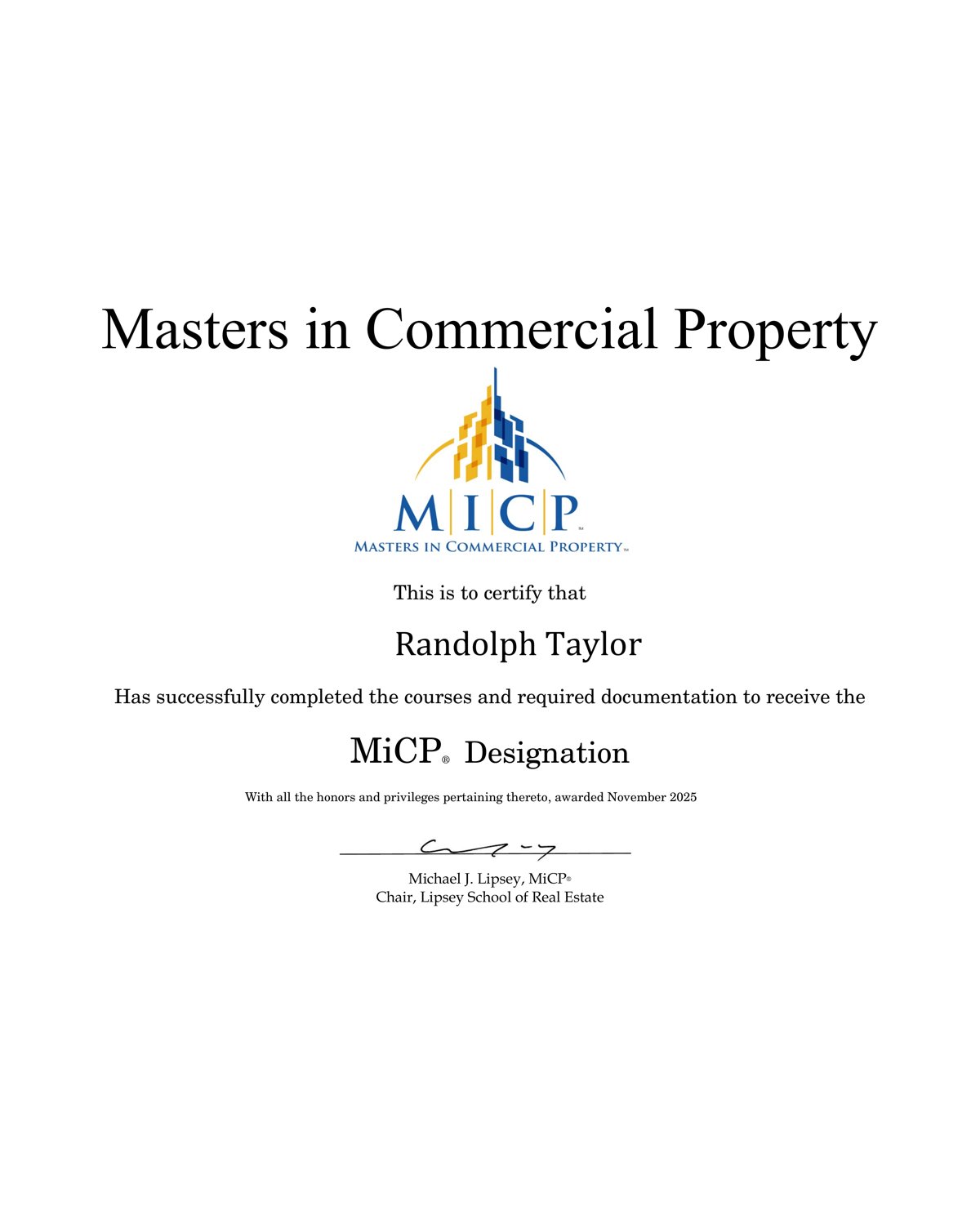

Randolph Taylor, Senior Associate with eXp Commercial’s National Multifamily Division, has earned the Masters in Commercial Property (MiCP®) designation through the Lipsey School of Real Estate.

The designation is awarded to commercial real estate professionals who complete advanced coursework and documentation demonstrating applied brokerage competence and disciplined transaction strategy. The program emphasizes structured systems used in real-world commercial real estate execution, with focus on financial analysis, valuation methodology, and negotiation discipline.

In commercial real estate investment sales, analytical precision and process discipline directly influence pricing credibility and transaction outcomes. The MiCP® designation reinforces structured advisory frameworks that support those objectives.

What the MiCP® Designation Represents

The training centers on practical brokerage execution rather than academic theory. Core areas include:

- Commercial real estate investment analysis

- Valuation strategy and pricing alignment

- Structured negotiation systems

- Transaction execution discipline

- Strategic client advisory frameworks

These competencies are directly relevant to multifamily investment sales, where underwriting clarity and capital market alignment drive buyer confidence.

Rather than promoting theory, the program emphasizes documentation standards, financial modeling discipline, and systematic negotiation approaches that strengthen real transaction performance.

Strengthening Multifamily Investment Sales Through Structured Analysis

Multifamily property owners in the Chicago metropolitan area operate within a capital environment shaped by:

- Interest rate volatility

- Increased lender scrutiny

- Investor return calibration

- Market-driven cap rate adjustments

Effective multifamily investment sales require disciplined underwriting, defensible valuation methodology, and structured negotiation execution.

Commercial real estate investment analysis involves detailed evaluation of income stability, operating expense normalization, capital expenditure forecasting, and risk-adjusted return expectations. Clear financial presentation reduces uncertainty during due diligence and supports pricing integrity.

Structured analysis also improves negotiation leverage. When underwriting assumptions are organized and defensible, transaction friction decreases and execution timelines improve.

For broader professional standards in commercial real estate education, see the CCIM Institute overview:

https://www.ccim.com

Application Within eXp Commercial’s National Multifamily Division

As part of eXp Commercial’s National Multifamily Division, Randolph Taylor focuses exclusively on multifamily investment sales across the Greater Chicago area.

Within Chicago multifamily brokerage, disciplined underwriting and strategic pricing alignment are central to optimized execution. The analytical frameworks reinforced through the MiCP® program strengthen transaction strategy and advisory precision.

For property owners evaluating valuation strategy or potential disposition timing, structured financial analysis remains critical. Additional information regarding multifamily valuation strategy is available here:

https://creconsult.net/chicago-multifamily-property-sales/chicago-multifamily-property-valuation/

Professional education does not replace experience. It refines systems and reinforces analytical discipline. The Masters in Commercial Property (MiCP®) designation reflects continued commitment to structured commercial real estate investment analysis and disciplined multifamily brokerage execution.

https://creconsult.net/masters-in-commercial-property-randolph-taylor/?fsp_sid=2232

No comments:

Post a Comment