eXp Commercial is one of the fastest-growing national commercial real estate brokerage firms. The Chicago Multifamily Brokerage Division focuses on listing and selling multifamily properties throughout the Chicago Area and Suburbs.

Wednesday, August 20, 2025

📍 Plainfield, IL | 2,859 SF | $24.00/SF NNN

Now available: a turnkey culinary kitchen space featuring over $450,000 in premium improvements, including commercial ovens, hood/ventilation, quartz countertops, 3-bay sink, and more. Ideal for:

✔️ Ghost kitchens

✔️ Commissary operations

✔️ Catering businesses

✔️ Culinary education programs

Located just off Route 59, this space benefits from high visibility, strong demographics, and synergy from neighboring tenants like Goldfish Swim School.

🔗 Full listing + photos:

https://creconsult.net/12315-rhea-drive-culinary-kitchen-lease-plainfield-il/

📞 Contact:

Randolph Taylor, CCIM

Vice President | eXp Commercial – Chicago

📧 rtaylor@creconsult.net

📱 (630) 474-6441

🔗 www.CREConsult.net

#culinarykitchen #commercialrealestate #ghostkitchen #PlainfieldIL #retailspace #commissarykitchen #CRE #expcommercial #forlease #chicagorealestate

Thursday, August 7, 2025

Fully leased 18‑unit multifamily building in Chicago Ridge, IL with updated financials and recent renovations. Strong in‑place cash flow with realistic rent growth upside and minimal near‑term capital needs make this an attractive value‑add or 1031 exchange opportunity.

Property Highlights:

Price: $2,450,000 • 18 Units (10 Two‑Bedroom / 8 One‑Bedroom)

Cap Rates: 7.56% Current • 8.88% Pro Forma

Occupancy: 100% • Renovation Year: 2024

Location: Near I‑294, Metra, and Chicago Ridge Mall

🔗 View Offering Memorandum:

https://creconsult.net/chicago-multifamily-listings/chicago-ridge-il-multifamily-property-for-sale/

📞 Contact Me:

Randolph Taylor, CCIM • Vice President | Multifamily Broker

eXp Commercial – Chicago

Phone: (630) 474‑6441 • Email: rtaylor@creconsult.net

Hashtags:

#Multifamily #CommercialRealEstate #CRE #1031Exchange #ChicagoSuburbs #RealEstateInvesting #ValueAdd

Wednesday, August 6, 2025

Two fully leased 12‑unit buildings in Lyons, IL offered as a 24‑unit portfolio. Renovated in 2024/2025 and delivering reliable stabilized cash flow with realistic rent growth upside—minimal near‑term capital needs make this a compelling value‑add or 1031 exchange opportunity.

Portfolio Highlights:

Price: $3,100,000 • 24 Units (17 Two‑Bedroom / 7 One‑Bedroom)

Cap Rates: 7.06% Current • 8.8% Pro Forma

Occupancy: 100% • Renovations 2024-25

Location: Prime west suburban area near Ogden Ave, I‑55, and Brookfield Zoo

🔗 View Offering Memorandums:

• Prescott Ave – https://creconsult.net/chicago-multifamily-listings/lyons-il-multifamily-portfolio-for-sale/

• 43rd St – https://creconsult.net/chicago-multifamily-listings/multifamily-property-lyons-il/

📞 Contact Me:

Randolph Taylor, CCIM • Vice President | Multifamily Broker

eXp Commercial – Chicago

Phone: (630) 474‑6441 • Email: rtaylor@creconsult.net

Hashtags:

#Multifamily #CommercialRealEstate #CRE #1031Exchange #ChicagoSuburbs #RealEstateInvesting #ValueAdd

Thursday, July 24, 2025

Pleased to represent the seller in the successful sale of a professional property in Bartlett. Closed “as-is,” all cash, in just 90 days — another satisfied client in the western suburbs.

If you’re considering selling your multifamily or commercial property, let’s talk about strategies to achieve your best outcome:

Contact us: https://creconsult.net/contact-us/

Schedule a meeting: https://meetings-na2.hubspot.com/meetings/randolph

Randolph Taylor, CCIM

Vice President | Commercial Real Estate Broker

eXp Commercial – Chicago

📧 rtaylor@creconsult.net | 📞 (630) 474-6441

#CommercialRealEstate #ClosedDeal #ChicagoSuburbs #eXpCommercial #BartlettIL

Tuesday, July 22, 2025

Chicago Rent Growth Surges in 2025, Ranks #2 in U.S. Market

Chicago Rent Growth Surges in 2025, Ranks #2 in U.S. Market

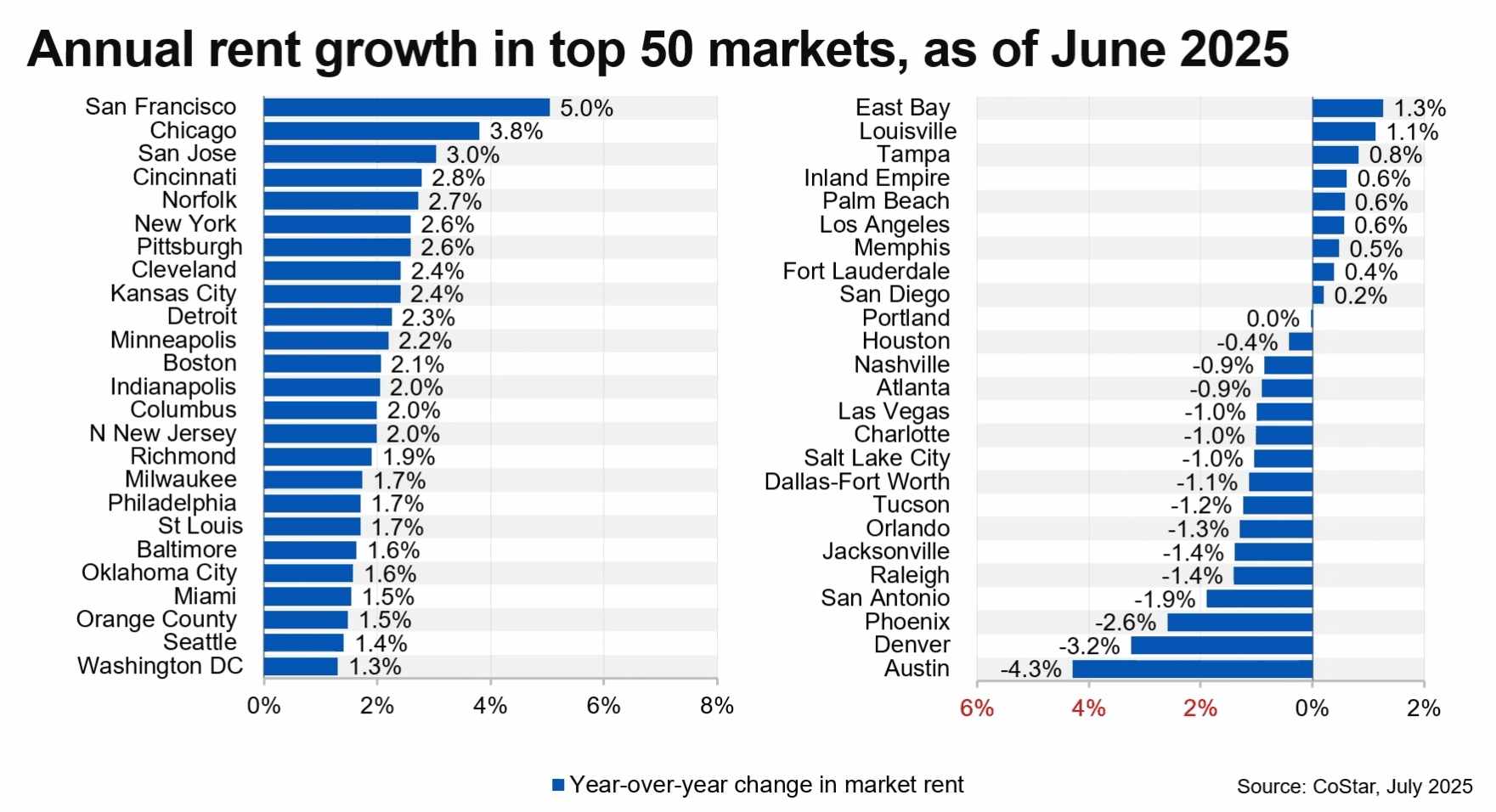

Chicago rent growth is surging in 2025, positioning the city as the second-strongest apartment market in the U.S., according to new data from CoStar Analytics. While San Francisco leads with a 5.0% annual increase, Chicago follows closely at 3.8%, driven by strong demand and limited new supply.

Nationwide, the U.S. multifamily sector is stabilizing after several years of volatility. Net absorption hit 268,000 units in the first half of the year—the third-highest ever recorded for that period. Meanwhile, new completions dropped by 25% year-over-year, helping ease the elevated national vacancy rate to 8.1%.

Chicago Outperforms as Sun Belt Struggles

Chicago rent growth stands out amid a national backdrop of modest rent gains. The CoStar report notes that asking rents nationwide rose just 0.9% year-over-year. In contrast, oversupplied Sun Belt markets like Austin (-4.3%), Denver (-3.2%), and Phoenix (-2.6%) saw steep declines.

Asset Class Trends: Affordability Wins

Affordable units (1–2 star) led rent growth at 1.7%, while luxury units (4–5 star) gained only 0.5%. Mid-tier (3-star) apartments aligned with the national average at 1%. These trends reflect growing demand for affordability, particularly in high-cost cities.

2025 Outlook for Multifamily Markets

Completions are projected to drop to 492,000 units by year-end. With sustained renter demand, the national vacancy rate may dip below 8%, and annual rent growth is forecast to rise to 1.8%. Chicago and other low-supply metros in the Midwest and Northeast are best positioned to outperform.

For more insights on multifamily trends, visit our Market Research section.

https://creconsult.net/chicago-rent-growth-2025-costar/?fsp_sid=1220

Monday, July 21, 2025

Fully stabilized apartment portfolio across three well-maintained assets in Lyons & Chicago Ridge, IL — 100% occupied with strong in-place income and significant upside through rental increases.

🔹 42 Units Across 3 Stabilized Properties

🔹 Blended Current Cap Rate: 6.88% | Pro Forma: 8.50%+

🔹 Turnkey Management & Strong Tenancy

🔹 Recent Renovations With Value-Add Potential

🔹 Ideal for 1031 Exchange or Portfolio Expansion

📍 Portfolio Includes:

12 Units – 4337 Prescott Ave, Lyons, IL

🔗 https://creconsult.net/chicago-multifamily-listings/lyons-il-multifamily-portfolio-for-sale/

12 Units – 7821 43rd St, Lyons, IL

🔗 https://creconsult.net/chicago-multifamily-listings/multifamily-property-lyons-il/

18 Units – 9826 Sayre Ave, Chicago Ridge, IL

🔗 https://creconsult.net/chicago-multifamily-listings/chicago-ridge-il-multifamily-property-for-sale/

💼 Offered individually or together as a portfolio — a rare opportunity to acquire stabilized, income-generating suburban multifamily assets in strong rental submarkets.

📩 Contact:

Randolph Taylor, CCIM

📧 rtaylor@creconsult.net

📞 (630) 474-6441

Dave Snehal, CCIM

📧 dave.snehal@expcommercial.com

📞 (773) 230-8055

#multifamily #chicagorealestate #cre #1031exchange #realestateinvesting #suburbanchicago #multifamilyportfolio #valueadd #expcommercial

Monday, July 14, 2025

📍 3217–3229 W Montrose Ave | Albany Park, Chicago

💰 Offered at $995,000

Excited to bring this fully leased ±4,000 SF retail condo to market in one of Chicago’s most vibrant neighborhoods. Located along high-traffic Montrose Avenue with over 21,000 VPD, this property offers:

✅ 6 storefronts with service, food, and professional tenants

✅ 100% occupancy

✅ Flexible lease terms for upside potential

✅ Current rents avg. $20/SF, while market rents are ~$28/SF MG

✅ Pro forma cap rate: 8.37%

📈 Low submarket vacancy (3.1%) and strong tenant demand make this a prime opportunity to secure stabilized income with immediate rent growth potential.

🔗 Full details, photos, and financials:

👉 https://creconsult.net/chicago-retail-investment-property

Reach out with questions or to request the offering memorandum.

—

Randolph Taylor, CCIM

Vice President | eXp Commercial

📞 630.474.6441

📧 rtaylor@creconsult.net

#ChicagoRealEstate #RetailInvestment #CommercialBroker #AlbanyPark #PassiveIncome #CRE #RetailForSale #eXpCommercial

Chicago Multifamily Mortgage Rates – February 2026 Market Update

Stabilizing Debt Costs Create Tactical Opportunities for Apartment Owners Updated: February 2026 Chicago multifamily mortgage rates are stab...

-

Just Listed: Golf Sumac Medical Offices | Des Plaines IL Price: $3,900,000 SF: 35,245 Stories: 3 Occupancy: 82.3% Cap Rate: 9.63% * Stabiliz...

-

REGISTER TODAY The Commercial Real Estate Symposium will provide junior and senior agents and brokers with valuable insights ...

-

🚨 Office Condo For Sale – Bartlett, IL 📍 802 West Bartlett Road, Bartlett, IL 60103 💰 Listed at $299,900 Unlock the opportunity to own a ...