Training and education are core offerings at eXp Realty® and eXp Commercial® is adding to the goodness by offering several opportunities for all agents — whether you’re with eXp Realty or not — to take part in commercial real estate training during the week of Dec. 6-10.

Free, 3-Day Course to Get Trained and Certified in Commercial Real Estate

The training program, “An Introduction to Commercial Real Estate,” is a full, three-day program being held Dec. 6-8 and will be facilitated by Michael Simpson of the National Commercial Real Estate Association (NCREA). It’s free and will be held virtually in the eXp Commercial Campus (download directions here).

> Register now for this FREE training

“There has always been a lack of education and training when it comes to commercial real estate,” said Stephanie Gilezan, Director of eXp Commercial Brokerage Operations. “Pre-licensing and continuing education barely touch on commercial real estate. With the lack of training, it has always been difficult for commercial agents and brokers to be successful in the commercial real estate space. At eXp Commercial, we want to put education and training at the forefront so all licensees have the training necessary to know the business but to also be successful in their commercial real estate career.”

Monday-Wednesday Dec. 6-8: “An Introduction to Commercial Real Estate”

- What: “An Introduction to Commercial Real Estate” training program

- When: Monday through Wednesday, Dec. 6-8 starting at 7 a.m. PT each day

- Where: eXp Commercial Campus Auditorium. (Download here.) For non-eXp agents, upon registration, information will be provided on how to access the eXp Commercial Campus.

- Who can attend: Licensed real estate agents who are interested in learning more about commercial real estate

- Cost: Free! (a $600 value)

- Agenda: See the curriculum here (All times are PT)

- Certification: Agents who attend classes Monday through Wednesday, Dec. 6-8 and do the homework and pass the test will be awarded a certificate verifying this accomplishment.

Getting insight and training into commercial real estate is not easily accessible and it can be costly. This 3-day course is estimated to be valued at $600, but eXp Commercial is offering it for free. eXp is committed to educating all agents in residential real estate, as well as commercial. This class is ideal for residential real estate agents who want to learn more about commercial real estate and add another tool to their arsenal. Don’t miss this free opportunity!

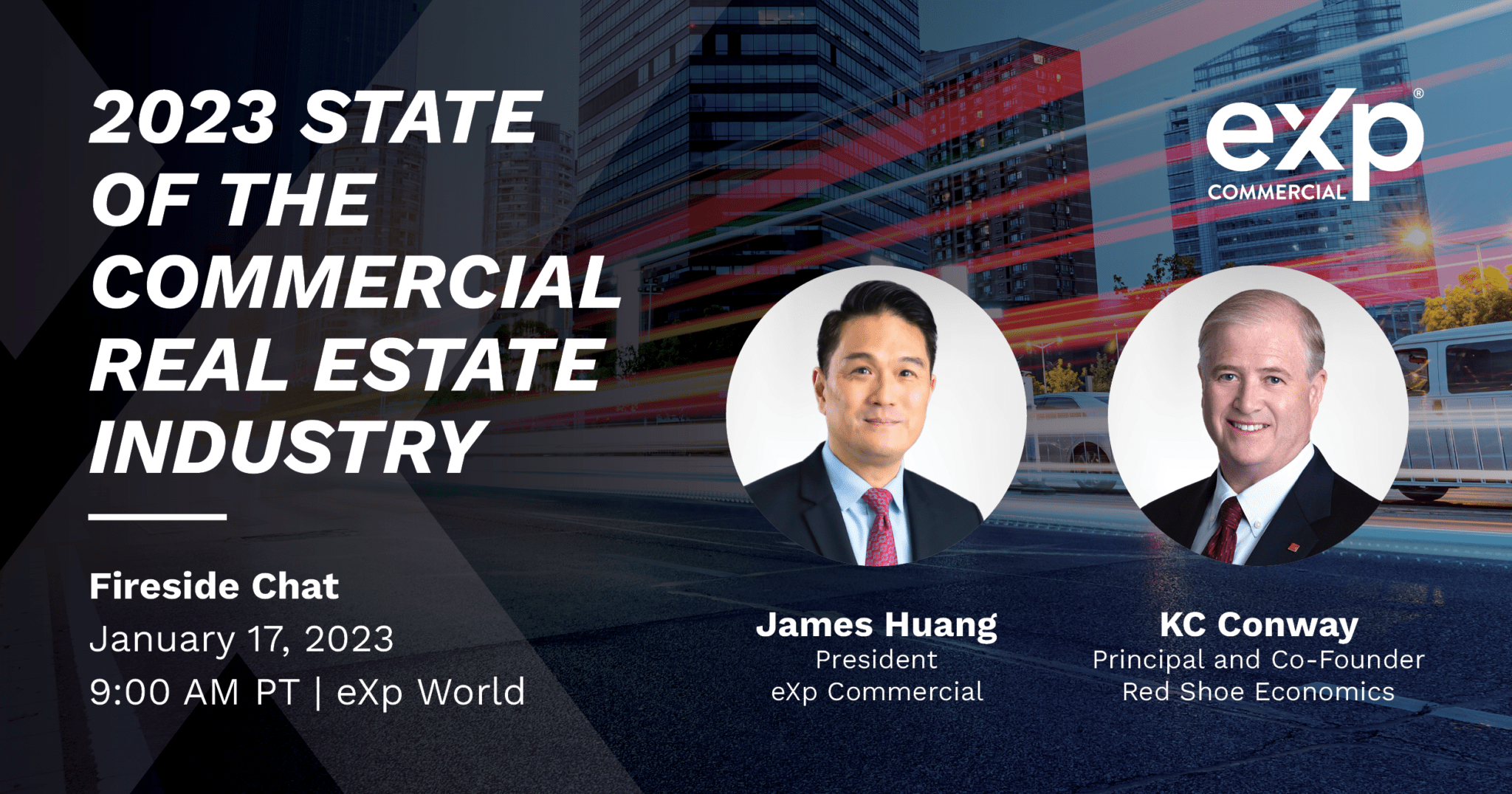

Thursday, Dec. 9: Commercial Real Estate Symposium

For more advanced commercial real estate agents, eXp Commercial is hosting the Commercial Real Estate Symposium on Thursday, Dec. 9, 2021, in the virtual eXp Commercial Campus. Hear from the industry’s top leaders, national economists and thriving entrepreneurs on the future of commercial real estate.

The Commercial Real Estate Symposium is open to commercial real estate licensees and will feature networking opportunities, breakout sessions, and giveaways.

KC Conway, the principal, and founder of Red Shoe Economics will be the main speaker and will address the future of commercial real estate from an economist’s perspective.

There will also be panels featuring leaders from the Society of Industrial and Office Realtors® (SIOR), Certified Commercial Investment Member (CCIM), and the Institute of Real Estate Management (IREM) on topics such as where the commercial real estate opportunities are, adaptive reuse, and why inclusion is important for the industry.

Friday, Dec. 10: Additional Networking

To offer an opportunity for additional networking, Friday, Dec. 10 will be a day for people to visit the eXp Commercial Expo Hall and network. This is a casual event to provide additional time for attendees to learn more about training and eXp Commercial.

Interested in a Career in Commercial Real Estate?

eXp Commercial is one of the fastest-growing real estate brokerages in the world, with a presence in 11 countries: the United States, Brazil, Australia, Canada, France, India, Mexico, Portugal, South Africa, Puerto Rico, and the United Kingdom.

With over 83K Commercial and Residential Agents around the world all connected and collaborating through eXp World – a virtual platform created by eXp’s Virbela technologies, eXp Commercial experts help their clients get the best out of their investments by providing commercial real estate buying, selling and leasing services across all asset types and specialties.

https://www.creconsult.net/market-trends/exp-commercial-offering-free-training-certification/