Source: U.S. Multifamily Market Faces Challenges Ahead

https://www.creconsult.net/market-trends/2024-multifamily-forecast/eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Source: U.S. Multifamily Market Faces Challenges Ahead

https://www.creconsult.net/market-trends/2024-multifamily-forecast/

Top and Bottom 10 Metros by Gross Income Growth for 2024. Image courtesy of Freddie Mac

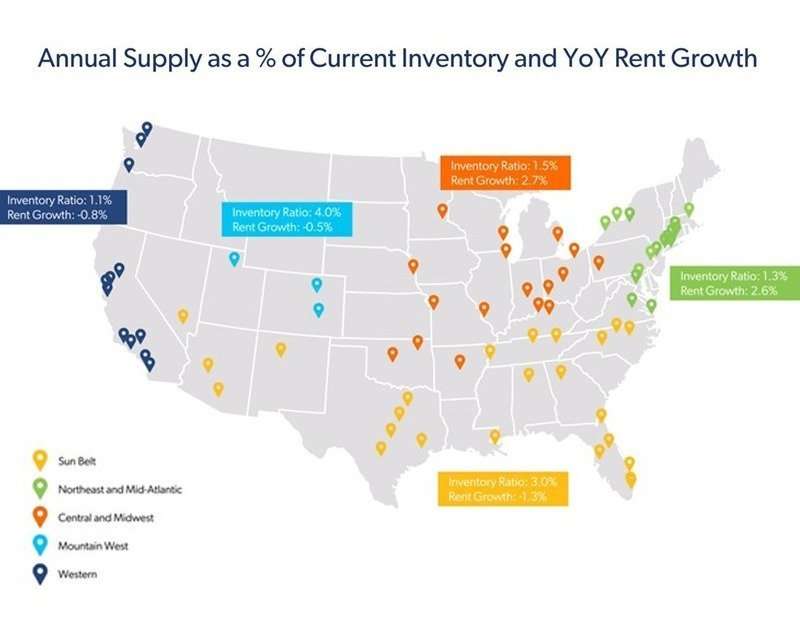

Annual Supply as a percentage of Current Inventory and YoY Rent Growth. Image courtesy of Freddie Mac and The RealPage

Source: Freddie Mac Outlook for 2024: Moderate Growth

https://www.creconsult.net/market-trends/2024-multifamily-market-forecast/

Chicago's Suburban Rental Market: A Hidden Gem for Investors

Amid a nationwide trend of cooling rents, Chicago's suburban multifamily market stands as a testament to stability and growth. While the national median rent has seen a slight decrease, Chicago's suburbs offer a unique allure to both renters and investors.

Danielle Hale, chief economist at Realtor.com, acknowledges a multifamily building boom in select regions, which has kept rents in check. However, the robust demand in Chicago's suburbs defies this trend because more people are choosing suburban living because of its convenience and affordability.

Contrary to the national narrative, rents in Chicago's suburbs have maintained their upward trajectory, appealing to a diverse demographic of renters and positioning investors for success in a market characterized by its resilience.

The unique market conditions of the Chicago suburbs, including lower unemployment rates and a consistent demand for rental properties, provide fertile ground for multifamily property investments, outshining the volatile urban rental landscapes.

"Discover the advantages of investing in Chicago's thriving suburban multifamily market. With steady demand and favorable economic conditions, now is the time to diversify your real estate portfolio. Contact us to learn how you can capitalize on these suburban investment opportunities."

Source: Here’s where the price of rent is dropping in the US

https://www.creconsult.net/market-trends/chicago-suburban-multifamily-investor/ [row]

[col span__sm="12" divider="0"]

[row]

[col span__sm="12" divider="0"]

Discover Moody's Analytics CRE's economic data benefits on Feb 29. Essential for Chicago's multifamily investors.

eXp Commercial is excited to showcase the invaluable asset Moody's Analytics CRE brings to our technology suite, offering unparalleled economic data and insights. This is particularly beneficial for our multifamily division focusing on the vibrant Chicago market. Our affiliation with Moody's Analytics CRE underscores our commitment to providing clients with a decisive competitive edge.

We warmly invite you to attend a unique webinar on Thursday, February 29th, at 11 a.m. PT / 2 p.m. ET, hosted by the esteemed economists at Moody's Analytics CRE. This session promises to unravel the complex fabric of the 2023 CRE trends, offering a clear perspective on their implications for the future, with a special emphasis on the multifamily sector in Chicago.

This webinar is an essential resource for stakeholders in the Chicago multifamily market. Moody's Analytics CRE's economic data is a powerful tool that can refine and enhance your investment strategy, aligning it with the latest market developments and forecasts.

The economic data provided by Moody's Analytics CRE is integral to our tech stack, equipping our clients with the insights needed to navigate the market successfully. This event epitomizes the strategic advantage our clients gain through access to high-quality economic and market information.

Don't miss this opportunity to elevate your understanding of the multifamily CRE market in Chicago. Register for the webinar today to benefit from Moody's Analytics CRE's economic data. Let eXp Commercial assist you in leveraging these insights for the success of your investment portfolio.

Achieve unparalleled success in multifamily property sales in Naperville and Aurora with the strategic expertise of Randolph Taylor and the eXp Commercial team. Our dedicated approach ensures your property stands out in the competitive market. Discover innovative sales strategies on eXp Commercial's website and see how we can elevate your property's profile.

Tailored Expertise for the Naperville and Aurora Markets Randolph Taylor brings unparalleled insights into the multifamily property landscape of Naperville and Aurora. Leveraging his extensive experience, we position your property for maximum exposure and optimal sales outcomes. Dive deeper into our market analysis techniques here.

Comprehensive Marketing Strategies At eXp Commercial, we don't just list your property; we launch it. Our comprehensive marketing strategies ensure your listing reaches a wide, qualified audience. From digital marketing to traditional advertising, we cover all bases. Learn about our unique approach here.

Our commitment to your success is unmatched. Partnering with us means gaining access to cutting-edge tools, detailed market insights, and a team that's dedicated to achieving the best possible outcome for your multifamily property sale in Naperville and Aurora.

Don't leave your multifamily property sale in Naperville and Aurora to chance. Let Randolph Taylor and the eXp Commercial team guide you to success. Our expertise, tailored strategies, and unwavering dedication are the keys to unlocking your property's potential.

[row v_align="middle" h_align="center"] [col span__sm="12" align="center"] [button text="Schedule Call" color="secondary" size="large" radius="99" link="https://meetings.salesmate.io/meetings/#/expcommercial/scheduler/call" target="_blank"] [/col] [/row] https://www.creconsult.net/market-trends/multifamily-property-sales-in-naperville-and-aurora-exp-commercial/

A lot of excitement is building for JTC’s February 21 webinar, “1031 in 2024: Strategies for Real Estate Investing.” Featuring a panel of expert speakers from the worlds of 1031 and real estate, including JTC’s Justin Amos and Shanaé Mabrie along with Simon Brower of Upstream 1031 and James Huang of eXp Commercial, this unique online event will focus on the challenges of the real estate market in 2024.

It’s been a difficult few years in the world of commercial real estate, with high prices, a lack of inventory, inflation, and recessionary fears all adding to the confusion. Property owners may be unsure if a 1031 exchange is feasible in this environment and what strategies could give them a leg up, which is why the webinar is attracting a lot of interest.

In the full press release, you can read about the webinar details, including discussion topics, how to sign up, and what’s being said about this exciting event. Those looking for answers on what the market is going to look like in 2024 and how to perform a successful exchange in a competitive environment won’t want to miss this opportunity.

To read the press release

https://www.creconsult.net/events/2024-real-estate-1031-webinar/At the halfway point of the year, Cleveland, Cincinnati, Columbus, and Chicago have all seen rent growth well ahead of the national average....