- The rent-price surge seen through 2021 likely peaked in the fourth quarter, Goldman Sachs said Tuesday.

- Shelter inflation gauges suggest price growth will start to slow faster by mid-2022, the bank added.

- The bank sees rent growth peaking at 5.1% in 2021 and slowing to 4.2% by the end of 2024.

Renters have been on a rollercoaster ride throughout the pandemic. That choppiness is cooling down soon, according to Goldman Sachs.

City rents have been on a tear. Prices were up 11.5% year-over-year in November, according to CoreLogic's Single-Family Rent Index, much higher than the 3.8% annual growth rate in November 2020 and marking the fastest inflation in at least 16 years. Popular pandemic moving destinations like Austin, Las Vegas, and Miami led the charge in 2021, and rents in major metro areas like New York City and San Francisco more recently roared back as people prepared to return to offices.

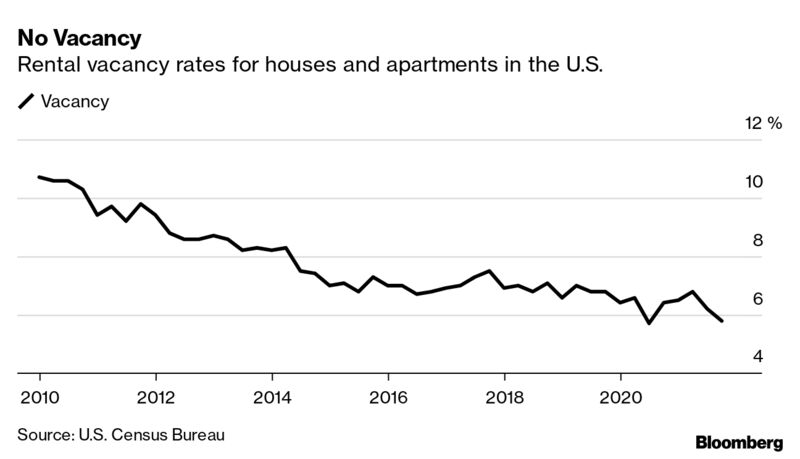

The surge raised concerns that the affordability crisis in the housing market could bleed into rentals. Yet early signs suggest the US is past peak rent inflation, and apartment prices should start to stabilize this year, Goldman analysts led by Jan Hatzius said in a Tuesday note.Shelter inflation accelerated to an annualized rate of 5.1% in the fourth quarter, according to the Census Bureau. Trends in other inflation measures, however, show rent growth starting to ease through the end of last year. The Consumer Price Index's rent and owners-equivalent rent measures both decelerated in December. The gauges track prices of new and continuing leases, and it takes longer for the latter to follow price increases in the former. By modeling when the new leases saw the biggest price hikes, the economists estimate that the rent-price surge was the strongest in the fourth quarter and will fade moving forward.

The cooldown won't be quick. Shelter inflation will linger at a year-over-year pace of about 5% through the third quarter before dropping to 4.8% at the end of 2022, Goldman said. Price growth will continue to ease to 4.5% at the end of 2023 and to 4.2% at the end of the following year, the team added. The forecast offers new hope that the country's broader inflation problem will also improve. Rent growth is a "sticky" form of inflation, meaning prices are not likely to decline after soaring higher.Persistently strong rent inflation is potentially a bigger problem for the economy than more temporary price increases for things like gasoline or food, as it could spark a new inflation crisis and the need for large-scale intervention. Goldman's outlook, then, assuages some concerns that the rent boom of 2021 would keep inflation stuck at its four-decade highs.

Still, risks exist on both sides of the bank's forecast. Rent inflation could accelerate again in 2022 if less of the bump from new-lease rents has made its way to renewals than expected, the team said. That would prolong the cycle and likely drive shelter inflation higher. Conversely, rent growth could drop even faster if most of the new-lease boost has already hit renewal inflation, the team said. Weaker underlying shelter-inflation trends could also drag on rent growth, they added.For now, rent is still growing at its fastest rate since the financial crisis, according to BLS data. Even the weaker inflation rates forecasted by Goldman sit above the pre-pandemic trend, but after a year of skyrocketing shelter prices, the bank's projected peak offers some respite for those struggling to keep up.