Home prices climbing, despite a slowdown in buying.

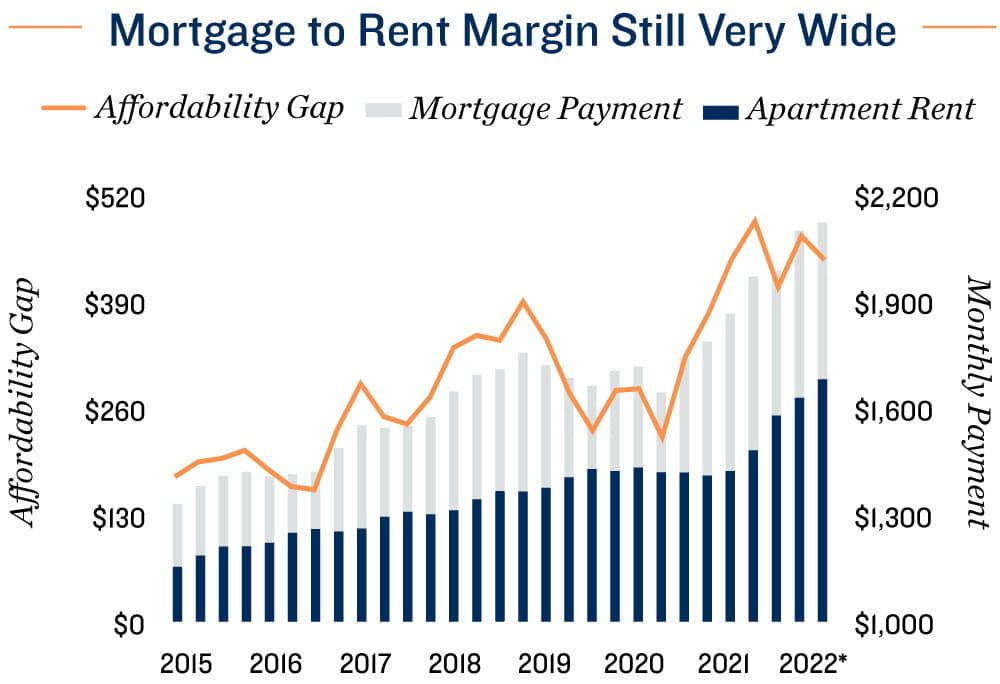

For the first time since 2019, the average rate for a 30-year mortgage breached 4 percent in March, then accelerated at an even faster pace, following the Fed’s first interest rate hike in over four years. Higher mortgage rates make houses less affordable, in an environment where elevated prices are already an inhibiting factor. In February, fewer existing homes sold than in any of the previous five months, as the number of existing homes available for purchase declined for the seventh straight month. The record-low supply and sturdy demand is maintaining upward pressure on values, with the median sale price reaching $382,200 in February, up 15.4 percent year-over-year. These conditions reinforce the multifamily segment’s demand surge, as the gap between mortgage and rent payments is wide, despite the recent swell in effective rents.

Apartment rent gains catching up to home prices. Preliminary estimates for the first quarter of 2022 show a 16.8 percent lift in average effective apartment rents in the United States, slightly faster than the annual price leap for homes. The formidable apartment rent increase is facilitated by extremely tight vacancy, with tenants competing for record-low volumes of available units in markets across the country. The national rental vacancy is estimated at just 2.4 percent for March 2022, almost 200 basis points below the 2019 register. Metros across the Sun Belt are recording the steepest rent climbs relative to home price growth. The six largest Florida markets, along with Charlotte and Atlanta, each had 2021 average effective rent jumps that were 1.5 times faster than their respective median home price rises. Young adults are moving to these markets in waves, aligning well with apartment demand.

Single-family rentals are not the lead cause of high prices. More REITs and corporations are exploring single-family homes as an alternative investment option. These well-capitalized groups often outbid individuals and private buyers, contributing to rising prices. Nonetheless, fewer than 2 percent of single-family rentals are owned by major institutional groups. They are playing a minor role, but the price lift is intrinsically driven by a housing shortage.Developing Trends

Interest rate hike expedites mortgage rate ascent. The 30-year mortgage rate has been steadily climbing, and the Fed’s announcement of an increase to the benchmark rate sped up the pace of growth in mid-March. Messaging from the Fed implies that several aggressive rate hikes are in store as the year progresses, which could move mortgage rates up past the 2010-2019 peak of 5.1 percent. This would likely soften demand for single-family homes and begin to alleviate the supply-demand imbalance that has persisted throughout the pandemic.

Permit activity indicates some additional relief. The single-family sector has been starved for development over the course of the health crisis, as inventories plummeted amid robust buying activity. Builders had a difficult time keeping pace with demand, as material costs soared and labor shortages impeded project timelines. These headwinds remain in force, though recent permit activity signals a rise in future completions. Single-family permits in February were up 5.2 percent year-over-year, while project starts advanced 13.7 percent.

-2.8% |

22.3% |

| Year-over-Year Change in Total Residential Completions | Year-over-Year Change in Total Residential Project Starts |

* 2022 Q1 figures are preliminary estimates Sources: Marcus & Millichap Research Services; Capital Economics; Freddie Mac; Moody’s Analytics; Mortgage Bankers Association; National Association of Home Builders; National Association of Realtors; RealPage, Inc.; U.S. Bureau of Labor Statistics; U.S. Census Bureau; Wells Fargo

No comments:

Post a Comment