- How last quarter's macroeconomic, public, and private market data will impact your business

- Industry outlook for 2022

- Economic recovery implications across property types and markets

- Data-backed areas of opportunity and risk for your business

eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

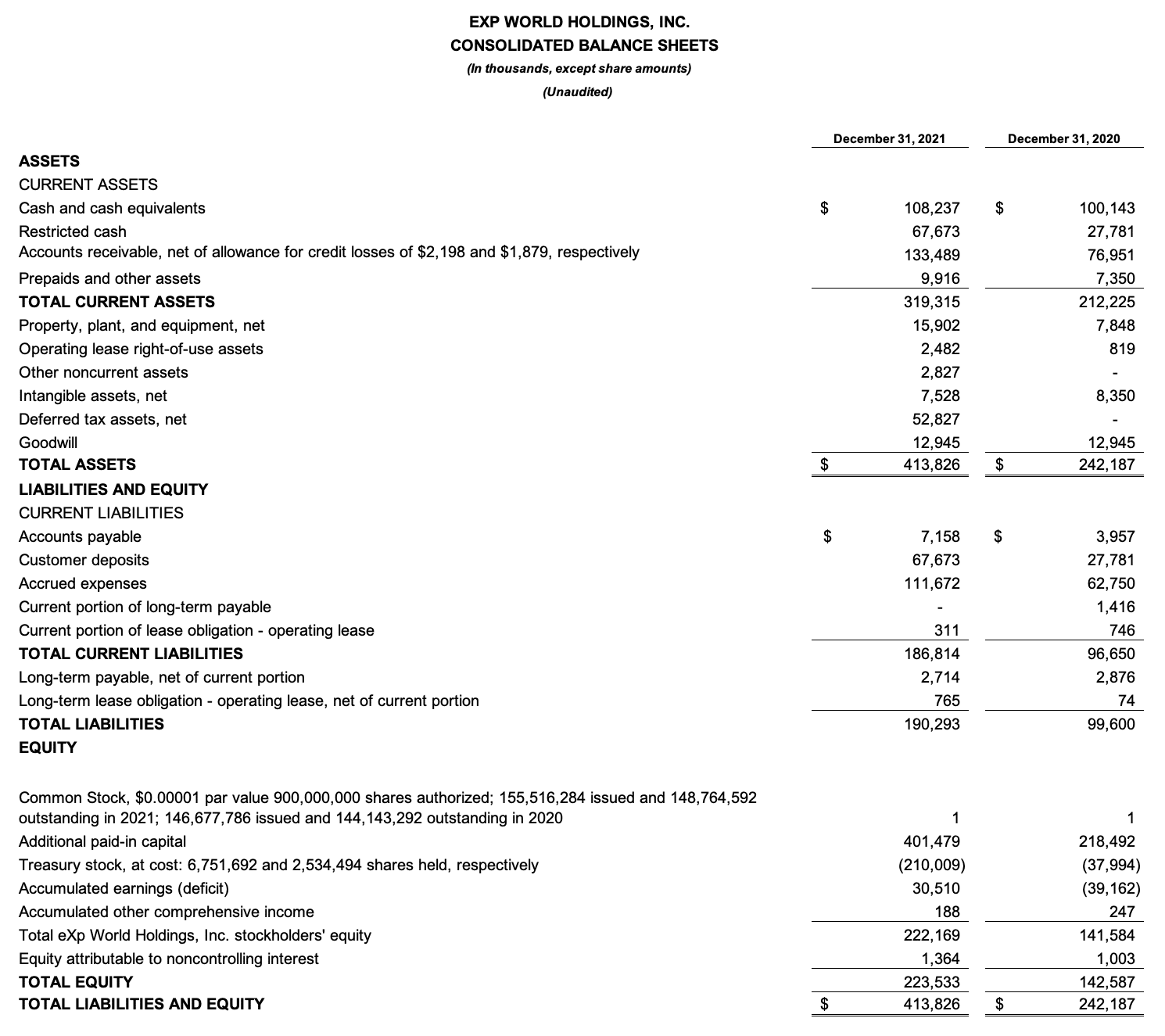

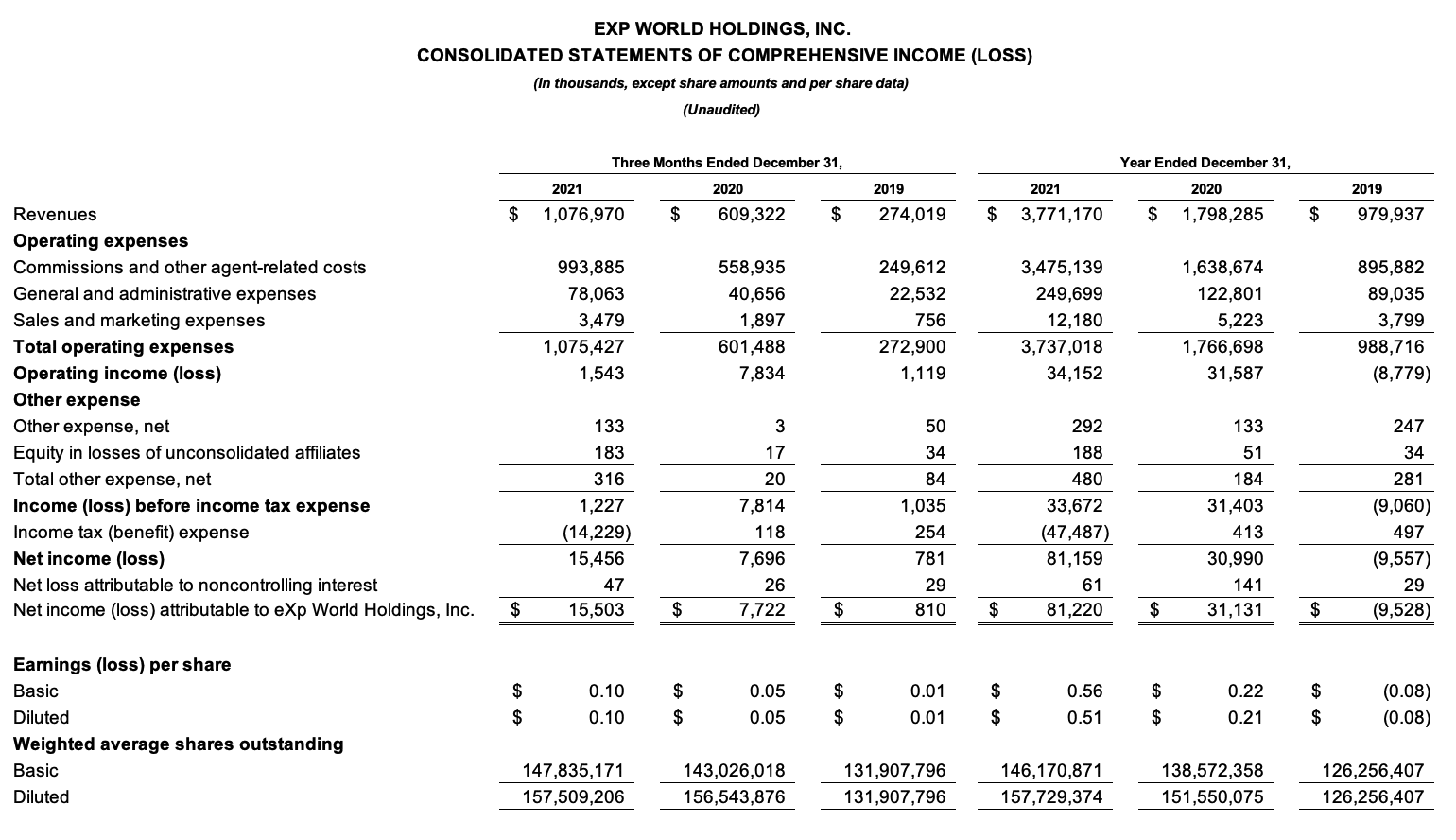

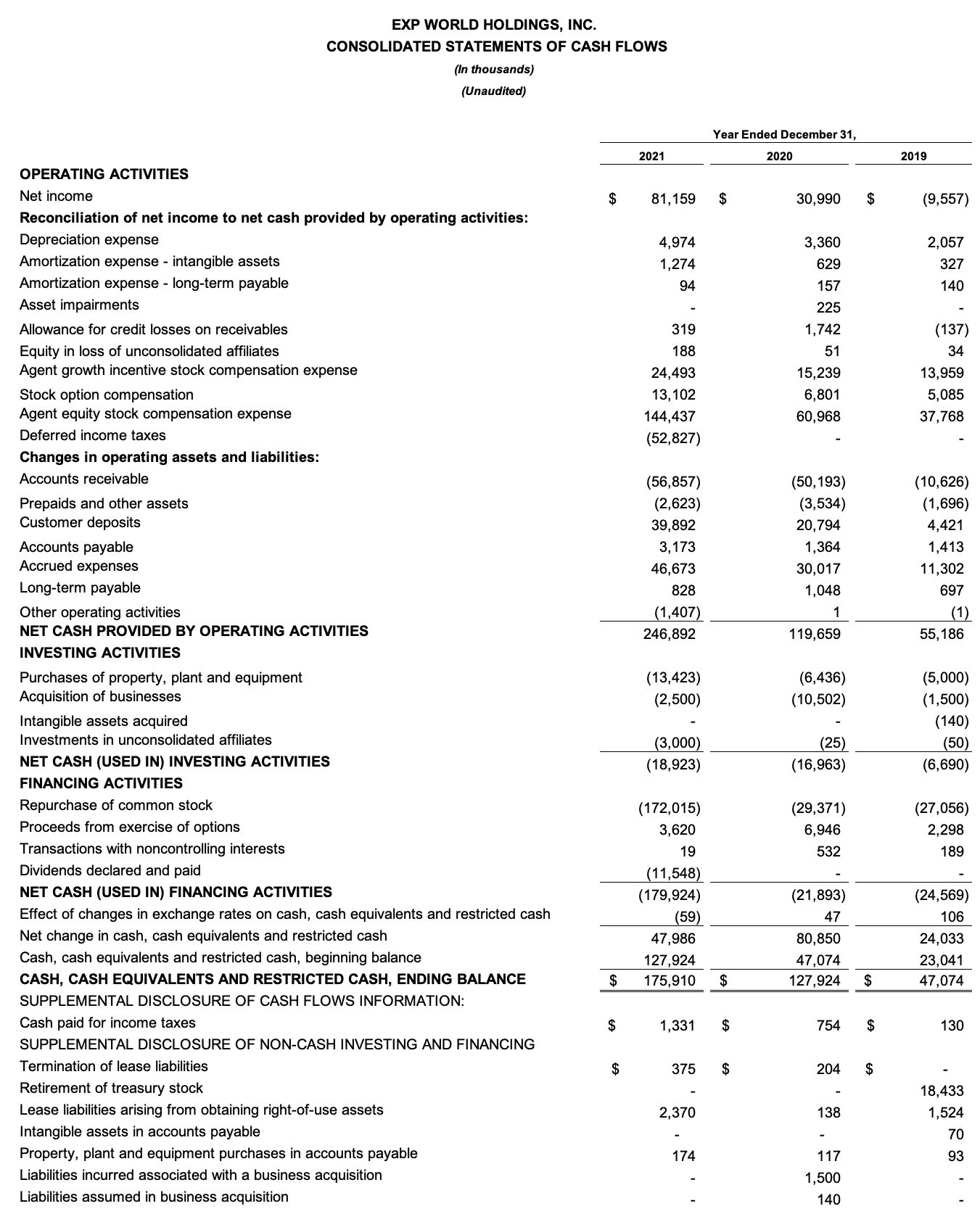

2021 Marks Highest Revenue and Profit Year in Company History, Driven by a 72% Increase in Agent Growth

Company Declares Cash Dividend for Q1 2022 of $0.04 per Share of Common Stock

BELLINGHAM, Wash., Feb. 24, 2022 (GLOBE NEWSWIRE) — eXp World Holdings, Inc. (Nasdaq: EXPI), (or the “Company”), the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises, today announced financial results for the fourth quarter and full-year ended Dec. 31, 2021.

Fourth Quarter and Full-Year 2021 Financial Highlights as Compared to the Same Year-Ago Period:

“2021 was another year of tremendous growth for eXp, as our core focus on innovation enabled us to welcome nearly 30,000 new agents across six continents to eXp,” said Glenn Sanford, Founder, Chairman and CEO of eXp World Holdings. “As real estate professionals increasingly turn to technology-based solutions for productivity and collaboration, our cloud-based platform has given us a first-mover advantage to scale our brokerage at the fastest rate in the industry. We attract top agents that value freedom, compensation and community.”

“We evolved our robust suite of products and services last year as we made preparations to launch SUCCESS Lending, a synergistic mortgage solution that aims to provide greater efficiencies and clearer communication between agents and their customers. To deepen our commitment to developing and inspiring our community of real estate professionals, we launched SUCCESS Coaching, our new business that provides a results-driven approach to personal development. Looking ahead, we believe there is a significant opportunity to capture additional market share in the real estate and adjacent industries as people and companies adapt to a digital future. We will remain focused on fostering collaboration and building an unparalleled network of industry professionals around the world,” concluded Sanford.

“In 2021, we achieved a record $3.8 billion in revenue by focusing on our growing, global community of real estate agents,” said Jeff Whiteside, CFO and Chief Collaboration Officer of eXp World Holdings. “Our year-over-year increase in transaction volume proves that the eXp model is resonating with top-producing agents and our ability to maintain this momentum underscores the strength of our competitive position. Reinvesting incremental cash flows generated by our business in products, services and technologies that further enhances the eXp platform for agents remains a priority as we scale, both within our existing markets and globally.” Fourth Quarter and Full-Year 2021 Operational Highlights as Compared to the Same Year-Ago Period:The Company will hold a virtual fireside chat and investor Q&A with eXp World Holdings Founder and CEO Glenn Sanford and CFO Jeff Whiteside on Thursday, Feb. 24, 2022 at 8:30 a.m. PT / 11:30 a.m. ET. The discussion will be moderated by Tom White, Managing Director and Senior Research Analyst at D.A. Davidson.

The investor Q&A is open to investors, current shareholders and anyone interested in learning more about eXp World Holdings and its companies.

Date: Thursday, Feb. 24, 2022 Time: 8:30 a.m. PT / 11:30 a.m. ET Location: EXPI Campus. Join at https://expworldholdings.com/contact/download/ Livestream: expworldholdings.com/events About eXp World Holdings, Inc. eXp World Holdings, Inc. (Nasdaq: EXPI) is the holding company for eXp Realty®, Virbela and SUCCESS® Enterprises.eXp Realty is the fastest-growing real estate company in the world with more than 75,000 agents in the United States, Canada, the United Kingdom, Australia, South Africa, India, Mexico, Portugal, France, Puerto Rico, Brazil, Italy, Hong Kong, Colombia, Spain, Israel, Panama, Germany and the Dominican Republic and continues to scale internationally. As a publicly traded company, eXp World Holdings provides real estate professionals the unique opportunity to earn equity awards for production goals and contributions to overall company growth. eXp World Holdings and its businesses offer a full suite of brokerage and real estate tech solutions, including its innovative residential and commercial brokerage model, professional services, collaborative tools and personal development. The cloud-based brokerage is powered by Virbela, an immersive 3D platform that is deeply social and collaborative, enabling agents to be more connected and productive. SUCCESS® Enterprises, anchored by SUCCESS® magazine and its related media properties, was established in 1897 and is a leading personal and professional development brand and publication.

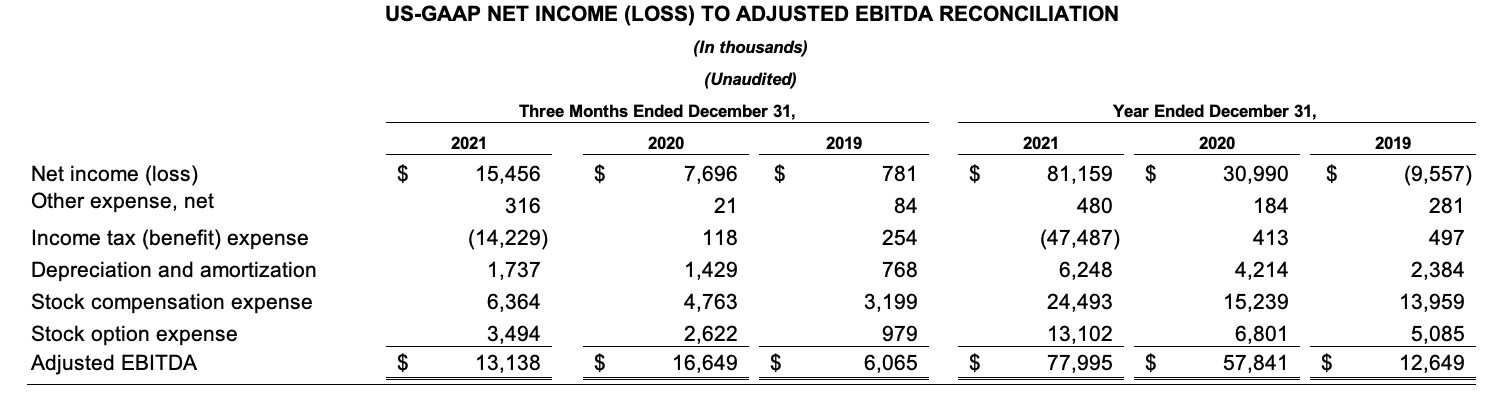

For more information, visit https://expworldholdings.com. Use of Non-GAAP Financial Measures To provide investors with additional information regarding our financial results, this press release includes references to Adjusted EBITDA, which is a non-U.S. GAAP financial measure and may be different than similarly titled measures used by other companies. It is presented to enhance investors’ overall understanding of the company’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.The company’s Adjusted EBITDA provides useful information about financial performance, enhances the overall understanding of past performance and future prospects, and allows for greater transparency with respect to a key metric used by management for financial and operational decision-making. Adjusted EBITDA helps identify underlying trends in the business that otherwise could be masked by the effect of the expenses that are excluded in Adjusted EBITDA. In particular, the company believes the exclusion of stock and stock option expenses, provides a useful supplemental measure in evaluating the performance of operations and provides better transparency into results of operations.

The company defines the non-U.S. GAAP financial measure of Adjusted EBITDA to mean net income (loss), excluding other income (expense), income tax benefit (expense), depreciation, amortization, impairment charges, stock-based compensation expense, and stock option expense. Adjusted EBITDA may assist investors in seeing financial performance through the eyes of management, and may provide an additional tool for investors to use in comparing core financial performance over multiple periods with other companies in the industry.Adjusted EBITDA should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of Adjusted EBITDA compared to Net Income (Loss), the closest comparable U.S. GAAP measure. Some of these limitations are that:

Cities and states have accelerated their distribution of Emergency Rental Assistance funds, leaving less extra money than expected in the pool for those who need it most.

The Treasury Department announced the first round of reallocations under the ERA program on Jan. 7, with $1.1B to change hands from jurisdictions that couldn’t or wouldn’t send their respective chunks of federal funding to those who either have run out of funds or will soon. The vast majority of the reallocations, about $875M, come in the form of voluntary transfers within individual states.

Only the first pool of ERA funds, just under $24B when accounting for administrative spending, was eligible to be reallocated, the announcement stated. Further reallocations from the ERA1 pool, as the agency labeled it, are forthcoming over the next few months, with the next deadline for requests being Jan. 21. The process of reallocating the second pool of rental assistance funds, or ERA2, is not legally allowed to begin until March 31.

The largest single transfer of funds was the state of North Dakota returning $149M of the $352M it received from ERA1 to the federal pool, which did not include any cities or counties within North Dakota among the reallocation recipients. North Dakota officials explained the decision by noting that a huge portion of the 120,000 renters in the state were not aware of the program, the Grand Forks Herald reports.

The most significant transfers of funds were from states to some of their largest jurisdictions. The highest dollar transfer came in Indiana, with the state transferring more than $91M to the city of Indianapolis. Wisconsin gave the cities of Milwaukee and Madison $61M and $35M respectively, with another $50M going to Milwaukee County. Nebraska gave the cities of Omaha and Lincoln $50M and $30M respectively, while Arizona sent $39M to Phoenix’s Maricopa County and Louisiana sent over $34M to New Orleans.

Of the money distributed directly by the Treasury Department to states, counties, and cities, the state of California was the biggest beneficiary, receiving over $50M. New York, where ERA distribution was notoriously slow to get off the ground, received $27M, while New Jersey, which fared considerably better, received $42M.

Only 21 jurisdictions had funds involuntarily recaptured by Treasury: seven states, 13 counties, and one city. The agency prioritized jurisdictions with demonstrated need within the same state when deciding where to reallocate those recaptured funds, but no data was publicly released laying out where exactly those funds wound up, unlike voluntary transfers within states. The Treasury Department declined to comment on the reallocation process beyond the press release, it told Bisnow through a representative.

The state of Idaho had $33M recaptured, while the only in-state recipients on Treasury’s list, the city of Boise and Ada County, received $7.2M and $3.7M, respectively. The rest of the recaptured $33M, the largest sum in the list of involuntary recaptures presumably went out of state.

Delaware, Montana, Ohio, South Dakota, Vermont, and West Virginia were the other states from which Treasury recaptured ERA money, with Laredo, Texas, being the only city to have funds recaptured in that fashion. Counties that had funds recaptured included Tuscaloosa in Alabama, five Texas counties, and New Jersey’s Union County, which sits across the Hudson River from New York and counts the key port city of Elizabeth as its largest municipality.

Only jurisdictions that requested additional funding and had obligated over 65% of their ERA1 allocations by the first application deadline of Oct. 15 were eligible to receive reallocations, and Treasury used both demonstrated need and effectiveness in spending ERA1 funding to prioritize recipients. But it couldn’t even come close to meeting the need in some jurisdictions.

The city of Philadelphia asked for $400M in reallocation funds based on the number of applicants and the average payout, which has been about $11K per applicant, said Rachel Mulbry, an assistant program manager for the Philadelphia Housing Development Corp. tasked with overseeing the city’s distribution. Treasury reallocated $8.4M to the city, which it has yet to receive, Mulbry and PHDC CEO David Thomas told Bisnow.

“The information we received from Treasury is that they anticipate us receiving the funding in the coming weeks,” Mulbry said.

The same day the reallocation data was released, Philly was forced to close its rental assistance application portal due to a lack of funds. Only a small portion of those who already applied will wind up getting assistance, even with the extra $8M, which would cover about 750 applicants at an average of $11K per household.

“It seemed unfair to have people’s expectations out there looking for relief when we couldn’t provide it,” Thomas said. “We were hoping not to close, and we were hoping legislators would figure out how to reallocate more funds, but it just hasn’t materialized.”

Even if Philly were to somehow receive the entire $400M it requested, it likely wouldn’t meet the demand if the city program were to reopen, though PHDC would probably attempt to open it if it received such a sum, Thomas said.

The divide between the need for rental assistance and the available funds still looms over the horizon, even as jurisdictions set a new high-water mark for money sent out the door in the month of November, according to Treasury data. Using November data to project forward, the agency estimates that $25B to $30B was distributed to tenants by the end of last year from the combined $46B available from ERA1 and ERA2.

The nature of the federal coronavirus relief packages was to treat the economic conditions caused by the pandemic as an acute crisis that demanded short-term funding to see people through to the other side. Though the economy has not shut back down through the emergence of the variants, the lost income that catching the disease could cause are still immediate dangers to housing stability, said Michael Spotts, a senior visiting research fellow at the Urban Land Institute’s Terwilliger Center of Housing. That includes unexpected burdens like remote learning when families don’t have daytime childcare options.

“People might have exhausted the minimal savings they had or taken on more debt to pay rent,” said Spotts, who authored a research report published in December for ULI about housing stability and the rental market. “The pre-existing conditions that contribute to [housing] insecurity will likely have worsened for a lot of people. So there will be a continued need for emergency rental assistance for people who suffer shocks going forward.”

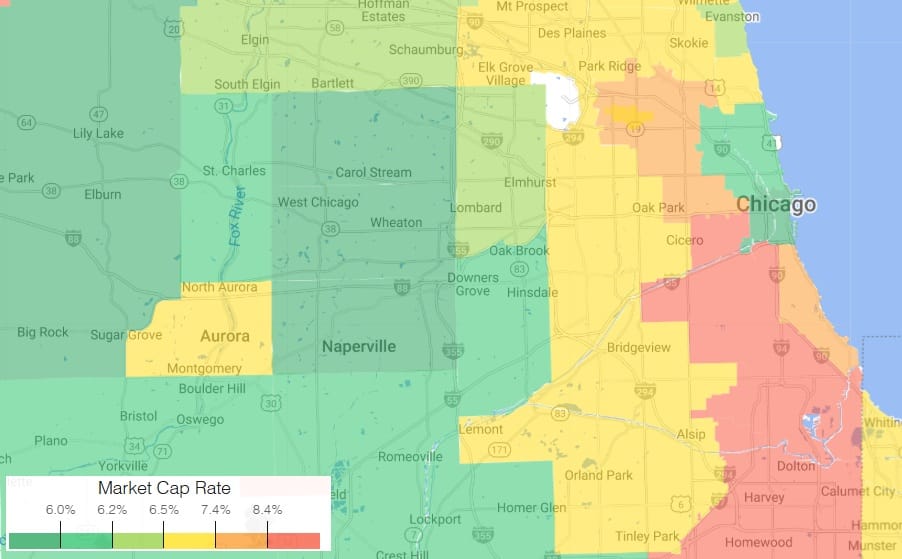

The U.S. apartment sector has experienced a rebound in both deal volume and asset pricing, but the performance varies across markets. The strongest growth in asset pricing tends to be concentrated in the Non-Major Metros, as shown in the chart below.

The simple average of annual price growth in the Non-Major Metros outpaced that of the 6 Major Metros in Q3 2021. Across the non-major areas, the average price growth stood at 14.8% while that across the 6 Major Metros averaged 4.5%.

In the 6 Major Metros, there is a loose relationship between the rebound in the pace of sales of individual buildings — the bedrock of the market — and subsequent price growth. Even with a triple-digit rebound in sales volume, some of these markets were still experiencing price declines in the third quarter. Markets such as San Francisco and Manhattan have faced stronger headwinds.

When the COVID-19 pandemic hit the U.S. in the spring of 2020, few could have imagined that the virus would still be impacting daily lives for the rest of the year, let alone nearly two years later. And when lockdowns started and 20-plus million jobs were lost, the dominant theme in the multifamily market was how to mitigate the damage.

However, as we start 2022, multifamily rents are coming off record-breaking highs in 2021 with an optimistic outlook for the year ahead. Between March 2020 and December 2021, asking rents in Matrix’s top 30 metros rose by an average of $194, or 13.5 percent. During that period, asking rents increased by 20 percent or more in nine of the 30 largest metros and 10 percent or more in 19 of the top 30. Meanwhile, in only four metros—large coastal centers San Jose, San Francisco, and New York, as well as Midland, Texas—were asking rents below pre-pandemic levels.Looking at the universe of 147 metros tracked by Yardi Matrix, asking rents increased by 20 percent or more in just over one in five (29) and by 10 percent or more in almost three quarters (79). The only metros that remain below pre-pandemic asking rent levels are in the Bay Area (San Francisco and San Jose), New York City, and Midland/Odessa, Texas, where rents are down by 22.5 percent.

The changes in rent since the pandemic started reveal much about demand and where growth could be concentrated going forward. Sheltering in place and working from home has loosened the link between home and work and limited the cultural advantages of large cities. That led to a migration from high-cost coastal centers starting in the spring of 2020. Where households are going can be seen by rent growth data.

The top choice is the South and Southwest. Between March 2020 and December 2021, asking rents grew by 34.5 percent on the Southwest Florida Coast; 31.1 percent in Phoenix; 28.5 percent in Tampa; 28.2 percent in Las Vegas; 27.2 percent in Boise, Idaho; 25.0 percent in Asheville, N.C.; 22.9 percent in Atlanta; 21.4 percent in Orlando; 20.7 percent in Raleigh-Durham; and 20.6 percent in Charlotte. These secondary and tertiary markets feature a lower cost of living than gateway metros, attractive weather, and geography, and a growing base of jobs as corporations expand there.

Another type of migration occurred between expensive coastal markets and nearby secondary markets that are less expensive. Asking rents since the pandemic started grew by 25.4 percent in the Inland Empire, 20.2 percent in Sacramento, and 18.3 percent in Orange County. In this type of migration, people move farther from job centers but within occasional commuting distance for flexible jobs. Or they are willing to make longer commutes in exchange for larger or less expensive apartments. Other metros that reflect this type of migration include Baltimore (11.7 percent), Colorado Springs (14.7 percent), Northern New Jersey (8.9 percent), and Long Island (8.6 percent).

The struggles of San Jose (-4.8 percent), San Francisco (-2.1 percent), and New York (-0.1 percent) reflect the high cost of housing in those markets and decline of office usage, especially among the technology jobs in the Bay Area metros. Some renters have become either unable or unwilling to pay high rents for small apartments in urban areas.

Even so, gateway cities can take heart from the fact that demand is rapidly returning. Year-over-year through November, occupancy of stabilized apartments is up 3.2 percent in New York, 2.9 percent in Chicago, 2.5 percent in San Jose, and 2.0 percent in San Francisco. As the pandemic gets nearer to its end phase, more companies are asking employees to come back to the office, if not full time at least more often. What’s more, as cities reopen, young workers from other parts of the country want to experience the cultural and lifestyle benefits of gateway centers.

Chicago Multifamily Cap Rate Map: What Drives Investment Value Understanding the Chicago multifamily cap rate landscape is essential for ...