Diversifying your investments is always a good idea. And in an economic moment like the present, it's a borderline necessity when the market looks to be approaching a volatile period.

For investors in residential real estate looking to upgrade their portfolios while scaling down their risk, commercial real estate offers an exceptionally safe and lucrative harbor. The commercial real estate market is much more insulated from market shocks than the residential market. The returns can be very attractive — often on par with top-quality investments like dividend stocks.

Let’s look at some of the unique pros and cons of investing in commercial real estate and some of the best ways to allocate your money in the commercial real estate world.

What Makes Commercial Real Estate Investing Unique

Commercial real estate investing is different from residential real estate investing in some fundamental ways. First of all, there’s more money involved. The average commercial property has a higher price tag than all but the highest-end residential properties, so it’s tougher to buy in.

Those high stakes also necessitate more careful analysis. While a simple comparative market analysis is great for residential investments, a commercial real estate investment demands more in-depth number-crunching.

However, that high price tag has an upside. Commercial investments are based more on careful analysis rather than heated speculation. Since relatively few investors can participate, there’s much less competition in the market.

Commercial properties also come with long, multi-year leases, ensuring a steady cash flow. Returns on a typical commercial investment are 6% to 12%, much higher than the standard residential return.

Finally, commercial properties can be extraordinarily low-maintenance. While residential rentals can be pretty low-maintenance if you work with a property management service, property managers also eat up a significant percentage of your rents. Using a triple net lease for your commercial property means the tenant pays maintenance, taxes, utilities, insurance, and everything but the mortgage. While triple net leases come with slightly lower rents than leases in which the owner foots some of these costs, they’re still much more lucrative, on a dollar-for-dollar basis, than professionally managed residential properties.

So what are the best ways to diversify into commercial real estate? Let’s look at some of the most popular paths.

Using a Transaction Sponsor

If you want the most streamlined, low-maintenance commercial real estate experience, putting your money into a project led by a transaction sponsor is likely the best way.

A transaction sponsor scouts out potential commercial projects. When they find one that’s promising, they negotiate a purchase agreement, assemble investor materials, and bring in the capital needed to buy or renovate the property.

You don't have to do much as an equity investor in a project like this. The transaction sponsor will oversee and is responsible for every phase of the project, from pre-acquisition due diligence through to the final disposition of the finished product.

To maximize diversification, allocate money to several different transaction sponsors. Since most sponsors specialize in various projects, you’ll likely have money in various properties.

Diversification Through Types of Commercial Real Estate

There are four main types of commercial real estate; allocating your money among them can further insulate you from risk. The main types are:

Industrial

This type includes buildings like warehouses as well as production or logistics facilities. Industrial properties offer excellent cash flow and low operational risks but are vulnerable to market downturns. They’re also typically quite large, which translates to high upfront costs.

Office

Office spaces offer excellent stability for investors, as leases are typically long and come with low tenant turnover. However, one of the significant downsides of a long lease is the few opportunities for rent increases. On top of that, there may be high upfront costs if an office space needs to be customized for a specialized client, like a medical facility.

While office spaces are typically stable even in volatile economic times, the rise of remote work during the pandemic has cast the future of office space into doubt.

Retail

Tenants like retail shops, gyms, entertainment properties, and bank branches use these properties. Similar to office space, retail spaces often come with long leases. On the downside, retail tenants are vulnerable to market changes and sometimes go bankrupt. Because the spaces are highly customized, expensive renovations are often necessary between tenants.

Multifamily

A commercial multifamily property has five or more residential units. While these properties are well insulated from economic turbulence, they come with the labor-intensive obligations of smaller residential investments — for example, property management costs and high tenant turnover. Despite their residential nature, these properties are still considered one of the core types of commercial real estate.

The genius of diversifying among different commercial real estate types is that you can take advantage of every market condition. For example, in a booming economy, you’ll reap the benefits of owning industrial space, and when the market enters a downturn, your multifamily investments will weather the storm.

Diversifying Through Property Classes

Savvy investors can also allocate their money to and invest in real estate along different commercial properties. Commercial property classes are:

Class A

This is the highest quality commercial property. Typically, the property is new, well-maintained, and centrally located. Consequently, it offers shallow risk and very predictable returns.

Class B

The second-highest commercial property class is usually between 10 and 20 years old, in need of minor renovations, and in a decent but not top-quality market. This property class offers slightly more risk but can give investors great returns if correctly managed.

Class C

Older properties (usually between 20 and 30 years old) require moderate repairs. Nearing the end of their usable life, they’re also located in fringe areas and require prudent management to deliver a consistent return.

Class D

These obsolete properties may require significant renovations or repairs to get back to acceptable conditions. Their very low buy-in could yield considerable profits to an innovative manager, but they could also result in a total loss.

Again, allocating investments among every class can offset risk and maximize profit. A Class A investment will consistently bring in cash flow, while a handful of lower-class assets can result in exponential gains.

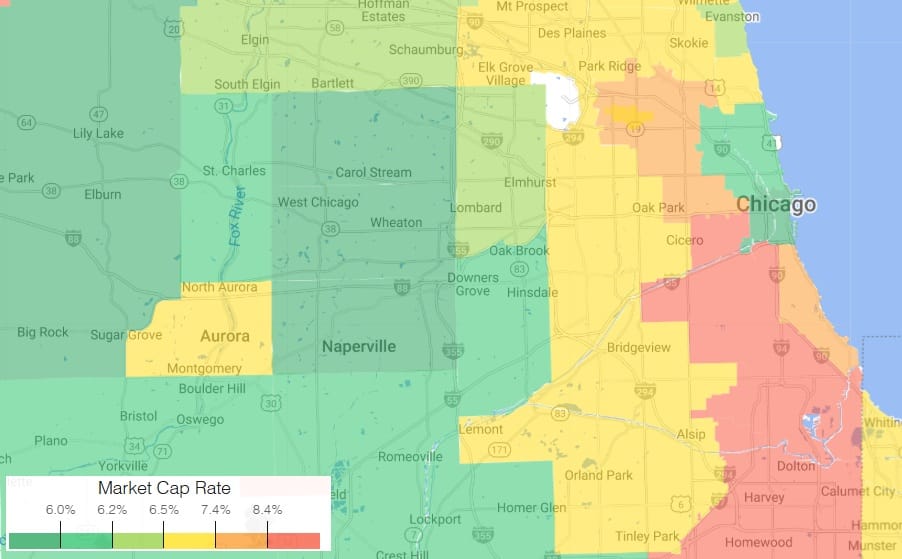

Diversifying by Location

Finally, allocating money among different geographical locations allows you to avoid being too tied up in the fortunes of any one market. Especially as issues like climate change threaten prime coastal markets like Miami and water scarcity threatens prospects in the West and the Sun Belt, it’s essential to keep “location, location, location” in mind.

The Bottom Line

Commercial real estate investments offer a viable and reliable sector into which to invest capital and diversify your portfolio. It’s worth exploring various asset classes, locations, and property types to find the best investment property. And, of course, when in doubt, it’s best to talk to an experienced commercial real estate broker to gain detailed market knowledge before you buy and receive guidance throughout the investment process.

Source: How to Diversify Your Investments With Commercial Real Estate | Crexi Insights

https://www.creconsult.net/market-trends/how-to-diversify-your-investments-with-commercial-real-estate/