eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Tuesday, March 28, 2023

Monday, March 27, 2023

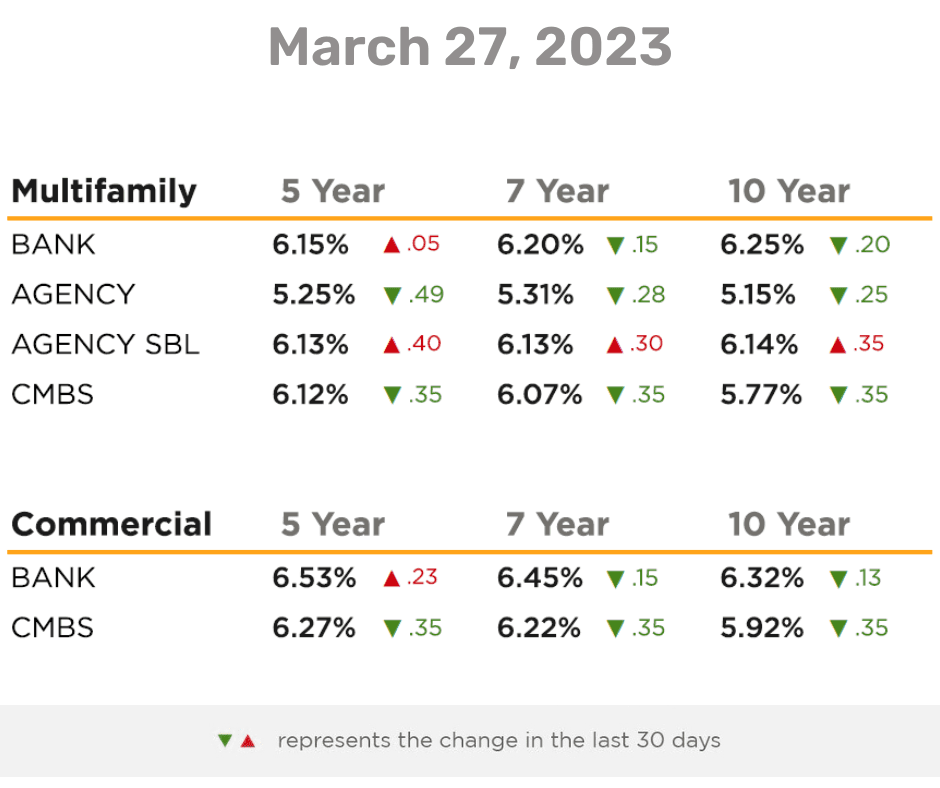

Commercial Rate Snapshot March 27th 2023

Commercial Rate Snapshot 1-16-2023

These are the average available rates from eXp Commercial's Capital Partner CommLoan database of 700+ commercial lenders as of 1/16/2023 and are provided for comparison purposes only.

*Actual rates are dependent on property and sponsor.

[ux_image id="128169"]Receive a Loan Quote from eXp Commercial's Capital Markets Partner CommLoan Thousands of Loan Programs. Hundreds of Lenders One Commercial Real Estate Lending Platform. One-stop shopping and unprecedented access to the capital markets

[sc name="financing"][/sc]

https://www.creconsult.net/market-trends/commercial-rate-snapshot-march-27th-2023/

Positive Shifts Ahead in Multifamily

Positive Shifts Ahead in Multifamily: NMHC

Panelists at the organization’s annual conference discussed current market issues and future silver linings.

“It is unusual for us as the industry darling to face valuation challenges, slowing rent growth, and somewhat soft renter demand,” Hessam Nadji, president & CEO of Marcus & Millichap, said of multifamily to the attendees of the National Multifamily Housing Council’s 2023 Annual Meeting. “Very unusual.”

Based on the surface of the facts facing multifamily, some outlooks can look scary. Multifamily unit absorption, according to Nadji, has turned negative while many apartments are currently under construction and will be delivered in 2022. The industry is also now facing the fastest economic tightening since 1980. However, as we pace further in 2023, Nadji expects we will start to reach normalization and have clarity on where the markets are going.

“Five years from now, we will be looking at the current set of dynamics as a current and rather unexpected temporary aberration,” Nadji told Multi-Housing News.

The issues at hand

Despite different NMHC panelists disagreeing on just how bad multifamily and the general real estate’s current circumstances are, the issues at bay were broadly similar across discussions. Multifamily faces tight financing, rising interest rates, high construction costs, prolonged construction timing, loan defaults, and the challenges of potentially overbuilding in specific markets.

When asked if the panelists believed construction rates would regulate and find a sense of normalcy again, Chip Bay, chief construction officer at Mill Creek Residential, responded by saying some people in the industry believe they already have. Therefore, the plan is re-budgeting for these higher costs instead of waiting to see what the future holds.

Further, after a strong 2022, lenders reset allocations for 2023 amidst volatile and uncertain markets. With proper funding more difficult to come by on top of already steep construction and building costs, man

While construction activity is slower than usual, transaction activity is simultaneously slower. Despite buyer demand remaining strong, the bid-ask gap between buyers and sellers makes deals less frequent. “For most operators, there is no urgency to sell or reduce prices,” Nadji told MHN. “At the same time, for a lot of operators who used short-term debt that is maturing as well as long-term debt that was placed five to seven years ago, there is a bridging challenge between the cost of debt they are used to and what is available in the current marketplace.”

A better future on the horizon

With so many issues at bay, it may not be easy to see the silver lining. However, several panelists and speakers throughout the NMHC conference gave reasons for retaining hope.

Senior Managing Director & Co-Chief Investment Officer at Bridge Investment Group, Colin Apple, said that the long-term fundamentals of multifamily as an asset are good. The market, over the next couple of years, he believes, will slow. Some purchases will be better located and positioned than others. In the longer term, once we are through the current pipeline of new deliveries, the multifamily industry will still be undersupplied and increasing in value.

Carl Whitaker, director of research and analysis for RealPage Inc., said that across several multifamily demand KPIs, there are already signs of stability in leasing, renewal, and occupancy. This indicates that the markets may return much faster than in the next couple of years.

Nadji spoke during the conference saying three things need to happen for the stars in multifamily to align and bring some clarity: an understanding of when the Federal Reserve will finish raising interest rates, clarity on the recession, and a recalibrating of the multifamily industry. Once the markets have a greater understanding of the timeline of each of those three things, we can hope to see regular trading activity later in 2023, according to Nadji.

“Our current challenges in the industry are short-term. The fact remains that housing is significantly undersupplied at a macro level,” Nadji told MHN.

Source: Positive Shifts Ahead in Multifamily: NMHC

https://www.creconsult.net/market-trends/positive-shifts-ahead-in-multifamily/Sunday, March 26, 2023

Commercial Multifamily Housing Industry Guide

Multifamily Housing: Definitions, Examples, and Opportunities

This guide addresses the following questions about the multifamily real estate sector.

-

What are the trends in multifamily home investing?

-

What does a multifamily home mean?

-

Is a multifamily dwelling unit commercial or residential?

-

What are the types of multifamily homes?

-

Who are the top multifamily companies?

The commercial real estate multifamily sector experienced a strong start in 2022. Vacancies dropped to 2.3%, down by 2.5 percentage points compared to the previous year, according to a Q1 2022 CBRE report. Additionally, new construction has added resulted in bringing about 66,400 units. Investors have noticed these positive developments, with total investments reaching $63B.

If you want to sell into the multifamily industry, it is essential to find the right contact — and filter out those that don't cover the suitable asset class. Here is a quick guide on the basics of multifamily commercial real estate investing for those interested in entering the market:

What Is Considered a Multifamily Home? (And What Is Commercial vs. Residential MFH?)

Multifamily properties consist of multiple apartment units, which can be managed by the investor or another entity, such as a management company, to manage building maintenance. Multifamily homes can be either residential or commercial, and we'll explain the difference.

Multifamily residential versus commercial

The number of units determines whether an asset is classified as a residential or commercial multifamily property.

-

Residential multifamily buildings consist of two to four units, such as duplexes.

-

Commercial multifamily properties consist of five or more units.

A single-family home is a property on a piece of land designated to have rooms and utilities for one family.

Single-family homes aren't considered multifamily properties. However, buildings with shared walls and separate utilities would classify the property as multifamily even when the homes are attached to the same land.

5 Common Types of Multifamily Buildings

Multifamily properties may differ based on ownership and the offerings for their tenants. Here is a look at five common types of multifamily investment properties:

-

Apartments have an independent building owner that rents out individual units to tenants. Buildings may contain only units or offer shared amenities for tenants, such as a pool or a fitness center.

-

Mixed-use developments are adjacent to office, retail, and dining spaces, which provide access to workplaces, shops, restaurants, and transit.

-

Age-restricted housing includes housing for seniors 55 and older.

-

Low-income housing is subsidized housing offered through government programs and isn't compared to market-rate housing.

-

Condominiums, co-ops, and townhomes are centered around the community and often come with shared amenities for residents. In a co-op, the investor purchases a share of the building and is given a long-term lease. The investor owns condos and townhomes and has to contribute to mortgage and property taxes.

Why Are Multifamily Units Appealing?

Multifamily assets appeal to some investors due to their liquidity — or how fast the property can be sold at market value. Additionally, multifamily properties provide a consistent income stream through tenant rent payments, and the property can often increase in value over time.

Multifamily Housing Trends: Focus On Live-Work-Play

Over the last decade, the multifamily sector has been experiencing a rise in mixed-use spaces, with renters preferring their homes, work, and entertainment all in one place. RentCafe insights showed that as of June 2022, the number of apartments in live-work-play communities increased from 10,000 flats in 2012 to 43,700 in 2022, indicating that this trend isn't likely to slow anytime soon.

Key Multifamily Statistics

-

As of 2019, there were over 43.9 million multifamily residences.

-

As of 2019, New York-New Jersey-Pennsylvania had the most prominent apartment stock, with around 2.4 million units.

-

In 2021, $335B was invested in multifamily assets.

-

As of January 2022, the average cost of constructing an apartment building in the U.S. was $11M.

-

As of April 2022, New York had the most multifamily residences.

https://www.creconsult.net/market-trends/commercial-multifamily-housing-industry-guide/

Saturday, March 25, 2023

The Dangers of Selling Commercial Property Too Late

The Dangers of Selling Commercial Property Too Late

The last downturn

cost those who chose to sell commercial property an average of

30.3% of their property value

Complacency is the most dangerous state to ignore.

It’s the moment before the market corrects and values decline. When the market goes through this initial correction, our natural tendency is to be complacent because initial corrections actually look like a cool-off period.

Then we expect the market to pick up again and continue with its growth phase.

But, the market continues to deteriorate and worries creep in as we wonder what is going on. Next, it is normal to say to yourself that your investments are good ones that they’ll ultimately come back.

When the market continues to soften until it seems there is no hope in coming back, that’s the absolute bottom of the market and the worst time to sell.

This point of capitulation is one of surrender and of asking how the government could let something like this happen.

Reason #2

Why people sell commercial property too late:

Ownership and Identity

In order to avoid loss, people will overvalue what they own.

That is what Richard Taylor, Daniel Kahneman, and Jack L. Knetsch identified with the Endowment Effect. In fact, Kahneman and Knetsch won the Nobel Peace Prize for their research in this area of behavioral economics.

It’s normal for people to overvalue what they own.

In a study with Cornell undergrads, broken into groups and given identical coffee cups, Kahneman and Knetsch told one group to value the cups they owned and the other group to value the cups they would purchase.

They found the undergrads with the coffee cups were unwilling to sell their coffee cups for less than $5.25 while their less fortunate peers were unwilling to pay more than $2.25 to $2.75.

But, it was Carey Morewedge’s research into the Endowment Effect that revealed that it’s not loss aversion that leads to overvaluation, it’s ownership and identity.

Morewedge found that it’s our sense of possession that creates the feeling of an object being mine, which then becomes a part of our identity.

Reason #3

Why people sell commercial property too late:

Loss Aversion

Why is it so difficult to sell commercial property in a market decline?

According to Brafman and Brafman, authors of Sway: The Irresistible Pull of Irrational Behavior people will go to great lengths to avoid perceived losses.

What’s more, people also succumb to their will to recover what once was. They will spend whatever it takes not to lose, be it time, money, or emotional resources.

Imagine watching someone playing craps in Las Vegas. When they are on a roll, taking in their winnings, they race through the growth phase, reaching the peak of the game.

They feel ecstatic.

But what happens when the tide turns and they start to lose?

They enter the complacency stage, call it a short turn of bad luck, and keep playing. They believe they will return to the top. But their bad luck continues.

By waiting to avoid losses, people hold off and then sell at the wrong time — maximizing their losses.

They lose their winnings, keep playing and generate losses. They would rather hold onto the idea of getting back to where they were at almost any cost than realizing their loss and moving on to another opportunity.

Reason #4

Why people sell commercial property too late:

Self Reliance Time Traps

Time Trap #1: Self-Education

People will self educate online because it is free and immediately available. A review of the search term on Google for “commercial real estate trends” returned 152 million results. A search for “commercial real estate trends YouTube” turned up 310 million results!

No doubt, an abundance of free information in the form of market data, blogs, market reports, and online opinions on what’s happening in the market is available.

Time Trap #2: Friends, Family, and Non-Commercial Advisors

When we aren’t sure what to do, we often consult friends, family, and non-commercial real estate advisors for input. Unfortunately, these people will not want to be the ones to say sell because it is easier to say no and risk being wrong than to say yes and risk not being right.

Plus, most of these folks will not have the data that you have seen here. These people are more likely to share anecdote based advice like “My friend made a killing in real estate. You should hold on, it will come back.” Remember, people who made this mistake lost in 2008-2010.

Time Trap #3: Hire a Traditional Broker

It is easy to find a traditional broker, given that 1 in 164 people in the United States today have a real estate license. According to the National Association of Realtors, there are about 2 million active real estate licensees in the United States.

The problem is that most traditional brokers do not specialize in Commercial Real Estate, Investment Sales and further specialization by property type.

Have you thought of selling your property and would like to know what it's worth? Request a valuation for your property below:

eXp Commercial Chicago Multifamily Brokerage focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

We don’t just market properties; we make a market for each property we represent. Each offering is thoroughly underwritten, aggressively priced, and accompanied by loan quotes to expedite the sales process. We leverage our broad national marketing platform syndicating to the top CRE Listing Sites for maximum exposure combined with an orchestrated competitive bidding process that yields higher sales prices for your property.

Apartment Owners Likely To Reap Rewards Of Housing Market Headaches

Apartment Owners Likely To Reap Rewards Of Housing Market Headaches

Ballooning costs in the for-sale housing market have served as an adrenaline shot for apartment demand, driving valuations up. However, ablation pummels the construction industry, and the development pipeline still can't keep up.

That's good news for existing apartment owners who are set to benefit from increasing rents bu. Still, it continued pain for those searching for a place to live and cities seeking relief from the nationwide housing crisis.

Investors are flooding the for-sale homebuyer's market to turn them into rentals.

"People are working, they're paying their rent, they've gotten through Covid, and maybe they've been saving for years to buy a house — but suddenly the cost of everything about buying a house is way up, so they're going to be renters still," said New Standard Equities CEO Edward Ring, whose company is an active investor in multifamily on the West Coast.

A deep recession might bring the cost of housing down quickly, as it did in 2008. Still, in that case, job losses would keep people in their apartments, Ring points out, though he's skeptical that a recession in 2022 or 2023 would be the kind of implosion that happened during the Great Financial Crisis.

"A lot of institutional money seems to be mistaking today's outlook with that of 2008," Ring said. "They're bracing for another massive recession. There are some similarities, such as rising home prices, but otherwise, dynamics aren't the same."

In short, he expects home prices to remain relatively high, along with the cost of mortgages, as long as the Federal Reserve tries to tamp down inflation via interest-rate increases.

Multifamily will be the beneficiary of that situation this year and maybe longer.

And there are already indications that the heated for-sale housing market is cooling, at least a bit.

According to the National Association of Realtors, inventory of for-sale homes increased year-over-year in May for the first time since June 2019; all, the annual increase of 8% over 2021 leaves the national housing market far short of its pre-pandemic levels, with just over 500,000 homes available.

Accordingly, the median asking price for single-family houses rose 17.6% over last year to a new high of $447K, while time on the market dropped six days to 31.

But rising interest rates are expected to clearly impact housing sales moving into the second half of the year.

In June, Fannie Mae lowered its forecast of mortgage originations and home sales for 2022, the result of climbing mortgage rates.

Higher mortgage rates are the housing market's "primary constraint," the agency said. Fannie Mae forecast that home sales will fall 13.5% year-over-year to 5.96 million units in 2022. Further, the GSE expects about 5.29 million homes to sell in 2023.

Rather than being good news for would-be buyers, fewer people will be able to afford homes at today's elevated prices, even though Americans are making more money. Household incomes have increased since the pandemic, but inflation is eating up those gains.

Historically, renters entered the market by moving into starter homes, allowing them to build equity to progress into larger, more expensive properties. But that dynamic was disrupted by the 2008 recession, Fogelman Properties President Mark Fogelman said. His company is an active multifamily investor, especially in the Southeast.

"As recently as the 2000s, developers were building subdivisions aimed at people making $40K to $80K a year, allowing people in that income group to matriculate from apartments to their own houses," Fogelman said.

"But because of lack of credit and a change in builder focus, now there's virtually no starter home inventory in the country," he said. "A 'starter home' now is $400K, which isn't affordable to many renters."

Even if developers wanted to build lower-cost housing, the current climate makes that very difficult. Rising construction costs and long construction timelines are limiting supply.

"The next six months will be like the last six months, only worse," Associated Builders and Contractors Chief Economist Anirban Basu told Bisnow, referring to the rising cost of everything that goes into construction. "Construction spending has likely fallen over the past 12 months after accounting for inflation."

The squeeze on first-time homebuyers comes as the number of household formations increases, which drives demand for all housing, primarily rental since new households tend to skew younger with lower incomes and fewer savings necessary for down payments.

U.S. household formation took a hit during the early months of the pandemic as the economy contracted. Still, much like the broader economy, it bound ced back with gusto by 2021, according to the Federal Reserve.

Over the past year and a half, household formation has been primarily driven to return to the pre-pandemic rates at which younger adults lived with parents or other family members, the Fed notes. The rebound has been an essential contributor to a surge in housing demand.

From the end of 2019 through March 2022, men's rents and house prices have ballooned to record highs, even as permits for new residential construction have risen to their highest level since 2006, according to the Fed.

The current climate might make things challenging for renters who want to own, but owners stand to benefit as renters remain in place. Currently, that dynamic is reflected in multifamily valuations and vacancy rates.

MSCI reported in late June that apartment asset prices set an all-time high rate of growth rateMay, up 23.3% compared with the same month in 2021, with demand for apartments still rising as household formation increases.

RealPage reported in May that the national vacancy rate for investment-grade apartments ticked down in Q1 2022 from the previous quarter to 2.4%, the lowest quarterly vacancy rate since the company began tracking in 2000.

A more comprehensive measurement of apartment vacancy also showed that rates have been dropping since last year. The U.S. Census Bureau's rental vacancy rate for all apartments (buildings with five or more units) rose from 0.6% in the first quarter of 2022 to 7%.

Rents for professionally managed apartments rose 15.2% year-over-year in Q1 2022, RealPage reported, up 1.3 percentage points from the previous quarter. It is also the third consecutive quarter of double-digit rent growth on the national level.

With its shorter lease terms, multifamily (as well as self-storage and hotels) has a more remarkable ability to monetize rental increases, LEX Chief Financial Officer John Todd said.

"In this market environment, you have a millennial household formation that is bolstering the need for housing, which generally people can't substitute," Todd said.

"All that pent-up housing demand has been released, and that shift will be here to stay for several years," Todd said. "Being an owner or investor in a multifamily property is a perfect place."

But despite a positive outlook, New Standard Equities Chief Operating Officer Julie Blank said that multifamily owners should be cautious.

"Operators must take a strategic look at the demographics they are targeting and set their business plans according to real-life scenarios," she said. "What can residents afford? Business owners can't be swayed into thinking everybody can afford something better."

Source: Apartment Owners Likely To Reap Rewards Of Housing Market Headaches

https://www.creconsult.net/market-trends/apartment-owners-likely-to-reap-rewards-of-housing-market-headaches/Friday, March 24, 2023

New study shows people would rather rent proven by the rise of the millionaire renter

It’s been reported that people are being priced out of homeownership, forced to settle for another lease, but that’s not the case across the board.

Homeownership is not a priority for everyone, and a new study by RentCafe found renting is preferable for many Millennials and Gen Zs—and it has nothing to do with cost.

With 43 million families living in apartments, the highest level in half a century, renting is popular even among high earners who are able to buy but prefer to rent instead. In fact, RentCafe’s recent analysis of IPUMS data reflected that the number of renters with annual incomes of over $150,000 grew by 82% between 2015 and 2020, faster than renters overall, who increased by 3.2% during the same period.

Now, from the 2.6 million high earners renting in the U.S. a new kind of tenant has risen: the millionaire renter, as the number of renter households with incomes of more than $1 million has tripled since 2015.

When looking at the total number of high-income renter households, New York is the “it” place for renters that earn over $150,000 with nearly 300,000 such households in 2020. Los Angeles is just behind New York with 82,655 high-income renter households, followed by San Francisco and Chicago with 80,020 and 51,000, respectively.

In fact, Chicago had a 97% increase in high-income renter households from 2015 to 2020, one of the biggest in the U.S.

Subscribe to:

Comments (Atom)

Chicago Multifamily Mortgage Rates – February 2026 Market Update

Stabilizing Debt Costs Create Tactical Opportunities for Apartment Owners Updated: February 2026 Chicago multifamily mortgage rates are stab...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...