ft, only a fraction of its peak volume in Q3 2021. It is worth noting that net absorption teased negative territory at -438,000 sq ft in December, the first time since 2009! As demand cooled more rapidly than supply, the vacancy rate extended its upward trajectory established in mid-last year and climbed another 20 basis points to 5.4% at the national level in this quarter. Although vacancy increases reflected market rebalancing, the level remained significantly lower than the sector’s pre-pandemic average. As a result, the growth of asking and effective rent slowed but stayed positive at 0.8% and 0.5%, respectively, in Q4.

Figure 4: Industrial (Warehouse/Distribution Center) Rent and Vacancy Trends Vacancy Trends Continue an Upward Climb After Years of Historic Construction While Remaining Below Pre-Pandemic Levels

Table 1: Summary of Moody’s Analytics CRE Q4 2023 Statistics

US Metros

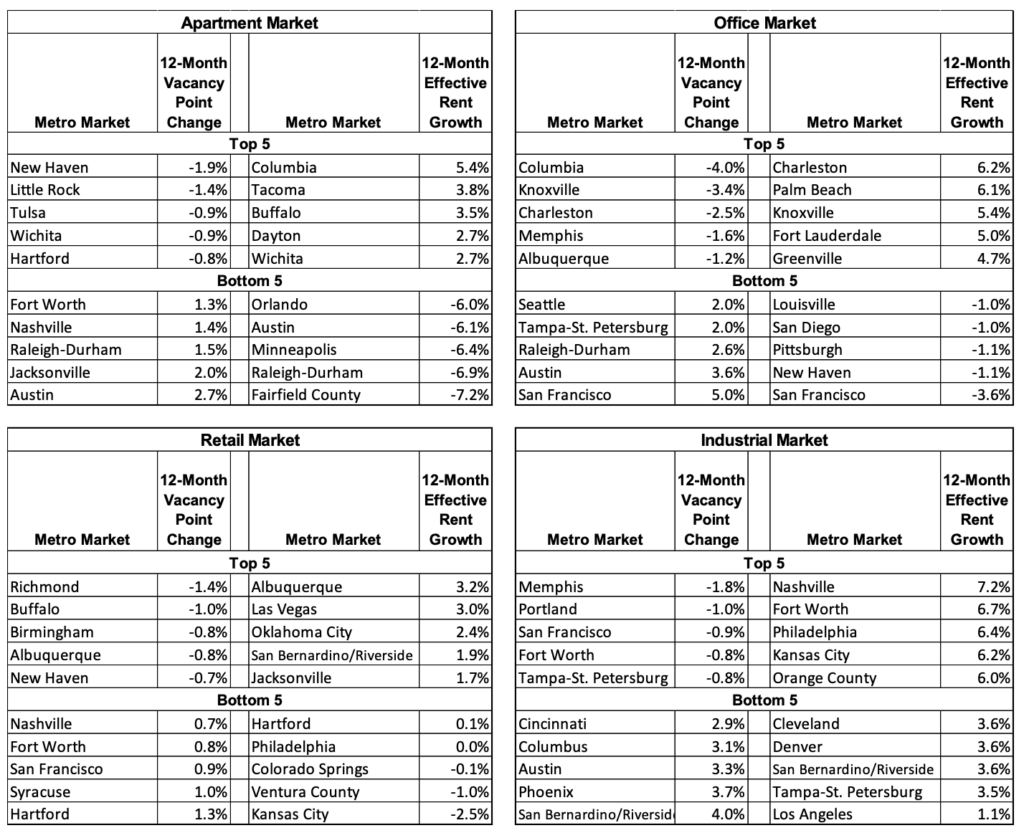

For multifamily, 1 in every 5 metros recorded over 2% of inventory growth in 2023, while nearly 60% (47 of 79) of primary metros had more move-outs than move-ins in the last quarter of the year. Nashville (5.2%), Jacksonville (4.1%), Austin (4.0%), Phoenix (4.0%), Charlotte (3.7%), Salt Lake City (3.7%), and Fort Lauderdale (3.0%) were leading the annual inventory growth among all. With little surprise, all of them suffered from year-over-year vacancy increases, ranging from 0.6% in Charlotte and Fort Lauderdale to 2.7% in Austin. Except for Salt Lake City, which was supported by more balanced market demand, all of the aforementioned metros also recorded notable annual effective rent declines, ranging from -1.3% in Nashville to -6.1% in Austin. In the final three months of the year, over 90% of all primary metros have experienced quarter-over-quarter vacancy increases, more than half of which also recorded rent declines at the same time. Nineteen primary metros recorded over 2% of asking rent declines in the fourth quarter, with Orlando (-3.8%), New Haven (-3.2%), Omaha (-3.2%), and Fort Worth (-3.1%) topping the list.

For offices, San Francisco (-4.4M sqft), Los Angeles (-2.4M sqft), Philadelphia (-2.0M sqft), Washington, DC (-1.4M sqft), Seattle (-1.3M sqft), Denver (-1.2M sqft), Orange County (-1.2M sqft), Baltimore (-1.1M sqft), and Raleigh-Durham (-1M sqft) each recorded more than 1 million sqft of negative net absorption in 2023. In the fourth quarter alone, Moody’s Analytics preliminary data showed over half (50 of 79) of US primary metros experienced negative absorption. San Francisco led the loss in Q4 with -2,400,000 sqft of net move-outs, while Washington, DC, and Chicago had over 100,000 sqft. Fifty-two primary office markets experienced vacancy increases in 2023, among which San Francisco (+5.0%), Austin (+3.6%), and Raleigh-Durham (+2.6%) significantly underperformed. Effective rents fell the most over the past 12 months in San Francisco (-3.6%), New Haven (-1.1%), Pittsburgh (-1.1%), San Diego (-1.0%), and Louisville (-1.0%), each experiencing a greater than -1.0% decline.

Retail vacancies declined or remained flat across 47 primary metros in Q4, but the changes were mostly moderate and stable, indicating the national trend was widespread. Retail vacancy changes ranged from -60 bps in New Haven to +100 bps in Syracuse, but only 6 of our 77 primary metros observed a shift of 40 bps or greater. Over 2023, retail star performers included Richmond (-140 bps), Buffalo (-100 bps), Birmingham (-80 bps), and Albuquerque (-80 bps), while Hartford (+130 bps), Syracuse (+100 bps), and San Francisco (+90 bps) experienced the sharpest rises in retail vacancy. Seventy-three of 77 primary markets recorded effective rent growth compared to a year ago, but Kansas City (-2.5%), Ventura County (-1.0%), and Colorado Springs (-0.1%) experienced declines while Philadelphia (0.0%) held flat.

Finally, over half of the primary industrial markets recorded negative net absorption in the final quarter of 2023. On a year-over-year basis, nearly 3 out of every 4 primary metros experienced higher vacancy. Five metros recorded more than 5% of warehouse-distribution space growth for the year, which are Austin (12.5%), Phoenix (10.5%), San Bernadino/Riverside (6.2%), Jacksonville (6.2%), and Fort Worth (5.1%). Aside from Fort Worth, which was supported by its unique advantages of an expandable market, affordable rent, and central location for logistics, other rapidly growing industrial markets all recorded year-over-year vacancy growth ranging from 1.9% in Jacksonville to 4.0% in San Bernadino/Riverside. Los Angeles lagged behind other industrial markets due to more than 6 million square feet of move-outs throughout the year.

*These retail statistics represent neighborhood and community shopping centers only. Moody’s Analytics CRE does not report mall rents at the metro level.

Table 2: Annual Effective Rent Growth and Vacancy Changes: Top 5 and Bottom 5 Metros

The US economy is gradually coming out of the good-news-is-bad-news paradox. Consumer confidence surged in the final month of 2023, which set the premise for another good year ahead. As inflation heads further in the right direction, rate cuts may finally be on the horizon. That will be welcome news for CRE transactions and the overall business environment. In the meantime, space market rebalancing and credit risks associated with CRE lending must be cautiously calibrated, monitored, and prepared for.

Each CRE sector has its own challenges and opportunities. The office's painful evolution depends on how the “Great Compromise” will set the broader return-to-office (RTO) policy in the near term. A glimmer of hope was ignited by a reset of property values (and therefore rent), especially in metros with the highest price per square foot. The multifamily market expects more projects to come online in 2024, as many projects in the pipeline faced delays due to capital constraints in the year prior. In contrast to the glut of supply will be the normalization of demand, driven by slowed population growth and (hopefully) renters moving up the homeownership ladder. Affordability continued to pressure renter households, especially those at the lower end of the income distribution. Retail was mostly in a holding pattern in recent quarters; lower-income households had to limit goods and service consumption due to elevated costs of living, the resumption of student loan payments, and the higher principal and interest on other debt. But lower interest rates may finally help retailers reconsider expansion, franchising, or even mergers and acquisitions. Regardless of a reliance on commuting workers, experiential retail and mixed-use communities are ever more appealing to local residents, businesses, and consumers. The industrial sector may have passed its golden period of growth due to the unexpected destruction of the supply chain over the past few years, but the revolution in inventory management and the requirement of warehouse/flex space for the important e-commerce industry continue to recalibrate the market equilibrium.

Space market challenges will pose potential risks to associated commercial loans, especially if the underlying collateral faces greater uncertainty with its performance metrics. That is indeed concerning for mid-size to smaller financial institutes, which have significant CRE exposures. But so far, Moody’s Analytics CRE does not believe this will become a source of systematic risk for the overall banking system. In 2024, we expect to see greater integration of live, work, and play communities to drive the formation of the space market’s new norm. Among many challenges, there will be abundant opportunities for market participants to invest in this new era if they believe in the future of commercial real estate.

https://www.creconsult.net/market-trends/moodys-analytics-cre-q4-2023-preliminary-trend-announcement/